Here are the latest developments in global markets:

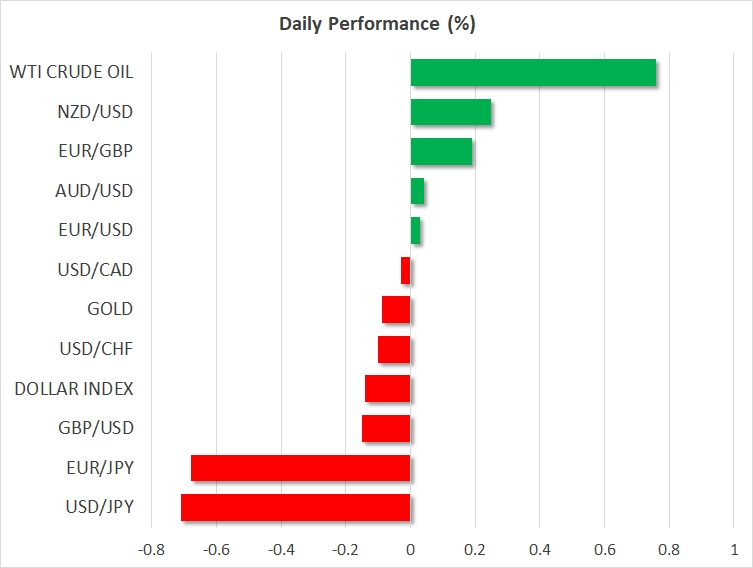

· FOREX: The US dollar index was marginally lower on Wednesday, after previously trading higher for three days in a row.

· STOCKS: Asian markets were mixed, with Japan’s Nikkei 225 declining by more than 0.2%, pulling back from the 26-year high it reached earlier in the week, though still remaining close to those multi-decade high levels. Meanwhile, the Topix added 0.15% while in Hong Kong, the Hang Seng was higher by 0.4%. In Europe, Euro Stoxx 50 futures suggest the index is likely to open slightly in the red. Over in the US, all three of the major indices - S&P 500, Dow Jones, and Nasdaq Composite - finished in the green yesterday, hitting fresh all-time highs. However, futures tracking the S&P, Dow, and Nasdaq 100 are currently in negative territory.

· COMMODITIES: Energy prices extended their recent gains overnight, with WTI and Brent crude climbing 0.8% and 0.5% respectively, the former reaching highs last seen in 2014. The moves came after the weekly private API inventory data signaled that US crude stockpiles are declining faster than previously anticipated. The report showed an 11.2 million barrels drawdown in inventories, much larger than the consensus of a 3.9 million reduction. The API data are generally considered as a gauge of the official EIA data - due out today. Gold traded lower on Wednesday, but only marginally.

Major movers: Yen rebounds further as shorts unwind; euro unfazed by political news

The Japanese yen continued to recover during the Asian trading session Wednesday. USD/JPY fell more than 0.7%, last trading near the 111.90 territory, with the next major support zone being near 111.70. Even though there was no clear fundamental catalyst behind the move, the JPY’s gains are being attributed to speculation that the Bank of Japan (BoJ) could begin to unwind its massive stimulus program, following news yesterday that the Bank bought fewer bonds under its regular operations.

However, as outlined here yesterday, the fact that the BoJ bought fewer bonds is not necessarily a signal that the Bank is moving towards tapering. It simply shows that the Bank did not need to buy as many bonds as usual in order to achieve its goal of keeping yields on longer-dated Japanese bonds fixed near 0%. Overall, the BoJ appears set to continue with its ultra-loose policy framework for a while yet, given that inflation remains so far away from its target. Still, all the talk about a potential tapering may have led investors to unwind some of their short-JPY speculative positions, leading to gains in the JPY. According to the latest CFTC commitment of traders report, JPY shorts are currently very high by historic standards.

