Foreign Markets, Fair Value and Volume:-

Today’s Economic Calendar:

Today’s economic calendar includes 8-Week Bill Settlement, FOMC Meeting Begins, Housing Starts 8:30 AM ET, Redbook 8:55 AM ET.

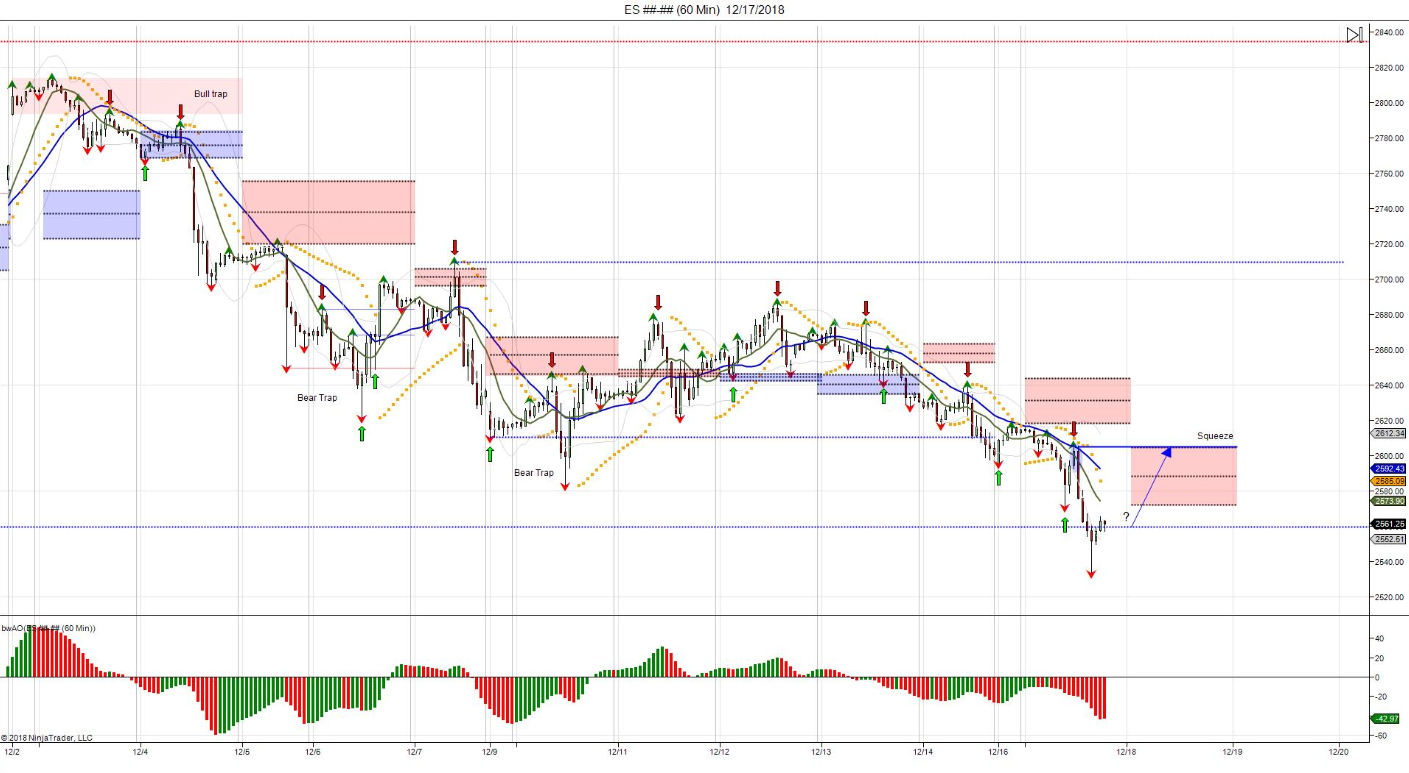

S&P 500 Futures: #ES ‘Down and Out’ in Beverly Hills

Chart courtesy of @Chicagostock – $ES_F Tuesday’s 3D pivot range >the market again to provide overhead resistance for sellers to defend/buyers to overcome. Buyers must overcome Monday’s failed high @ 2605 to squeeze shorts & reverse S/T momentum to retest last wk’s failure. Close

After trading lower in the overnight session the S&P 500 futures opened Monday’s trade at 2593.00 and then sold off on the open making an early low of 2571.00 before rallying higher pushing to a high of day at 2605.50 at 10:15 and then following a 13 handle pull back then made a double top at 11:00 and soon after sell programs came and and pushed the ES lower through the late morning back down to 2575.25 just before noon.

