- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Euro Jumps On ECB Minutes; U.S. CPI And Retail Sales On The Horizon

Here are the latest developments in global markets:

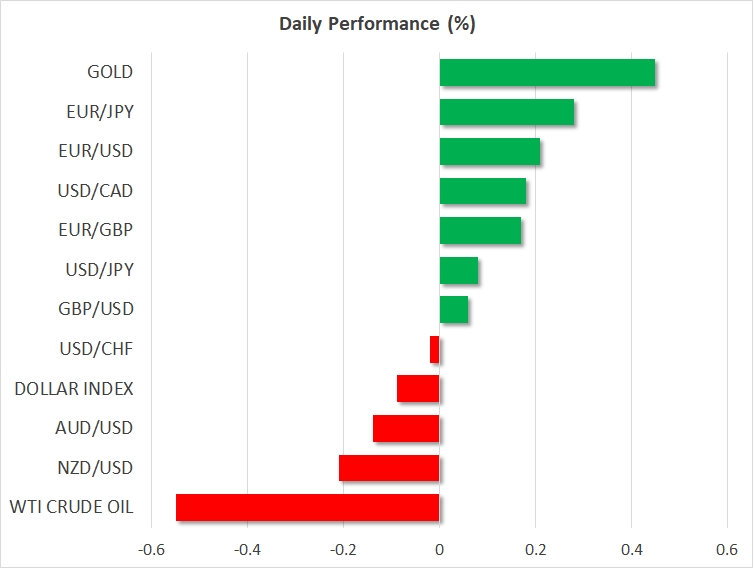

· FOREX: The US dollar index traded marginally lower on Friday, extending the notable losses it posted on Thursday on the back of weaker-than-expected US producer price data and a stronger euro.

·STOCKS: Asian markets were mixed. Japan’s Nikkei 225 and Topix indices traded lower by 0.2% and 0.6% respectively, but Hong Kong’s Hang Seng index climbed 0.8%. In Europe, futures tracking the Euro stoxx 50 suggest it could open 0.3% higher. Over in the US, the Dow Jones, S&P 500 and Nasdaq composite finished in the green yesterday, with all three indices recording fresh all-time highs. Futures tracking the Dow, S&P and Nasdaq 100 are all currently in positive territory, but only marginally. Of particular interest today will be the announcement of earnings for Q4 2017 by banking giants JPMorgan Chase (NYSE:JPM) and Wells Fargo (NYSE:WFC), as well as asset manager BlackRock Inc (NYSE:BLK) and PNC Financial Services Group (NYSE:PNC); the results will be released before Wall Street’s opening bell.

· COMMODITIES: Oil prices corrected lower today, with WTI and Brent crude declining by 0.5% and 0.3% respectively, erasing the hefty gains they posted yesterday. Despite this pullback, both WTI and Brent are still hovering near multi-year highs, amid declining US crude inventories, the extremely cold weather observed in the US recently, and the OPEC-led supply curbs. Importantly, the United Arab Emirates’ oil minister hinted yesterday that the current OPEC and non-OPEC deal could be extended beyond its current deadline of December 2018, adding further to the optimism surrounding the oil market. In precious metals, gold edged up 0.4% without any major news behind the move, likely boosted by the softer US dollar.

Major movers: Euro shines as ECB minutes heighten tapering speculation

The euro surged yesterday, after the minutes from the European Central Bank’s (ECB) December policy meeting showed the Governing Council is willing to consider an adjustment in its forward guidance in early 2018, provided the economy and inflation remain on a healthy track. This probably heightened speculation that the Bank’s massive stimulus program may be coming to an end, perhaps as early as this year.

Even though such signals are not particularly new, as several ECB policymakers have already expressed their desire to see the Bank adjust its policy language soon, this was the first time an official ECB communication suggested as much. What’s more, investors may have been surprised by the potential timing of such a move. Since QE is currently intended to run until September 2018, or beyond, one would have expected the ECB to begin adjusting its language around the middle of 2018, and not early in the year as the minutes indicated.

