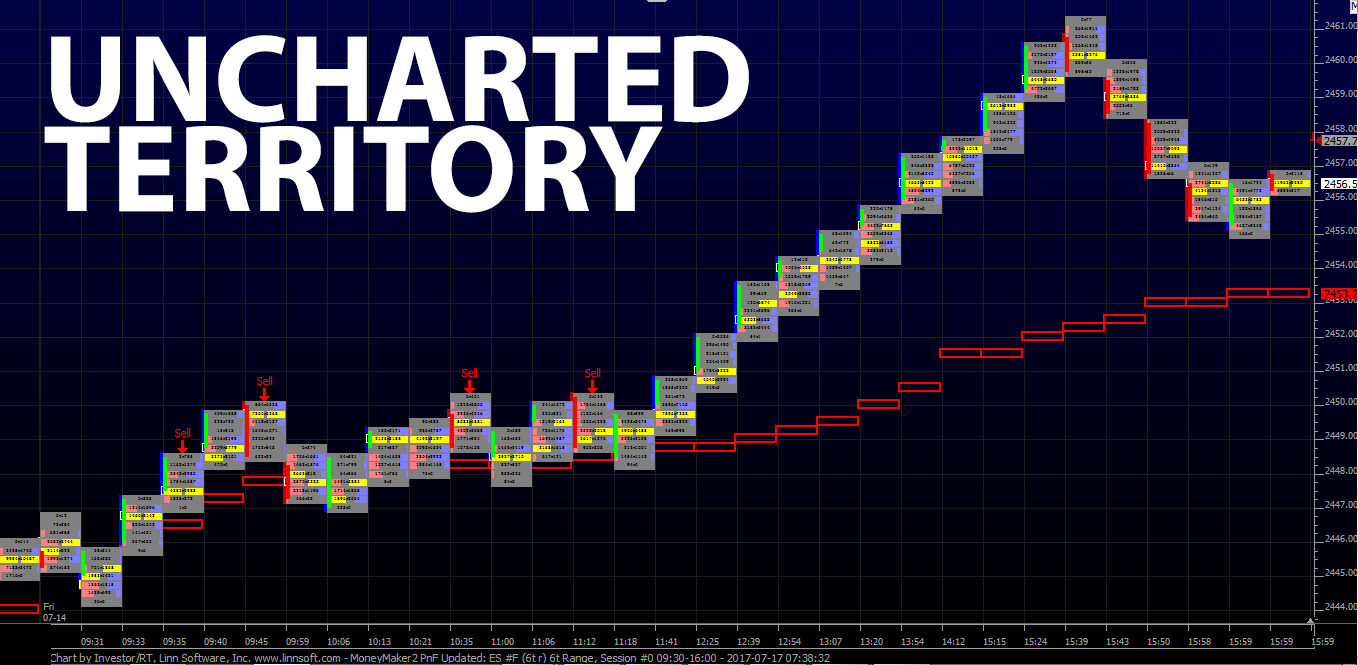

The S&P has closed higher 4 out of the last five weeks, but the higher it goes, the less interest and volume there is. After gapping lower on the 8:30 CT futures open the S&P 500 futures (ESU17:CME) initially rallied up to 2450.00, pulled back to below the 2446 area, and then triple topped at 2450.25, just a few ticks under the all time high at 2451.50.

For the next 2 hours the ES traded in a 2 handle range. We understand it was a Friday, but with the all time high at 2451.50, and so many buy stops above, it’s hard to believe the bots did not ‘run the stops’ right away, but it did eventually happen.

Despite U.S.retail sales falling for the second month in a row, and consumers pulling back, the S&P 500 futures broke through to new all time highs going into 11:30 CT, and then up to 2452.75 at 11:45. After that, the big stop run I have been talking about took the ES up to 2455.75 at 12:40 CT, and by 2:45 it was trading all the way up to 2461.25, almost 10 handles higher than the previous contract high.

When you look at Friday’s chart (above), you will see two things; early sideways trade, and then an upside explosion with almost no down ticks.

In the end it was a mammoth stop run. The bots sniffed out all the buy stops and never let up. It was one buy program after another, and anyone that tried to ‘short it’ got killed. There was also a total lack of volume. At 3:00 CT there was just 900k ESUs traded, with 152k of that coming from Globex pre-8:30 CT futures open.

When the smoke cleared, the S&P 500 futures (ESU17:CME) settled at 2456.00, up +10.50 handles, or +0.42%, the Dow Jones futures (YMU17:CBT) settled at 21595, up +86 points, or +0.39%, and the Nasdaq 100 futures (NQU17:CME) settled at 5843.25, up +45.75 points, or +0.78%.

While You Were Sleeping

Overnight, equity markets in Asia traded mostly higher, led by the NZX 50, which closed up +0.63%. Meanwhile, in Europe, markets are mixed, with a slight bias to the upside, as investors wait for more earnings news.

In the U.S., the S&P 500 futures opened the Globex session at 2457.00, and traded in a 5 handle range all night. The high at 2459.00 was made right on the open, and was tested twice, but so far has failed to break through. As of 6:30 am CT, the last print in the ESU is, 2457.50, up 1.75 handles, with 95k contracts traded.

In Asia, 7 out of 11 markets closed higher (Shanghai -1.42%), and in Europe 9 out of 12 markets are trading higher this morning (FTSE +0.59%). This week’s calendar consists of 18 economic reports, 16 U.S. Treasury auctions and announcements, and NO Fed speakers. Today’s economic calendar includes the 3-Yr Note Settlement, the 10-Yr Note Settlement, the 30-Yr Bond Settlement, Empire State Mfg Survey, a 4-Week Bill Announcement, a 3-Month Bill Auction, and a 6-Month Bill Auction.

Our View

“Mutual Fund” Monday has been strong, closing higher on 12 of the last 15 occasions, with those few lower closes being very minimal. Given the current bullish trend, and the strength on the first day of the week, we lean toward being buyers of small pullbacks, while looking for the ESU17 to hold above the old 2151 high.

If you want to short, Tuesday’s have been extremely weak, and it could be worthwhile to short a rally midday and hold into tomorrow with smaller size. However, we prefer the long side above 2150, and as volume slows down more and more into the end of the month, thin to win will take over, but that won’t last forever.