Summary: Equities fell this past week, led by an 11% drop in the US's largest stock, Apple (NASDAQ:AAPL). For the first time since the February low, the near-term trend in the SPDR S&P 500 Fund (NYSE:SPY) is weak: the current set-up normally leads SPY, through price and time, to its 50-dma and lower Bollinger® Band, both currently about 3% lower. Overall, breadth, sentiment, macro, commodities and seasonality support higher equities prices in the week(s) ahead. The month of May typically starts strong and the NASDAQ has been down 7 days in a row: combined, these suggest a positive start to the week is likely.

Equities fell this past week. Worldwide, equities lost just 0.4%, as did emerging markets. Europe lost 2%.

In the US, SPX and small caps lost 1.2%. Leadership has moved to small cap stocks: the RUT made a new 2016 high this past week.

For the second week in a row, NDX was the laggard: it lost 1.5% last week and another 3% this week.

What accounts for the disparity between the greater weakness in NDX and the other indices? Primarily, the price of oil. Crude gained another 5% this week and helped offset weakness in SPX and RUT. NDX has zero exposure to energy.

Safe havens - Treasuries and gold - were higher: Treasuries gained 0.8% and gold gained 5%.

Why did equities fall this past week? It's an important question because the cause of weakness says much about what happens next.

Deteriorating breadth was not the cause. Below the surface, breadth has been strong.

The NYSE advance/decline line - the cumulative total of the daily difference between advancing issues and declining issues on the NYSE - reached a new all-time high on Wednesday. This means that participation in the rally continues to be widespread. Recall that the advance/decline line has declined before the SPX has made its final high at every cyclical top in the past 50 years. Further gains should still be ahead (post here).

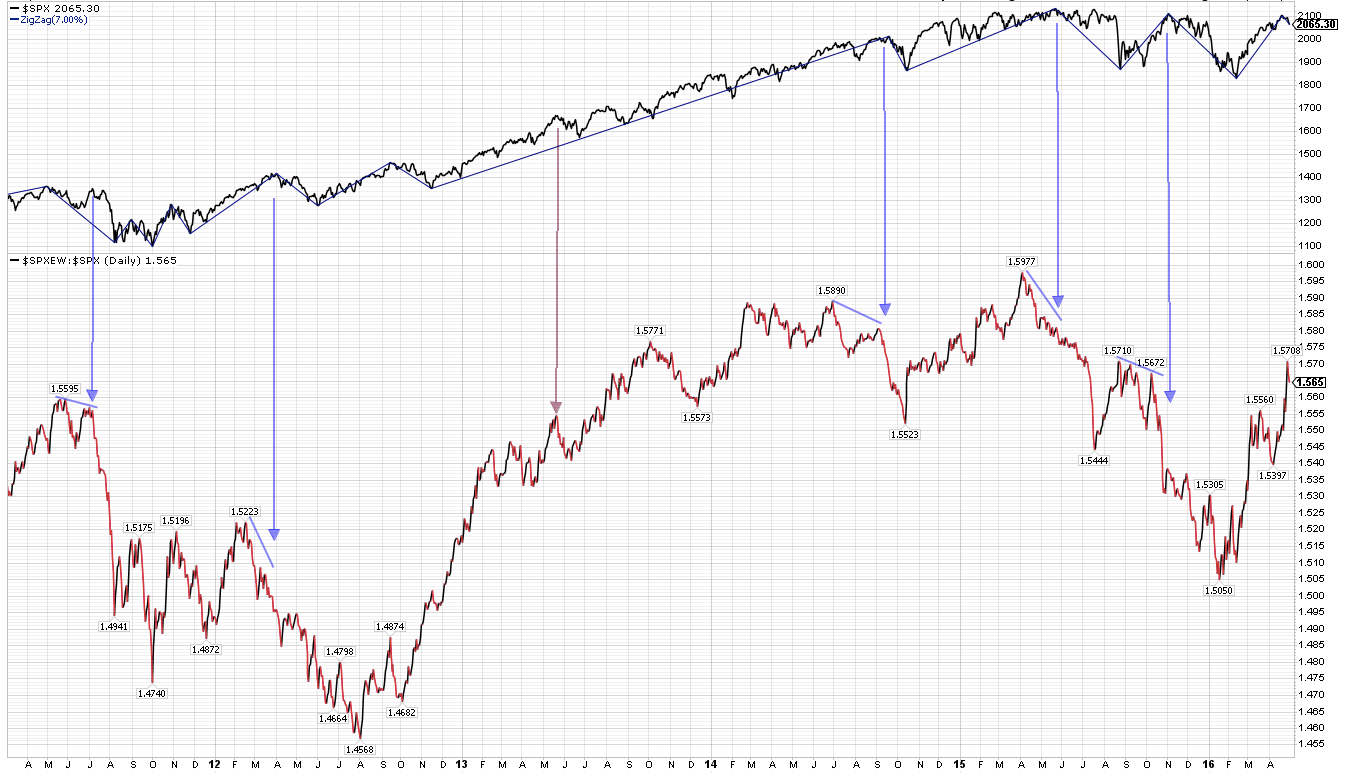

The average stock in the SPX has been rising faster than the size-weighted index (lower panel). This is another way of saying that participation has been strong. It's not a perfect predictor, but very often the average stock will underperform the size-weighted index before a correction of greater than 5% (arrows). That hasn't happened.

