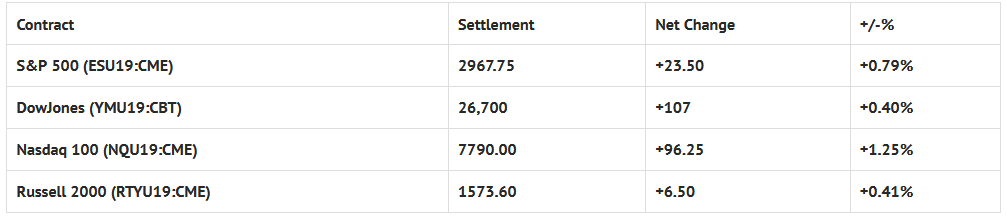

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed higher: Shanghai Comp -0.03%, Hang Seng +1.17%, Nikkei +0.11%

- In Europe 8 out of 13 markets are trading higher: CAC +0.07%, DAX -0.08%, FTSE +0.50%

- Fair Value: S&P +3.79, NASDAQ +25.96, Dow -8.76

- Total Volume: 1.44 million ESU & 204 SPU traded in the pit

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes Motor Vehicle Sales, the 8-Week Bill Settlement, John Williams (NYSE:WMB) Speaking at 6:35 AM ET, Redbook 8:55 AM ET, and Loretta Mester Speaking at 11:00 AM ET.

S&P 500 Futures: First Trading Day Of The New Quarter

Chart courtesy of Scott Redler @RedDogT3 – $spx futures -5 as market need to prove this is a breather, vs. a breakout failure.

After gapping higher 25 handles to open Sunday nights Globex session at 2970.00, the S&P 500 futures (ESU19:CME) retraced to print a low at 2963.00, then rallied to print a new all time high at 2981.00, and opened Monday’s regular trading hours (RTH) at 2979.25.

The ESU immediately popped after the 8:30 CT bell to take out the Globex high, printing another new all time high at 2981.75, before taking a step back. It was a negative news kind of day, and every headline that hit the tape drove the futures lower. By 1:30, the ES had bottomed out at 2955.50, essentially filling the overnight gap.

According to the Stock Trader’s Almanac, the first trading day of July is the best performing first day of all 12 months, with the S&P 500 advancing 85.7% of the time (average gain 0.42%). The guys with the better seats were well aware of this, and by the time the MiM reveal came out showing $1.3 billion to buy MOC, the ES had rallied 12 handles off its RTH low.

Going into the end of the session, the futures continued to rally, printing 2968.25 on the 3:00 cash close, and 2967.75 on the 3:15 futures close, up +23.50 handles on the day.