Summary: The SPDR S&P 500 ETF (NYSE:SPY) made a new all-time high this past week. The short and long term trend is higher. Despite a gain of 16% over the past 10 weeks, the majority of evidence indicates that investors largely remain skeptical and defensive. That, together with strong breadth, implies that higher highs still lie ahead. Shorter term, SPY is back to where it failed, repeatedly, to go higher in the spring, summer and fall of 2015. In the best scenario, attaining and then holding significant gains will likely take time.

Equities rose again this past week. Worldwide, equities gained 1.5%. Europe gained 1.5% as did US small caps. SPY and the DJIA gained 0.6%.

Weakness was confined to large tech companies: the NASDAQ 100 (NDX) lost 1.5% but the equal-weight version of the NDX (NASDAQ:QQEW) was flat. In other words, a few large tech companies pulled the NASDAQ 100 lower.

Safe havens - Treasuries and gold - were weak: Treasuries lost 2.6% and gold was flat.

By most accounts, the uptrend from the February low continues to be strong. SPY has gained in 8 of the past 10 weeks. It has also gained in 7 of the past 9 days.

Since mid-February, SPY and NDX have both gained 16%. Leading the upside, however, have been emerging markets, which are up 25%.

Advances as strong as the current one are relatively rare. The S&P has made a "higher low" every week since mid-February. Since 1954 (62 years), this has happened only 13 other times. What happened next? In every case, the S&P had a higher weekly close within the next 2 months. At the end of 2 months, 85% of these cases closed higher.

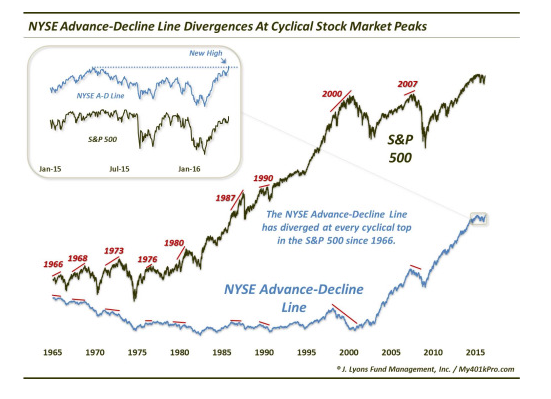

Below the surface, breadth has been strong. The NYSE advance/decline line - the cumulative total of the daily difference between advancing issues and declining issues on the NYSE - reached a new all-time high on Friday. This means that participation in the rally continues to be widespread.

For those concerned about a bear market, this is significant. The advance/decline line has declined before the S&P has made its final high at every cyclical top in the past 50 years. This implies further highs still lie ahead. Read more on this from Dana Lyons here.

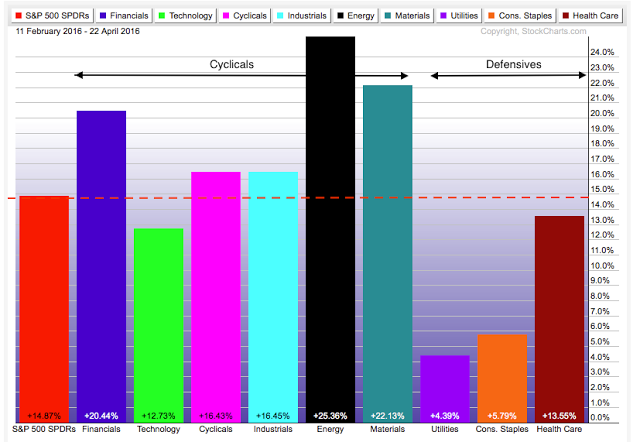

All of the sectors of the S&P are rising and the advance is being led by cyclicals. Defensives are lagging.

What has been most surprising about the rally is this: by most measures, investor skepticism remains pervasive.