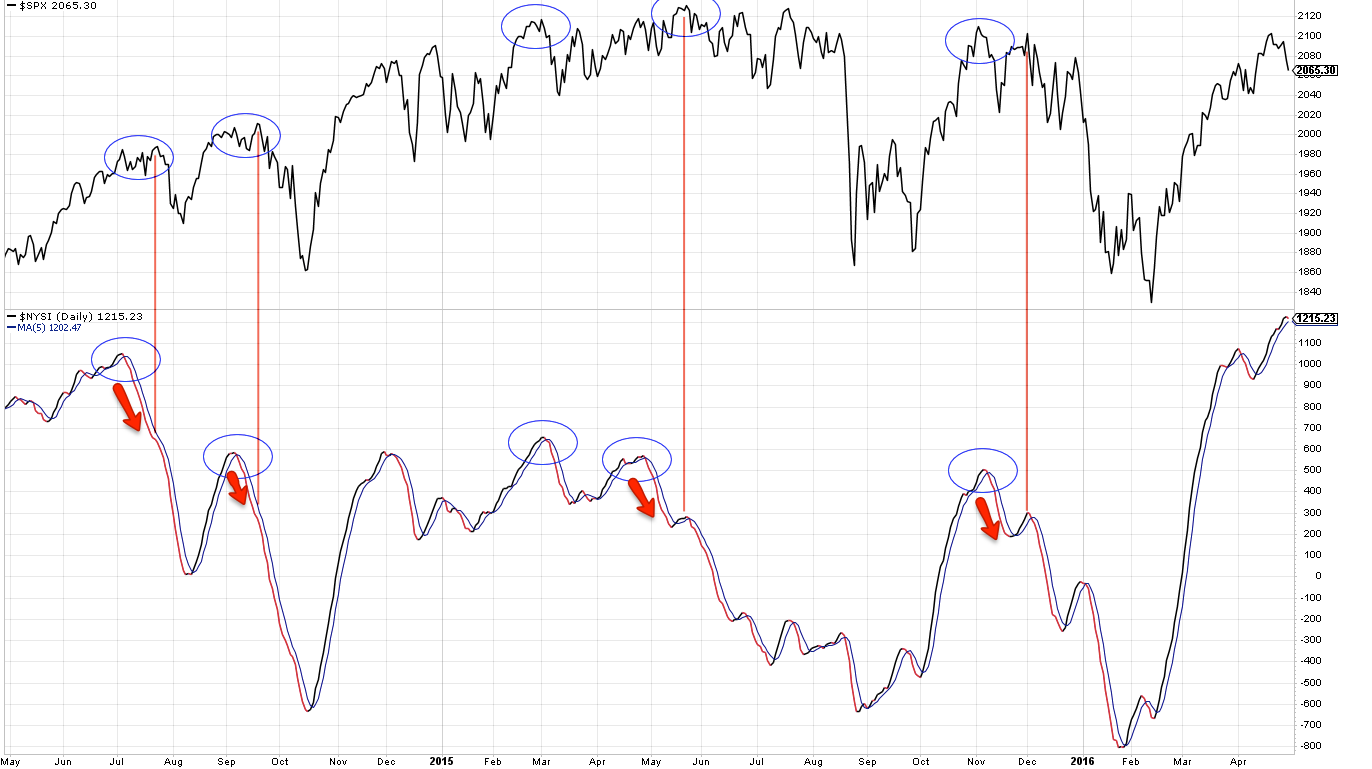

Similarly, the momentum of breadth (the McClellan oscillator) was positive until Friday, in turn pushing the Summation index higher. Momentum in breadth typically wanes into an intermediate top, something that also has not happened (circles in bottom panels).

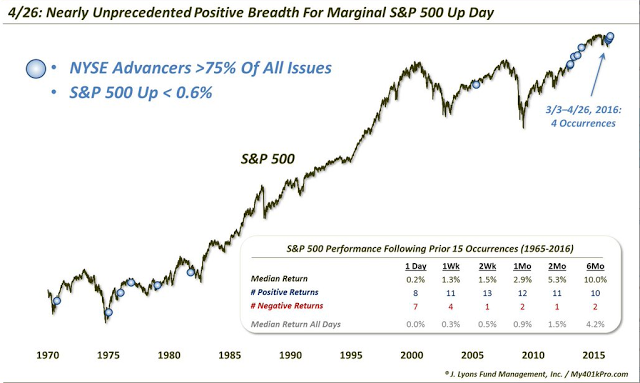

Within the SPX, since the February low, the largest 50 stocks have gained 11%. But the smallest 50 have gained an astounding 42% (data from Bespoke). That type of action can cause breadth statistics to be strong while the indices make relatively small advances. Prior instances are limited, but the SPX has been higher 1 and 2 months later more than 80% of the time under similar circumstances (from Dana Lyons; his post is here).

So, overall, breadth has supported the rally and suggests further gains are still ahead.

