Wednesday February 8: Five things we are talking about

With global data continuing to paint a mixed picture on the pace of inflation in the developed world has investors proceeding with caution, and for now, somewhat in a directionless manner.

Currently, capital markets lack conviction as they seek more details from the Trump administration on promised spending increases and tax cuts. While in Europe, the market is assigning a greater risk premium to European countries (Netherlands, France) where the rise of populism is gaining traction ahead of national elections.

Expect the market to focus on today’s EIA oil inventory report (10:30 EST) and the RBNZ monetary policy decision (03:00pm EST).

1. Equities see the green light

In Japan, indices edged up overnight as the yen's (¥112.30) recent rise outright stalled, while upbeat earnings is helping shore up market sentiment. The Nikkei closed up +0.5%.

Note: Investors remain cautious ahead of this week’s Abe-Trump summit starting Friday. Both trade and currency policy is expected to be high on the agenda.

In Hong Kong, stocks closed at their three-month highs, boosted by shares of China property developers and brokers. The Hang Seng index ended up +0.7%, while the Hong Kong China Enterprises Index gained +1.1%.

In Shanghai, stocks have rallied to a one-month, on the back of financials. The Shanghai Composite Index closed up +0.4%, it’s highest since Jan. 11.

In Europe, equity indices are trading mixed. On the Eurostoxx 600, banking stocks once again are trading notably lower across the board, while energy stocks are also lower as oil trades near contract lows. On the FTSE 100, commodity and mining stocks are trading notably higher.

U.S. equities are set to open in the black (+0.1%).

Index: Stoxx50 +0.5% at 3,251, FTSE flat at 7,184, DAX +0.3% at 11,586, CAC 40 +0.7% at 4,789, IBEX 35 +0.3% at 9,356, FTSE MIB +0.5% at 18,748, SMI +0.3% at 8,396, S&P 500 Futures +0.1%

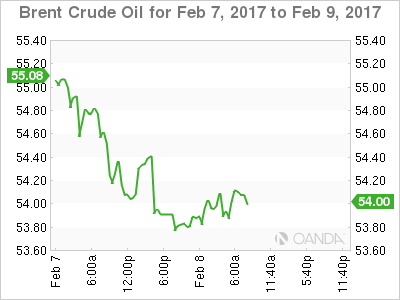

2. Oil prices remain under pressure from bloated inventories

Ahead of the U.S open, global crude prices remain under pressure, extending yesterday’s fall, as a massive increase in U.S. fuel inventories and a slump in Chinese demand would suggest that global crude markets remain oversupplied despite OPEC-led efforts to cut output.

Brent crude futures are trading at +$54.70 per barrel, down -35c, or -0.64%, from yesterday’s close. U.S. West Texas Intermediate (WTI) crude is at +$51.68 a barrel, down -49c, or -0.94%.

Note: Yesterday’s American Petroleum Institute (API) reported a massive inventory number – crude inventories rose by +14.2m barrels in the week to +503.6m, compared with market expectations for a +2.5m increase. While gas stocks rose by +2.9m barrels, compared with expectations for a +1.1m barrel gain.

Expect dealers to take direction from today’s EIA report at 10:30am EST.

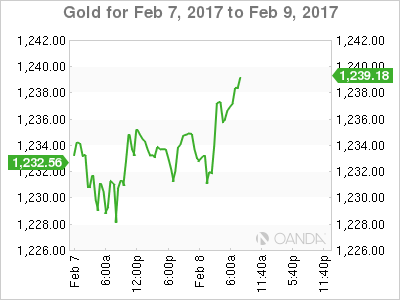

Gold continues to hold firm near its three-month highs hit yesterday (+$1,235.78) on dollar strength amid political and economic uncertainty on both sides of the Atlantic – U.S. and Europe.

The precious metal has gained nearly +5% over the last month, and nearly +7% since the year began.

