-

S&P futures suggest underlying index will bottom

-

Treasurys, gold, yen fall, suggesting investor focus is on earnings, not geopolitics

-

Japan's Shinzo Abe may resign in June

-

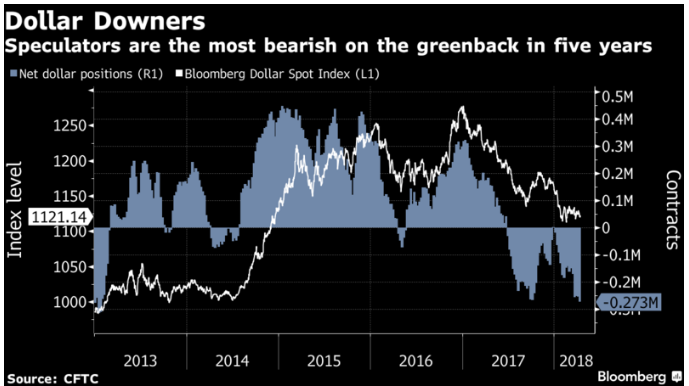

Hedge funds most bearish on dollar in 5 years

-

Oil slides on rising production worries, but remains above bullish pattern

-

Banks continue to report earnings. Goldman Sachs (NYSE:GS) is scheduled to release earnings for the fiscal quarter ending in March before market open on Tuesday, with an EPS forecast of $5.67, versus last year's EPS of $5.15 for the same quarter. Morgan Stanley (NYSE:MS) is expected to report coroporate results on Wednesday for the same fiscal quarter, with an EPS consensus of $1.28, versus $1.00 for the same quarter last year.

-

John Williams, soon to be president of the New York Fed, speaks on the economic outlook in Madrid on Tuesday.

-

China GDP and Japanese inflation are the featured data points in Asia.

-

Trump welcomes Abe to Mar-a-Lago on Tuesday. North Korea and trade will probably be discussed.

-

Miners Vale (VALE), Rio Tinto (NYSE:RIO) and BHP Billiton (NYSE:BHP) each release quarterly production reports this week.

- Global streaming entertainment giant Netflix (NASDAQ:NFLX)) reports Q1 2018 earnings after today's close. Expectations are for EPS of $0.64 on Revenues of $3.69B.

-

The STOXX Europe 600 decreased less than 0.06 percent as of 8:58 a.m. London time.

-

The MSCI All-Country World Index fell less than 0.05 percent.

-

Futures on the S&P 500 gained 0.3 percent, climbing to the highest level in almost four weeks.

-

The UK’s FTSE 100 dipped 0.1 percent to the lowest level in a week.

-

The Dollar Index fell 0.2 percent, to 89.62.

-

The euro increased less than 0.05 percent to $1.2337.

-

The British pound surged 0.1 percent to $1.4247, hitting the strongest level in more than 10 weeks.

-

The Japanese yen jumped 0.1 percent to 107.24 per dollar.

-

South Africa’s rand advanced less than 0.05 percent to 12.0712 per dollar.

-

The yield on 10-year Treasuries climbed three basis points to 2.85 percent, the highest in almost four weeks.

-

Britain’s 10-year yield advanced two basis points to 1.455 percent.

-

Germany’s 10-year yield advanced three basis points to 0.55 percent, the highest in almost four weeks.

Key Events

Shares in Europe steadied on Monday morning while US futures on the Dow, the NASDAQ 100 and the S&P 500 edged higher, suggesting stocks may rebound after Friday's losses across all major indices. This comes in the aftermath of Saturday's US-led airstrike against Syria.

In European trading, losses in food and beverage stocks offset gains in leisure companies.

S&P 500 futures broke above the neckline of a H&S bottom since March 23. Should the upside breakout endure, it would put in play a much larger, potential double bottom, since February 5, with a neckline at the 2,800 level.

Meanwhile, stocks posted a mixed performance in the Asian session. While Japan's TOPIX and Australia's S&P/ASX 200 advanced, Chinese shares on the Shanghai Composite and on Hong Kong's Hang Seng showed no signs of a rebound as they tumbled 1.5 percent and 1.75 percent respectively, trading at the bottom of the session.