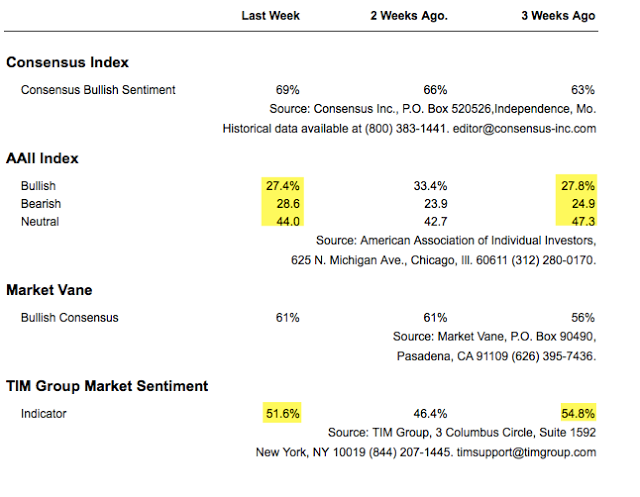

It's hard to say excessive investor bullishness exhausted the rally. Bullish sentiment fell this week in surveys by Investors Intelligence, AAII and NAAIM. Over the past 3 weeks, investors within AAII have moved from neutral to bearish (from Barrons).

Moreover, a paltry $0.1b flowed into equity ETFs and mutual funds this week. That compares with an outflow of more than $9b in the prior two weeks. Money flows have been negative 13 of the past 17 weeks. It would be a remarkable top if investors had all anticipated it beforehand. The bear market rally in March-May 2008 included several positive weeks of equity inflows, including one that was more than $20b in one week. The current rally has seen nothing close to this yet (data from Sentimentrader and Lipper).

Overall, sentiment is likely to become more bullish before the current rally exhausts itself.

It's hard to say that credit worries underlie the weakness in stocks. The iShares iBoxx USD High Yield Corporate Bond Fund (NYSE:HYG), which tracks the high yield corporate bond index, gained 0.5% and made a new 9-month high this past week. It is now less than 3% from reaching its all-time high. HYG has gained in 10 of the past 11 weeks. If there is a looming credit crisis, the market seems unaware.

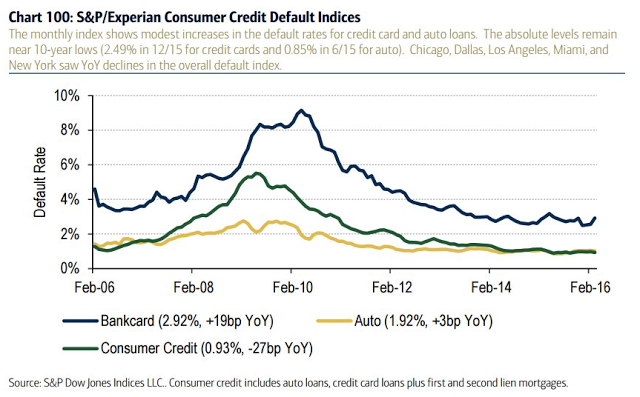

Related, consumer defaults are near a 10 year low. This includes the auto loans that some investors continually fret are a ticking time bomb (from @NickatFP).

Macro data continues to support equities. Growth is modest but positive and certainly not recessionary. The first estimate of 1Q16 GDP showed 2% yoy real growth. GDP is at a new all-time high. Excluding inventory adjustments, annual growth was 2.3%.

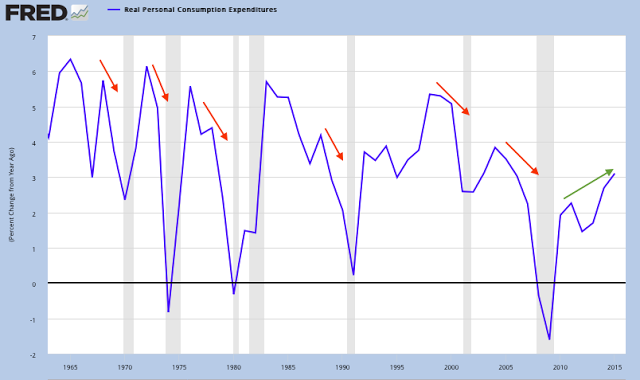

Personal consumption, the component that accounts for 70% of the economy, grew a strong 2.7% in 1Q16. Consumption growth the past 7 quarters is the strongest since 2006, 10 years ago. Growth has weakened into prior recessions, but the pattern now is one of continued improvement (arrows).

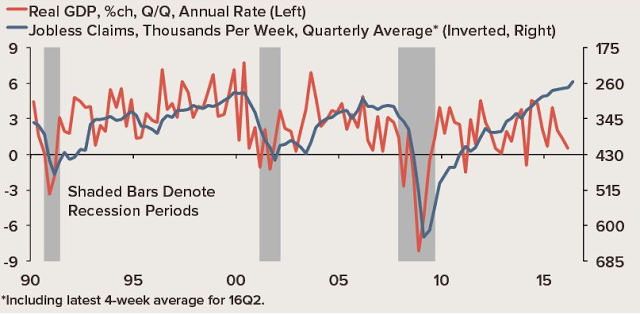

Similarly, jobless claims reached a 42 year low. The trend is still positive (blue line). At a minimum, jobless claims have flattened, if not risen, ahead of prior economic weakness. That is plainly not the case at present (from Jim O'Sullivan).

May trading begins this week, but the change in seasonality is not a likely cause for the weakness in equities.

While "sell in May and go away" is a popular axiom on Wall Street, the reality is that the SPX has started November higher than it closed in April 67% of the time. There have been some notably bad summers but on a median basis, the SPX has gained 4% during this period since 1970. We reviewed this in a post this week (here).

The last 10 years are an example of what typically happens in summer. In the chart below, the green boxes show periods where the index closed higher. That's mostly been the case in the past 45 years, too. Notably, most summers have seen a drop of at least 5% (arrows). The problem is it can happen in May or October or any month in between. Most often, these drops have been a profitable opportunity to get long.

