Are financial markets justified going from a growth story to an inflation narrative?

Today’s US consumer price index (08:30 am EST) is being touted as one of the most significant economic release in a number of years as capital markets seek to understand the recent plunges in global equities and sovereign bonds.

With investors already on edge, they are expected to renew this months convulsion on any sign that US inflation is exceeding expectations at a rate that may entice the Fed to quicken its plans for tightening monetary policy.

Already this month, after a stronger US non-farm payroll (NFP) print and wage numbers, investors have sent US Treasury yields aggressively higher and instigated a rout in equities that pushed them into the first correction in 18-months.

Note: Market expectations are looking for the core-CPI (ex-food and energy) to rise +1.7% in January y/y compared with the +1.8% increase in December. US retail sales are also out this morning and are expected to have increased for a fifth consecutive month.

A higher CPI will give the USD strength, lead to higher yields and lower equity prices, but a tepid headline print could cause more of a problem, especially with record short US 10-year treasury position and a market focusing on President Donald Trump’s proposed budget and the rise in US twin deficits.

Note: Lunar New Year celebrations for the Year of the Dog begin, affecting China, Hong Kong, Taiwan, Singapore, Malaysia and Indonesia. Chinese mainland markets are closed Feb. 15-21.

1. Stocks mixed reaction

In Japan, the Nikkei share average dropped to a fresh four-month low overnight as investor sentiment was again sapped by worries about US inflation data due this morning. The Nikkei ended -0.4% lower, its lowest closing since early October. The broader TOPIX fell -0.8%.

Down-under, Australia's S&P/ASX 200 index fell -0.3%, following a +0.6% rise on Tuesday. In South Korea the KOSPI closed out the overnight session up +1.1%, helped by a +3% jump in Samsung (KS:005930).

In Hong Kong, shares rebound sharply ahead of Lunar New Year holiday. Trading will resume on Feb 20. At close of trade, the Hang Seng index was up +2.27%, while the Hang Seng China Enterprise (CEI) index rose +2.14%.

In China, stocks rebounded overnight, but volumes were thin, as many traders had already left for the weeklong Lunar New Year holiday. Chinese markets will reopen on Feb. 22. At the close, the Shanghai Composite index was up + 0.46%, while the blue-chip Shanghai Shenzhen CSI 300 index was up +0.8%.

In Europe, regional indices trade higher across the board following a rebound in Wall Street yesterday and strength in US futures this morning.

US stocks are set to open in the black (+0.4%).

Indices: STOXX 600 +0.7% at 373.2, FTSE +0.7% at 7216, DAX +0.7% at 12286, CAC 40 +0.6% at 5139, IBEX 35 +0.5% at 9693, FTSE MIB +0.2% at 22071, SMI +0.9% at 8832, S&P 500 Futures -+0.4%

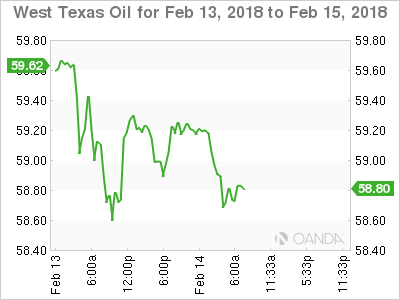

2. Oil dips on looming oversupply and weak US dollar, gold higher

Oil prices have dipped overnight, pressured by lingering oversupply including rising US inventories. However, the prospect of Saudi output dropping next month, economic growth hopes and a weaker US dollar all combined to limit losses.

Brent crude futures are at +$62.68 per barrel, down -4c. Brent was above +$70 a barrel earlier this month. US West Texas Intermediate crude futures are at +$59.06 a barrel, down -13c from yesterday’s close. WTI was trading above +$65 in early February.

On Wednesday, the Saudi energy ministry said that Saudi Aramco’s crude output in March would be -100k bpd below this month’s level while exports would be kept below +7m bpd.

Stateside, yesterday’s API report showed that US crude inventories rose by +3.9m barrels in the week to Feb. 9, to +422.4m.

Note: That is due to soaring US crude production, which has jumped by over +20% since mid-2016 to more than +10m bpd, surpassing that of top exporter Saudi Arabia and coming within reach of Russia, the world’s biggest producer.

Oil traders will take their cue from today’s EIA print (10:30 am EDT) and US inflation release.

