By Ambar Warrick

Investing.com-- Chinese and Taiwanese stocks plummeted on Monday ahead of a possible trip by U.S. House Speaker Nancy Pelosi to Taipei, while Hong Kong’s Hang Seng index led losses across Asian markets.

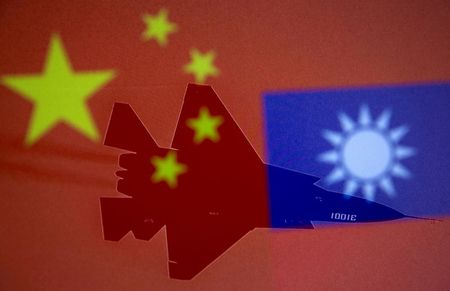

Investors were wary of political tensions stemming from Pelosi’s potential trip to Taiwan- which has been vehemently opposed by China. The House of Representatives Speaker is currently on a tour of Asia.

Reports said that both Taiwanese and U.S. officials had said that Pelosi could visit the country this week, despite warnings from China over such a move. U.S.-China relations are already at a low point due to Beijing’s ties with Russia.

U.S. officials said Beijing’s responses to the meeting could include military action, or other “spurious” legal claims.

As of 2218 ET (0218 GMT), the Taiwan Weighted benchmark index shed 1.8%, while the Chinese blue-chip index dropped more than 2%. The Shanghai Composite index also dropped 2.4%.

Most other Asian bourses fell sharply, with Japan’s Nikkei 225 down 1.6%.

Hong Kong’s Hang Seng Index tumbled 2.9%, with real estate and technology stocks weighing the most. Property developer Country Garden Holdings Company Ltd (HK:2007), and mobile phone maker Xiaomi Corp (HK:1810) were the worst performers on the index, down 6.2% each.

The Australian benchmark index dropped 0.6% ahead of a widely awaited interest rate hike by the Reserve Bank later in the day. The hike, which will be the RBA’s largest raise this year, comes as the bank struggles to curb rising inflation.

Tuesday’s sell-off in Asian stocks is largely a follow-up to a weak overnight session on Wall Street, where mixed U.S. manufacturing data drove the main indexes lower. The S&P 500 dropped about 0.3% on Monday.

Asian stocks had also started the week on a soft note, after data showed China’s manufacturing sector had unexpectedly shrunk in July.

Dismal manufacturing readings from Asia and Europe have also raised concerns over a potential global recession. The United States has already logged two consecutive quarters of negative growth.