Moreover, since 1950, when SPX is up YTD at end of April, the May-through-October period is even better: SPX gains an average of +3.9% vs -2.9% if the SPX down YTD. A positive summer is therefore the set up now (data from Ryan Detrick).

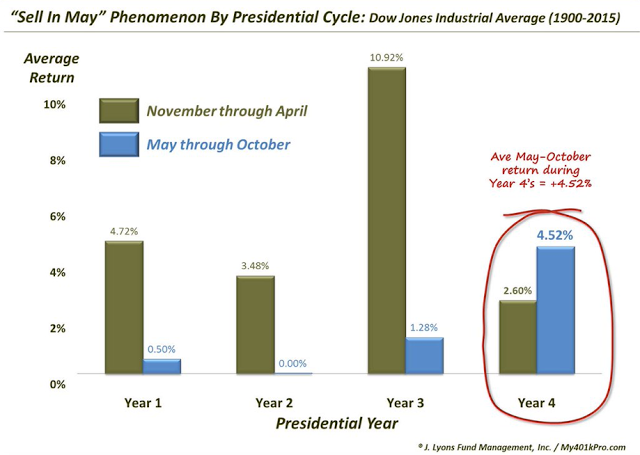

Finally, the May-through-October period tends to be stronger than normal in presidential election years. Yes, equities tanked into the 2008 election (chart from Dana Lyons).

Overall, seasonality suggests higher prices over the next several months.

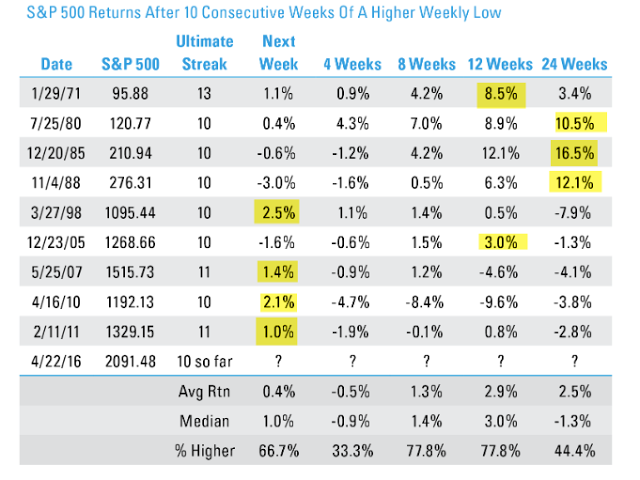

The trend in equity prices is not indicative of looming weakness. SPX is up two months in a row. As discussed last week, SPX made a "higher low" for 10 weeks in a row. Since 1954 (62 years), this has happened only 13 other times. What happened next? In every case, the S&P had a higher weekly close within the next 2 months. At the end of 2 months, 85% of these cases closed higher. Data from 1970 is shown below (from Ryan Detrick).

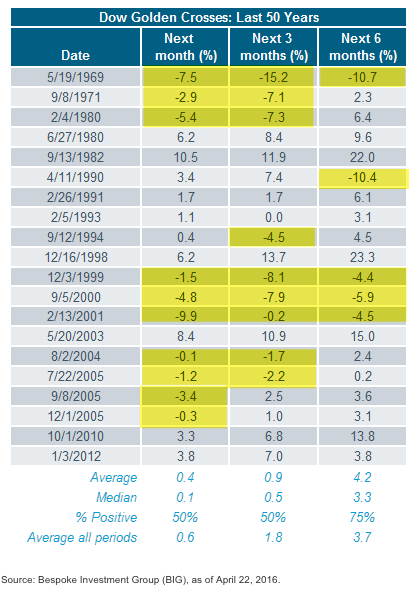

The DJIA and SPX both experienced a "golden cross" in the past week, where their 50-dma crossed above their 200-dma. As the name implies, this is expected to be a positive for stocks. But is it?

Shorter-term, no, but longer-term, yes. Over the next 3 months, stocks advanced only 50% of the time. But stocks have been higher 3 months later 64% of the time since 1965, so a "golden cross" has been followed by below average performance.

The main difference is seen 6 months later: stocks have been higher 75% of the time after a "golden cross" versus 67% "anytime" since 1965. Most of the failures 6 months later occurred during the 2000-02 tech bubble bear market. A "golden cross" hasn't failed since (from Bespoke).

One other insight from the table above is that if stocks fall over the next month after a "golden cross" then they are also likely to be lower after 3 months. This is something to keep in mind going forward.

Overall, the major trend for US equities still supports higher prices.

Rising commodity prices support equities. Crude oil remains the most important commodity: its low in February corresponded to the exact day of the low in Treasury yields, the price of high-yield bonds and the SPX. This week, crude made a 5-month high. Momentum remains strong (top panel). A strong trend will stay overbought, something to keep watching. Above $44, and crude will remain within its trading range from last autumn, with a potential target high of $50.

Overall, breadth, sentiment, macro, trend and commodities all support further advances in equities. So why the weakness in equities this past week?

One answer is Apple, the largest company in both the NDX and SPX. Apple lost 11% this past week after reporting disappointing earnings. The stock is down nearly 30% over the past year.

