Here are the latest developments in global markets:

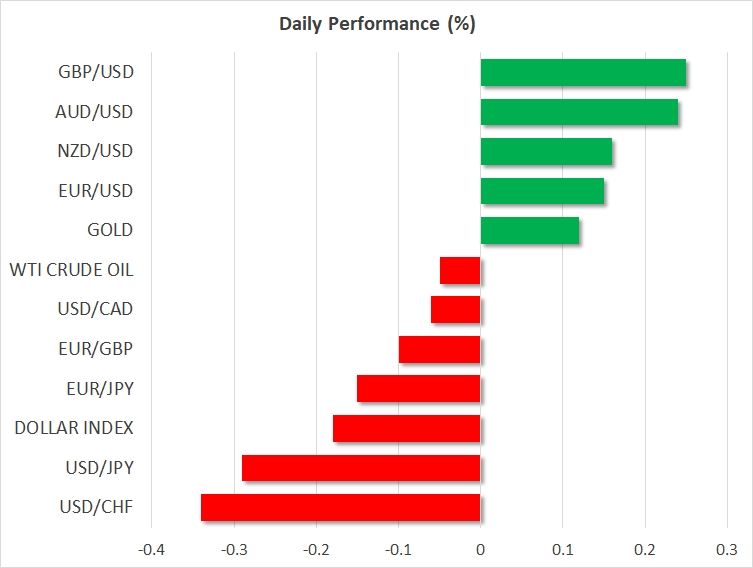

· FOREX: The dollar index traded nearly 0.2% lower on Wednesday, extending the losses it posted yesterday amid concerns of a potential escalation in trade tensions with China.

· STOCKS: Japanese equities corrected lower, with the Nikkei 225 and the Topix indices closing down by 0.8% and 0.5% respectively, as the latest surge in the yen took its toll on the nation’s markets. That said, both indices still stand near their corresponding 27-year highs. In Hong Kong, the Hang Seng was up by 0.2%, reaching a fresh all-time high. European investors appeared undecided, with futures tracking the Euro Stoxx 50 being flat, suggesting the index could open around yesterday’s close. The US yesterday saw yet another record high close for the S&P 500 and Nasdaq Composite, while the Dow Jones closed marginally in the red. Futures tracking the Dow, S&P and Nasdaq 100 are all currently in positive territory.

· COMMODITIES: Oil prices traded slightly lower on Wednesday, giving back some of the gains they posted yesterday. The correction lower came after the private API inventory data – released overnight – showed that crude stockpiles rose during the last week, following nine consecutive weeks of drawdowns. Gold was 0.1% higher, last trading near $1343 per ounce. Technically, a potential upside break of the recent highs at $1344 could pave the way for advances towards the September highs of $1357, especially if the dollar remains on the back foot, helping to boost demand for the dollar-denominated precious metal.

Major movers: USD touches fresh 3-year lows on protectionism concerns

The greenback came under renewed selling pressure yesterday, with the dollar index falling to find support near the psychological level of 90.00. The selloff appears to be driven by worries around the protectionist set of measures introduced by the US yesterday, with markets potentially discounting the scenario of an analogous response from China that would escalate the situation further, thereby harming both economies. The Australian Dollar will likely be very sensitive to any updates in this story, as a US-China trade standoff could harm the Australian economy as well, due to its large trade exposure to China.

Euro/dollar broke above 1.23, boosted by the dollar’s underperformance. That said, the pair may be at risk of a modest correction today, as investors may opt to take some profits off the table ahead of the ECB policy decision tomorrow, where there is a risk that the central bank’s President, Mario Draghi, will talk down the euro.

Sterling/dollar breached 1.40 yesterday for the first time following the Brexit vote. Even though the latest leg up reflects more dollar weakness than sterling strength, evident by the subdued moves in euro/sterling and sterling/yen, the broader rally in the pound is undeniable, and is likely a result of markets repricing the Brexit risk premium amid growing optimism around the negotiations. However, there appears to be a risk of markets running ahead of themselves, as pricing-out Brexit risks still appears somewhat premature at this stage. Excluding some constructive comments by French President Macron recently, there have been no material developments on the Brexit front that could justify such a sizable rally. Expectations that the two sides are due to agree on a transitional deal by the end of March are elevated, suggesting that any disappointment in that process has the capacity to dent optimism around the negotiations, and perhaps the pound itself.

