Market Brief

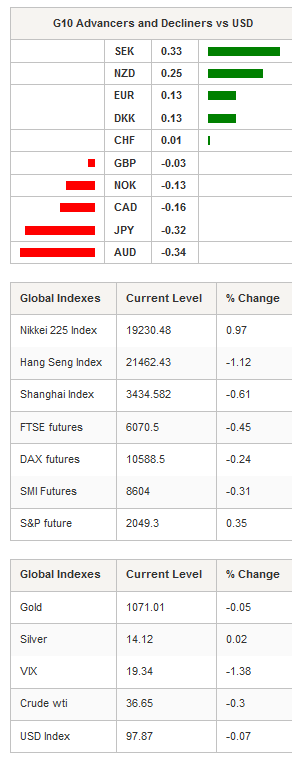

Aside from the fact that the release of some economic data from the US could create volatility in the FX market, we are heading into a quiet Friday session. Market participants are holding their breath ahead of next Wednesday’s FOMC meeting during which Janet Yellen is expected to start tightening monetary policy. From our standpoint, the US dollar is mainly exposed to downside risk as a rate hike is already priced in. Moreover, it would not be the first time that the Fed disappoints markets this year, so be ready for the eventuality of a big disappointment. EUR/USD traded sideways in Tokyo and remained between 1.0927 and 1.0950 during the entire session.

The one-week 25-delta risk reversal in USD/JPY reached -2% indicating that market participants are looking for downside protection ahead of the FOMC meeting. It also indicates that the market considers the possibility that the Fed stays on hold. USD/JPY traded higher overnight and returned above the 122 threshold after finding a strong support around 121.60 (50dma and 200dma).

Crude oil is moving further downhill as it prints multi-year lows on a daily basis. West Texas Intermediate crude fell to $36.38 a barrel yesterday in the US, while its counterpart from the North Sea, the Brent crude, slid to $39.38 a barrel a few hours later during the Asia session. Selling pressures on crude oil are expected to remain high in 2016 as OPEC announced last week that it will maintain the level of supply.

In New Zealand, the market’s reaction to the solid manufacturing PMI was muted. The gauge ticked higher in November, printing at 54.7 compared to a downwardly revision of 53.2 in October. Separately, food prices contracted another 0.2%m/m in November after shrinking 1.2% in the previous month. NZD/USD holds ground above the 0.6719 support implied by the 61.8% Fibonacci level (October-November debasement).

In the equity market, Asian regional indices fell deeper into negative territory as the oil rout weighs. In Mainland China the Shanghai Composite was down 0.61% and the Shenzhen Composite fell 0.72%. In Hong Kong, the Hang Seng slid 1.12%, while in South Korea, the KOSPI paired losses, down 0.18%. However, Japanese shares did managed to trade higher with the Nikkei 225 up 0.97%.

European stocks are set to open lower this morning as all futures are blinking red on the screen. The FTSE 250 was down 0.45%, the DAX 0.24%, the CAC 40 0.21% and the SMI 0.31%. The Euro STOXX 600 fell 0.39%.

EUR/CHF is sliding slowly towards the 1.0750 support after the Swiss National Bank decided to leave rates unchanged. USD/CHF is trading sideways around 0.9870 and will find a strong resistance at 0.9915 (50-day moving average). A support can be found at 0.9655 (200-day MA).

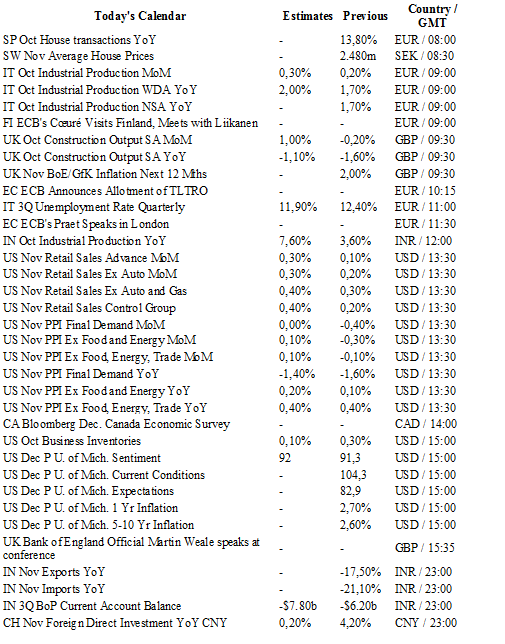

Today traders will be watching industrial production from Italy and India; retail sales, PPI and Michigan sentiment indices from the US.

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0955

S 1: 1.0458

S 2: 1.0000

GBP/USD

R 2: 1.5529

R 1: 1.5336

CURRENT: 1.5161

S 1: 1.4857

S 2: 1.4566

USD/JPY

R 2: 135.15

R 1: 125.86

CURRENT: 121.96

S 1: 120.07

S 2: 118.07

USD/CHF

R 2: 1.0676

R 1: 1.0328

CURRENT: 0.9877

S 1: 0.9476

S 2: 0.9259