An adjustment in the Bank’s forward guidance in the coming months could unleash another wave of euro appreciation, as investors begin to position for the end of the QE-era. That said, whether or not the ECB will actually proceed with tapering its asset purchase program will likely depend on whether wages and inflation accelerate, something not evident thus far.

The antipodean currencies were on the retreat today, with AUD/USD and USD/NZD trading 0.1% and 0.2% lower accordingly. Meanwhile, USD/CAD was up nearly 0.2%, with the loonie’s softness likely owed to the pullback in oil prices.

Day ahead: US CPI and retail sales dominate attention

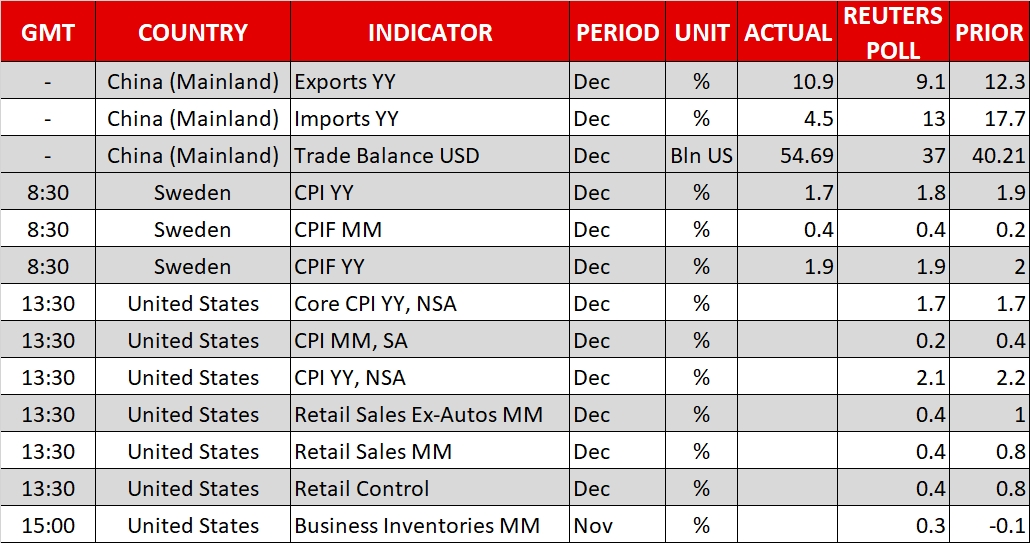

The highlights of the day in terms of releases will be US inflation figures and retail sales for the month of December. Both releases are due at 1330 GMT. Month-on-month as well as on an annual basis, the pace of inflation growth is expected to ease a bit relative to November’s figures. Year-on-year, core CPI is forecast to expand by 1.7% in December, the same pace as in November. Although the Federal Reserve’s preferred inflation measure is the core personal consumption expenditures (PCE) price index, CPI figures still have their significance and they could spur speculation on the outlook for interest rates and thus result in dollar movements. It should be mentioned that yesterday’s PPI figures out of the US surprised to the downside.

In terms of retail sales, those are expected to grow at a slower pace in December after expanding by 0.8% in the month that preceded, far outstripping expectations and pointing to a robust economy. Retail sales excluding automobiles are also anticipated to slow in December.

Data on US business inventories for the month of November due at 1500 GMT could also attract some interest.

Boston Fed President Eric Rosengren – a non-voting FOMC member in 2018 – will be giving a speech on the US economic outlook at 2115 GMT.

In commodities, oil traders will be paying attention to the US Baker Hughes oil rig count due at 1800 GMT.

