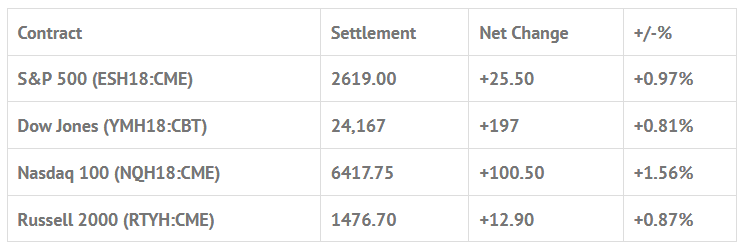

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed higher: Shanghai Comp +0.76%, Hang Seng -0.16%, Nikkei -2.32%

- In Europe 12 out of 12 markets are trading higher: CAC +1.23%, DAX +1.42%, FTSE +1.22%

- Fair Value: S&P -1.69, NASDAQ +2.41, Dow -30.95

- Total Volume: 3.8mil ESH & 2.7k SPH traded in the pit

Today’s Economic Calendar:

Today’s economic calendar is light, and includes the Treasury Budget at 2:00 PM ET.

S&P 500 Futures: #2529 Retest (PPT) Plunge Protection Team To The Rescue

Sure, there have been some big rallies, but you know what? They just can’t seem to hold. After trading down to 2580.25 on Globex Thursday night, the ES rallied all the way up to 2617.00. Total overnight volume was big, 550,000 futures contracts traded.

I have to be honest, there is no way to do all the dips and rips. After so many failed rallies, so many that I lost count, the ES gave way all the way down to 2930.00, down 60 handes on the day at 12:40 CT. It was a smashing type selloff that took no prisoners. As bad as the S&P looked, there was another plan in place, its called the PPT, or Plunge protection team. When it showed up, the ES traded all the way up to 2909.25, up 89.25 handles from the low, at 1:25.

After the high, the ES sold off down to 2566.50, and then started moving back up to 2588.75 as the MIM moved from over $500 million to buy down to $200 million to buy. After a small pullback, the MiM flipped to $2 billion to buy, and the ES traded all the way up to (get this) 2637.75, a 107.75 handle rally. The benchmark futures traded 2619.75 on the 3:00 cash close, and settled at 2618.00, up 20.75 handles, or +0.80%.

S&P 500 Implied Volatility Surges To Levels Only Seen After Lehman Brothers Failed And It’s Not Over Yet

Last week a well know Chicago based fund, LJM, which was a premium seller in the S&P 500 options, ‘blew up’. The fund was betting on the markets remaining calm and the VIX staying low. Here is the story from Reuters titled ‘U.S. fund that lost most of its value shuts doors to new investment’.

In a letter to their customers, they said they were selling futures to protect, but that only added to the losses. Here is part of a letter the head of the fund, Tony Caine, put out to his investors:

As many of you may be aware, the market losses and volatility spike on Monday, February 5th were unprecedented. The VIX Index spiked 20 points, from 17.3 to 37.3, and was the largest one-day spike in the Index’s history. LJM strategies have suffered significant losses.

At this time, the portfolio management team is trying to hedge with as many futures as possible to attempt to insulate portfolios from further losses. Our plan is to go to a defensive position depending on liquidity of options markets. Our goal is to preserve as much capital as possible. Then Friday, law firm Scott&Scott, Attorneys at Law, LLP Filed a Class Action Suit Against LJM Funds Management Ltd. (LJMIX).

The business of selling premium in the S&P 500 options has a very tainted part. The funds make month after month racking up big returns, then lose it all in one day. This goes back to the days of well known hedge fund manager Victor Niederhoffer, leaving hundreds of millions in losses at Chicago based futures broker Refco on the other side of the coin, but this is a lot smaller story.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.