Market Brief

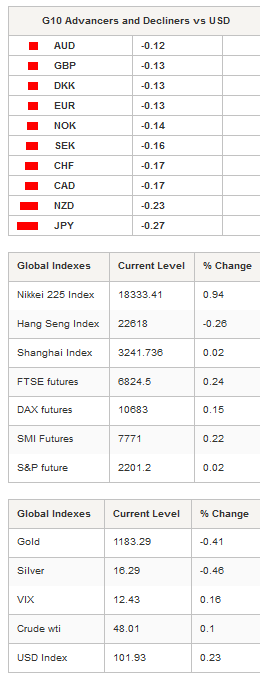

The US dollar extended gains against almost every currency pair during the Asian session, as the sell-off in bonds and emerging markets geared up. After climbing 0.70% on Tuesday, the dollar index added another 0.10% in Tokyo and reached 101.90, the highest level since March 2003.

The better-than-expected US data released yesterday further strengthened the case for an interest rate hike in the US. Emerging market currencies continued to suffer from a massive outflow as investors turn to US assets. The Dow Industrial Average closed at an all-time high yesterday - for the third day in a row and closed at 19,083.

Apart from the Mexican peso, which suffered a severe sell-off amid Trump’s election, the Brazilian real was the worst performer in the EM complex as it retreated as much as 10.90% against the greenback with USD/BRL jumping to 3.50 before easing at around 3.38 as markets calmed down. The main reason behind the recent emerging market debasement is that over the past months, these markets have seen massive inflows against the backdrop of a hunt for higher returns. USD/BRL has however been unable to break its 200dma to upside and is currently stuck below it at 3.43.

The Japanese yen came under renewed pressure on Thursday as investors continued to favour the greenback amid solid US data. USD/JPY climbed to 113.42 in the early European session, up more than 2% on the week as durable goods orders rose 4.8%m/m in October, beating the median forecast of 1.7%, while the previous reading was upwardly revised to 0.4% from -0.3%. The measure excluding transportation was up 1% m/m versus 0.2% expected and upward revision of 0.2%. Separately, initial jobless claims came in line with consensus, printing at 251k versus 250k expected.

In the equity market, Asian regional markets were mixed this morning with the Nikkei rising 0.94% as traders returned from vacation. In Mainland China, the Shanghai Composite was flat, while the Shenzhen Composite was down 0.38%. Offshore, the Hang Seng was off 0.26% and the Taiex fell 0.28%. In Europe, equity futures were blinking green across the screen - the DAX was up 0.14%, the Footsie 0.24% and the Euro Stoxx 50 up 0.20% - suggesting a higher open.

Currency Tech

EUR/USD

R 2: 1.1259

R 1: 1.0954

CURRENT: 1.0532

S 1: 1.0458

S 2: 0.9613

GBP/USD

R 2: 1.2857

R 1: 1.2674

CURRENT: 1.2424

S 1: 1.2302

S 2: 1.2083

USD/JPY

R 2: 121.69

R 1: 114.87

CURRENT: 113.41

S 1: 106.14

S 2: 104.97

USD/CHF

R 2: 1.0328

R 1: 1.0257

CURRENT: 1.0178

S 1: 0.9632

S 2: 0.9537