Here are the latest developments in global markets:

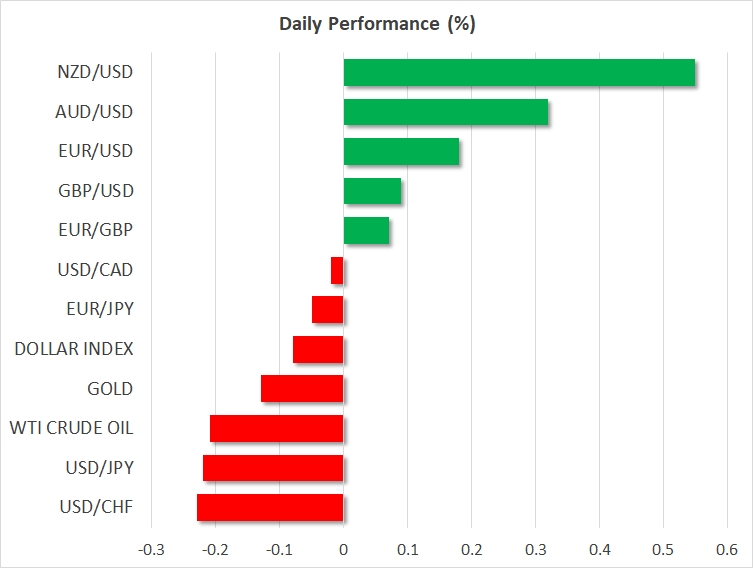

- FOREX: The dollar was losing some ground versus a basket of currencies on Monday after recording its highest since March 1 last Friday, the day February’s US employment data showed stronger-than-anticipated jobs growth.

- STOCKS: US markets surged on Friday on the back of the US employment report, which showed that wage growth remains subdued. The disappointing earnings figures suggest that there is little pressure on the Fed to raise rates aggressively, a factor that boosted risk appetite. The Nasdaq Composite and the Dow Jones both climbed by 1.8%, while the S&P 500 lagged slightly behind, still gaining a robust 1.7%. Importantly, the Nasdaq closed at a record high. Futures tracking the S&P, Dow Jones, and Nasdaq 100 are all flashing green as well. The positive sentiment rolled over into Asian trading on Monday, with Japan’s Nikkei 225 and Topix indices rising by 1.7% and 1.5% respectively, while Hong Kong’s Hang Seng index was up by 1.8%. Europe appears set to follow suit, with futures tracking all the major indices being a sea of green.

- COMMODITIES: Oil prices traded lower on Monday, with Crude Oil WTI and Brent Crude being down 0.2%, both benchmarks giving back some of the notable gains they posted on Friday. The risk-on sentiment in equity markets in combination with the drop in the number of active US oil rigs helped the precious liquid to rally. The lower rig count is a very encouraging sign for the supply side of the oil market, as it signals that US production may have peaked, for now at least. In precious metals, gold was lower on Monday but not by much, last seen near the $1321/ounce mark. The yellow metal has been under pressure lately as risk appetite staged a comeback, and in case of further declines, the recent lows near $1312 could offer some immediate support.

Major movers: Dollar eases a bit; antipodeans on the rise on improved risk appetite

The dollar index was 0.1% down, falling marginally below the 90 handle after rising to 90.36 on Friday, this being its highest since March 1. Following Friday’s NFP report that showed jobs growth exceeding expectations, the focus for short-term direction for the dollar now turns to Tuesday’s inflation figures for the month of February. It remains to be seen whether tomorrow’s data will mirror Friday’s wage growth numbers.

Equities were on the rise as worries over a trade war further receded in investors’ minds and Friday’s jobs report out of the US showed wage growth cooling, failing to spur expectations for higher inflation as was the case in the previous month’s report that led to an equity selloff. Market participants for the most part currently expect the Federal Reserve to deliver three quarter percentage point interest rate hikes in 2018.

Politics are at play in Japan, partly dampening risk sentiment and supporting the safe-haven perceived yen. The Finance Ministry altered documents in relation to a controversial land sale and this raises questions about the future of Finance Minister Taro Aso, who is seen as a key person in PM Abe’s government. Aso himself said that he does not intend to resign. At 0731 GMT, dollar/yen was 0.2% down at 106.56.

Euro/dollar was 0.2% up at 1.2330. Eurozone’s common currency recorded losses versus the greenback last week, after ECB chief Mario Draghi noted that inflation in the euro area remains muted following the Bank’s meeting last week, whilst also making reference to the risk of rising protectionism.

The antipodeans were on a positive footing on Monday: aussie/dollar and kiwi/dollar traded higher by 0.3% and 0.55% respectively, both rising to their highest since late February. Positioning was seen as coming on the back of overall elevated risk sentiment, due to easing concerns over trade and rising inflation that could have pushed the US central bank to proceed with a faster pace of monetary policy tightening.

Day ahead: Quiet Monday in a relatively busy week

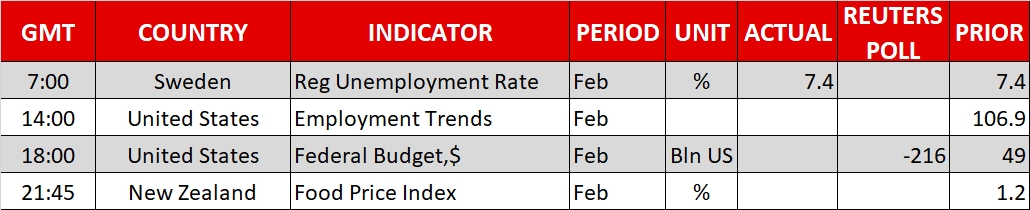

In terms of economic data releases, the calendar is practically empty today. The only indicator that could attract some attention is the US Conference Board’s employment trends index for February, due out at 1400 GMT, though this is usually not a major market mover.