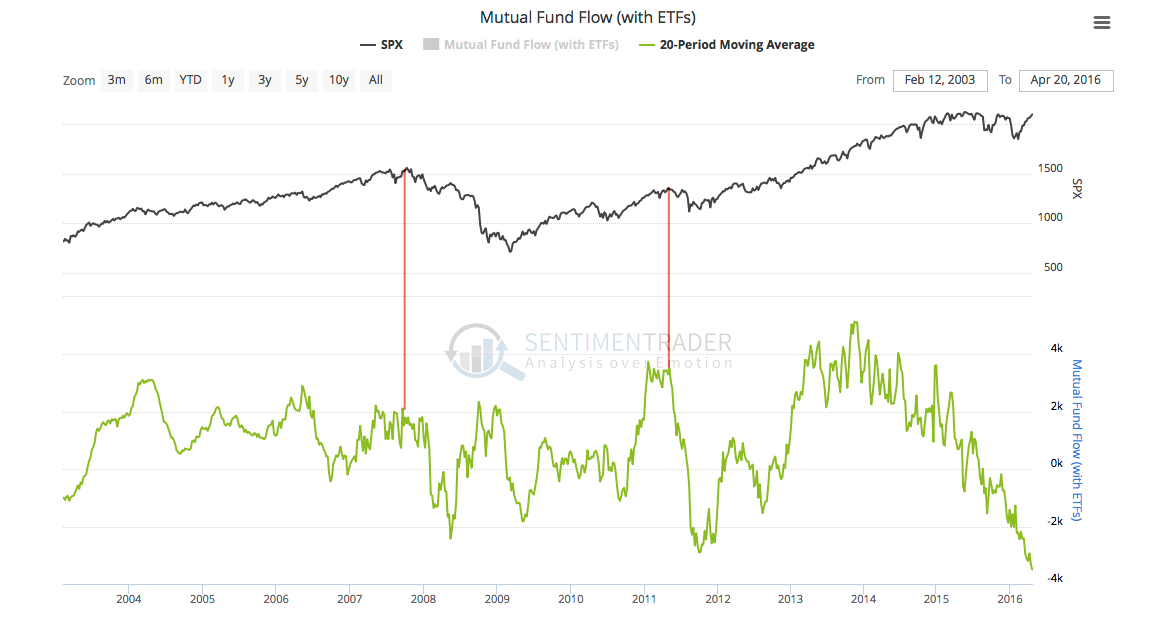

SPY made a new all-time high on Wednesday, yet $4.5b flowed out of equity ETFs and mutual funds during the week. Money flows have been negative 13 of the past 16 weeks, longer than any time during the 2007-09 bear market (green line, lower panel). It would be a remarkable top if investors had all anticipated it beforehand. The bear market rally in March-May 2008 included several positive weeks of equity inflows, including one that was more than $20b in one week (data from Sentimentrader and Lipper).

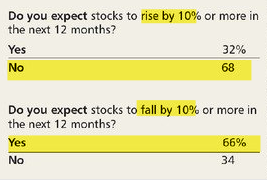

More likely, investors continue to fear another decline. In a poll of "Big Money" managers in Barron's this week, fully two-thirds see more downside risk than upside reward. This is one of the least bullish readings from this poll in the past 20 years.

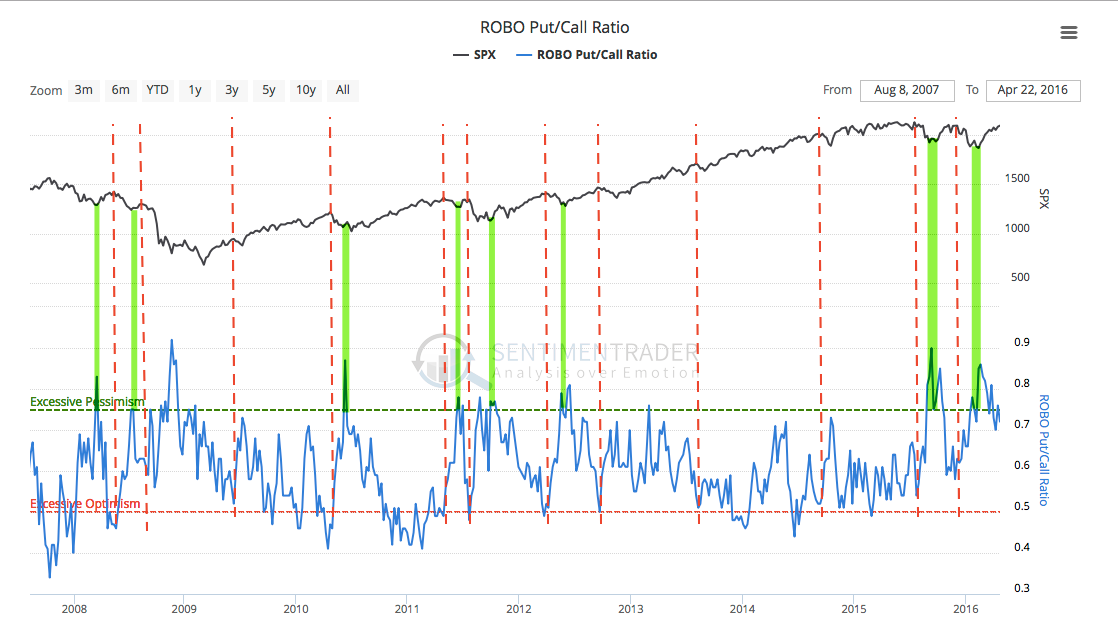

Small investors are similarly skeptical. Looking only at retail investors, downside put buying has dominated upside call buying. Since 2007, current levels have never corresponded with a significant top (red lines); instead, it has corresponded with relative lows in the S&P (green lines; from Sentimentrader).

