The Federal Reserve’s two day meeting came to a close yesterday with rates unchanged, and the S&P 500 futures (ESU17:CME) trading in a 3 1/2 handle trading range for nearly 4 hours.

At 12:30 CT yesterday, the ES was trading at 2475.50, unchanged on the day. Total volume was 550,000 contracts, with 160,000 coming from Globex pre-8:30 futures open. As always we like to write about the markets, but there is just not that much to say. The ES has closed higher, up 16 of the last 19 trading days, and the NQ has closed higher 13 out of the last 15 sessions…

At 1:00 CT the fed issued its policy statement, saying “FOMC Rate Unchanged At 1.0%-1.25%, Expected-Balance-Sheet Unwind To Start `Relatively Soon.’” Just after that, the ES down ticked to 2473.50, and then popped up to 2467.25. After the smoke cleared, the ES went back to its narrow 3 handle chop.

Late in the day, the ES tested Tuesday’s close, the 2474.50 – 2474.00 area, 6 different times. At 2:00, the MiM showed $24 million to buy, at 2:18 it was $45 million to buy, at 2:30 it was $65 million to buy. Then, at 2:37, the MiM ‘flipped’ to sell $57 million, then to $103 million for sale, then to over $209 million for sale, and then, right on the 2:45 cash close, the MIM started showing over $900 million for sale. Just as it did, the ES ‘finally’ sold off thru the 2474.00 area, down to a new daily low at 2471.50, and then popped back up to 2475.50 going into the 3:00 cash close.

In the end, it’s almost unbelievable that on the second day of a fed meeting, less that 1 million ESU contracts traded.

On the 3:15 futures close, the S&P 500 futures (ESU17:CME) settled at 2473.25, down -0.75 handles, or -0.01%, the Dow Jones futures (YMU17:CBT) settled at 21646, up 86 points, or +0.40%, and the Nasdaq 100 futures (NQU17:CME) settled at 5948.00, up 14.25 points, or +0.23%. It was another long day on a list of many.

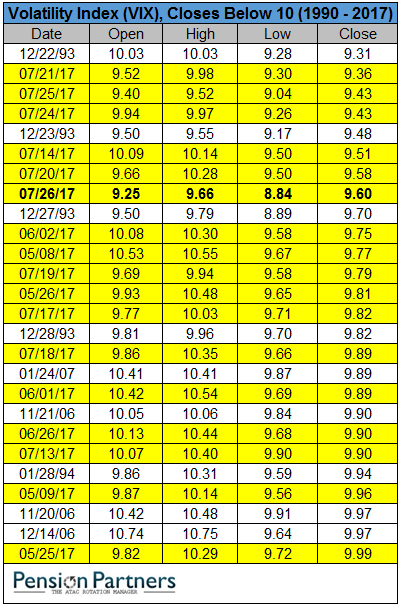

VIX 884

The VIX traded down to 8.84 yesterday. The chart below is from Pension Partners, and shows 17 of the 26 lowest closes in history, which have all come in the last 3 months. It is a quiet market, but how much longer can this go on? Scary? Yes it is! Are things going to change soon? Only time will tell!!! According to Factset, 8.84 is the lowest reading since the CBOE started publishing real-time data in the early 1990s.

While You Were Sleeping

Overnight, equity markets in Asia traded higher, led by the Hang Seng Index, which closed higher by +0.71%. Meanwhile, European stocks are trading mixed this morning, as traders await more big name earnings data. As Asian markets were closing, and European markets were opening, the ES popped up to a new high at 2480.00, before settling back into another 3.5 handle range. As of 7:00 am CT, the last print in the ESU is 2477.25, up +4.00 handles, with 138k contracts traded.

In the U.S., the S&P 500 futures opened last nights Globex session at 2474.50, and immediately traded up to an early high at 2477.75. After that, the ES traded in a 3.25 handle range until just 2:00am CT.

In Asia, 10 out of 11 markets closed higher (Shanghai +0.05%), and in Europe 7 out of 12 markets are trading higher this morning (FTSE +0.04%). Today’s economic calendar includes the Weekly Bill Settlement, Durable Goods Orders, International Trade in Goods, Jobless Claims, Chicago Fed National Activity Index, Bloomberg Consumer Comfort Index, EIA Natural Gas Report, Kansas City Fed Manufacturing Index, a 3-Month Bill Announcement, a 6-Month Bill Announcement, a 7-Yr Note Auction, Fed Balance Sheet, and Money Supply.

Our View

Well… The band plays on. In all my years of being in the trading business, I have never seen the S&P move less than it is now. The basic pattern is to sell the gap higher, and buy the ES when it falls under the vwap. I do think there is a general concern amongst market pundits that the low VIX could change at any minute, but it’s been like this for 3 months. Our view is to sell the early rallies and buy weakness.

PitBull: CLU osc 15/8 turns down on a close below 46.15; ESU osc 15/15 turns up on a close above 2480.52; vix osc -5/-7 turns down on a close below 9.09.