Stock-index futures pulled back slightly Wednesday as investors waded through a flood of corporate earnings and looked ahead to renewed trade talks between the U.S. and China next week.

Technology shares were also expected to be in focus after the U.S. government acknowledged it is investigating the largest U.S. technology companies for anti-competitive practices.

How are the major benchmarks faring?

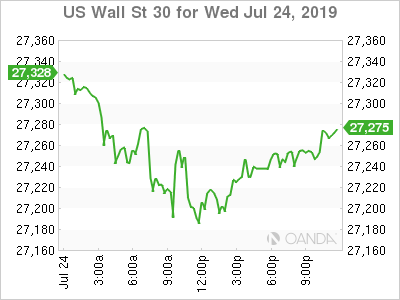

Futures on the Dow Jones Industrial Average YMU19, -0.28% were off 87 points, or 0.5%, at 27,235, while S&P 500 futures ESU19, +0.02% lost 7 points, or 0.2%, to trade at 3,001. Nasdaq-100 Futures NQU19, -0.13% declined 31.25 points, or 0.4%, to 7,952.5.

Stocks saw gains Tuesday, with major indexes ending just a whisker shy of all-time closing highs set on July 15. The Dow DJIA, -0.26% rose 177.29 points, or 0.7%, to 27,349.19, while the S&P 500 SPX, +0.10% gained 20.44 points, or 0.7%, to 3,005.47. The Nasdaq Composite COMP, +0.21% advanced 47.27 points, or 0.6%, to 8,251.40. The gains left the Dow just 0.04% away from its all-time closing high, while the S&P 500 was 0.3% below its closing record and the Nasdaq finished 0.08% away from its high.

What’s driving the market?

Second-quarter corporate earnings results continue to flood in, with shares of Dow component Caterpillar Inc (NYSE:CAT). CAT, -3.87% falling 3.1% in premarket trade after the manufacturer of construction and mining equipment reported a quarterly profit that fell below analyst expectations, continuing a trend of subdued performance in industrial stocks during the second-quarter earnings season.

Fellow Dow constituent Boeing (NYSE:BA) Inc. BA, -0.99% shares were set to weigh on the Dow, after the aerospace giant swung to a loss in the second quarter, while blue-chip AT&T Inc (NYSE:T). T, +2.56% shares were slightly lower after meeting estimates.

Shares of Boeing and Caterpillar were on pace to shave a combined 55 points from the Dow.

Earnings Watch: Facebook’s fine, Boeing’s bind

The Justice Department late Tuesday said its antitrust division was reviewing “whether and how market-leading online platforms have achieved market power and are engaging in practices that have reduced competition, stifled innovation, or otherwise harmed consumers.”

“It seems today could be the day the bears take control,” wrote Edward Moya, senior market analyst at Oanda. “After what was a very hot start to earnings season, investors got a cold bucket of ice poured over themselves as the DOJ opened a probe on tech’s biggest stars and industrial earnings from Boeing and Caterpillar disappointed immensely.”

Experts said Facebook Inc (NASDAQ:FB). FB, -0.50% and Apple Inc (NASDAQ:AAPL). AAPL, +0.04% are likely most at risk if government regulators are serious about pursuing antitrust actions, while Google parent Alphabet (NASDAQ:GOOGL) GOOGL, -0.53%, GOOG, -0.50% and Amazon.com (NASDAQ:AMZN) -0.45% are also under scrutiny.

Meanwhile, a U.S. delegation headed by U.S. Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin is set to travel to China for trade talks next week, The Wall Street Journal reported, marking the first in-person talks since the Group of 20 summit last month.

Which other stocks are in focus?

Anthem (NYSE:ANTM), -3.95% shares fell 2% before the bell Wednesday after the health insurer reported second-quarter expense growth outpacing sales, though it beat expectations for quarterly profits.

Northrop Grumman Corp (NYSE:NOC), +3.90% stock fell 0.8%, even after the defense and aerospace manufacturer surpassed analyst estimates for second-quarter earnings and profit.

Shares of United Parcel Service Inc (NYSE:UPS). UPS, +8.72% were 4.4% higher in premarket trade, after the company reported better-than-expected earnings and profit for the second quarter.

How are other markets trading?

The yield on the 10-year U.S. Treasury note TMUBMUSD10Y, -1.68% fell one basis point to 2.062%.

Crude oil prices CLU19, +0.99% rose 0.5% to $57.05, while gold GCQ19, +0.33% prices added 0.3% to $1,426. The U.S. dollar DXY, -0.11% meanwhile, slid 0.1% early Wednesday.

Stocks traded in Asian markets were mostly higher on Wednesday, with the China CSI 000300, +0.79% ending the day up 0.8%, the Nikkei 225 NIK, +0.41% rising 0.4% and Hong Kong’s Hang Seng index HSI, +0.20% advancing 0.2%.