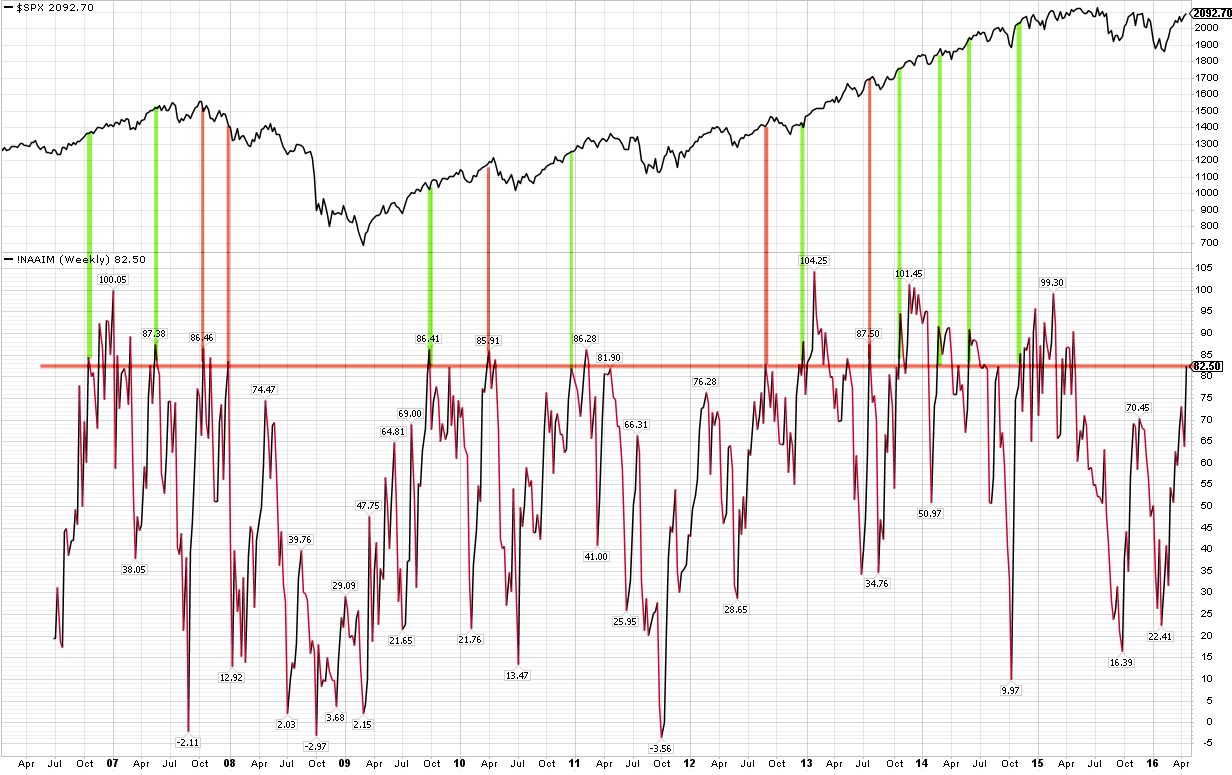

The most bullish sentiment poll is that of active investors. Their net exposure has risen to 82% long from just 22% in February. Similar levels over the past 10 years are highlighted below; in many cases, the index has continued to move higher.

The evidence is too mixed to be considered bearish. Why? Because it takes an increase in bulls to make a bull market. What is most noteworthy from this poll is that high bullish sentiment arrived after a 16% rise in stocks over the past 10 weeks (from NAAIM).

