Markets traded in a risk-on manner yesterday, with the US Senate passing a USD 1trln infrastructure bill. That said, although most equity indices drifted north, expectations over a Fed tapering, as well as over interest rate hikes, have come forth, with the attention now falling on the CPIs for July, due to be released today.

Expectations are for minor slowdowns, but we don’t expect something like that to hurt speculation around the Fed’s future course of action.

Investors Await CPIs To Solidify Sept. Tapering

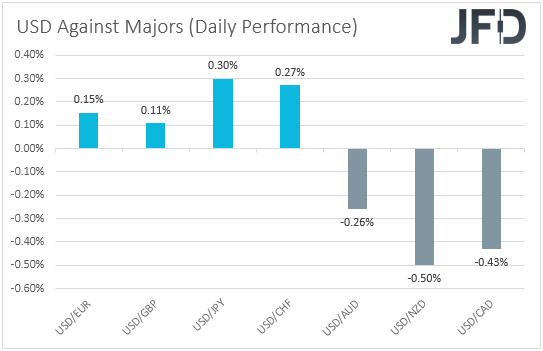

The US dollar traded mixed against the other major currencies on Tuesday and during the Asian session Wednesday. It gained versus JPY, CHF, EUR, and GBP in that order, while it underperformed against NZD, CAD, and AUD.

The strengthening of the risk-linked Aussie, Kiwi, and Loonie, combined with the weakening of the safe-havens yen and franc, suggests that markets traded in a risk-on fashion yesterday and today in Asia.

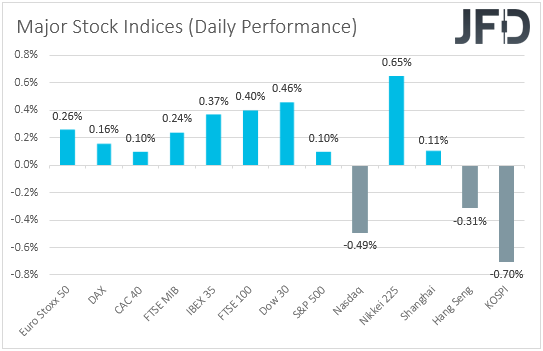

Indeed, turning our gaze to the equity world, we see that major EU indices were a sea of green, with the upbeat appetite rolling into the US session. Both the Dow Jones and the S&P 500 edged to fresh record highs, however, the NASDAQ was the one to lose some ground.

Today in Asia, the picture was more mixed. Japan’s Nikkei 225 and China’s Shanghai Composite gained, while Hong Kong’s Hang Seng and South Korea’s KOSPI slid.

With no clear catalyst behind the advance in EU equities, we suspect that it could be what we’ve said yesterday. With speculation around an earlier action by the Fed, investors may have rushed into equities in order to take advantage of the low-interest-rate environment for as long as they can.

In the US, market participants also decided to increase their risk exposure, perhaps also due to the US Senate passing a USD 1trln infrastructure bill, with 19 Republicans getting on board. The bill, which will now head to the House of Representatives, could be the nation’s biggest investment of its own kind in decades.

Immediately after that, the Senate kicked off a debate on a USD 3.5trln package on climate change, universal preschool, and affordable housing.

However, the optimism cooled during the Asian session today, perhaps due more to concerns about the impact of the coronavirus on several Asian economies where vaccination rates are lower.

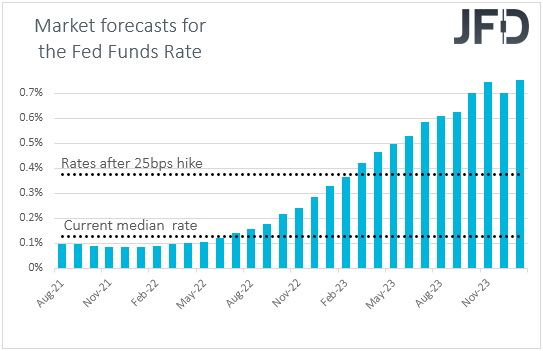

Back to monetary policy and the Fed, market participants continued to add to bets that the Committee will soon have to start scaling back its asset purchases, perhaps as soon as next month.

According to the Fed funds futures, they also brought forth the timing of when they expect interest rates to start rising. Yesterday morning, they’ve been anticipating this to happen in March 2023. Now, they are almost fully pricing in the first hike to be delivered in February 2023.

With that in mind, we will pay extra attention to today’s US CPIs for July, as they can well impact those expectations. The headline rate is forecast to have ticked down to +5.3% yoy from +5.4%, while the core one is forecast to have slid to +4.3% yoy from 4.5%. Nonetheless, we don’t believe that such a small decline will be enough to hurt expectations with regards to the Fed’s future course of action.

Inflation would still be well above the Fed’s objective of 2%, and with underlying pressures still elevated, many market participants could stay convinced that this is unlikely to prove to be transitory, and that the Fed should act as soon as possible. With that in mind, if the CPIs solidify the case for a tapering start in September, market participants may then start speculating on the pace of the normalization process.