In Europe, the Eurogroup – a term which refers to the finance ministers of the 19 nations that make up the eurozone – will meet to discuss developments in Greece, deepening the Economic and Monetary Union, as well as developments around the exchange rate and inflation. While these meetings typically do not produce much movement in the euro, any comments on the exchange rate will still be closely monitored by traders, especially given the absence of other events today.

The rest of the week is much more interesting as on Tuesday, we will get the all-important US CPI figures for February. Wednesday will see the release of US and Chinese retail sales prints, while on Thursday, the Swiss National Bank (SNB) and the Norges Bank will both announce their rate decisions.

In equity markets, the inflation and the trade-war narratives will likely remain at the forefront. Major stock indices surged on Friday, after the US employment data showed that despite robust jobs growth, wages have still not picked up. The subdued wage figures suggest that there is little pressure on the Fed to raise rates quickly, and if tomorrow’s CPI data confirm this narrative, then we may see more gains in equities. At the same time, investors are likely to keep one eye on any retaliation measures by the EU and China to the US tariffs. The magnitude and the scope of any responses could be a signal of what happens next. If these major economies reply in harsh fashion, that may provoke more US action and increase further the risk of a vicious protectionist cycle, whereas calmer responses could pave the way for a de-escalation in trade tensions.

In politics, developments in Italy could continue to be in focus. On Friday, the leader of the 5-Star Movement (M5S) Luigi Di Maio said that his party was preparing policy proposals for other parties, in order to reach common ground and form a government.

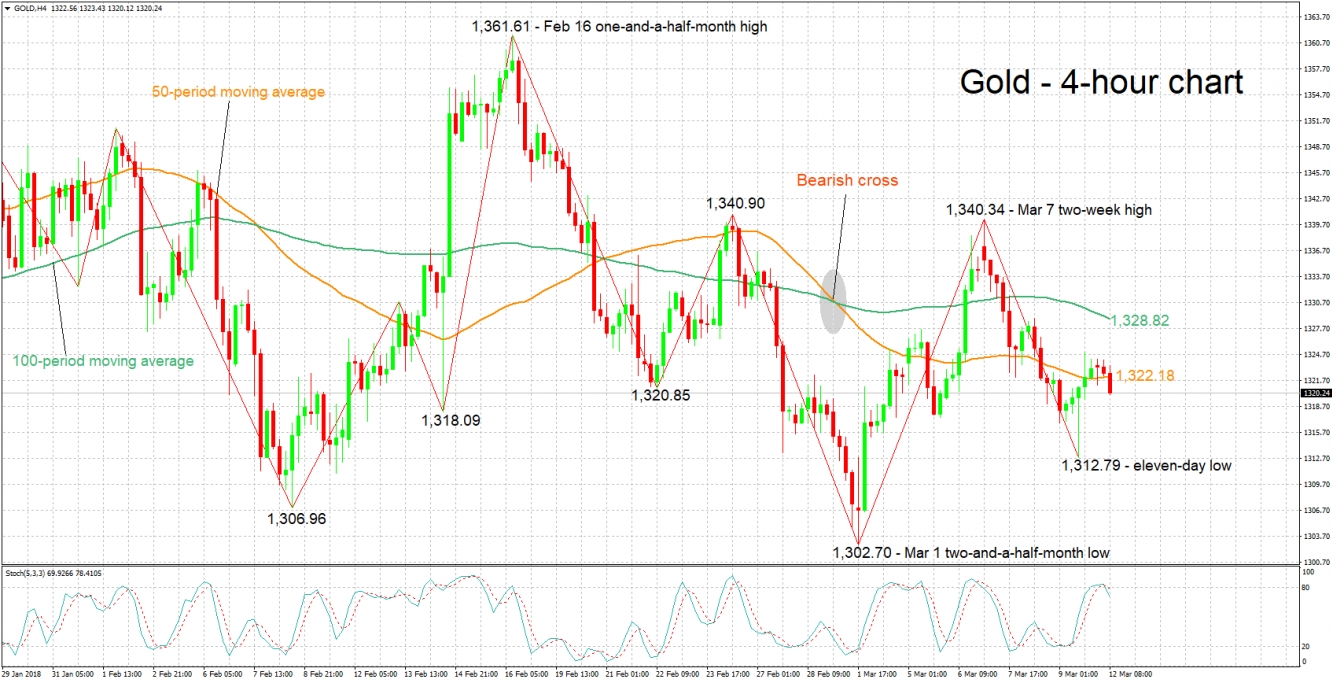

Technical Analysis: Gold rises from 11-day low though stochastics give bearish signal in very short-term

Gold has recovered somewhat after hitting an 11-day low of 1,312.79 during Friday’s trading. It is retreating though at the moment, with the stochastics giving a bearish signal in the very short-term: the %K line has crossed below the slow %D line, with both lines heading lower.

Should the greenback weaken further, then the dollar-denominated metal stands to potentially gain. Resistance in case of rises could come around the current level of the 50-period moving average at 1,322.18. The area around this also encapsulates a couple of bottoms from the recent past. A break to the upside would turn the attention to the 100-period MA at 1,328.82.

On the other hand, a stronger US currency is likely to lead to losses for gold. The range around Friday’s 11-day low of 1,312.79 might offer support. Further below, the focus would increasingly start turning to the two-and-a-half-month low of 1,302.70 from March 1, while the area around a previous bottom at 1,306.96 could also act as support.

Rising or abating trade risks also have the capacity to offer direction to the safe-haven perceived asset.