Safe haven assets including Treasurys, the Japanese yen and gold swung from gains to losses, underscoring rising investor confidence that markets will overcome potential geopolitical uncertainties including the possibility of Russia or Iran, both allies of the Assad regime, intervening in Syria.

The yen was also weighed down by local politics, as Japanese Prime Minister Shinzo Abe's approval rating has tanked, falling to a record low of 26 percent on allegations of cronyism and coverups. Former leader Junichiro Koizumi said he expects Abe to resign in June in order to protect his party's footing ahead of upcoming elections.

It's ironic that the yen should be losing ground on the mounting potential of an Abe resignation, considering that his administration has supported keeping the currency weak. The yen should have strengthened to reflect the higher probability of another administration pursuing an alternate monetary policy.

While the USDJPY broke to the upside of a falling consolidation and crossed above the 50 dma, it may be completing a bearish, rising wedge.

Global Financial Affairs

There is a chance that the timing of the attack in Syria may have taken into consideration financial markets. An attack during the week would have almost certainly prompted widespread knee-jerk selloffs. Having found out about the military action after Friday's close, investors have now had the chance to temper their initial reactions and process the news. Risk-off is dissipating, probably because the headwind of a counter-attack from Russia has so far not materialized, quelling fears of escalation.

Despite Trump's confident "Mission Accomplished" tweet on Sunday, reports suggested that there was no meaningful damage to military installations or in terms of casualties. So, while Vasily Nebenzya, Russia's UN Ambassador, warned that he 'cannot exclude' the odds of a fully-fledged war, Russia's lack of response could have been predicted given recent incursions into Syria by other nations.

In September, Israeli air forces struck a Syrian weapons development center in Hama province; a month later an anti-aircraft battery near Damascus was targeted and in December weapons warehouses near the capital were hit. In January and February, they struck various other Syrian and Iranian military posts and more recently, on April 9, they bombed the T-4 airbase in Homs province, killing several Iranian military officers.

In none of these cases did Russia's air defense forces strike back. This seems to underpin their strategy of talking tough while not taking risks on the ground.

If Russia hasn't responded to Israel, it's highly likely that it would respond to the US. Still, Russian financial markets have been hit hard by renewed US sanctions. The situation could get worse as the prospect of further restrictions is likely. An already wounded party that comes under mounting pressure is just as likely to strike back as it is to attempt an escape.

While the risk of a fresh batch of US sanctions and broader geopolitical worries continue to weigh on investor sentiment, the focus is turning to corporate earnings season which begins in earnest this week. Speeches by Federal Reserve officials, including incoming New York Fed Chair John Williams, will also be monitored closely.

Friday's 0.29 percent decline on the S&P 500 was led by losses in Financials stocks (-1.51 percent), after Wells Fargo (NYSE:NYSE:WFC), JPMorgan Chase (NYSE:JPM) and Citigroup (NYSE:NYSE:C) reported higher-than-expected earnings results but subdued forward guidance.

The dollar slipped after data from the US Commodity Futures Trading Commission showed that hedge funds are the most bearish on the greenback in five years.

Last week, Fitch Ratings reaffirmed the AAA rating for the US but warned that "the outlook for public finances has deteriorated since the last review." The ratings agency said the US has the world's highest "debt tolerance" thanks to the dollar's global reserve currency status.

However, two elements threaten to challenge the global primacy of the USD: worldwide, central banks are mulling a conversion of some of their reserves to euro and China's recent launch of yuan-denominated oil futures contracts.

The lack of any significant response to the missile attack in Syria has shifted the market narrative towards fears of a further increase in production, sending WTI futures back below $67 a barrel. Russia and Iran could back down from the supply limits agreed upon among OPEC members, while Saudi Arabia is threatening to build a nuclear arsenal if the US doesn't renew its sanctions against Iran. Technically, the bullish Ascending Triangle's upper bound is so far providing support.

Up Ahead

Market Moves

Stocks

Currencies

Bonds

Commodities