Day ahead: Eurozone PMIs, UK employment & wage growth and Davos on the agenda

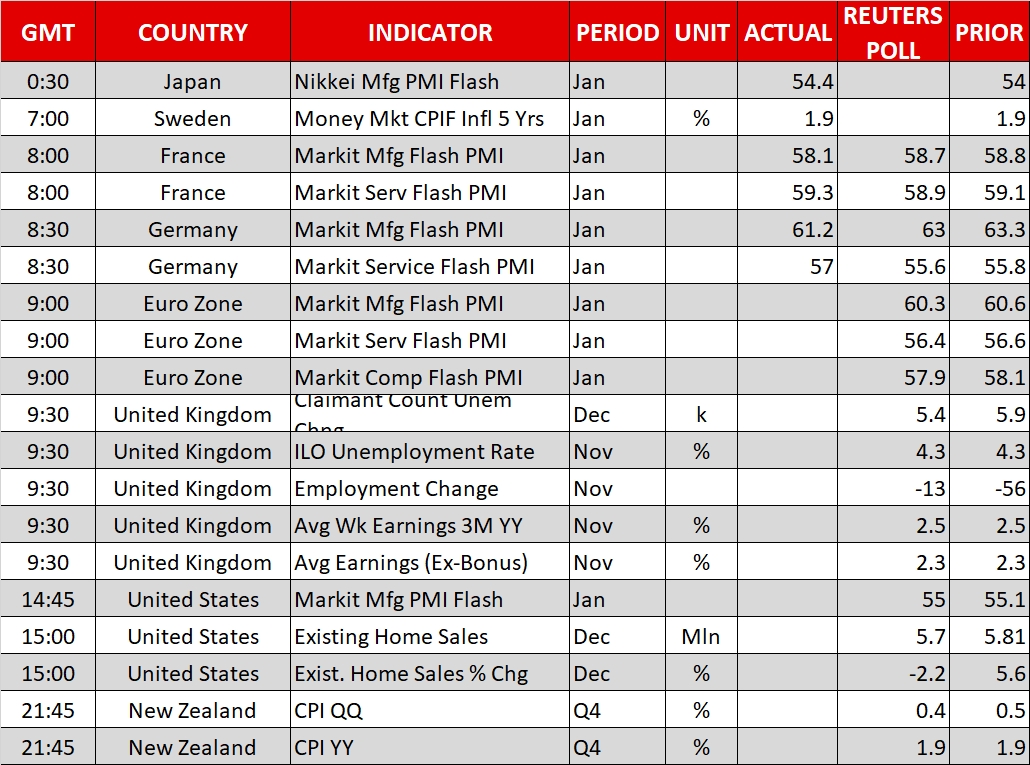

Eurozone flash PMI figures for the month of January – for the manufacturing and services sectors, as well as the composite measure that blends the two – will be made public at 0900 GMT. All three readings are anticipated to slow down relative to December’s releases, though not by much, remaining comfortably above the 50 threshold that separates expansion from contraction and continuing to project a relatively positive picture on eurozone growth. Deviations from expectations – and depending on the extent of the deviation, of course – can lead to positioning on the euro. Germany and France, the eurozone’s two biggest economies, saw the release of their respective figures earlier in the day; both countries' services PMIs (Germany and France) surprised to the upside, with their manufacturing PMIs (Germany and France) missing forecasts.

The UK will see the release of important employment and wage growth data at 0930 GMT. The unemployment rate is expected to remain at the four-decade low of 4.3%, with the bulk of investors’ interest likely falling on average weekly earnings – year-on-year they’re anticipated to expand at the same pace as in the previous month – as growth on that front could spur expectations for further BoE tightening sooner rather than later; at the moment inflation outpaces wage growth, rendering it a risky endeavor to raise rates as it could further weigh on economic growth. Sterling is likely to be sensitive to today’s releases.

Out of the US, Markit’s January flash manufacturing PMI due at 1445 GMT and data on December existing home sales to be released at 1500 GMT will be attracting attention. Manufacturing PMI is expected at 55.0, only slightly below the respective figure from the previous month and existing home sales are forecast to decline by 2.2% after hitting an 11-year high in November.

New Zealand inflation figures for Q4 2017 are due at 2145 GMT. On an annual basis, the CPI reading is expected to grow by 1.9%, the same pace as in Q3, while it is forecast to reflect a slowdown on a quarterly basis; expectations are at 0.4%, down from Q3’s respective figure of 0.5%. The bank’s target range for annual inflation is 2% plus/minus 1%.

Trump administration officials, including the President himself, will be heading to the World Economic Forum in Davos, Switzerland on Tuesday and Wednesday. Trade could emerge as a hot topic at Davos after the Trump administration’s recent decision to impose tariffs on washing machines and solar panels.