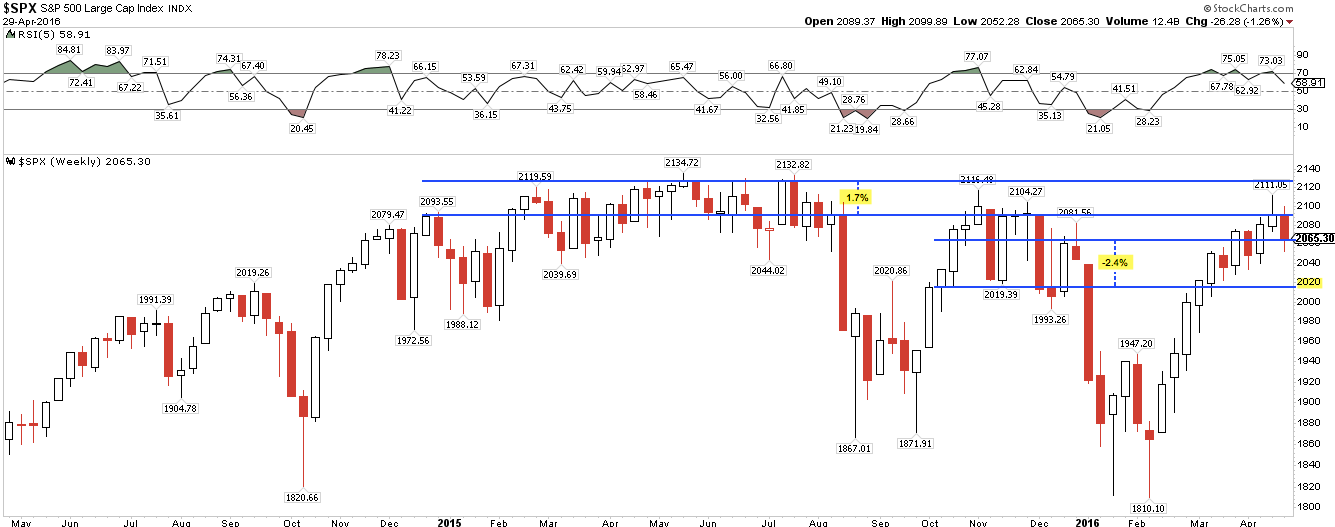

Probably more importantly, SPX (non-dividend adjusted) hit big resistance last week. Over the past 70 weeks, there have been about 25 weekly closes less than 2% higher than last week's close. In other words, that had been an area of previous strong resistance which, in the best scenario, will likely take time to move through. Last November's rally stopped near the same level; support then was near 2020, about 2% lower.

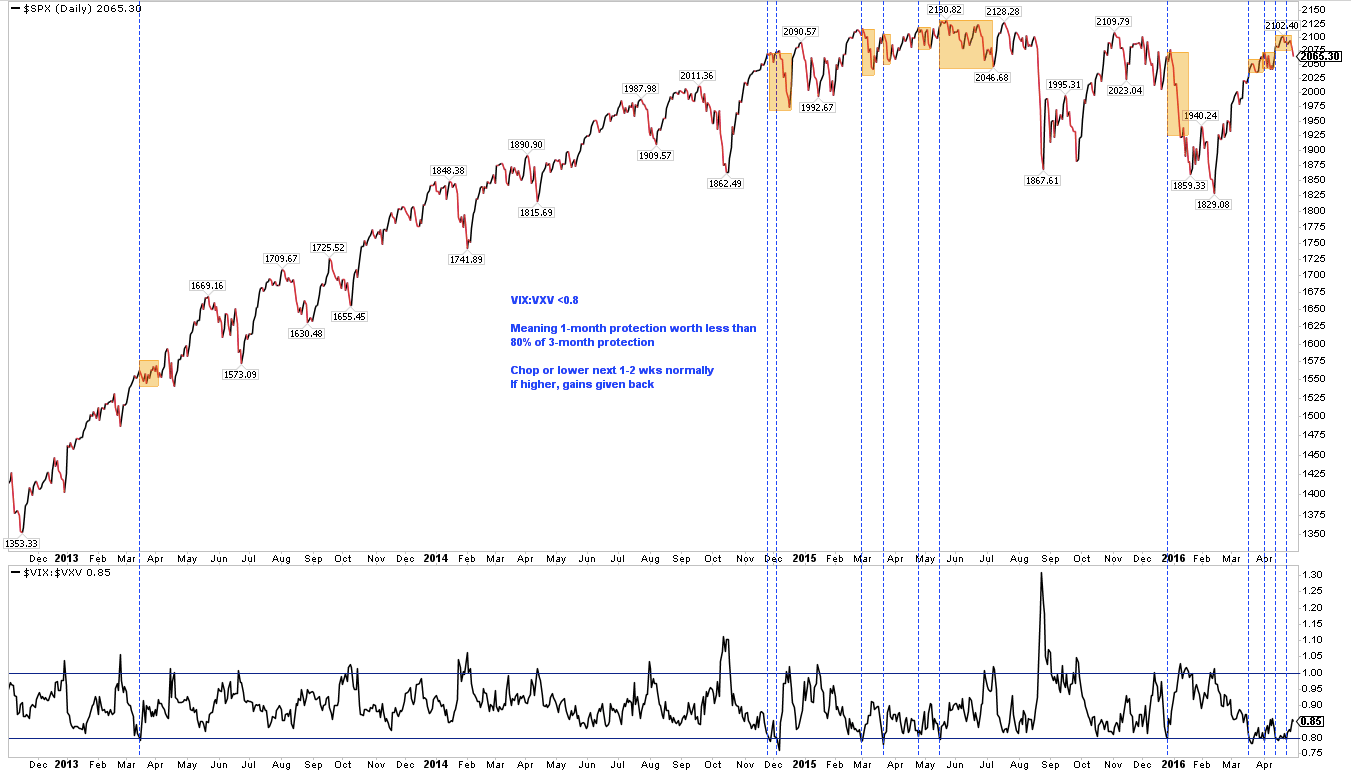

We think the term structure of volatility (via VIX and VXV) contributed to last week's fall. We showed this chart last week: when 1-month protection is worth less than 80% of 3-month protection, the rally in SPX reverses; if it continues higher, those gains are then given back. That 80% level had been reached 4 times recently. If all the gains from the first signal are given back, SPX would trade down to about 2040.

