by Pinchas Cohen

The Week That Was

No On Healthcare;Tax Cuts Next?

The effect of the failed healthcare repeal and replace initiative on the market is more complex than just the negative headlines. Conventional wisdom had it that enacting healthcare was the gateway to tax cuts. However, now that the healthcare bill is out of the way, lawmakers can turn directly to tax cuts, the promised land for investors.

Again, however, the dynamic is more complex than just a few headlines. Even if lawmakers will now turn their energies toward cutting taxes, the $400 billion dollars in savings the government counted on from healthcare reform evaporated in the early hours of Friday morning when the 'no' vote won. So investor expectations, which have been simmering since November, should be tempered regarding the size of any tax cuts. Faced with the current legislative reality, a simplified tax code that would help streamline business, would be beneficial.

Q2 GDP: Difference Between Global Headlines and US Internals

While economic data from China, Japan, Canada and Europe hitting a 16-year high, all signs point to global economic growth. Even German consumer confidence hit a 16-year high. Still, data out of the US is showing that its economy is merely revving in place.

The initial US Q2 GDP read is 2.6-percent as was forecast, but that's before the number undergoes the customary, repeated revisions. Investor focus should be on the lack of real wage pressure and low inflation. During last week’s FOMC meeting, while the Fed took no action per expectation, they did change their inflationary language from their July statement, when they said that inflation was “somewhat running below” the Fed's 2 percent target to last week’s wording which said that inflation was “running below,” target; no longer “somewhat” but totally outright. The Fed is clearly making a bigger admission, acknowledging what Treasury and dollar traders have been maintaining all along – inflation is simply not happening. With the shorter path to rising rates and the resulting flattening yield-curve, the Fed will not likely raise rates per their earlier rhetoric.

European and US Stocks

If Europe’s economy is doing so well, why did The Stoxx 600 Index decline over 1-percent at the end of last week? It just so happened that the euro appreciated by 2.5 percent against the dollar. This makes European stocks both 2.5 percent more expensive as well as hurts European exports. So, while the European stock market may have declined, it was on strength rather than weakness.

The Fed and Trump administration troubles were only part of the story last week for US stocks. It was also filled with earnings releases which left the market mixed on the week.

The week started higher on beats, but over the past few days weakness prevailed, rendering the S&P 500 flat overall at Friday's close. Of course, within that bigger picture there were strengths and weaknesses. One area that should be highlighted are the mega cap marquee names—the S&P 100—with earnings beats and upside guidance from the likes of Boeing (NYSE:BA), Caterpillar (NYSE:CAT) and Verizon (NYSE:VZ).

Weakness in Transports: What does that say about stocks overall?

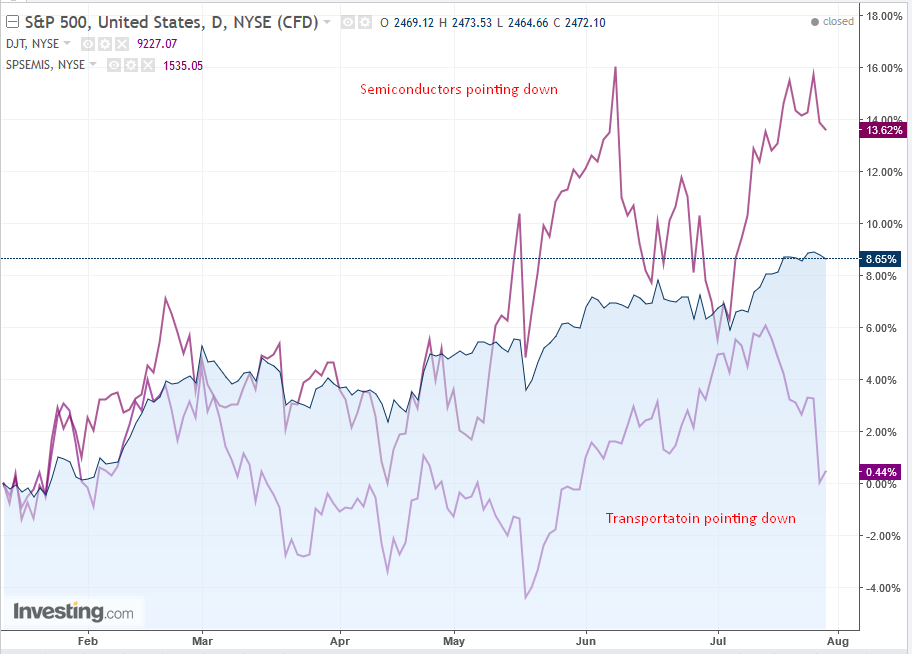

What began during the week before last, with pricing pressures on airlines, rolled over last week to other companies in the transports sector including trucking, railroads and air freight. Generally, when the transports are down, it’s a bad signal for the overall market, due to the sensitivity of these companies to economic cycles.