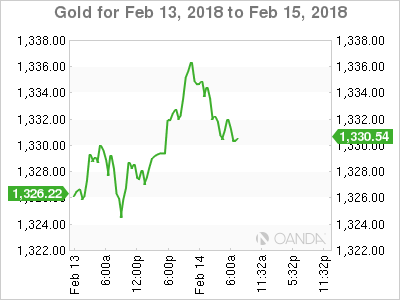

Ahead of the US open, gold prices have rallied for a third consecutive session overnight to hit a one-week high, buoyed by a weaker dollar, while the market awaits US inflation data for clues on the pace of future Fed rate increases. Spot gold is up +0.3% at +$1,332 an ounce.

3. Sovereign yields little changed

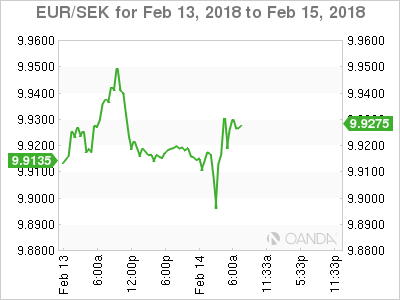

Earlier this morning, Sweden’s Central Bank (Riksbank) kept their repo rate unchanged at -0.5%. Deputy governor Henry Ohlsson voted to raise rates, but the central bank’s signals on inflation were more downbeat. The inflation forecast for this year was downgraded to +1.8% from +2%. The statement indicated that policy makers would start raising the rate in H2 of 2018. Policy makers stressed that was important not to raise the rate too early and was committed to stimulus to prevent inflation setbacks.

Elsewhere, fixed income seeks guidance from today’s US CPI release. The yield on US 10-year Treasuries fell less than -1 bps to +2.83%. In Germany, the 10-year Bund yield declined -2 bps to +0.74%, while in the UK, the 10-year Bund yield dipped -1 bps to +1.618%. In Japan, the 10-Year JGB yield decreased -1 bps to +0.07%, the lowest in more than five weeks.

4. Dollar on soft footing

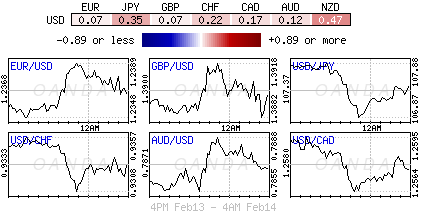

The USD remains on soft footing ahead of key Jan CPI data.

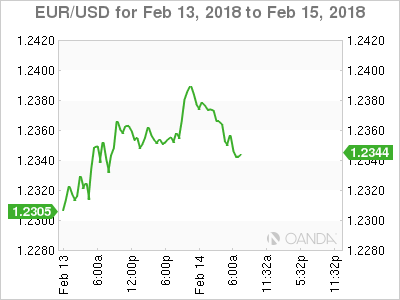

The EUR/USD is steady, trading atop of the €1.2350 area after various European GDP data highlighted better economic growth prospects (see below).

USD/JPY tested ¥106.85 overnight for 15-month lows. The pair came off its worst level to approach 107.50 just ahead of the NY session after Japanese officials reiterated that they had no comments on forex levels.

In South Africa, political optimism that President Zuma would resign has sent the ZAR to its best level in nearly two-years outright. The South African Democratic Alliance (DA) leader Mmusi Maimane (opposition) has stated that the party's motion to dissolve parliament was being processed by the Speaker. USD/ZAR is at $11.85 ahead of the open stateside.

The Swedish krona has been volatile after the Riksbank interest rate decision. The krona briefly rose soon after the announcement, but has since pared those gains EUR/SEK last trades flat on the day at €9.9163, compared with €9.8952 before the decision.

5. Eurozone economy ends 2017 on a high note

Note: There were a number of European GDP releases in the euro session highlighting better economic growth prospects – Germany mixed; Netherlands beat and Italy a miss.

Industry helped drive the eurozone +0.6% expansion in Q4. This morning’s ‘flash’ estimate of Q4 GDP is the second release and confirms that quarterly growth slowed a tad from Q3’s +0.7% to +0.6%.

There is no breakdown until the next release; however, expenditure evidence would suggest that weaker consumer spending growth was the main driver of the slowdown, while investment expanded after Q3’s contraction and net trade again made a positive contribution to growth.

Digging deeper, industry appears to have made a stronger contribution to GDP growth than in Q3. Following the consensus-beating +0.4% monthly rise in IP in December.