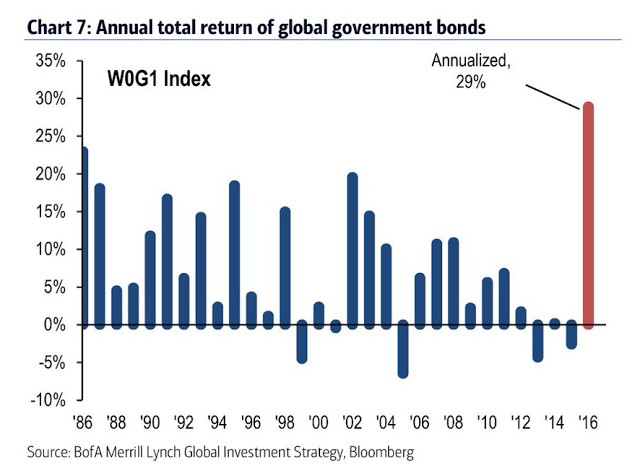

Where has money been flowing as it has left equities? Into Treasuries. Inflows into taxable bond ETF and mutual funds have been positive 15 of the past 16 weeks. Not just in the US, but global annualized returns YTD in risk-free government bonds is the highest in 30 years (from BAML).

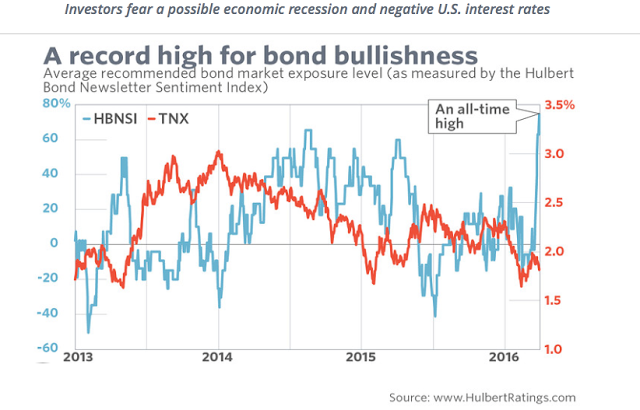

Bond sentiment is normally the flipside of equity sentiment, so it's noteworthy that the average recommended bond market exposure among newsletters tracked by Mark Hulbert recently reached an all-time high. In other words, investors are being urged to seek the shelter of low risk assets.

With relative extremes in sentiment and fund flows, Treasury yields may have just reached an interim bottom, matching the lows from February and early 2015. The 50-dma is now starting to rise.

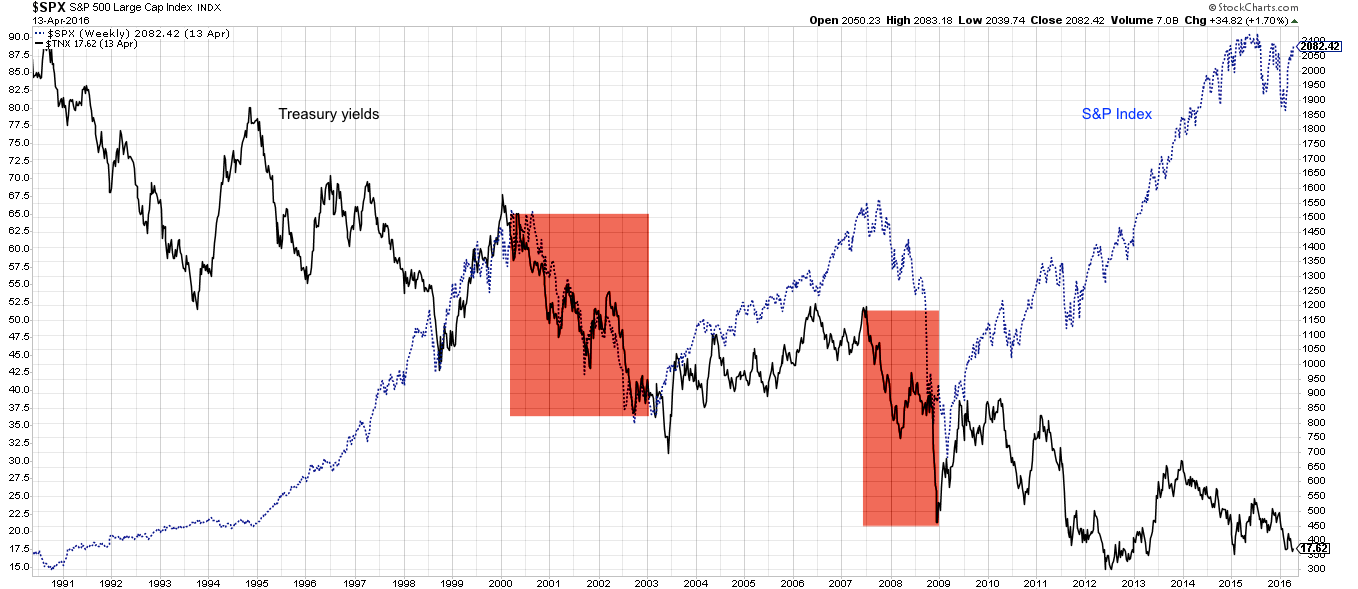

Much has been made about the divergence between yields and equities, with equities rising as yields have fallen. While it's true that yields fall with equities (due to growth concerns; red boxes), the reverse is not always the case: rising equities have been associated with both rising and falling yields. Over the past 35 years, yields have mostly been in a downtrend while equities have mostly been in an uptrend.