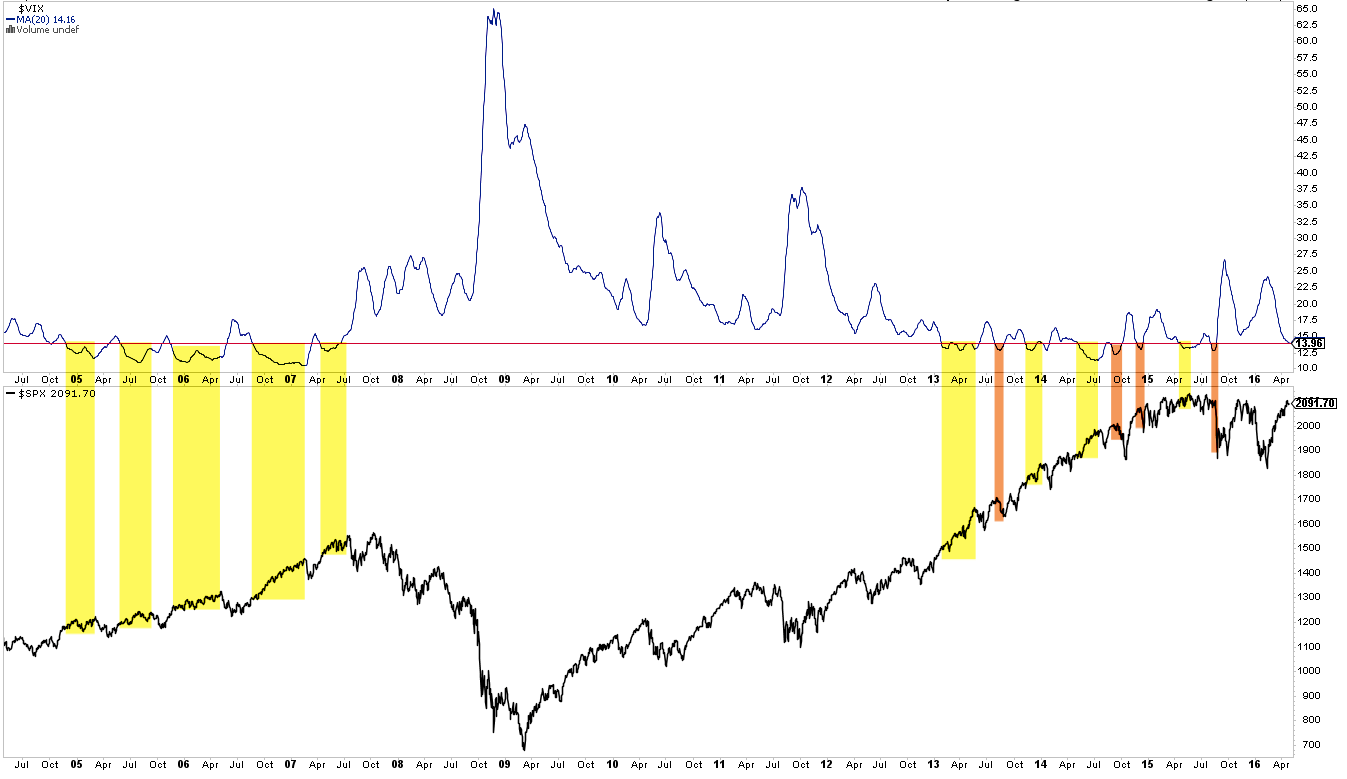

We don't share the current trader anxiety over the persistently low level of the VIX itself. Over the past 20 days, the average VIX has been near 14 (upper panel). That's low but not unusual. Nor is it necessarily bearish on its own. Most of the time, the SPX has moved higher (yellow shading, lower panel). That doesn't mean the index won't fall, but on its own, a low VIX doesn't suggest a consistent downside edge.

