Monday January 29: Five things the markets are talking about

US Treasurys have extended their selloff, pushing yields to its highest in three-years as capital markets prepare itself for a busy week of data releases and monetary policy announcements.

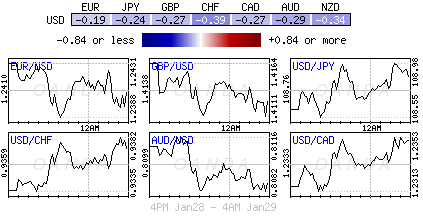

Note: Higher sovereign yields have given the mighty US US dollar a temporary lift from its multi-year lows against G20 currency pairs print from last week. Is this sustainable? Not if other sovereign yields back up at the same rate. US dollar bulls require a wider spread.

Investors can expect the FX market most likely to continue to lean on the US dollar until they elicit another response from US Treasury Secretary Mnuchin that suggests “he cares” – because US economic data alone will find it rather difficult to turn the tide of the current general dollar weakness.

On Wednesday (Jan 31), Federal Open Market Committee (FOMC) gathers for Chair Janet Yellen’s final meeting on interest rates before her term ends.

This is also jobs week in the US and on Friday (Feb 2) US employers are expected to have added more jobs in January than a month earlier. Government data is also expected to show the jobless rate held steady atop of its two-decade low, and the pace of wage growth picked up from a year earlier.

In China, estimates of Chinese manufacturing and services industries are due Wednesday (Jan 31), while in Europe, growth and inflation are on display this week. On Tuesday (Jan 30), data is expected to show the euro economy with a solid expansion, while on Wednesday (Jan 31), the core euro-zone inflation report may show an uptick from a year ago.

Elsewhere, the sixth round of NAFTA talks conclude in Montreal.

On Tuesday evening (9:00 pm EDT), President Trump delivers his first State of the Union address – he is expected to build momentum for legislation on infrastructure and immigration.

1. Global stocks rally pauses

US indices finished last week on yet another positive note pressing new highs.

In Japan, the Nikkei ended flat in choppy trade overnight, with gains in cyclicals (computer chips) offset by weakness in shares sensitive to domestic demand, notably railroads and construction companies. The broader Topix produced a small gain (+0.1%).

Down-under, Aussie shares rose +0.4% on Monday, led by financials, taking a cue from Wall Street, while in S. Korea, the KOSPI 200 hit another record high, climbing +0.91%.

In Hong Kong, the Hang Seng Index fell overnight, ending a seven-day winning streak, as the market took a breather after repeatedly hitting record highs. At close of trade, the Hang Seng Index was down -0.56%, while the Hang Seng China Enterprise (CEI) fell -0.47%.

In China, stocks tumbled on Monday, with the FTSE China Blue Chip Value 100 posting its worst day in more than two months, led by a slump in consumer and healthcare firms as investors booked profits after a recent strong rally. The Shanghai Composite index was down -0.97%, while the blue-chip index was down -1.81%.

In Europe, regional indices trade mostly lower, tracking the declines in US futures after their record closes stateside Friday.

US stocks are set to open in the black (-0.3%).

Indices: STOXX 600 – 0.2% at 399.8, FTSE flat at 7669, DAX -0.4% at 13287, CAC 40 -0.2% at 5521, IBEX 35 -0.5 at 10544, FTSE MIB -0.2% at 23820, SMI -0.2% at 9497, S&P 500 Futures -0.3%

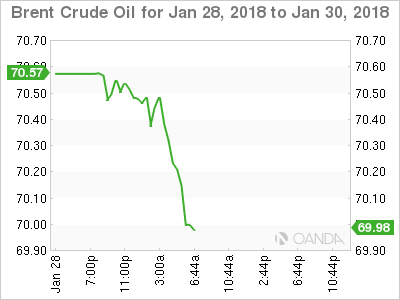

2. Oil dips as North American output soars, gold lower

Ahead of the US open, oil prices have dipped as soaring North American production is seen as undermining efforts led by OPEC and Russia to tighten supplies.

Brent crude futures are holding above +$70 per barrel, but are down by -19c from Friday’s close at +$70.34 a barrel. US West Texas Intermediate (WTI) crude futures are at +$66.19 a barrel, up +5c.