Rising commodity prices support both higher yields as well as higher equity prices. Crude oil remains the most important commodity: its low in February corresponded to the exact day of the low in both yields and the S&P. This past week, crude made a 4-month high. Momentum remains strong (top panel). A strong trend will stay overbought, something to keep watching. Above $44, and crude will reenter its trading range from last autumn, with a potential target high of $50.

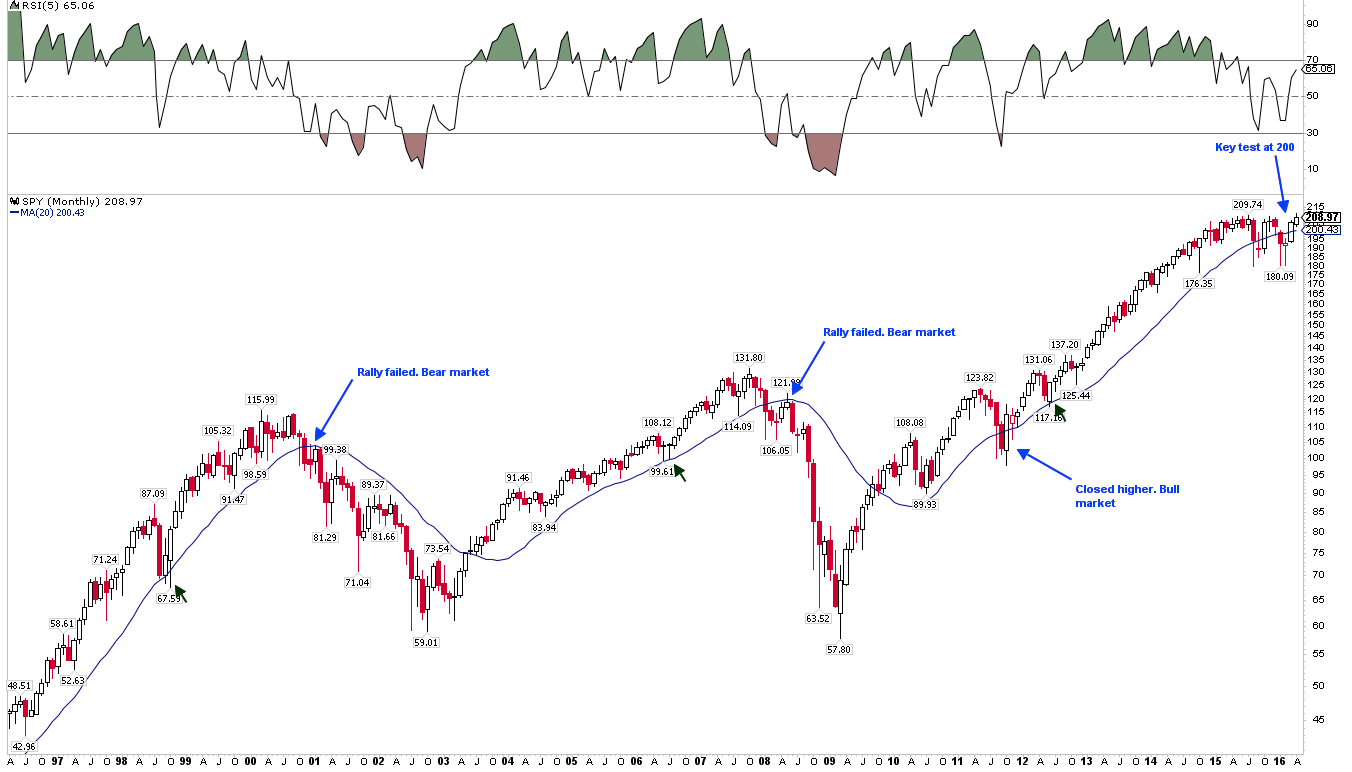

On a dividend-adjusted basis, SPY closed at a new all-time high (ATH) this past week. Monthly momentum is the best since July 2015. Remaining above 200 (on a month-end closing basis) keeps the long term trend intact. Note that SPY is up two months in a row (including April). It has not risen three months in a row since May 2014.