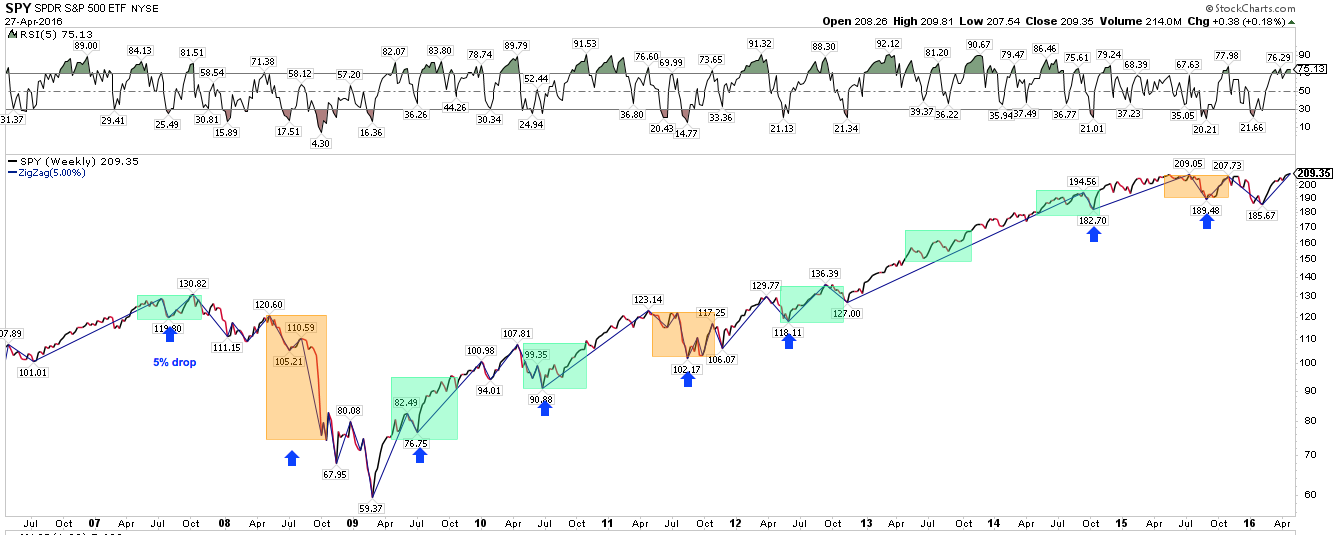

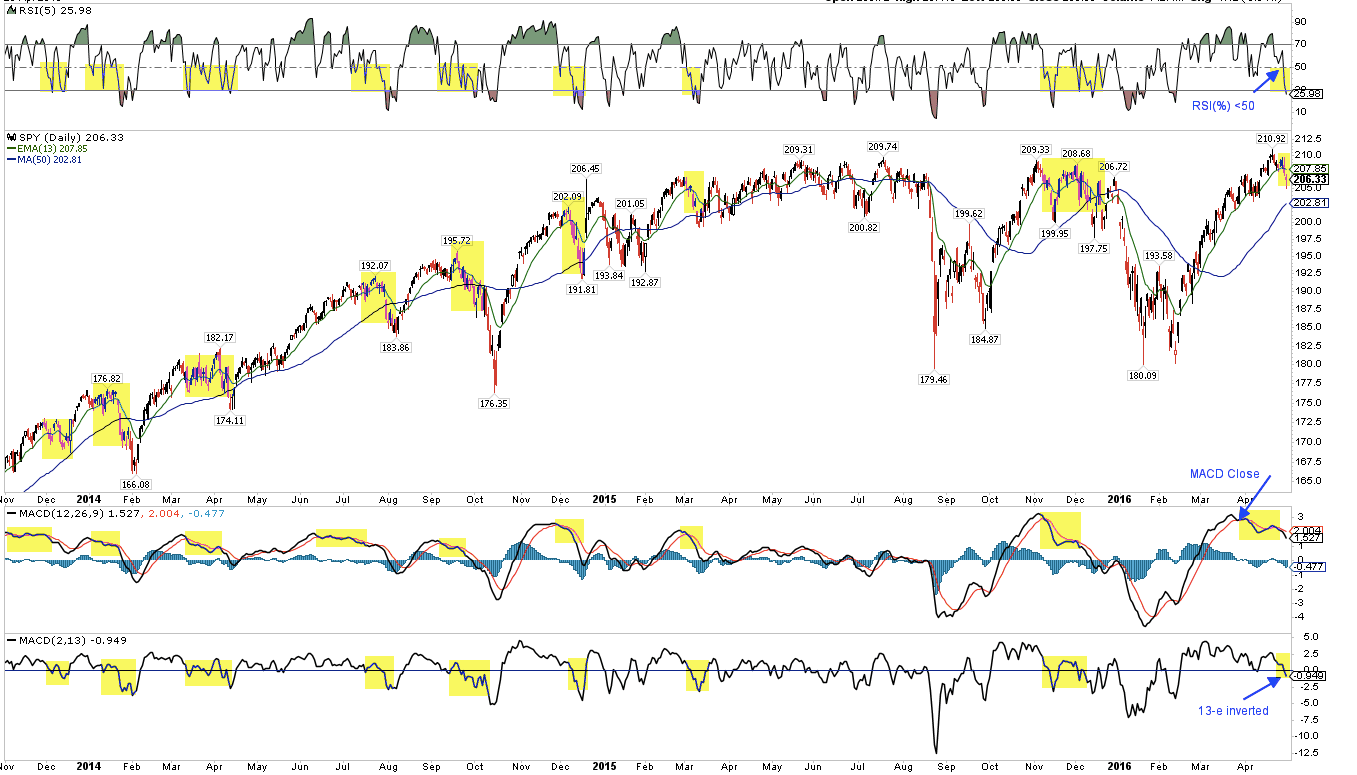

Since the February low, SPY's momentum had been mostly overbought (top panel) and the 13-ema had been rising (lowest panel). These were important positives for the near term trend. That changed Thursday. The MACD had already pinched close, which says that the rate of ascent is declining. When all 3 of these take place (yellow shading), SPY normally moves through price and time to its 50-dma (blue line). That seems to be the most likely scenario for the week(s) ahead.

