Tuesday March 6: Five things the markets are talking about

Global equities have extended their rebound overnight as investors judge the recent selloff sparked by global trade fears as a tad overdone. President Donald Trump continues to face mounting domestic resistance to his planned levies on steel and aluminum imports.

The ‘big” dollar and oil are trading steady as U.S Treasury yields again back up.

Strong job growth and a deeper decline in the unemployment rate are the calls for this week’s U.S highlight – Friday’s non-farm payroll (NFP) at 08:30 am EDT.

Note: Today’s U.S factory orders are expected to reveal a sizable January decline (-0.4% vs. +1.7%).

Trade data will be the highlight tomorrow morning and an increasing U.S deficit would only support Trump’s discussion about tariffs. In the afternoon, the Beige Book will be released, where the economic assessments have until now, at least, been subdued.

On tap: Central bank rate activity this week – BoC (Mar 7), ECB (Mar 8) and BoJ (Mar 8/9). The ECB is not expected to change policy on Thursday, but the Governing Council may discuss a change to pave the way for the end of QE.

1. Stocks jump as fears recede

In Japan, the Nikkei share average rallied overnight to snap a four-day losing run. The ‘bid’ dollars bounce lifted exporter shares. The Nikkei ended the day up +1.79%, while the broader TOPIX rallied +1.27%.

Down-under, Aussie shares edged higher as export-based stocks rallied on receding fears of a global trade war. The S&P/ASX 200 index rose +1.1% to 5,962.4 at the close of trade. The benchmark ended down -0.6% on Monday. In South Korea, the KOSPI closed up+1.53%.

Note: The Reserve Bank of Australia (RBA) left its cash rate at +1.5% overnight, a widely expected decision given policy makers have signalled a steady outlook for some time to come.

In Hong Kong, stocks rebounded aggressively amid the perception that Trump is facing growing pressure from political allies to pull back from his proposed tariffs plans. The Hang Seng index rose +2.1%, while the Hang Seng China Enterprise (CEI) gained +2.7%.

In China, stocks too rebounded overnight, aided by robust gains in shares of real estate and healthcare firms. At the close, the Shanghai Composite index was up +1%, while the blue-chip Shanghai Shenzhen CSI 300 was up +1.2%.

In Europe, regional indices have rebounded following strong gains stateside yesterday and in Asia overnight.

U.S stocks are set to open in the black (+0.2%).

Indices: STOXX 600 +0.7% at 373.5, FTSE +1.0% at 7184, DAX +1.1% at 12227, CAC 40 +0.7% at 5203, IBEX 35 +0.4% at 9631, FTSE MIB +1.1% at 22056, SMI +0.1% at 8816, S&P 500 Futures +0.2%

2. Oil inches up on strong demand forecasts, gold higher

2. Oil inches up on strong demand forecasts, gold higher

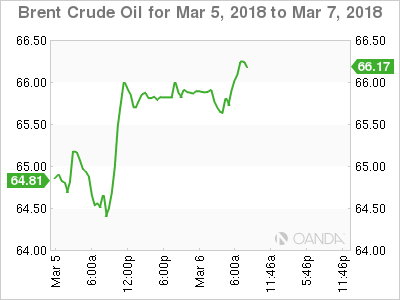

Oil futures have rallied overnight for a third consecutive session, supported by robust demand forecasts and as ministers from OPEC touted the strength of its agreement to cut output to bolster prices.

Brent crude futures are at +$65.67 per barrel, up +8c, or +0.12%. U.S West Texas Intermediate (WTI) crude futures are at +$62.68 a barrel, up +11c, or +0.18%.

The IEA said yesterday that global oil demand was expected to grow over the next five years, while output from OPEC producers would rise at a much slower pace.

To fill the gap between OPEC and global demand, the IEA said the U.S would supply much of the oil demand as its shale oil production was set to surge.

Note: U.S crude production has risen to more than +10m bpd, overtaking top exporter Saudi Arabia.

Expect dealers to take their cues from the weekly inventory reports. Today, API is set to release its inventory data at 4:30 pm EST and tomorrow the EIA is scheduled to report its data at 10:30 am EST.

