by Pinchas Cohen

Global equities opened in Asia to uncertainty and geopolitical risk exposed as President Donald Trump tours Asia with the primary purpose of creating a united front against North Korea. Investors winced as Trump called on both Russia and China to join him against Kim Jong Un’s regime. Another concern for investors is Trump’s secondary purpose for his tour – addressing other countries' unfair trade practices with the US, particularly China.

Investors in Asia may have found comfort in the fact that geopolitics were complicated by Saudi Arabia's crackdown on princes, government officials and billionaires while UK Prime Minister Theresa May decides whether to fire a member of her cabinet just seven days after her defense secretary quit in a sexual-harassment scandal, which caused sterling to fall. Japan’s Topix posted its highest close since 1991.

While North Korean wasn't the biggest market-moving event, US tax reform is emerging as just that. As investors have become desensitized to the North Korean drama, they have also become largely desensitized to geopolitical risk in general since the Brexit vote. At this point it seems that actual military escalation would drive investors into safe havens. And that's not easy to hedge.

Which brings us back to the tax-reform bill, which we forewarned exactly a week ago may take longer than investors believed. The more time that passes, the more hurdles, it seems, stand in the way of tax reform.

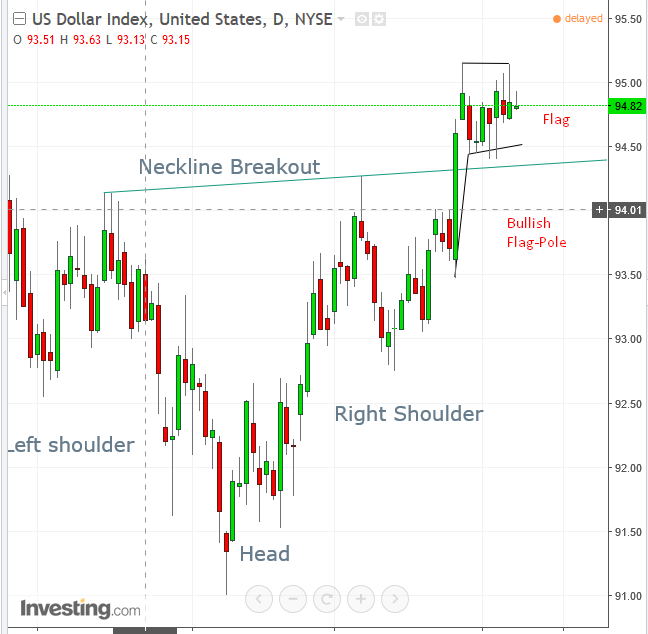

U.S. dollar traders are on the fence as the dollar index ranges between 94.50 and 95 after a dovish Fed chair appointment. An upside breakout of this range would signal a resumption of the prior sharp move between 93.50 and 94.75 in a single session, which completed a head-and-shoulders bottom.

Stocks in Europe advanced, despite a mixed Asian trading session. Personal and household goods stocks led the advance in the Stoxx Europe 600 index after companies including Ubisoft Entertainment (PA:UBIP) reported earnings that beat expectations. Banks underperformed on disappointing results from Credit Agricole (PA:CAGR). The euro inched higher as government bonds were little changed.

Crude oil dropped for a second day on signs that U.S. crude stockpiles may have declined less than expected, ending a three-day winning streak and forming a bearish shooting star. While the recent surge on Saudi Arabia’s turmoil is not sustainable, real fundamentals exist to sustain the biggest oil rally since OPEC and NOPEC reached an unprecedented production-cut agreement. Ellen Wald noted 5 Reasons Oil is Climbing, which include the Nigerian production cap, Iraq's support for the cut extension, along with Turkmenistan’s and Uzbekistan’s OPEC admission.

Based on a macro technical analysis, oil prices should stay below the key $60 level before falling to retest the $26.05 low of February, 2016 – which retested the '08 crash low – before resuming their downtrend.

Up Ahead

-

U.S. consumer sentiment probably cooled in early November from a more-than 13-year high; the University of Michigan’s report is out on Friday.

-

OPEC releases its World Oil Outlook.

-

Argentina’s central bank unexpectedly raised borrowing costs. Mexico, New Zealand and Malaysia are also holding monetary-policy meetings this week.

-

The European Commission’s chief Brexit negotiator Michel Barnier and U.K. Brexit Secretary David Davis resume talks.

-

Earnings season continues with announcements from Walt Disney (NYSE:DIS), Adidas (DE:ADSGN) and Siemens (DE:SIEGn). European financial companies set to report include Banca Monte dei Paschi di Siena (MI:BMPS), Credit Agricole (PA:CAGR), Allianz (DE:ALVG) and Zurich Insurance Group (SIX:ZURN).

Market Moves

Stocks

-

Japan’s Nikkei 225 decreased 0.1 percent.

-

The MSCI Asia Pacific index jumped 0.1 percent to the highest in about 10 years.

-

The Stoxx Europe 600 index gained 0.1 percent as of 8:10 London time (3:10 EDT).

-

The U.K.’s FTSE 100 rose 0.1 percent.

-

Germany’s DAX rose 0.2 percent.

-

The MSCI Emerging Markets index sank 0.1 percent.

-

Futures on the S&P 500 dipped less than 0.05 percent to 2,586.00.

Currencies

-

The Dollar Index meanders, flat with yesterday’s close.

-

The euro gained 0.1 percent to $1.1598.

-

The British pound decreased 0.2 percent to $1.3142.

-

The Japanese yen rose 0.2 percent to 113.82 per dollar.

Bonds

-

The yield on 10-year Treasuries decreased one basis point to 2.31 percent, the lowest in more than three weeks.

-

Germany’s 10-year yield increased less than one basis point to 0.33 percent.

-

Britain’s 10-year yield declined one basis point to 1.226 percent, the lowest in eight weeks.

-

Japan’s 10-year yield decreased one basis point to 0.026 percent.

Commodities

-

West Texas Intermediate crude declined 0.4 percent to $56.99 a barrel.

-

Gold increased 0.3 percent to $1,278.66 an ounce.

-

Copper fell 0.5 percent to $3.07 a pound, the lowest in more than four weeks.