The early afternoon saw more selling as the S&P’s went on to break the morning low and trade down to 2556.25 just after 1:00 pm before continuing to break lower smashing through every attempted rally making a low of day in the final hour as the MIM had shown over 1.5 billion to sell since before 1:30 and then ended up being 2.8 billion to sell as the ES printed 2533.50 late in the day before rallying higher to print 2551.50 on the 3:00 close and then settled the day at 2555.50 down 50.00 handles or 1.92%.

In the end it’s pretty simple, the markets act like crap. The Shanghai Composite is down 27% year todate. As most of you know I like bull markets but you have not heard me say anything bullish in weeks if not months. In all honesty I am getting more concerned with everyday drop. It kind of reminds me of the 2000 tech bubble and how tech stocks sank everyday for weeks. The PitBull said it reminds him of 1987 but also said that this is much bigger. While I can not rule out a 50 to 100 handle rally I just have zero faith that it will hold. In terms of the markets overall tone it seems to be getting worse by the day. In terms of yesterday’s overall trade it seems like the volume is starting to taper as we go into the Christmas holidays.

Take Your Investment Blinders Off, These Are Not Our Fathers Markets

Our View: The markets continue to get ‘picked apart’ as the public gets more defensive about their stock holdings. Yesterday Goldman Sachs (NYSE:GS) said “Investors should increase portfolio defensiveness given our forecast for heightened risk and fat tails,” and recommends investors own “high quality” stocks in 2019. As of today close the ES is down ? handles or % since making its November or December ??? 2812.50 high. That was only ? trading days ago. Goldman also said expects the S&P 500 index will reach 3,000 by the end of next year, from about 2,600 this week. The firm assigns a 50% probability to that baseline scenario. But Goldman sees a 30% probability for its downside 2019 forecast of 2,500 and a 20% probability for its upside forecast of 3,400.

Well you know what I have to say about that? We have to get through 2018 first! This decline has become to total shit show and it doesn’t seem to have an end in sight. 2550, 2520 they are all just number now.

Our view; Is it possible the ES goes to 2200.00, right where the Trump rally started? My gut tells me if you have big profits in your mutual ETF funds to consider taking a small amount of profits. Consider it a high class problem if your wrong. You still have 80% of the position. We don’t like the ES but think it could be setting up for a bounce. The problem is that the bounce won’t last.

PitBull: CLG OSC -5/-8 turns up on a close above 53.62; ESZ OSC -20/-4 turns up on a close above 2635.58; VIX OSC 8/2 turns down on a close below 21.98.

Take Your Investment Blinders Off, These Are Not Our Fathers Markets

Our View: The markets continue to get ‘picked apart’ as the public gets more defensive about their stock holdings. Yesterday Goldman Sachs said “Investors should increase portfolio defensiveness given our forecast for heightened risk and fat tails,” and recommends investors own “high quality” stocks in 2019. As of today close the ES is down ? handles or % since making its November or December ??? 2812.50 high. That was only ? trading days ago. Goldman also said expects the S&P 500 index will reach 3,000 by the end of next year, from about 2,600 this week. The firm assigns a 50% probability to that baseline scenario. But Goldman sees a 30% probability for its downside 2019 forecast of 2,500 and a 20% probability for its upside forecast of 3,400.

Well you know what I have to say about that? We have to get through 2018 first! This decline has become to total shit show and it doesn’t seem to have an end in sight. 2550, 2520 they are all just number now.

Our view; Is it possible the ES goes to 2200.00, right where the Trump rally started? My gut tells me if you have big profits in your mutual ETF funds to consider taking a small amount of profits. Consider it a high class problem if your wrong. You still have 80% of the position. We don’t like the ES but think it could be setting up for a bounce. The problem is that the bounce won’t last.

PitBull: CLG OSC -5/-8 turns up on a close above 53.62; ESZ OSC -20/-4 turns up on a close above 2635.58; VIX OSC 8/2 turns down on a close below 21.98.

Market Vitals Technical Analysis for Tuesday 12-18-2018

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.