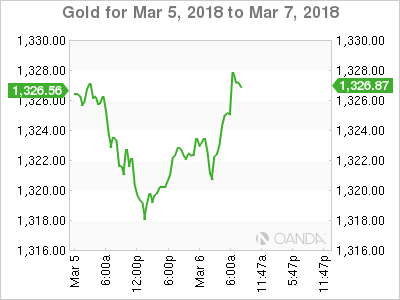

Ahead of the U.S open, gold prices have edged up a tad on a softer dollar and as the market covers some short positions amid trade war fears. Spot gold is up +0.1% at +$1,321.05 per ounce.

3. Sovereign yields push higher

Overnight, the Reserve Bank of Australia (RBA) left its cash rate target unchanged at +1.50% (as expected). The accompanying policy statement was unrevised. It reiterated the view that low level of interest rates was continuing to support the Aussie economy and that inflation was expected to remain low for some time – An appreciating exchange rate (A$0.7767) could slow economic activity and inflation.

In Japan, the Bank of Japan (BoJ) Governor Kuroda tried to clarify some of his earlier comments made during the Confirmation Hearings on March 2 – he stated that the BoJ would consider an exit around Fiscal 2019 because of the chances of hitting inflation target at that time. Kuroda reiterated that the BoJ was keeping policy “very accommodative” as it took time to get rid of deflationary mindset. In other words, fewer stimuli remains unthinkable before reaching the CPI target.

Elsewhere, German Bund yields trade slightly higher, while Italian BTP versus Bund spreads trade narrower in a sign that investors apparently have absorbed, at least for now, the outcome of Italy’s elections. The 10-year Bund yield is trading at +0.65%, up +2 bps. Dealers will now turn their attention to the ECB’s Governing Council’s meeting on Thursday.

The yield on 10-year U.S Treasuries has decreased -1 bps to +2.87%, while in the U.K, the 10-year Gilt yield increased +1 bps to +1.495%, the highest in a week.

4. Dollar confined to tight ranges

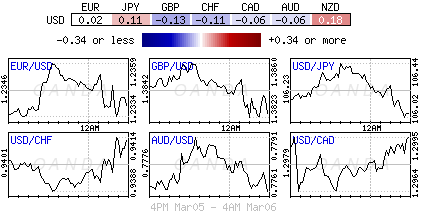

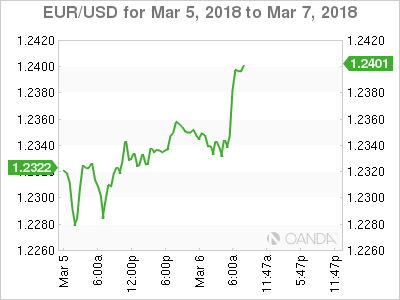

The FX market remains subdued, confined to tight trading ranges ahead of three major rate decisions announcements this week – Bank of Canada (BoC) tomorrow, European Central Bank (ECB) Thursday and Bank of Japan (BoJ) on Friday.

The EUR/USD is steady just under the mid-€1.23 area as negatives from the hung Parliament after Sunday’s Italian elections seemed to dissipate. The EUR ‘bull’ is expecting the ‘single’ unit to retest the upper end of its recent trading range

USD/JPY (¥106.16) is off its Asian session highs after the BoJ’s Kuroda played down his recent commentary regarding a potential exit from its ultra-loose policy stance.

Elsewhere, EUR/SEK (€10.1888) hit a fresh eight-year high as Riksbank Governor Ingves stressed that “monetary policy needed to proceed cautiously with future hikes.”

USD/ZAR ($11.7516) is lower as South Africa GDP beat expectations. Also, the South Africa Parliament has delayed a planned debate relating to the SARB (Central Bank) mandate and Independence. The SARB has been under the radar to possibly be nationalized.

5. Eurozone retail sales continues to grow

Data collected by Markit in February showed that Eurozone retailers reported an eleventh consecutive monthly rise in “like-for-like” sales during the month. Moreover, the rate of expansion quickened from January’s five-month low and was solid overall.

The acceleration at the eurozone level reflected sharper rises in Germany and France, and renewed growth in Italy.

The headline print rose to 52.3 in February, from 50.8 in January.

Digging deeper, sales were broadly unchanged when compared to the same month one-year prior, after having been down the previous two months.