Market Brief

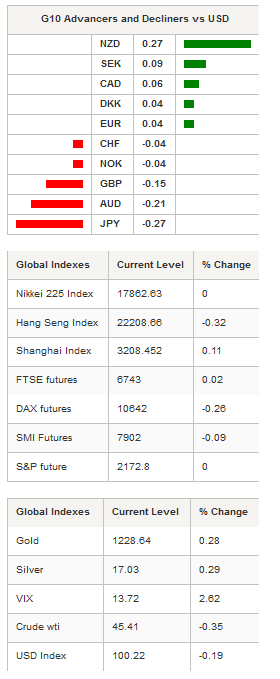

The FX market was mixed this morning as no clear trend emerged during the Asian session. The dollar index was treading water at around 100.40 as the greenback lost ground against the SEK, the CAD and the EUR but extended gains against the JPY, the GBP and the CHF. After the sharp rally of the last few days, sovereign yields took a breather on Thursday. The monetary policy sensitive U.S. 2-Year yields eased to 0.9932% from 1.0274% in the previous day, while U.S. 10-Year yields slid below the 2.20% threshold after hitting 2.2950% on Wednesday.

Overnight, the BoJ sent a warning signal to bond traders, announcing that it was ready to buy an unlimited amount of securities. The BoJ’s announcement came on the back of a sell-off in the bonds market that lifted yields to multi-month highs. The Japanese 10-Year sovereign yields closed in positive territory for the first time since March this year. In spite of the recent weakness of the yen, the BoJ wants to make sure that speculators stay at a reasonable distance from its currency. Yesterday, USD/JPY hit the highest level since June 1st this year as it tested 109.75. On the upside, the main resistance can be found at around 111.50-112 (multi highs), while on the downside a support lies at around 105.50 (previous high, now support).

After falling more than 3.50% following the US election, the single currency has been consolidating at around 1.07. Overnight, EUR/USD traded sideways at between 1.0680 and 1.0715, highlighting the overall sentiment that the EUR selling may have been overdone. EUR/USD rose 0.23% on Thursday and moved to 1.0715 as the European open.

Asian regional equity returns were mixed on Thursday. The Nikkei closed flat at 17,862, while the broader Topix index rose 0.10%. In China, the Shanghai Composite rose 0.11% while the tech-heavy Shenzhen Composite was off 0.38%. Offshore, the Hang Seng slid 0.32% and the Taiex rose 0.37%. in Europe, equity futures were blinking red across the screen, with the DAX down 0.26%, the CAC off 0.09% and the broad Euro Stoxx 600 falling 0.21%.

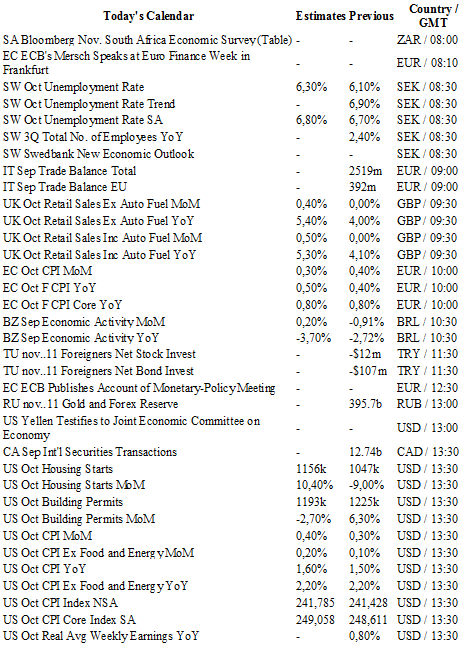

Today traders will be watching the unemployment rate from Sweden; retail sales from the UK; CPI from the euro zone; gold and forex reserves from Russia; housing starts, building permits, CPI report, initial jobless claims and Janet Yellen’s speech.

Currency Tech

EUR/USD

R 2: 1.1259

R 1: 1.0954

CURRENT: 1.0724

S 1: 1.0666

S 2: 1.0524

GBP/USD

R 2: 1.2857

R 1: 1.2674

CURRENT: 1.2455

S 1: 1.2380

S 2: 1.2083

USD/JPY

R 2: 113.80

R 1: 111.45

CURRENT: 108.86

S 1: 106.14

S 2: 104.97

USD/CHF

R 2: 1.0328

R 1: 1.0093

CURRENT: 1.0007

S 1: 0.9632

S 2: 0.9537