Despite generally bullish sentiment, consensus believes the market is beginning to come under pressure from rising output in North America.

US crude production has grown by over +17% mid-2016 to +9.88m bpd in mid-January.

Note: Output is expected to break through the +10m bpd soon.

Baker Hughes on Friday stated that US energy companies added 12 oil rigs drilling for new production last week, taking the total to 759.

US production is already on par with top OPEC exporter, Saudi Arabia. Only Russia produces more.

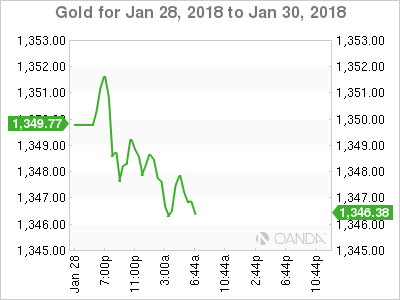

Ahead of the US open, gold prices have eased a tad as the US dollar gained some lost ground. Nevertheless, the yellow metal continues to hover within striking distance of its 17-month high print of last week. Spot gold is down -0.2% at +$1,347.60 per ounce.

3. Likelihood grows for a Fed rate rise in March

The recent rise in US market inflation expectations – boosted by rising oil prices – goes someway to support the Fed’s confidence in its inflation outlook.

Currently, the market is not expecting an interest rise at the policy decision on Wednesday (Jan 31) – the Fed fund odds are +6% for a back up in o/n rates.

Note: It will be Chair Janet Yellen’s final meeting on interest rates before her term ends.

The odds for a hike in March – the first meeting this year that has a press conference and fresh projections outlook – is around +70%.

Note: The Fed’s ‘dot plot’ forecasts three rate increases for 2018.

The yield on US 10-Year Treasurys has backed up +4 bps to +2.70%, the highest in almost four-years. In Germany, the Germany 10-Year yield increased +2 bps to +0.65%, the highest in more than two-years, while in the U.K, the 10-Year Gilt yield climbed +1 bps to +1.451%, the highest in a year.

4. Dollar consolidates for now

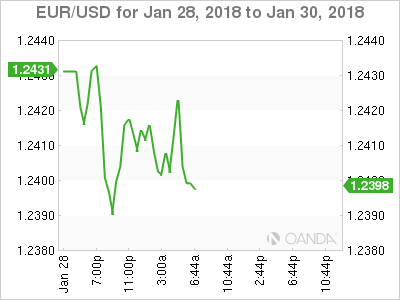

The US dollar starts this week somewhat consolidating, as G10 currencies failed to break last Thursday’s highs.

The dollar has advanced after capping a seventh week of losses on Friday. The yen (¥108.69) fell as the BoJ downplayed Governor Kuroda’s comments on stronger inflation. The US dollar has been unable to remain above the psychological ¥109 level in a quiet session.

GBP (£1.4090) remains on the back foot as pressure builds on PM Theresa May over Brexit.

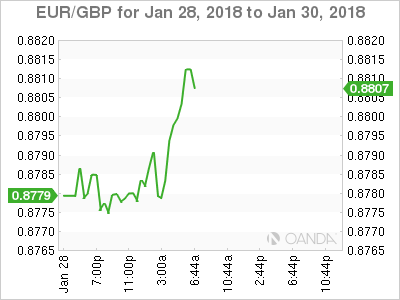

EUR (€1.2401) trades atop of its recent low registered outright after President Trump’s reply to the weak dollar environment comment last week. The pair tested €1.2385 before inching back above €1.24 in quiet trading.

Bitcoin (BTC) has climbed, holding its value above +$11,000 even after a heist of nearly +$500m in a different digital token prompted calls for more cryptocurrency regulation.

5. German import prices rose +3.8% y/y

The index of German import prices rose by +3.8% on an annual average in 2017 compared with 2016 (2016: –3.1% compared with 2015).

Note: This was the highest price increase since 2011 (+6.4% compared with 2010).

In December 2017 the index of import prices increased by +1.1% compared with the same month of the preceding year, and the lowest price increase since November 2016 (+0.3% compared with November 2015).

In November and in October 2017 the annual rates of change were +2.7% and +2.6%, respectively. From November to December 2017 the index rose by +0.3% m/m.