Beyond Davos, other policymaker appearances include a discussion on the Riksbank’s current monetary policy by the Swedish central bank’s Deputy Governor Martin Floden. The discussion is set to commence at 1030 GMT and will be taking place at a Moody’s seminar on Credit Trends.

The EIA report including information on US crude and gasoline inventories for the week ending January 19 is due at 1330 GMT. Crude stocks are expected to decrease by 1.3 million barrels, posting their tenth straight weekly decline. This compares to a drawdown of around 6.9m barrels in the week that preceded.

On the corporate earnings front, Comcast (NASDAQ:CMCSA) and General Electric (NYSE:GE) will be among companies releasing their results before Wednesday’s opening bell on Wall Street, with Ford (NYSE:F) following suit after the US market close.

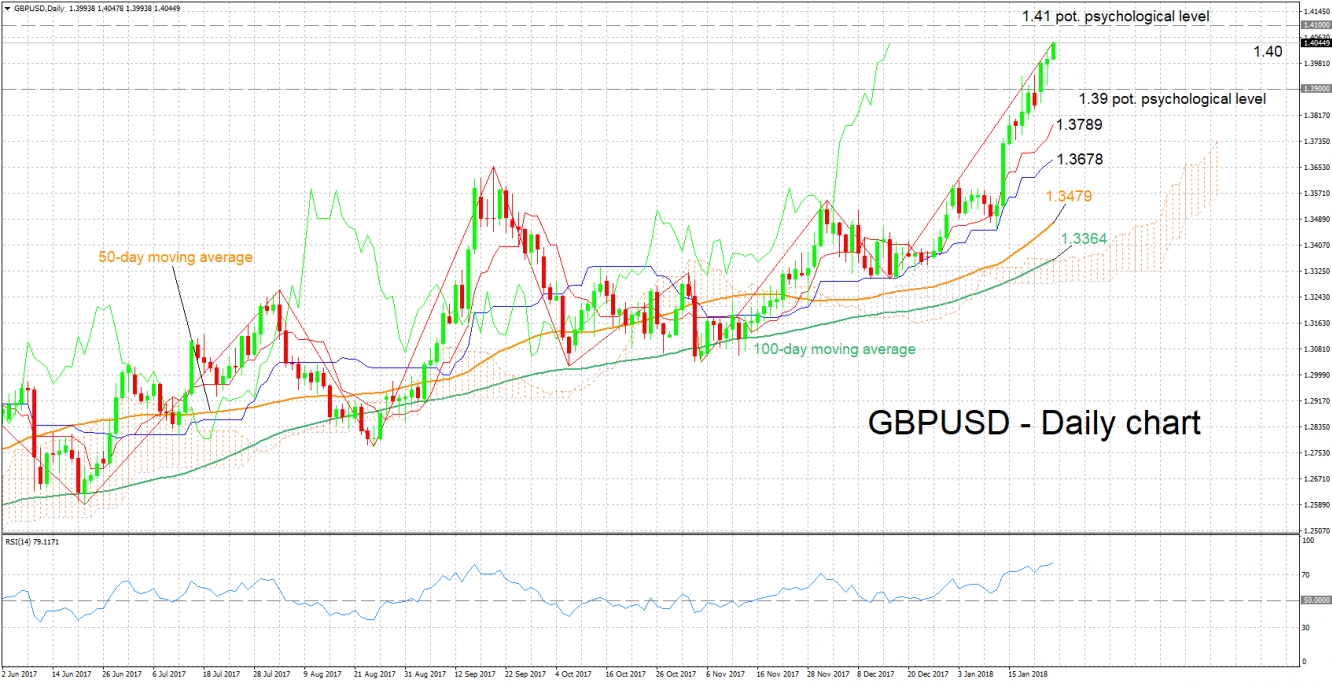

Technical Analysis: GBP/USD touches fresh 1½-year high; RSI overbought

GBP/USD has advanced considerably in recent weeks, reaching a fresh, more than one-and-a-half year high of 1.4048 during today’s trading. The Tenkan- and Kijun-sen lines are positively aligned and the RSI is rising; all these point to a bullish short-term picture. However, notice that the RSI indicator is in overbought territory above 70.

Should today’s UK readings on employment and wage growth come in stronger than expected, then the pair is expected to gain, with the area around the 1.41 handle – a potential psychological level – coming into view as a potential barrier to the upside.

If the releases disappoint, though, then GBP/USD is likely to lose ground. In this case, support could come around the 1.39 level, this being another potential psychological mark. The 1.40 handle, which is relatively close to where price action is currently taking place, might function similarly as well.

Assuming an overextended market, it is worth pointing out that a data miss is likely to be met with a larger decline than an “equivalent” data beat (as it might spur profit-taking as well.)