Thursday May 25: Five things the markets are talking about

There were no surprises from the Fed yesterday, but the tone, it was a tad more ‘dovish’ than the neutrals were expecting.

The FOMC minutes release received a muted reaction in the bond market, despite most Fed members saying that they felt “weaker data would be temporary and that another rate hike is coming soon.”

Expectations are for a rise as soon as next month (June 13-14). The committee also talked about tapering their balance sheet “gradually with caps and increasing the cap every three- months.”

Net result, U.S equity markets ended on their highs, with S&P rallying to a record close, the dollar losing some support on yield differentials as investors took note of increased caution about lower inflation data in. And while the case for June rate hike remained above +80% (prior +83%), the Fed funds odds of two-more rate hikes this year have now slid below 50%.

Their next meeting is June 13-14, which will be followed by a press conference.

The markets focus now shifts to Vienna to see if OPEC and non-OPEC members officially extend last November’s production cut deal to support global prices.

1. Mixed reaction from regional bourses

The Fed’s ‘dovish’ tone has helped U.S and Asian stocks to post yet more record highs. But that equity bullishness has failed to transfer to Europe, where some stock exchanges are closed today for the Ascension holiday.

In Japan, stocks rose overnight as the strong-yen (¥111.78) trend paused. The Nikkei share average ended +0.4% higher, while the broader Topix gained +0.2%.

In Hong Kong shares followed regional markets higher, even after Moody’s downgraded Hong Kong’s local and foreign currency issuer ratings shortly after cutting China’s ratings yesterday. The Hang Seng index rose +0.8%, while the China Enterprises Index gained +1.7%, a fresh 22-month high.

In China, equities have rebounded sharply, as the blue-chip CSI 300 index posted its best day in 21-months amid growing hopes that global index provider MSCI Inc. will add mainland shares to its benchmark next-month.

Korea’s Kospi was the best performing regional index, rallying +2.1%, supported by the Bank of Korea (BoK) leaving rates on hold (+1.25%) overnight in a unanimous decision, but signaled a bullish view, stating growth was now seen above last months forecast as household debt increase subsided.

In Europe, most indices have reversed their earlier gains to trade largely lower across the board. Ahead of the U.S open, the DAX trades lower by over -0.5%.

U.S indices are set to open in the black (+0.2%).

Indices: Stoxx50 -0.2% at 3579, FTSE -0.1% at 7507, DAX -0.5% at 12578, CAC 40 -0.2% at 5332, IBEX 35 +0.2% at 10931, FTSE MIB -0.6% at 21233, SMI -0.3% at 9035, S&P 500 Futures +0.2%

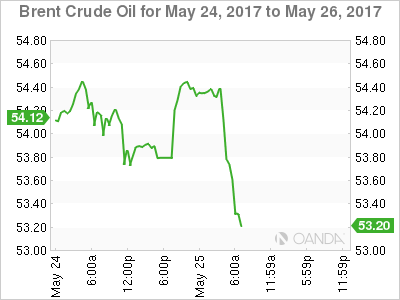

2. Oil steady before expected extension of OPEC output cut

Oil prices are steady ahead of today’s OPEC meeting expected to extend production cuts into 2018 in an attempt to drain a global-glut.

Brent crude oil is unchanged at +$53.96, while U.S light crude (WTI) is -10c lower at +$51.26. Both benchmarks are up more than +15% from this months lows.

OPEC and various non-OPEC members, including Russia, are widely expected to agree to extend Novembers cut in oil supplies by -1.8m bpd. The current deal only covers the H1 of 2017.

Note: Market observers believe that a nine-month extension would have little impact on the “average” price forecast for 2017, which is +$55 per barrel for Brent. However, the bulls believe that if producers can agree in a cut extension to cover all of 2018, the tighter market could push average 2018 Brent prices up towards +$63 per barrel.

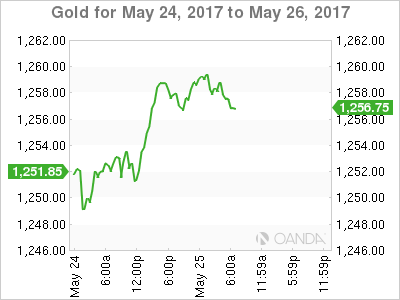

Gold (+$1,257.90 an ounce) is holding steady ahead of the U.S open, supported by the USD slipping after yesterday’s FOMC minutes downplayed the chance of more aggressive interest rate hikes.