3. Treasury, Bunds yields fall, euro periphery spreads widen

Lower global oil prices is attracting buying interest in the U.S. Treasury bond market, sending yields lower. While euro political risks, especially the French election uncertainty, is also support demand for this week’s Treasury auctions.

Note: U.S. bonds continue to offer more attractive yields compared to bunds, JGBs and gilts. The U.S. Treasury Department is this week selling a total of +$62B of three-, 10- and 30-year securities in its quarterly refunding.

U.S 10’s currently yield +2.4%, down from a yesterday’s session high of +2.439%.

In Europe, the yield spread between10-Year French and equivalent German government bonds remains on a widening course, currently trading slightly over +78 bps on investors’ mounting concern about who might win France’s upcoming presidential election.

In Italy, the yield differential between 10-Year Italian BTPs and 10-year German Bunds has topped +200 bps, amid the potential of an election in Italy and on concerns about the banking sectors (10-year BTP/Bund yield spread stood at around +162 bps in December).

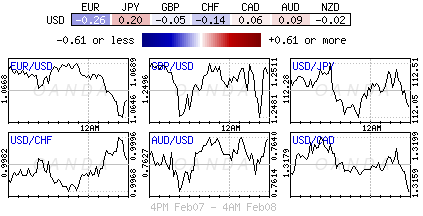

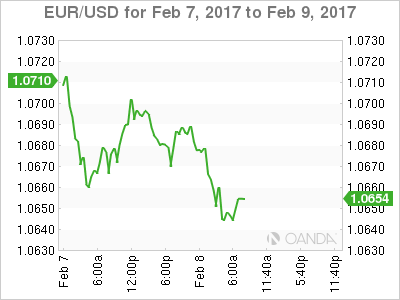

4. Dollar finds support on rate differentials

Comments this week from Fed officials stating that next months FOMC meeting could be ‘live’ is providing the USD with support. The market believes that there is a potential for Yellen to surprise with some ‘hawkish’ comments at her semi-annual testimony to Congress.

Europe’s single unit is softer by -0.3% overnight, trading atop of the €1.0650 level. Weighing on the euro are concerns about the outcome of European elections (Netherlands and France) this year.

Note: Dealers are looking for a more technical breakdown, citing €1.0605 as key support for the time being.

Sterling (£1.2488) seems to be consolidating yesterday’s gains after the BoE’s Forbes suggested that UK economy might soon need a rate “hike.”

Note: The UK’s House of Commons is expected to vote on Article 50 Bill later day (expected in evening local time).

Elsewhere, the PBoC has weakened the yuan slightly more aggressively overnight (¥6.8849 vs. ¥6.8604) to the lowest CNY setting in a fortnight.

Note: the PBoC also skipped its ‘reverse repo’ operations for the fourth straight session, though reiterated that banking system liquidity is at high level and that last week’s +10bp increase in offer rates should not be interpreted as tightening.

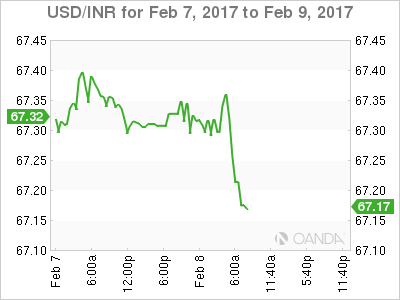

5. Reserve Bank of India (RBI) surprises markets

In a surprise move overnight, the RBI kept its policy rate on hold (+6.25%, unanimous 6-0) for a second consecutive meeting, opting to wait for more clarity on the trend for inflation and on how a radical crackdown on “black money” or high value cash would impact the country’s economic growth.

India policy makers also changed their stance to “neutral” from “accommodative”, saying it would monitor inflation, despite calls for the central bank to support the economy that was dealt a blow when PM Modi abolished high-value notes in a bid to target unaccounted cash.

The decision has disappointed investors – India’s benchmark 10-Year bond yields have aggressively backed up +13 bps after the RBI signaled the end of the easing cycle.