Here are the latest developments in global markets:

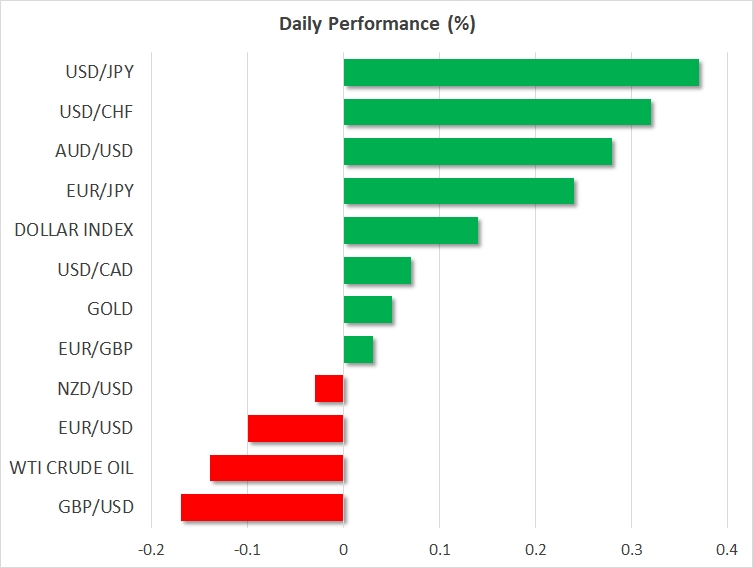

· FOREX: The US dollar index traded slightly higher during the Asian trading session Thursday, after experiencing heightened volatility on Wednesday. The index initially took a dive on reports that China is considering to slow or cut its US bond purchases, but managed to recover its losses to trade virtually unchanged in the following hours.

· STOCKS: Asian markets were mostly in the red today, with Japan’s Nikkei 225 and Topix indices closing 0.3% and 0.2% lower respectively. In Hong Kong, the Hang Seng was marginally in positive territory, while in Europe, futures tracking the Euro Stoxx 50 traded 0.2% higher. In the US, the three major indices broke their winning streak on Wednesday, with the SandP 500, Dow Jones and Nasdaq Composite all finishing in the red, likely weighed by reports that China could slow its US Treasury purchases, and that the US may withdraw from NAFTA. That said, futures tracking the SandP, Dow, and Nasdaq 100 are all currently in the green.

· COMMODITIES: Oil prices pared some of their recent gains, with WTI and Brent crude trading lower by 0.1% and 0.2% respectively, though both remain very close to multi-year highs. Prices reacted little to the weekly EIA data yesterday that showed a larger-than-anticipated drawdown in crude inventories, possibly because such an outcome was largely anticipated following a similar reaction in the private API data earlier this week. Gold traded higher on Thursday, albeit marginally.

Major movers: Dollar trades like a rollercoaster; loonie slips

The US dollar plunged during the European morning Wednesday, following a Bloomberg report that China is considering to slow or halt its purchases of US Treasuries. The declining appeal of US bonds, relative to other assets, and the trade tensions between the two nations were cited as the main reasons for this consideration, according to the report. However, the currency’s tumble was short-lived, with the dollar index managing to roughly recover all its China-related losses before US markets closed. The greenback then gained further during the Asian morning Thursday, after Chinese authorities denied this report, indicating that it could be based on wrong information. The denial likely reassured markets participants that one of the biggest buyers of US bonds is not set to leave the market just yet.

Elsewhere, the Canadian dollar lost ground against its US counterpart yesterday, as NAFTA concerns came back to the forefront of investors’ minds. Reuters reported that according to Canadian officials, President Trump will soon announce that the US intends to pull out of NAFTA. Even though the White House later stated that there has been no change in the President’s positions on NAFTA, the loonie did not manage to recover its losses. Markets seem to have taken this report very seriously, evident by the sharp decline in the implied probability for a rate hike by the Bank of Canada next week. It currently rests at only 42% from 80% previously according to Canada’s overnight index swaps, indicating that investors expect NAFTA jitters to keep the Bank sidelined for now.

The antipodean currencies were mixed, with aussie/dollar trading nearly 0.3% higher, but kiwi/dollar being marginally lower. The aussie received a boost overnight following the release of Australia’s retail sales for November, which were much stronger than expected.

Day ahead: Eurozone industrial production and ECB minutes, US jobless claims and PPI on the horizon

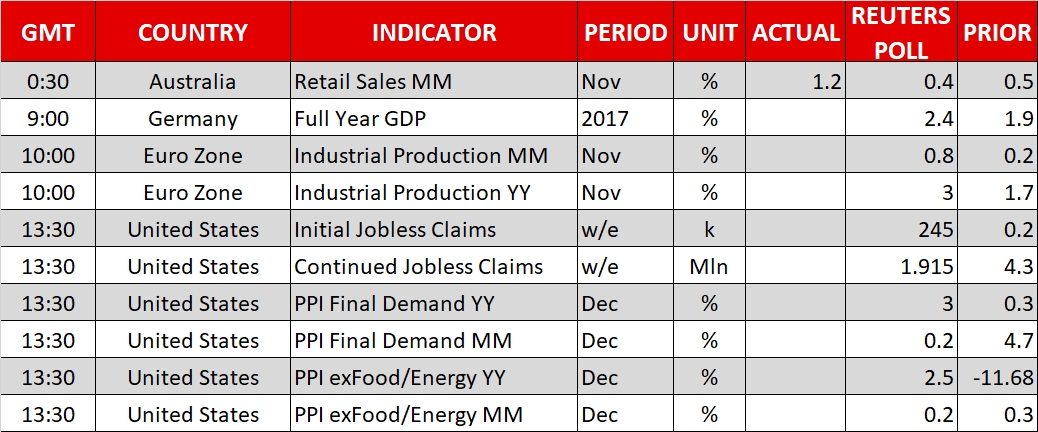

Germany, Europe’s largest economy, will see the release of figures on 2017 full year GDP growth at 0900 GMT. Expectations are for the rate of expansion to stand at 2.4% y/y. This compares to 2016’s 1.9%.