3. U.S yields fall on Feds ‘gradual’ approach to reduce balance sheet

Treasury yields fell after the Fed outlined a plan to unwind its balance sheet by “gradually” allowing increasing amounts of the securities to mature without reinvesting them.

Investors have expected the Fed to reduce its balance sheet carefully, but a more concrete plan to do so is still a positive for bonds, which could be hurt if the Fed took a more aggressive approach.

The plan is expected to involve introducing a series of “caps” that would determine the maximum amount of the Fed’s maturing debt that would be reinvested in new securities – the caps could increase over time to accelerate the shrinking of its balance sheet.

The yield on U.S. 10-Year’s fell less than -1 bps to +2.24%, after losing -3 bps to +2.25% yesterday.

Elsewhere, French 10-Year yields fell -3 bps, while German Bunds dropped -4 bps to +0.36%.

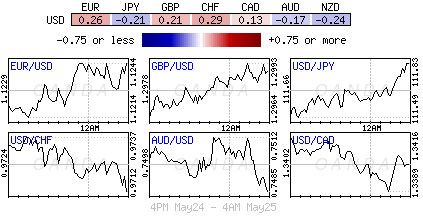

4. Dollar loses its shine

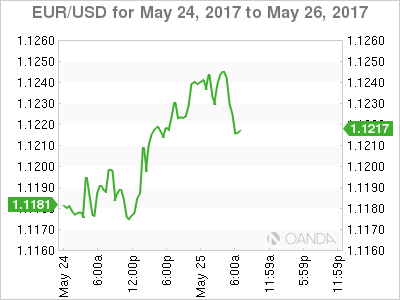

The ‘mighty’ USD remains on the defensive as the Fed dialed down market’s “hawkish” policy expectations.

The EUR/USD (€1.1227) continues to hover atop of the psychological €1.12 handle. Many expect the ‘single’ unit pullbacks to be brief and shallow. The ‘bulls’ believe the EUR is in the process of going higher – the prospect of the ECB announcing a path to more tapering of its asset-purchase program at the June ECB meeting, improving eurozone economic activity, and rising eurozone capital inflows is expected to support the currency towards €1.1275 -1.13.

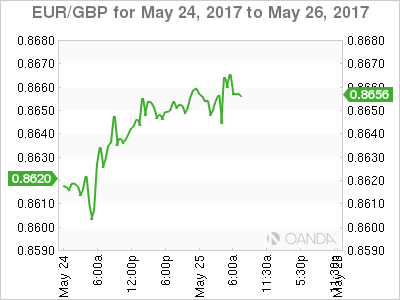

The pound briefly traded above £1.3000 this morning ahead of this morning’s Q1 GDP reading and has since drifted lower (£1.2960) after the data was revised lower in its second reading (see below). Nevertheless, GBP is still within striking distance of testing the alleged option barriers at £1.3050. To many, £1.3000 is considered the key pivot and with any momentum through theses levels expect the structural shorts out there post-Brexit will be looking to wind back. Short-term sterling bulls are now targeting £1.3350/1.3400.

USD/JPY (¥111.88) has resisted the trend and is trading higher after Japan’s Upper House approved government’s two nominees for the BoJ board. The nominees would replace current dissenters of Kuroda’s QQE policy.

5. U.K’s Q1 growth revised down

Data this morning showed the U.K. economy slowed more sharply than first thought in Q1 – a warning sign on domestic growth ahead of next months General Election (June 8) and the start of Brexit talks with the EU.

The ONS said its latest data suggests the economy expanded at a quarterly rate of +0.2% in Q1, a weaker pace of growth than the +0.3% preliminary estimate published in April and much weaker than the +0.7% pace for Q4, 2016. It suggests that U.K households are feeling the pinch from rising prices and inadequate wage growth.

Trade also weighed on growth as imports outpaced exports, despite a weakened pound.

Note: there was one bright spot and it was business investment, which rose a steady +0.6% on the quarter.