by Pinchas Cohen

Key Events

- Asia stocks climb, breaking tech selloff

- Pound flat; election announcement gains almost erased

- Oil recovers; first repeated gain in 3 weeks

- Investors look to Fed meeting

Global Affairs

After the biggest two-day global tech sell-off in more than 6-months, Asia-Pacific equities have started to rise, in what may leave investors questioning if this is a climb back to the top or a break in the fall to a lower bottom.

The tech sector was the market leader that paved the way for global equities to hit repeated record levels this year. Investors felt untouchable after disregarding last Thursday’s three high-risk events; the Comey testimony, UK elections and the ECB's policy decisions. The sudden sell-off in high-flying, mega-cap techs had investors considering whether this rapid decline would lead declines in other global equities, or worse, spur a complete market crash.

Global indices climbed this morning, starting with the Asia Pacific region, from Australia to Hong Kong. Tech stocks in the MSCI Asia Pacific remained steady, good news after the NASDAQ 100 Index suffered its worst two-day fall since September 2016. Tech stocks in Europe pared 1.3%, opening at 41.50, where it continues to remain steady today.

Still, investors should be cautious. The NASDAQ fell as much as 1.9 percent during yesterday's trading. The bottom line: despite the global tech sell-off and political risks in the US and the UK, global equities are still attracting buyers, even when they're less than 0.8 percent from all-time highs.

Oil recovered from its plunge off its $52 high on May 25, before the disappointing OPEC cut-extension announcement pushed the commodity down to $45.20, the lowest in over a month. Today it is trading over $46, after Friday’s and Monday’s first back-to-back gains in three weeks, ironically during the same two days that global tech stocks crashed.

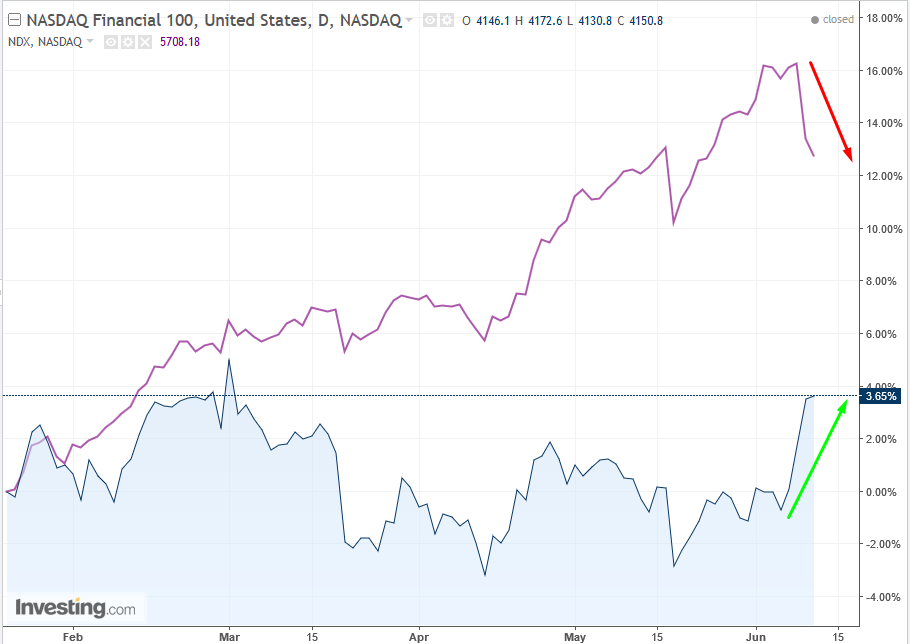

Perhaps oil rising for the first time in a while on the very same days as the tech selloff isn’t a coincidence. As you can see in the chart above, while the NASDAQ had its worst 2-day loss of the year at three percent, the NASDAQ's crude oil index rose 0.94%.

Another, seemingly unrelated event to the tech sell-off is the much-anticipated Fed policy decision and its forgone conclusion of a second quarter-percent rate hike this year. There is a minority market opinion that the recent reflation rally occurred because of economics, and not President Donald Trump’s pro-growth agenda.

During the two-day 3% tech sell-off, the same exchange’s financial sector actually rallied 3.6%, more than the NASDAQ 100’s much talked about fall. So, is the tech sell-off a leading indicator of an impending market crash, or are equity investors simply rotating out of momentum stocks and into value stocks?

While 90 percent of tech stocks were down yesterday, financials and energy — laggers this year — were up. Growth indices were down, but value indices were up. This trend is likely to continue over the next weeks to months, rather than just days, as tech valuations have become disproportionately high. However, tech stocks may get a small boost on higher exports, thanks to a weaker dollar.

Safe haven assets such as Treasuries, gold, the Japanese yen and US dollar are trading within a holding pattern, ahead of tomorrow's Federal Reserve policy meeting.

The pound, whose fortunes seem directly tied to the UK's PM Theresa May, was unable to climb. It is still unclear whether May can survive the fallout from her unsuccessful election gamble. The question is whether investors will look beyond May's political survival when determining the value of the GBP.

The Week Ahead

- After Comey’s testimony, investors will be seeking more answers during US Attorney General Jeff Sessions testimony before the Senate Intelligence Committee, later today.

- The FOMC quarter-percent interest rate hike is already priced in, and investors are looking to the Fed for signs of a potential economic downturn and how it plans to handle its over $4 trillion balance sheet.

- Central banks in Japan, Switzerland and Britain are holding policy meetings. Japan has been under pressure to address its QE program, while Britain is too unstable at the moment, with Brexit negotiations and the fallout from the recent election, to consider a rate change.

Market Moves

Stocks

- Futures on the S&P 500 Index rose 0.2 percent. The Nasdaq 100 fell 0.6 percent on Monday, adding to its 2.4 percent rout on Friday. Apple (NASDAQ:AAPL) fell 2.4 percent while Microsoft (NASDAQ:MSFT) slid 0.8 percent. Losses in the S&P 500 were muted, with the benchmark gauge down 0.1 percent.

- The STOXX Europe 600 Index climbed 0.4 percent as of 8:14 a.m. in London, after dropping 1 percent on Monday.

- Japan’s TOPIX rose 0.1 percent while the Nikkei 225 Stock Average fell less than 0.1 percent amid continued weakness in Softbank (T:9984) and other technology companies.

- The S&P/ASX 200, Australia’s benchmark gauge, climbed 1.7 percent, with energy and financial shares leading the way as investors returned from a holiday.

- South Korea’s KOSPI added 0.7 percent.

- Hong Kong’s Hang Seng increased 0.4 percent.

- China's Shanghai Composite advanced 0.4 percent.

Currencies

- The Dollar Index was trading in a holding pattern till 3:20 EDT, when it suddenly plunged with a gap, from 97.17 to 97.13 and continued its decline until 97.02. At 4:00 AM it turned, as of 4:21 EDT its up to 97.04.

- The pound strengthened 0.2 percent to $1.2680, after sliding as much as 0.8 percent on Monday; it hit $1.2636 on Friday, the lowest since May 18.

- The euro retreated 0.1 percent to $1.1193.

Bonds

- The yield on 10-year Treasuries fell less than one basis point to 2.21 percent, after rising for four straight sessions.

- UK, Germany and French benchmark yields all rose one basis point.

- Australian benchmark yields were little changed at 2.40 percent.

Commodities

- West Texas crude futures rose 0.2 percent to $46.18, gaining for a third day. This is ahead of tomorrow's government data forecast to show crude stockpiles resumed declines after an unexpected rise.

- Gold slipped 0.1 percent to $1,264.91, after four straight days of losses as investors anticipate the Fed will raise rates Wednesday.