In Europe, euro/dollar remained largely unfazed by headlines yesterday that Italy’s 5-Star Movement abandoned its pledge to leave the euro if Brussels did not accept to renegotiate some of the EU’s fiscal rules. Ahead of the looming Italian general election in March, this development alleviates some political uncertainty and could imply brighter skies ahead for the common currency.

In the commodity-linked currencies sphere, USD/NZD traded 0.2% higher while AUD/USD was in the green too, albeit marginally.USD/CAD traded close to neutral territory despite the strong gains in oil.

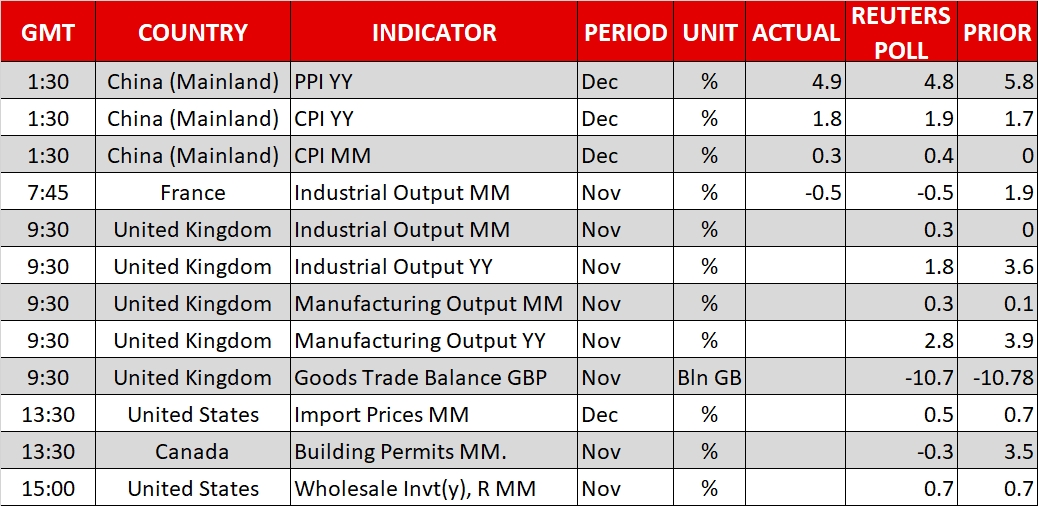

Day ahead: UK manufacturing output expected; Riksbank minutes also due

Krona pairs could be gathering some attention as minutes from the Swedish Central Bank’s meeting on monetary policy will be made public at 0830 GMT.

UK manufacturing output figures for November due at 0930 GMT is likely to be the release gathering most attention during Wednesday’s European session trading. Month-on-month, manufacturing output expanded for the sixth straight month in October – the longest stretch in decades – spurring hopes that the British industry could be in for a strong performance in 2018 despite analysts predicting a slowdown in overall economic activity. Today’s reading on November manufacturing production will shed light on whether factories will continue to defy downbeat forecasts on the UK economy, with forex market participants placing their sterling positions accordingly. Data on industrial output and figures on the goods trade balance will also be watched. Those will be released alongside manufacturing output numbers.

Canadian building permits for the month of November are due at 1330 GMT, with US December import prices to be released at the same time. Data on US wholesale inventories are scheduled for release at 1500 GMT.

In policymakers’ appearances, Chicago Fed President Charles Evans and Dallas Fed President Robert Kaplan will be participating in discussions later in the day; Evans at 1400 GMT and Kaplan at 1410 GMT as well as at 1515 GMT. St. Louis Fed President James Bullard is scheduled to give a presentation on the US economy and monetary policy at 1830 GMT. Neither of the aforementioned is an FOMC voting member in 2018. Bank of England Deputy Governor Ben Broadbent will be answering questions on central bank policy on BBC radio at 1500 GMT.

The EIA report on US crude and gasoline stocks pertaining to the previous week is due at 1530 GMT. Crude oil inventories are expected to have declined by around 3.9 million barrels over the period of coverage. This compares to a drawdown of around 7.4m barrels in the week that preceded.

