By Avaneesh Pandey -

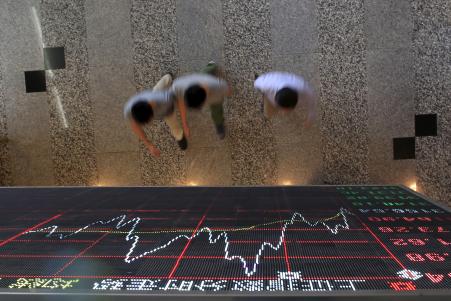

Asian stock markets extended losses Wednesday and European shares opened sharply lower after fresh and disappointing Chinese economic data cast doubts over the country’s growth targets. As investors mulled over the likelihood of new stimulus measures, the Shanghai Composite Index closed down 0.9 percent.

The downbeat mood was also reflected in other Asian bourses, with Japan’s Nikkei 225 index and South Korea’s Kospi Composite Index dropping 1.9 percent and 0.5 percent, respectively. India’s benchmark S&P BSE Sensex was also trading 0.2 percent in the red.

China’s Consumer Price Index (CPI) -- which measures changes in the price levels of a basket of consumer goods and services -- rose 1.6 percent in September from a year earlier, falling short of the 1.8 percent expectation, according to data released Wednesday. The Producer Price Index -- a measurement of what firms charge for their goods -- dropped 5.9 percent year-on-year in September, marking the 43rd consecutive month of deflation.

While the inflation data, combined with Chinese trade data released Tuesday, sparked concerns over a slowdown in the world’s second-largest economy, it also revived hopes of further stimulus measures by the country’s central bank.

“Disappointing Chinese data drove another sell-off in Asia today,” Angus Nicholson, a market analyst at IG Group in Singapore, told the Associated Press. “Today’s Chinese CPI essentially guaranteed further cuts to the interest rate and the reserve requirement ratio before the year is out.”

Weakness in Asian markets also impacted European stocks, which fell sharply at the open, and U.S. stock futures, which traded a shade lower Wednesday. While futures for the S&P 500 and Dow Jones Industrial Average were both down 0.1 percent, Nasdaq futures declined over 0.3 percent.

The pan-European STOXX 600 was trading down nearly 0.5 percent, as gloom in Asia and Wall Street continued to weigh on investors. London’s FTSE 100 was down 0.7 percent, France’s CAC 40 traded 0.9 percent in the red, and Germany’s DAX slipped over 1 percent.