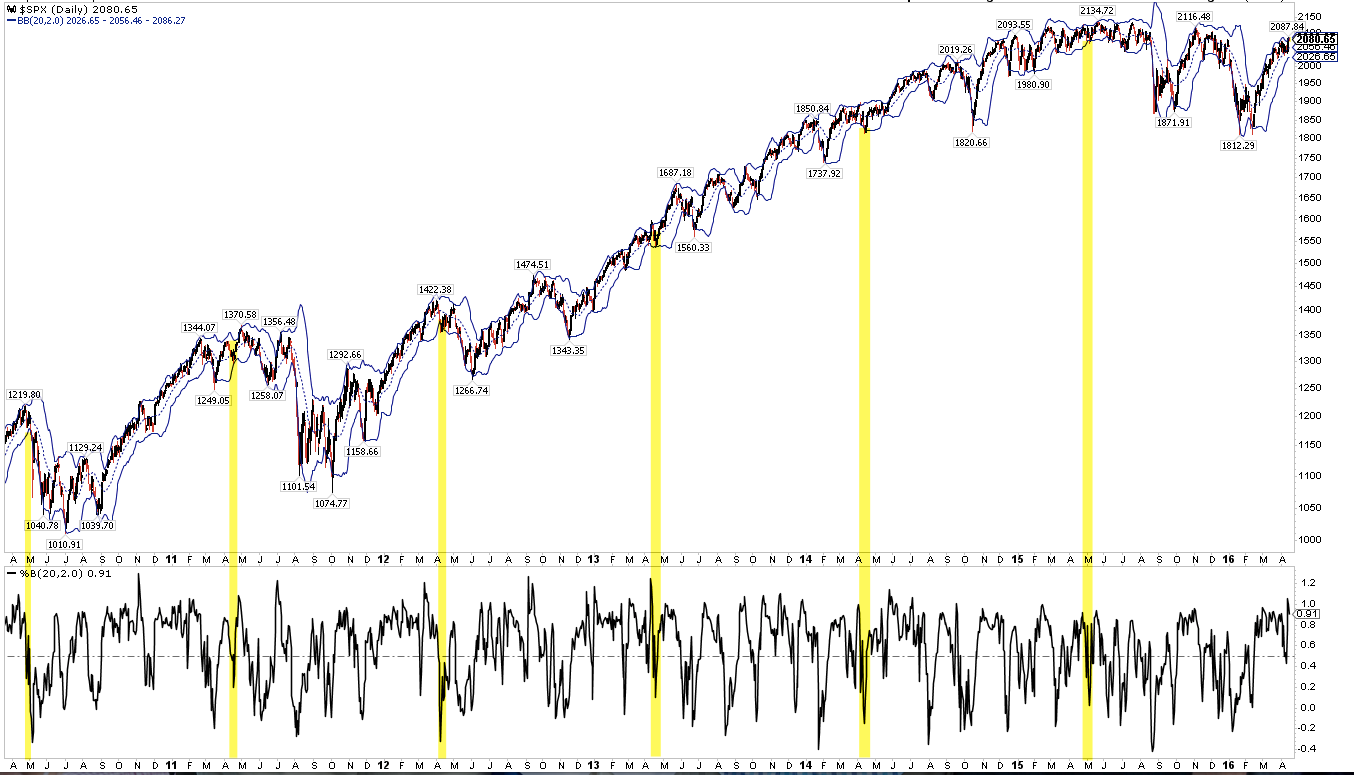

Interestingly, SPX has moved to its lower Bollinger Band in either April or May in each of the past years (yellow shading). That level is now near the 50-dma, at about 2030.

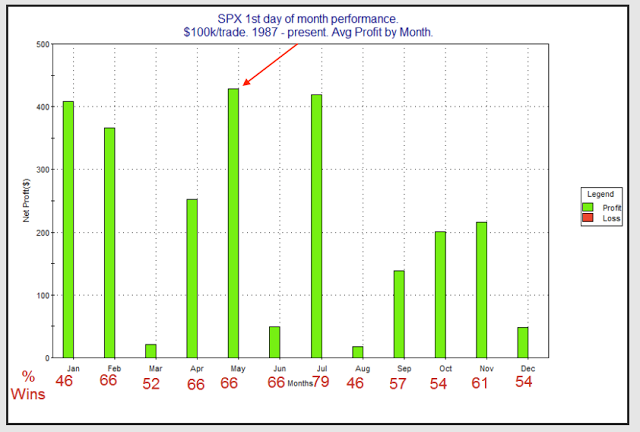

Today, Monday is the first trading day of May. The first trading day of the month is often positive. May's first day has been especially strong, and the tendency to rise on the first day of the month is even stronger when the prior month ends weak (from Rob Hanna, here).

Moreover, the NASDAQ has now fallen 7 days in a row. This is only the 3rd time in the past 5 years it has fallen this many days in a row. Within the next 2 days, NDX bounced 1.5% and nearly 3% (from Index Indicators).

Net, there are some good positives heading into the new week. On a rally, SPY resistance is 207.5-208 (also the location of his 13-ema).

On the economic calendar, nonfarm payrolls (the employment situation) will be released Friday.

In summary, equities fell this past week, led by an 11% drop in Apple. For the first time since the February low, the near-term trend in SPY is weak: the current set up normally leads SPY, through price and time, to its 50-dma and lower Bollinger Band, both currently about 3% lower. Overall, breadth, sentiment, macro, commodities and seasonality support higher equities prices in the week(s) ahead.

The month of May typically starts strong and the NASDAQ has been down 7 days in a row: combined, these suggest a positive start to the week is likely.