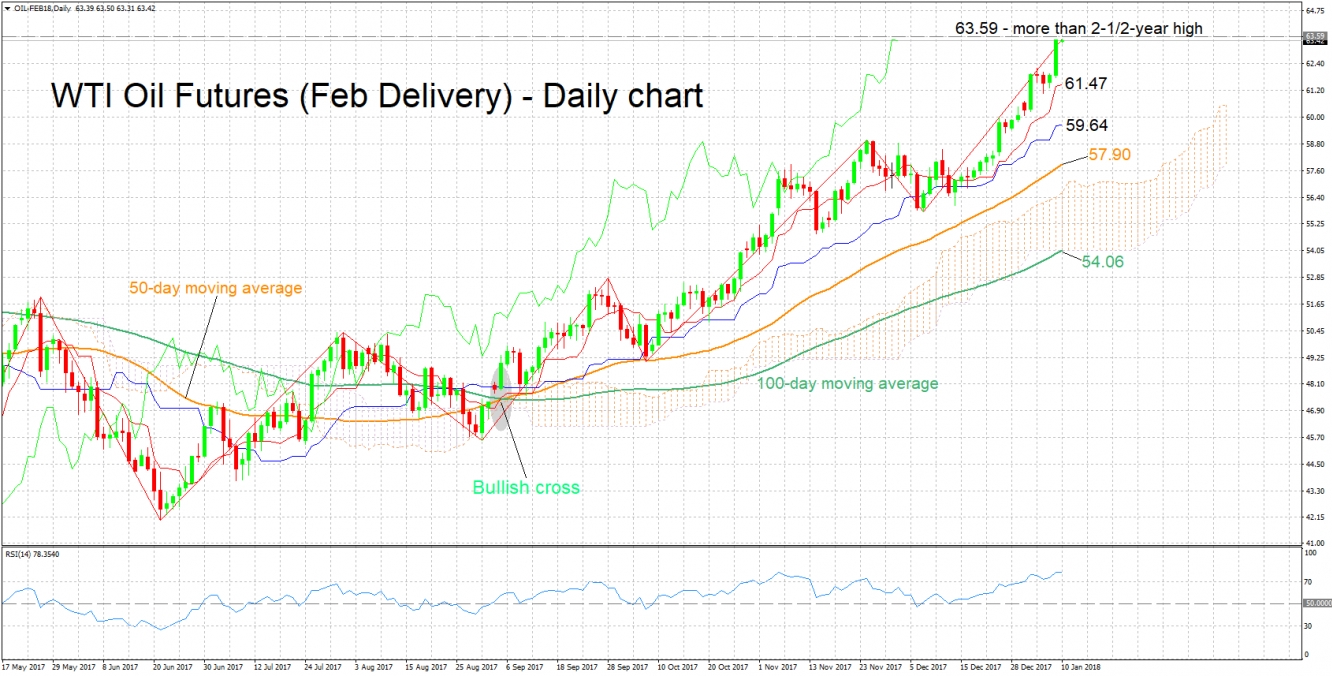

Technical Analysis: WTI oil futures rise to highest since May 2015; RSI overbought

WTI oil futures for February delivery hit 63.50 during today’s trading – their highest since May 2015 – after gaining 2.5% in Tuesday’s trading. Technical indicators are pointing to a bullish picture in the short-term: the Tenkan- and Kijun-sen lines are positively aligned and the RSI indicator has been rising over the last number of weeks. It should be noted though that RSI is in overbought territory above 70; a pullback in the short-term is not to be ruled out.

A larger-than-anticipated decline in crude stockpiles out of today’s EIA report could further boost prices, pushing them above 63.59, this being a more than 2½-year high that could be providing some resistance at the moment. Further above, round numbers – for example the 64.00 and 65.00 handles – could act as psychological barriers to additional bullish movement.

On the contrary, a smaller-than-projected drawdown in crude inventories could weaken prices. In this case, the area around the Tenkan-sen at 61.47 would come into view as potential support.