While factories can manufacture to restock, transport companies deliver only when there are orders to be delivered, and orders only occur when there's demand. The Dow Jones Transports Index is down 7 percent over the last two weeks.

Another cyclical area within the broader index, which confirms a rotation out of cyclicality, is semiconductors. On Thursday, they had a rough day, falling about 1 percent. They are now down 1 percent for the week.

Intel (NASDAQ:INTC), however, blurs the picture. Intel’s earnings report revealed that the chip maker beat on both top and bottom line growth, as well as provided upside to guidance – supporting the semiconductor sector. Bottom line: keep an eye on semiconductors to see if they follow transportation’s decline.

Telcos: The Newcomer

Up until this past week, telcos have been one of the weakest performing sectors in the S&P 500, not just during the first six months of this year but in four of the last five years. Reports of Verizon and other telecom sector stalwarts surprised in terms of the number of postpaid ads for the quarter. Both Verizon and AT&T (NYSE:T) almost cut in half the losses for the sector this year.

The Week Ahead

All times quoted are EDT

Monday

5:00: Euro area - inflation (flash, July): core inflation is expected to remain steady at 1.1%. Markets to watch: Stoxx 600, Stoxx 50, DAX, EUR crosses.

The EURUSD pair closed at the highest price since January 2015, breaking out of a sideways pattern in which it was trapped since 2015. Should the pair maintain this trajectory, the next natural habitat could be between 1.18 and 1.30.

10:00: US – Pending Home Sales (MoM) (Jun): Expected to rise from -0.8 percent to 1.0 percent. Markets to watch: S&P 500, Dow Jones Industrials, NASDAQ, US dollar crosses.

The dollar index declined to its lowest level since June 2016 and is heading lower, toward its lowest level since early May of that year. Should it fall below the 91.92 level, implications suggest a further decline toward 85.00.

21:45: China – Caixin Manufacturing PMI (July): Expected to remain steady at 50.4. Markets to watch: Shanghai Composite Index, Hang Seng Index and USD/CNY and additional CNY crosses.

EARNINGS

HSBC Holdings (NYSE:HSBC) is scheduled to report earnings after market close, with a forecast of $0.13 EPS, on $25.22 billion in revenue.

Tuesday

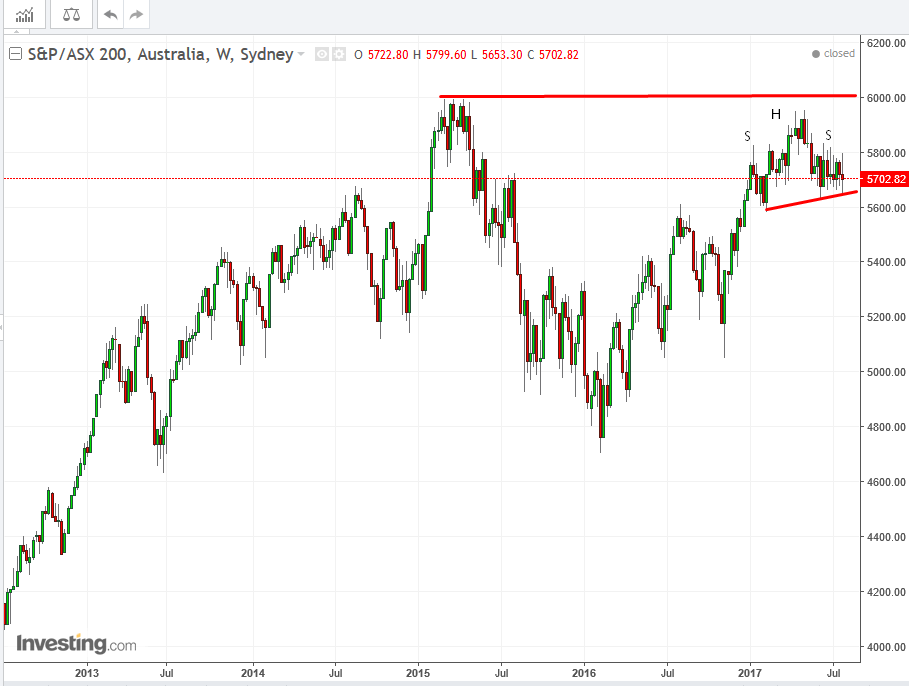

00:30: Australia – RBA Interest Rate Decision: No change expected to the headline interest rate. Keep an eye out for any shift in outlook, with the AUD likely to respond to any hawkish or dovish change in tone. Markets to watch: S&P/ASX 200 index, AUD crosses.