November industrial production figures out of the eurozone will be gathering attention later in the day (1000 GMT). Month-on-month, industrial output is anticipated to rise by 0.8% and year-on-year by 3.0%. A deviation from analysts’ forecasts could cause some movement in euro pairs.

Market participants’ attention will later be falling on the minutes from the European Central Bank’s meeting on monetary policy that are scheduled for release at 1230 GMT.

Out of the US, the most important release will pertain to initial and continued jobless claims data for the previous week due at 1330 GMT. The number of initial jobless claimants is expected to fall by 5k relative to the week that preceded to stand at 245k, below the 300k level which is linked to a strong jobs market for the 149th consecutive week, this being the longest run since 1970. Large discrepancies from expectations have the capacity to spur positioning on the dollar.

Also of interest will be US data on December producer prices due at the same time as jobless claims figures (1330 GMT). In November, producer prices increased firmly, pointing to rising inflation – US CPI figures will be released on Friday, with forecasts anticipating price pressures to remain relatively muted.

New York Fed President William Dudley will be talking on the US economic outlook for 2018 at 2030 GMT. The New York Fed President holds permanent voting rights within the FOMC.

In politics, any developments on NAFTA negotiations will be closely watched; sources yesterday saying that US President Donald Trump will soon announce withdrawing from the trade agreement led to weakness in the loonie.

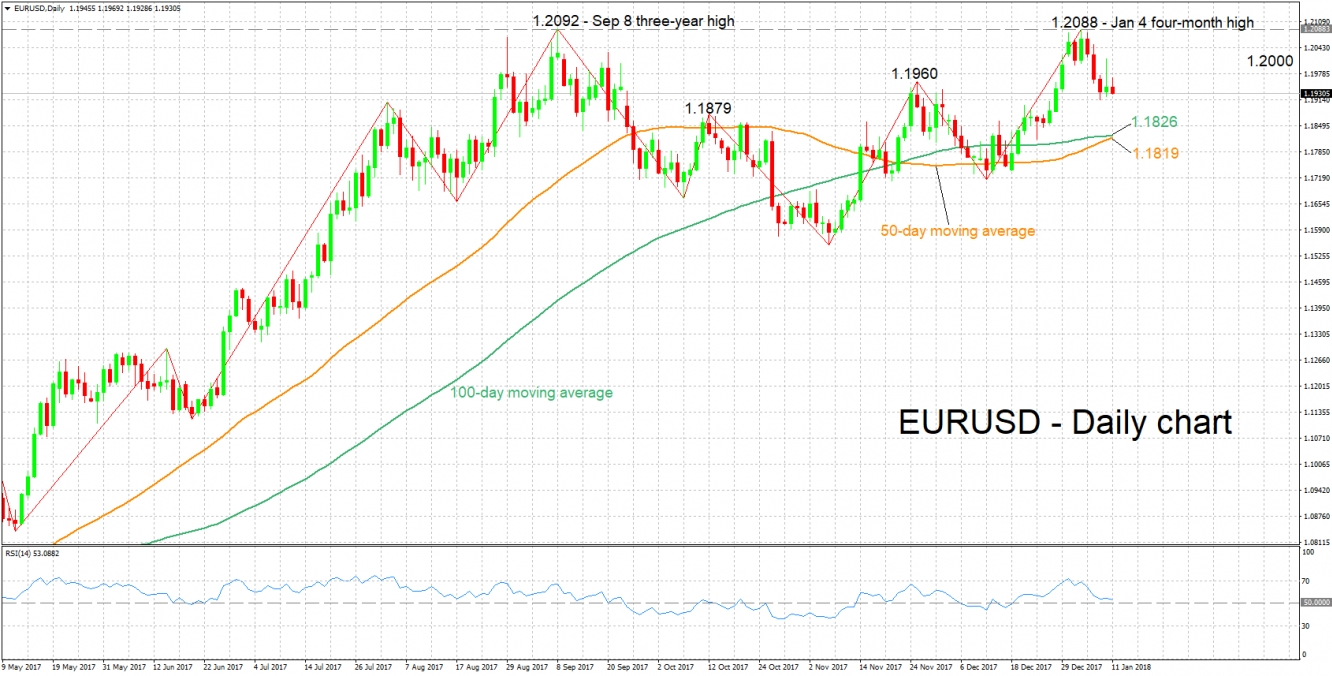

Technical Analysis: EUR/USD could have entered neutral phase in short-term

EUR/USD has been moving sideways over the last couple of days, with the pair possibly entering a neutral phase in the short-term. The RSI, which has also been moving sideways close to the 50 neutral-perceived level throughout this period, is supporting this view.

Stronger eurozone data on industrial production or more importantly a hawkish take in ECB minutes are likely to spur long euro/dollar positions. The area around the 1.20 handle could act as a barrier to upside movements, with the range around it also encapsulating 1.1960, a top from the recent past. Further above, the focus would shift to early January’s four-month high of 1.2088.

On the other hand and in case of weaker data or a dovish take in ECB minutes, the pair is expected to record losses. In this scenario, the area around the previous top of 1.1879 could offer support, with attention next falling to the current levels of the 100- and 50-day moving averages which seem to be converging around 1.1820.