Yesterday, after trading in an 11 handle range overnight, the S&P 500 futures (ESU17:CME) opened the 8:30am CT regular session at 2474.50, up 4.50 handles. The ES printed a 2475.00 high on the open, and then sold off in a choppy fashion, ultimately finding a low of 2468.00 going into the European close. From there, the S&P’s attempted to rally, but ran out of steam during the less participated midday, making an afternoon high of 2474.00, but was never able to recover the open before settling the day at 2471.75, up 1.75 handles. Total volume on the September mini just barely hit over one million, and the market-on-close was $1 billion USD favoring the buy side.

The real story of the day was after the close, as AAPL reported earnings and shares rose from right around $150 at the close, up to just below $160 just after the conference call, a 7.5% gain helping to push the Nasdaq futures higher after the close. The VIX settled the day just above the $10.00 mark at $10.09, while crude oil futures tumbled, finding resistance at the $50.00 area, pushing down more than $2.00 from Monday’s high.

August was the best, Now the worst

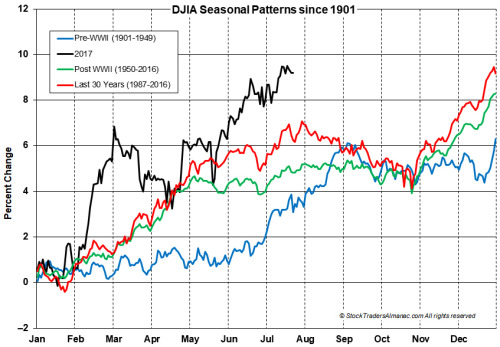

There is some dispute regarding the market’s historical track record during the month of August. Some will say it is one of the best months of the year, others say it is the worst. The correct answer is, August was the best, but now it is the worst. Based upon DJIA data starting in 1901, August once averaged a handsome 2.3% gain (1901-1949) and was the top DJIA month of the year, up 35 times in 48 years. From 1950 to 2016, August is the third worst month, up 37 times in 67 years and over the past 30 years (1987-2016) August has been the worst DJIA month with an average 1.1% loss.

In the above chart we have plotted three seasonal patterns using various beginning and ending date ranges. First off, let’s focus on the blue line. This is what DJIA did between 1901 and 1949. Back then farming and agriculture was a significant portion of the U.S. economy and thus the stock market. Harvest season and its cash flows was a prime driver of DJIA. The market generally started the year off quietly drifting sideways to slightly higher until making a leap higher through July and August to an early September high just as harvesting season was also reaching a peak.

Around 1950, just after the end of WWII, farming and agriculture’s sway over the market began to wane as the middle class began to blossom and the modern day consumer appeared. Fewer and fewer people were living and working on farms, instead they choose the city and suburban life. Instead of working the fields, people are now on vacation in August. This caused a shift in the market’s behavior as well, represented by the green, post WWII (1950-2016) line. Over the past 67 years, DJIA has been reaching a seasonal high in May just as summer begins and the school year nears an end. DJIA then wanders throughout the summer months and into mid-Autumn before rocketing higher to finish the year. Note how little the pattern has changed over the past 29 years (red Line) when compared to the green line.

Courtesy of the Stock Trader’s Almanac

While You Were Sleeping

Overnight, equity markets in Asia traded mixed, with a slight bias to the upside, and were led by the NIKKEI, which closed up +0.47%. Meanwhile, in Europe, equity markets are also trading mixed, but with a slight bias to the downside, led by the FTSE, which is currently trading down -0.32%.

In the U.S., the S&P 500 futures opened last night’s globex session at 2474.00, and traded sideways all night. The ES was held to just a 3.5 handle range as traders await the ADP employment data due out at 7:30am CT. As of 6:30am, the last print in the ES is 2472.75, down -0.50 handles, with 100k contracts traded.

In Asia, 8 out of 11 markets closed higher (Shanghai -0.20%), and in Europe 9 out of 12 markets are trading lower this morning (FTSE -0.32%). Today’s economic calendar includes the Bank Reserve Settlement, MBA Mortgage Applications, ADP Employment Report, Gallup U.S. Job Creation Index, a 3-Yr Note Announcement, a 10-Yr Note Announcement, a 30-Yr Bond Announcement, Treasury Refunding Announcement, EIA Petroleum Status Report, Loretta Mester Speaks, and John Williams Speaks.

Our View

Right now it feels like a waiting game. Either waiting for a new high to short, or enough of a pullback to buy, and unless you are buying the 7-8 handle dips intraday and scaling out by the close, there isn’t much to swing trade for right now.

For position traders, it’s the case of too high to buy and too firm to sell, and for the intraday guys, we have to ask how many more 5 – 10 handle pullbacks can we buy with our eyes closed before getting burned on a 20 handle sell off like last Thursday.

I put out yesterday that there are buy stops built in above 2478 to 2484, and then from 2484 to 2490. The market has been building a short term ceiling the last nine sessions between 2475 – 2480, when that breaks, it’s on to 2500 before Labor Day. However, from a swing perspective, it’s starting to look like more favorable circumstance to short the market using that 2480 as a risk marker. Am I calling a top? NO! But the risk/reward may be suitable from here to look for 2460 or 2450, while risking to 2480 from the current print of 2474.