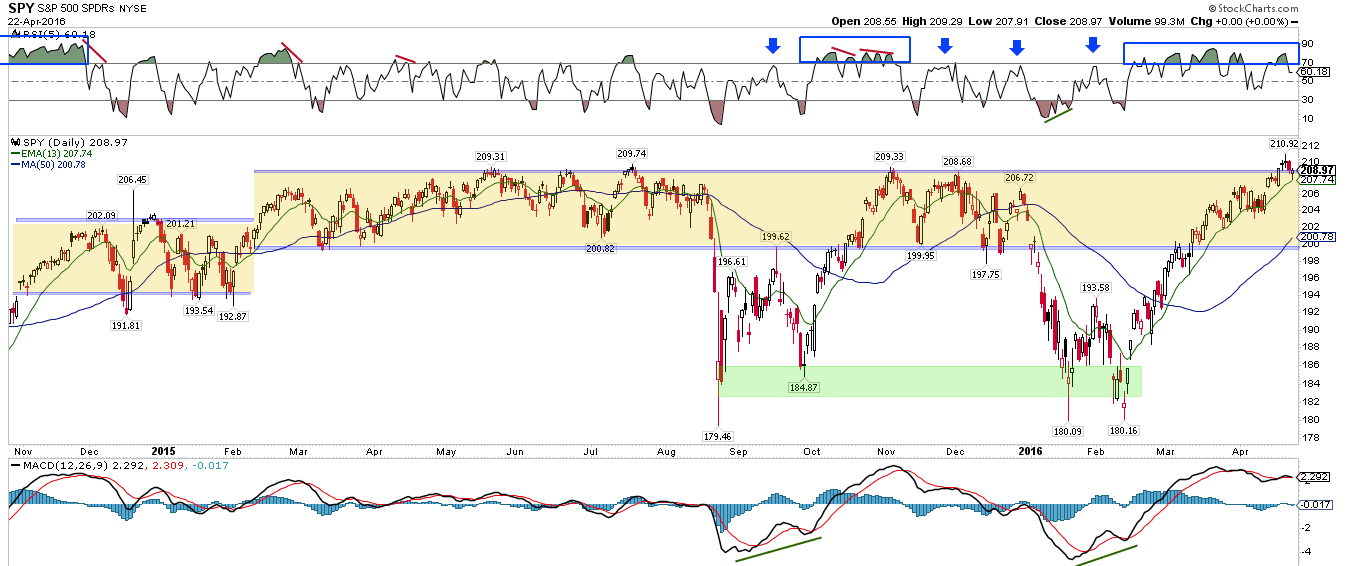

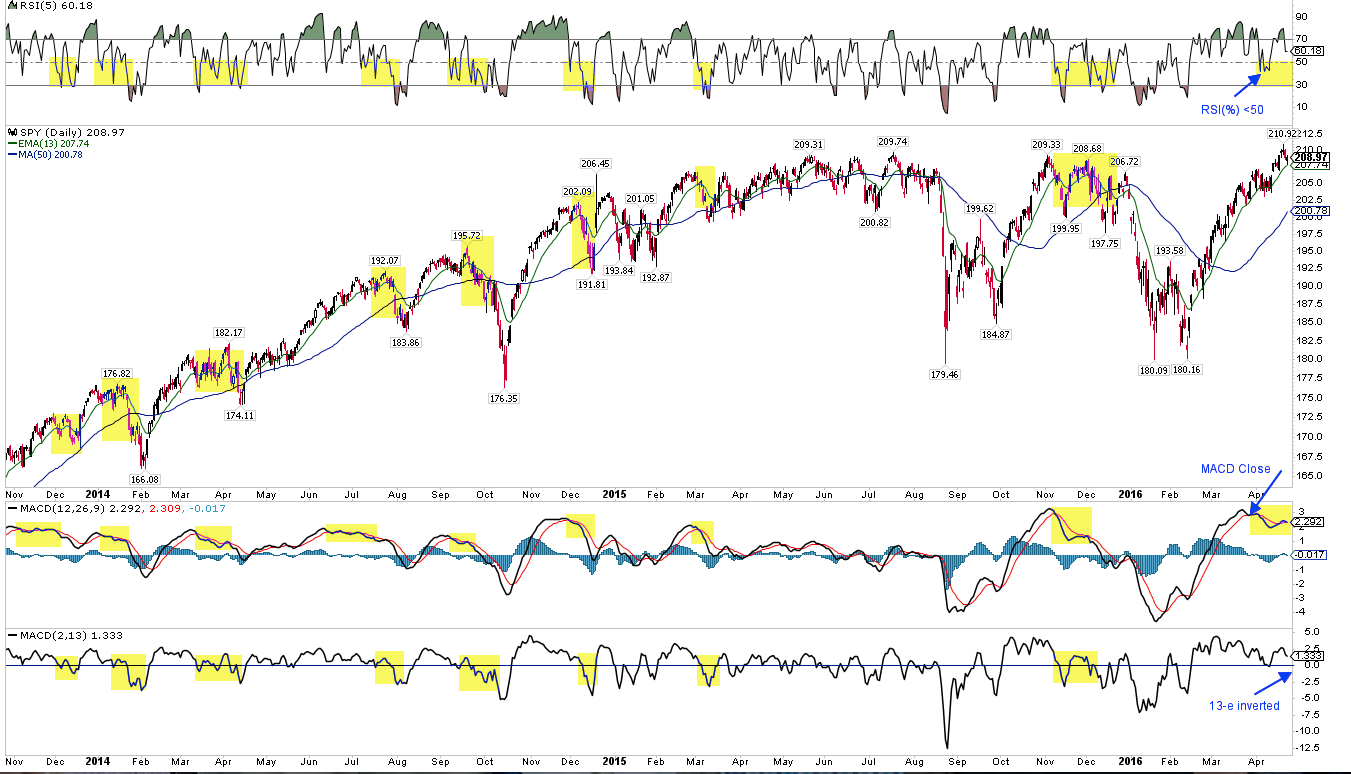

On a daily timeframe, SPY's momentum remains mostly overbought: a positive (top panel). All of its moving averages, from the 5-dma to the 200-dma, are rising. While there is no foul yet, Wednesday's high was reversed on Thursday. That high came near multiple resistance from spring, summer and fall 2015. It would be surprising if SPY broke higher without first struggling at this level.