Currently, the Fed is buying USD 120bn worth of assets per month. So, a USD 20bn taper means that the program will end in six months, and thereby allow even earlier rate hikes, while withdrawing only half of that amount would take a full year. We may get more information on that front at the Jackson Hole Economic Symposium, scheduled later this month.

S&P 500 – Technical Outlook

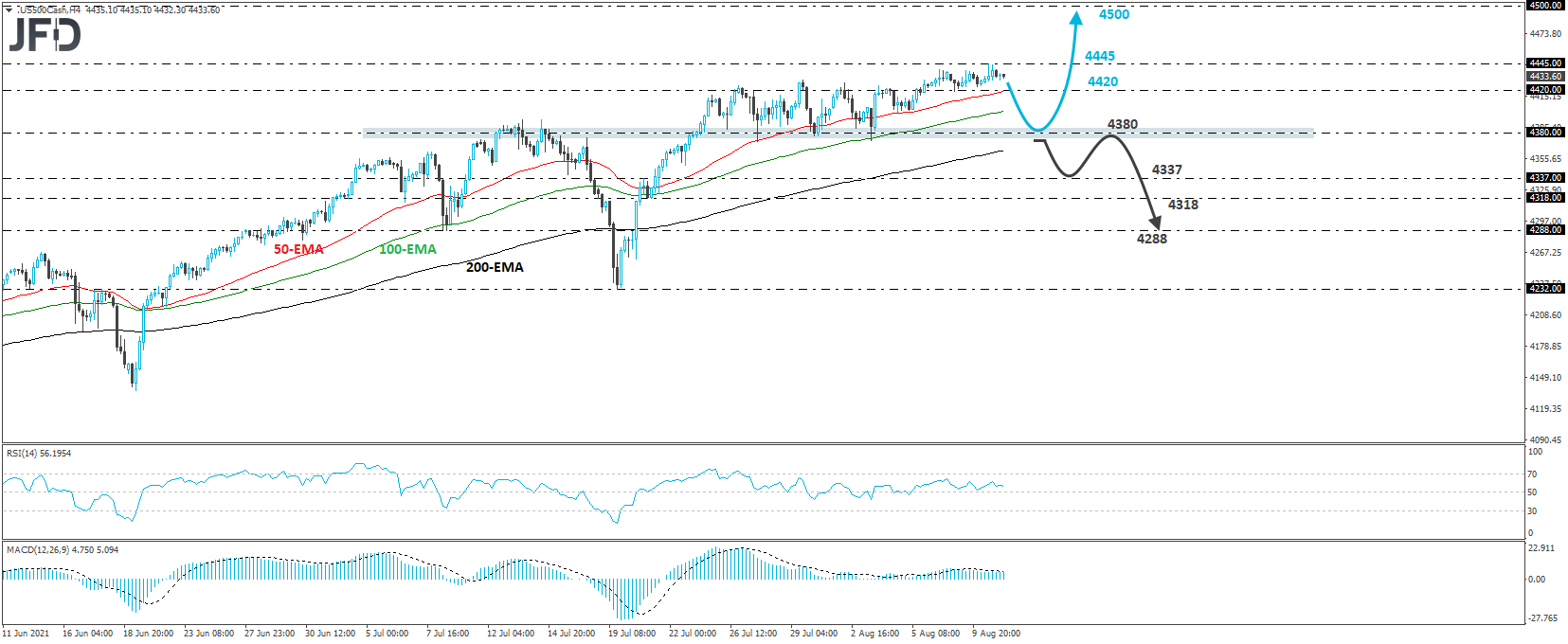

The S&P 500 cash index traded slightly higher yesterday, hitting a fresh record high at around 4445. Overall, the broader trend of the index remains positive, and thus, we would expect it to conquer fresh records. However, before that happens, we cannot rule out a corrective retreat.

A drop below 4420 could confirm the case of a corrective retreat, and may allow the index to travel towards the key support zone of 4380. The bulls may re-enter the action from near that area, and push for another test near 4445, where a break will take the index into the uncharted territory. With no prior highs and inside swing lows to mark new resistance levels, we would consider as such the round number of 4500.

On the downside, we would like to see a clear and decisive dip below 4380, a zone that’s been acting as a floor since July 26, before we abandon the bullish case, at least in the short run. The bears could then dive towards the 4337 or 4318 levels, the break of which could extend the slide towards the 4288 zone, marked by the low of July 8.

