The FOMC statement and news flow from the WSJ that Trump has appointed Powell as Fed chair will garner the lion’s share of the headlines. However, looking back over the session that was, one can argue that the bigger influence has been the miss to the October US ISM manufacturing, with the index printing a slower pace of growth at 58.7.

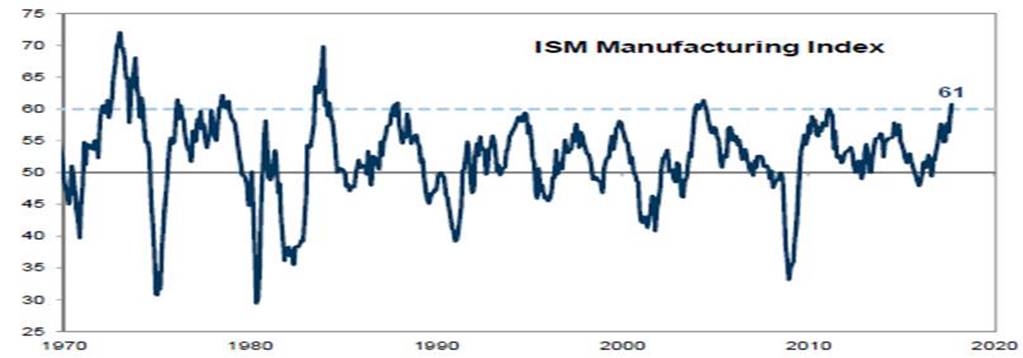

This manufacturing print has to be a focal point going forward because we can go back to the 1980’s and see that moves into 60 on this index have historically marked tops, where we tend to see swift reversals and pain in the US economy. I am not saying that will occur this time around, but it pays to watch and this time around we may even get a fiscal boost from tax reform in 2018. Either way, we saw a decent bid in US fixed income, specifically from the seven-year US Treasuries and longer maturities and this has seen the 2’s vs 10-year treasury curve flatten three basis points (bp) and at 74bp is now the flattest since July 2016.

Let’s not forget that at 58.7, US manufacturing index is still painting a very strong picture and while we have seen longer-term inflation expectations falling it hasn’t dented confidence in equities or high yield credit to any great capacity. In fact, if we look at the FOMC statement that came out four hours after the ISM manufacturing read we can further positive signs, where traders have assessed the statement as a green light to increase short-term rate expectations, with the underlying tone of the wording somewhat more upbeat than some had been expecting. So looking at the interest rate markets, we have seen the implied probability of a December hike increasing to 87%, while perhaps, more importantly, we can see the market now discounting 58bp (+3bp on the session) by the end of 2018 and 76bp (+3.5bp) by the end of 2019. The reaction formed largely on the narrative that the US economy is no longer “rising moderately”, but is now undergoing “a solid pace”, although the central bank is describing inflation as “soft”.

G10 FX has been thrown around by gyrations in fixed income, but on the day we can see the US dollar up 0.3%. After the US equity close, the WSJ reported that Trump “is said to have picked Powell as Fed chair”, which won’t surprise as this has largely been in the price for a few days and if anything confirms the notion that Trump perhaps doesn’t like to surprise markets.

AUD/USD traded into $0.7696 after the ISM manufacturing but is trading a touch lower at $0.7671 at the time of writing. GBP has had a mixed session, with all eyes on the Bank of England policy decision at 23:00 aest, where the market is some 90% priced for a hike, so the rates market and sterling will largely key off the urgency portrayed in the MPC statement and from Mark Carney’s press conference (and inflation report) some 30 minutes later. One to watch.

The S&P 500 started the day on the front foot trading into 2588, but traders preference was to fade the move taking the index back to the flat line before buyers stepped back in, where saw the market grind somewhat higher into the close. Post-market we saw Facebook (NASDAQ:FB) report solid numbers, although shares are only up 1.2% in the after-hours trade.

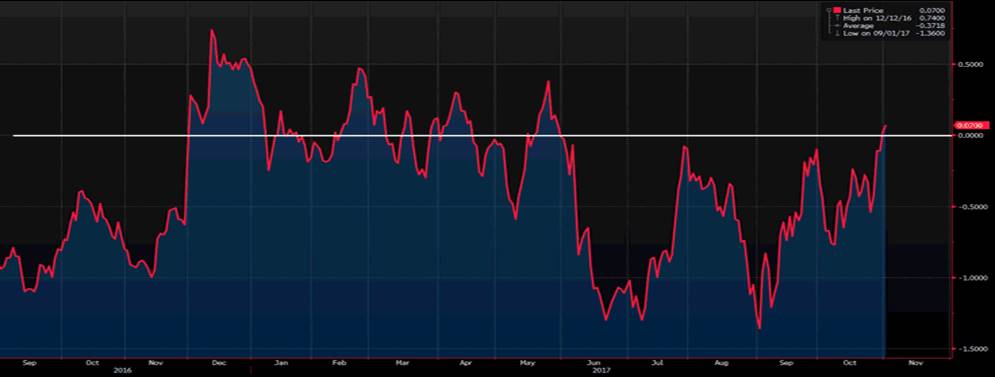

In terms of sector leads, energy has worked well, closing up 1.1% despite US crude and Brent prices closing a touch lower on the day, which is interesting given we have seen a bigger than expected decline in crude and gasoline inventories. Some focus here on the fact that we have seen the US crude futures curve go into backwardation, with the front-month futures contract is trading at a premium to the June 2018 contract – see the Bloomberg screenshot below. This, in itself could act as a headwind for further appreciation in the barrel.

We can also see the materials sector closing up 0.6%, but I would expect the ASX 200 materials sector to fire ahead today, with BHP right at the helm and we see BHP opening over 1% higher (based on its ADR). Spot iron ore closed up 1.4%, while in the Dalian futures space we have seen iron ore, steel, and coking coal close up 2.2%, 1%, and 5% respectively. Copper has also had a better time, closing up 1.4%.

So aggregating all the news we can see SPI futures up mere four points at 5936, although at one stage we did see the index trade up to 5952, which was the highest level since May 2015. The bulls couldn’t quite hold this level though, but that said, we still see the ASX 200 testing its own year-to-date high of 5956.52 on open, so the target for the bulls is to push for a session close above this high and there is plenty for traders to focus on, including focusing on moves in the Nikkei, KOSPI and Hang Seng, which are all trending beautifully. On the docket then we get NAB’s 2H17 earnings, while on a more macro theme traders will assess portfolio risk ahead of Apple (NASDAQ:AAPL) result tomorrow (07:30 aest), Trump’s announcement speech of the new Fed chair and US payrolls report (consensus 312,000 jobs, average hourly earnings +2.7%).