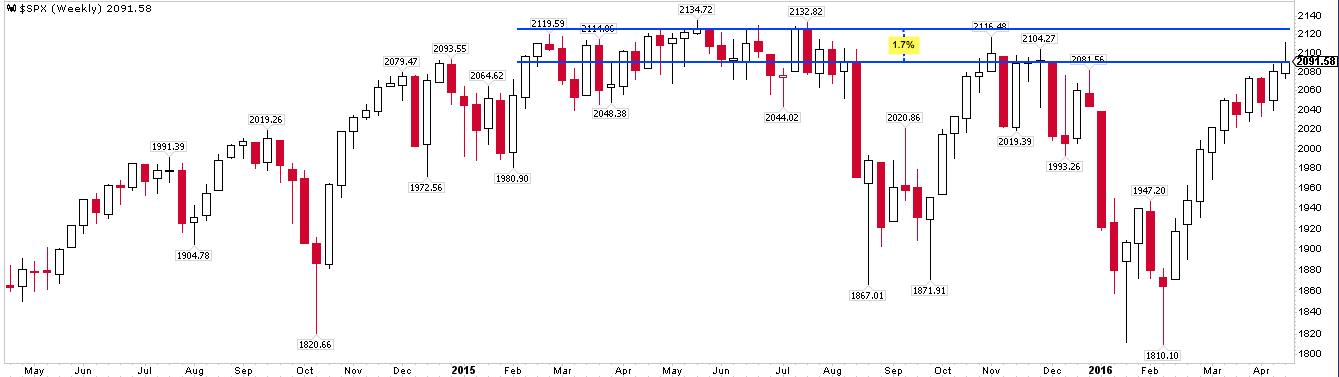

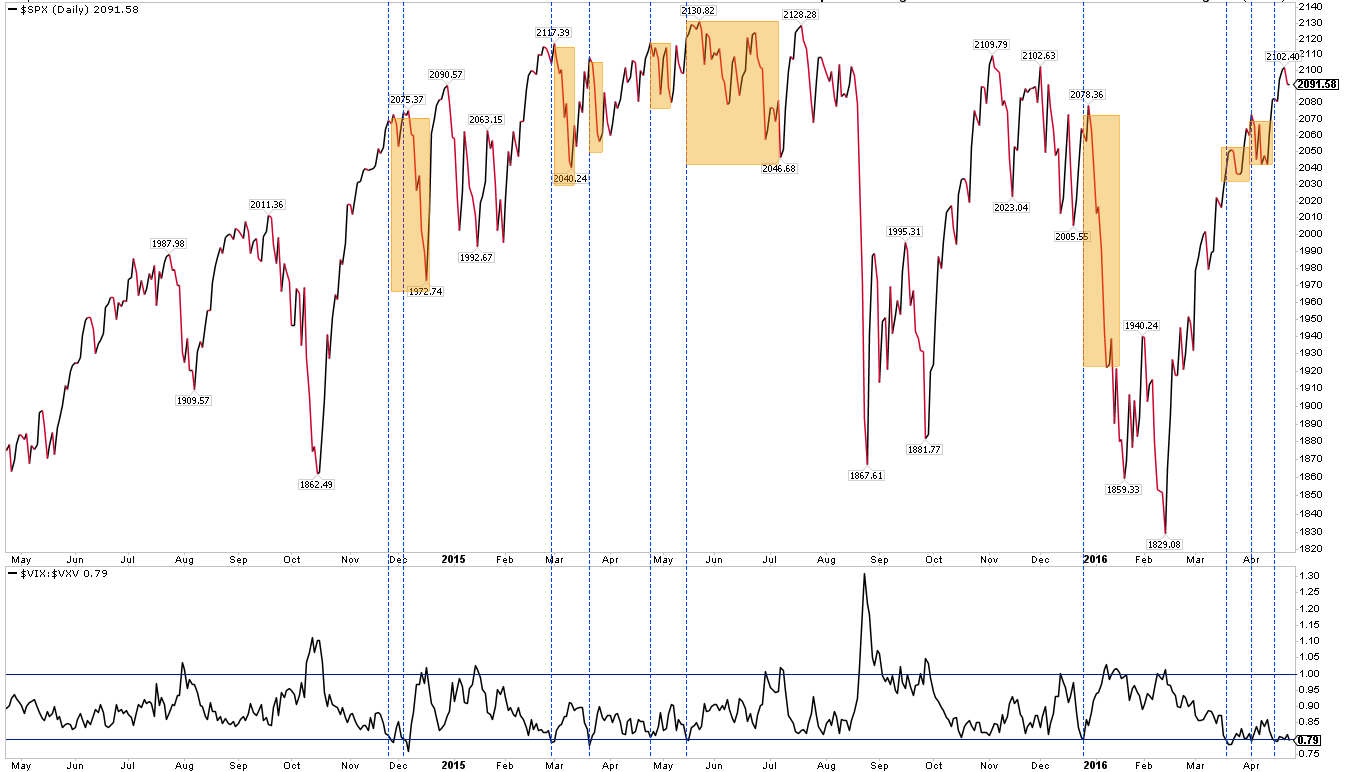

The potential for limited upside or a period of chop at current levels is perhaps better shown on the SPX (non-dividend adjusted). Over the past 70 weeks, there have been about 25 weekly closes less than 2% higher than the current level. In other words, this has been an area of previous strong resistance that, in the best scenario, will likely take time to move through.

If Wednesday marked a significant point of reversal, then the first tell will be that the 5-dma inverts lower. Early this week, look for it to be resistance as it has been in the past when SPY has first closed below it (209.5; green circles). Next, look for hourly RSI to weaken. Since February, RSI has been mostly overbought and infrequently oversold; that will reverse if the short term trend turns lower (top panel). The first big level of support this week is the open gap from April 13 at 207; that gap closes at 206 (middle blue line).

Supporting choppiness near term is the term structure of volatility. When VIX (1-month volatility) is less than 80% of VXV (3-month volatility), SPY normally struggles to make any gains, and most often retraces in the week(s) ahead. Last Friday marked the 4th time in 3 weeks that VIX:VXV closed below 80%.

If there is more than short-term weakness ahead, daily RSI(5) will drop below neutral (top panel) and the 13-ema will invert (it's currently at 207.7 which was Friday's low; lowest panel). The MACD has already pinched close, which says that the slope of the uptrend is declining. This isn't surprising, as the initial slope was steep and would inevitably become less so. But when all 3 of these take place (yellow shading), SPY normally moves through price and time to its 50-dma.

The economic calendar is busy this week.

- Monday: new home sales

- Tuesday: durable goods orders

- Wednesday: FOMC statement

- Thursday: GDP

- Friday: personal consumption and the employment cost index.

In summary, SPY made a new all-time high this past week. The short and long term trend is higher. Despite a gain of 16% over the past 10 weeks, the majority of evidence indicates that investors largely remain skeptical and defensive. That, together with strong breadth, implies that higher highs still lie ahead. Shorter term, SPY is back to where it failed, repeatedly, to go higher in the spring, summer and fall of 2015. In the best scenario, attaining and then holding significant gains will likely take time.