The ASX 200's 5827.20 high during May came very close to the 2016 high of 6000. Since the beginning of this year, the index has been trading within the pattern of a H&S top, which would confirm the 2016 high. Should the reversal line break, with a decline to 5,6000, it would suggest a retesting of the 5,500 price level.

3:55: Germany – Manufacturing PMI (Jul): Expected to remain steady at 58.3. Markets to Watch: The DAX, Stoxx 600, Stoxx 50, euro crosses.

4:00: Germany – Unemployment Change (Jul): Expected to decline from 7,000 to -5,000. Markets to Watch: The DAX, Stoxx 600, Stoxx 50, euro crosses.

4:30: UK – Manufacturing PMI (JUL): Expected to remain flat at 54.3. Markets to watch: FTSE 100, GBP/USD and other GBP crosses.

5:00: Euro area – GDP (flash, Q2): second quarter GDP is expected to have remained flat on the quarter at 0.6%, weakened slightly to 1.p% on year. Markets to watch: Stoxx 600, Stoxx 50, Dax, EUR crosses.

10:00: US – ISM Manufacturing PMI (July): The figure is expected to weaken to 52.3 from last month’s strong 57.8, which would be the lowest level since last October. Market to watch: US dollar crosses.

EARNINGS

- BP (NYSE:BP) reports earnings before market open. The expectation is for $0.14 EPS, vs $0.23 YoY, on $50.62 billion revenue.

- Apple (NASDAQ:AAPL) reports Q3 2017 earnings after the market closes. Expectations are for $1.57 EPS on $44.67B in revenue.

The stock has been trading in a range for a whole year. Will Tuesday's earnings report provide a breakout above 38 or below 32?

Wednesday

8:15: US – ADP Nonfarm Payrolls (July): Its correlation to Friday's NFP number is often refuted, yet this is a major jobs number all the same. Estimated to rise to 179k from 158k. Markets to watch: US indices, dollar crosses.

10:30: US – EIA Crude Inventories (w/e 28 July): stockpiles expected to fall by 1.4 million barrels, after a much bigger than expected drop of 7.2 million last week. Markets to watch: Brent, WTI, USD/CAD and additional CAD crosses, USD/RUB and additional RUB crosses.

Oil closed its best week this year with an 8.6 percent advance, after it had been relegated to a bear market. Oil has advanced about 18.5 percent since its $42.95, June low.

The price had returned to its steepest downtrend line, if one would connect the February high to the May high, while crossing through the April high and respecting only its closing prices. A more purist technician may include the April high, in which the angle is higher, from the steeper $50, where it’s now and $51, with the more purist drawing. Drawn lines are subjective and followed only by technicians and have a self-fulfilling-prophecy value.

However, more reliable support and resistance comes from peaks and troughs, which are both objective and are also followed by non-technicians. Fundamental analysts remember horizontal prices, even if they don’t plot trendlines. The previous May peak was at $52. Should the price break above that, then investors would need to question whether there is a reversal back to a bull market.

The steepest trendline—not respecting the April high price, to reflect the closer trendline to the June high—receives confirmation by the fact that the 200 dma (red) is there. The price closed above the 200 dma, right beneath the steepest of the trendlines, and beneath the round psychological key $50 price level. This makes a short attractive, from a risk-reward perspective.

EARNINGS

- Rio Tinto (NYSE:RIO) is scheduled to report earnings before market open. Last Wednesday we wrote that the miner was riding the copper recovery and was likely heading higher. This has so far been confirmed with the stock breaking out of the 6 year falling channel. Now, the price has to contend with the $47.11 February 13 high. Share price may range between $37 and $47.

- Tesla (NASDAQ:TSLA) reports after the US market closes. Consensus expectations are for EPS of -$1.76 on $2.59B in revenue.

Thursday

4:30: UK – Services PMI (July): The most important of all the UK PMI surveys, a weak or strong reading can have a material impact upon GDP expectations for the quarter. Estimated to fall marginally from 53.4 to 53.2. Markets to watch: GBP crosses, FTSE 100.

7:00: UK – Bank of England Interest Rate Decision: Will they or won’t they? Lots of mixed signals coming from rate setters after the 5-3 split to stay unchanged last time round. Markets to watch: FTSE 100, GBP crosses.

10:00: US – ISM Non-Manufacturing PMI (July): This ISM number is forecast to remain steady at around 57.4. Market to watch: US dollar crosses.

Friday

8:30: US – Nonfarm Payrolls (July): Expectations are for an increase of about 183,000, after June’s 222,000 rise beat expectations and May’s upwardly revised figure of 152,000. Markets to watch: S&P 500, Dow Jones, NASDAQ, + Global Indices, US dollar crosses.

8:30: Canada – Employment Change (July): Often overshadowed by the US figure, keep an eye out for this release as a driver of CAD volatility. Estimated to fall from 45.3k to 29.8k. Market to watch: CAD crosses.