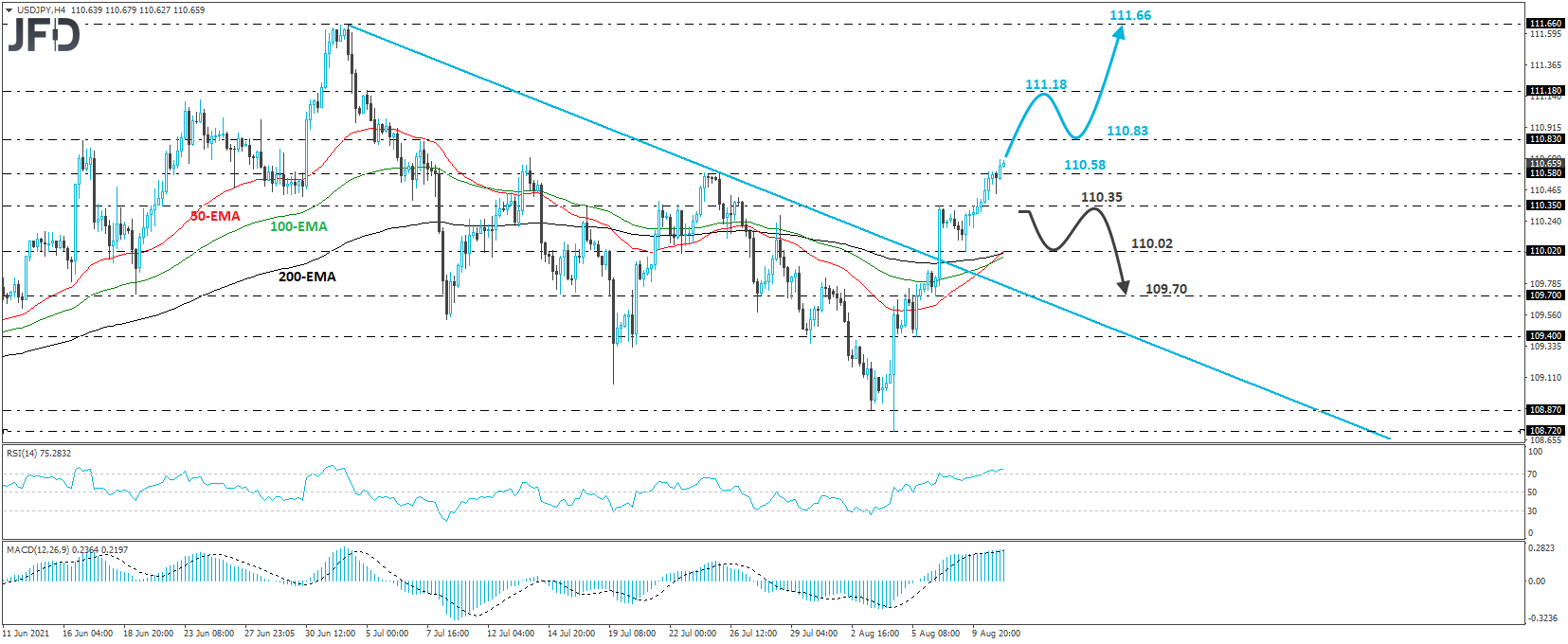

USD/JPY – Technical Outlook

USD/JPY has been in a rally mode since Aug. 4. On Aug. 6, the pair emerged above the downside line drawn from the high of July 2, while during the Asian session today, it emerged above the 110.58 barrier, marked by the highs of July 23 and 26. Overall, the bias remains positive and thus, we would expect the advance to continue.

We believe that the bulls will soon target the 110.83 barrier, the break of which could extend the gains towards the high of July 5, at around 111.18. There, the bulls may decide to take a break, thereby allowing the pair to correct lower. However, the bulls may take charge again after testing the 110.83 zone as a support and shoot for higher levels. The next area to consider as a resistance is the high of July 2, at around 111.66.

On the downside, we would like to see a dip below 110.35 before we start examining the case of a deeper correction. This may initially pave the way towards the low of Aug. 9, at 110.02, where another break could carry extensions towards the low of Aug. 6, at 109.70.

As For The Rest Of Today's Events

We don’t have any other top-tier data on the agenda, but we do have two Fed officials speaking after the CPIs and those are Atlanta President Raphael Bostic and Kansas City President Esther George. We already know that Bostic supports beginning the taper process soon, therefore, most of the attention is likely to fall on George’s view. If she is also in favor of an early action, the US dollar is likely to extend any potential inflation-related gains.

As for tonight, during the Asian session Thursday, Australia’s Wage Price Index for Q2 is coming out and the forecast points to a slowdown to +1.4% yoy form +1.5%.

During the early European morning Thursday, the main event is likely to be UK’s preliminary GDP for Q2, with the forecast pointing to a rebound of +4.8% qoq from -1.6%, something that could take the yoy rate up to +22.1% from -6.1%. Industrial production for June is also coming out and expectations are for a slowdown to +0.3% mom from 0.8% mom.

At last week’s gathering, the BoE lowered the threshold of when they will start reducing their stock of bonds. Specifically, they said that they will do so when the policy rate hits +0.50%, by not reinvesting the proceeds of maturing debt. The previous guidance was for the Bank to not start unwinding its bond purchases until interest rates were near +1.5%.

For some participants this could mean that QE tapering may start earlier than previously anticipated, and a strong GDP print could add credence to that view. The British pound is likely to receive some support, but we prefer to avoid exploiting any gains against currencies the central banks of which are also expected to start normalizing their policies soon. For example, we would see decent chances for an uptrend continuation in GBP/AUD.