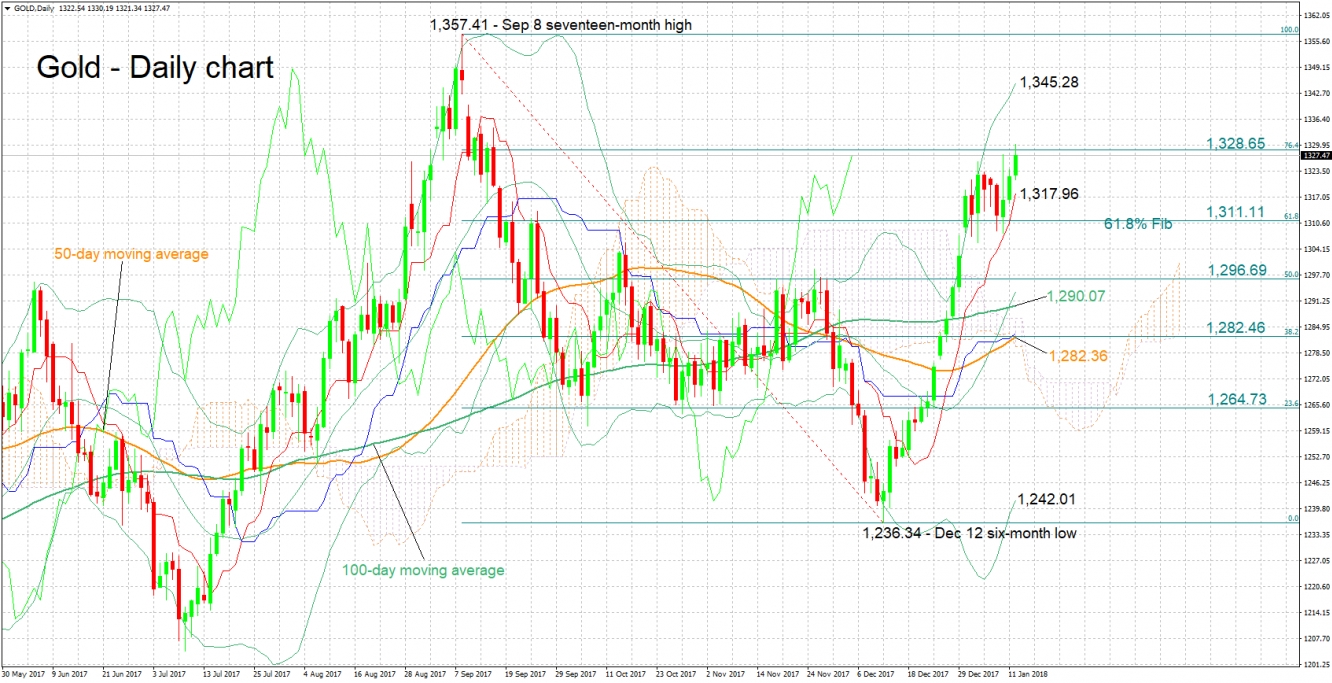

Technical Analysis: Gold bullish in short-term; hits 4-month high

Gold is on its third straight day of advancing, touching 1,330.19 in today’s trading, its highest in four months. The Tenkan- and Kijun-sen lines are positively aligned, pointing to bullish short-term momentum.

The dollar-denominated metal has been supported on the back of the greenback’s weakness. Stronger data on inflation and retail sales out of the US later on Friday are expected to strengthen the greenback and weaken gold. In this case, the precious metal might find support around the current level of the Tenkan-sen at 1,317.96.

A disappointment on the US data front though would likely see gold adding to gains, boosted by more weakness in the dollar. The area around the 76.4% Fibonacci retracement of the September 8 to December 12 downleg at 1,328.65 could act as resistance to price advancing. Note that the 76.4% Fibonacci was violated earlier in the day, before the price retreated back below it. Further above, the focus would turn to the upper Bollinger band at 1,345.28.

Related Articles

The US dollar has come under some pressure on the back of the rerating of the US growth outlook and expectations that the Russia-Ukraine conflict is nearing an end. However, we...

The Swiss franc is down for a second straight trading day. In the European session, USD/CHF is trading at 0.8980, up 0.38% on the day. Switzerland’s GDP Eases to 0.2% The Swiss...

USD/JPY is consolidating near 149.33 on Wednesday, with the yen pausing its rally while holding near four-month highs against the USD. This stabilisation follows renewed support...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.