Friday November 25: Five things the markets are talking about

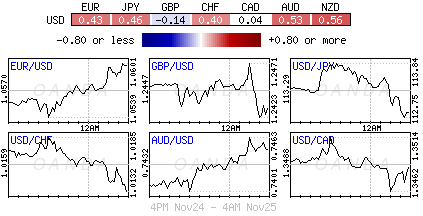

It seems that investors are happy to take a breather in this holiday-shortened week as the dollar pares this week’s surge supported by U.S rate differentials.

The “reflationary trade” continues to suck money back in to U.S equity markets, while putting further pressure on emerging market FX rates, bond prices and stock markets.

Expectations for stronger U.S. economic growth and higher inflation have sent stateside indexes to fresh highs this week, while U.S 10-year yields have settled at their highest level in yearly three-years (+2.38%).

Do the present U.S market fundamentals justify the recent moves or are the asset-price moves built more on hope? Currently, many of Trumps policy proposals lack detail, and it’s not very clear what support Trump will actually get from Congress.

1. Global equities a mixed performance

Asian equities advanced overnight as the U.S Thanksgiving break helped slowdown the dollar’s rally that has sucked capital out of most emerging markets.

MSCI’s broadest index of iShares MSCI Pacific ex Japan (NYSE:EPP) added +0.5%. It is set to end the week +1.7% higher, its biggest weekly gain in two-months, but remains down -3% from just before Trump’s election victory.

The Nikkei, which earlier hit its highest level in 11-months, closed +0.26% higher as the dollar pared its gains. That’s a weekly gain of +2%, and is up almost +6.9% since before the U.S. election.

In Europe, equity indices are trading mixed with banking and healthcare stocks weighing on the Euro Stoxx 600. Commodity and mining stocks are trading mixed and providing pressure to the FTSE 100.

U.S futures are set to open up +0.2% higher.

Indices: Stoxx50 +0.2% at 3,045, FTSE -0.1% at 6,826, DAX flat at 10,689, CAC 40 flat at 4,543, IBEX 35 -0.1% at 8,646, FTSE MIB +0.1% at 16,513, SMI +1.1% at 7,881, S&P 500 Futures +0.2%

2. Crude prices soften, commodities mixed

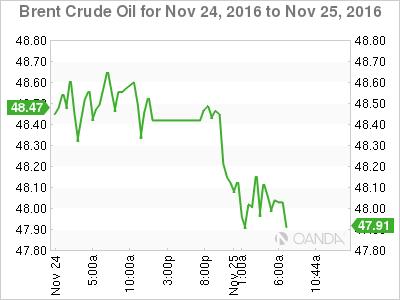

Crude Oil is under pressure, falling -1% ahead of the U.S open, dragged down mostly by a strong dollar, rising Saudi supplies to Asian clients, and a fall in Chinese imports.

Brent crude futures are trading at +$48.42, down -58c, or -1.2% from yesterday’s. West Texas Intermediate (WTI) crude futures are at +$47.41 per barrel, down -55c, or +1.2%.

Ahead of next week’s highly anticipated OPEC meeting in Vienna (Nov 30) on supposed production cuts, OPEC’s focus shifts to negotiations with Iran and Russia for production curbs after Iraq signaled it will agree to reduce output.

Will a deal be formulated? History says no, their remains disagreement within the producer cartel as to which member states should cut and by how much. Nevertheless, the market is pricing in some form of agreement, but oil market reaction will hinge on the credibility of the proposed action.

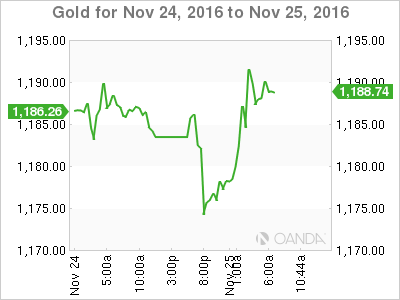

In other commodities, spot gold prices have rallied +0.5% to +$1,187.30 an ounce on the back of a weaker dollar. Industrial metals have pared some of this week’s euphoric gain with copper slipping -0.5% having surged +8% already this week and +20% on the month.

3. Sovereign yields, they don’t make sense?

Yield spreads are throwing up some weird pairings with the massive repricing of global bonds after Trump’s surprise victory that has instigated the “reflation” trade.

Despite the U.S.’s outlook being stronger than that of the eurozone, some yield comparisons would be considered extreme – France’s 50-year sovereign debt is currently yielding +1.84% this morning, through the +1.86% yield on the U.S five-year notes. Germany’s 30-year bund is yielding less than the U.S. two-year paper whose yield has jumped to a 6-1/2-year high of +1.17%.

Elsewhere, the yield on 40-year JGB fell -5bps to +0.715%, reversing an earlier climb after an +$4.4b auction sold at a highest yield of +0.725% triggered a bout of bond buying.

Note: U.S Fixed Income markets close early at 2pm EST.

4. U.K Q3 GDP unrevised

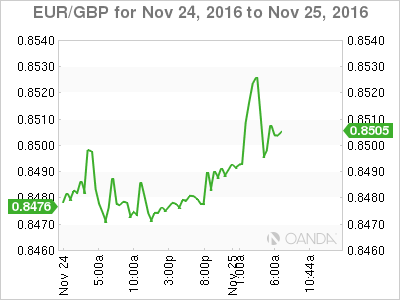

The pound is little changed (£1.2450) after data this morning showed that U.K. Q3 GDP remained unrevised, as expected, at +0.5% q/q and +2.3% y/y, fuelled by household and government spending and trade.

Other data showed that business investment in the U.K. rose in Q3, confounding expectations for a post-referendum fall. Investment rose +0.9% after June’s Brexit vote (June 23), as firms splashed out on new buildings, machinery and equipment.

The data add to signs that the U.K economy remains somewhat resilient, but concerns about its prospects next year persist, as rising inflation is expected to squeeze household budgets.

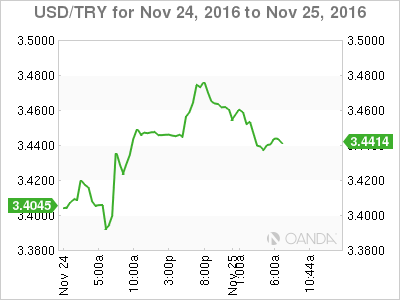

5. TRY wilts despite central bank efforts

All the positives of yesterday’s surprise +50bps rate rise to +8% by Turkey’s central bank (CBRT) has been more than offset by the European Parliaments decision to vote overwhelmingly in favor to temporarily freeze talks on Turkey’s bid to join the EU.

Despite a more hawkish CBRT, the TRY ($3.4500) continues to underperform its peer EM pairs. Any further weakening is likely to put more tightening pressure on Turkish policy makers. Yesterday’s statement with the MPC decision does not contain anything that would imply the hike is “one and done.”