- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Opening Bell: Equities Hit Record High After Yellen; USD Falls

by Pinchas Cohen

Key Events

- Yellen confident about US economy, but not rushing tightening cycle

- Dow Jones Industrial Average climbs to record

- KOSPI hits record, Hang Seng reaches 2-year high

- Yellen’s slower pace turns back the tech-to-financials rotation, proving bonds right

- Dollar falls on weakened rate outlook, gold climbs

- Loonie gains most against dollar, on first BoC rate hike in 7 years

- Oil climbs back over $45 key level on surprise drop in US stockpiles

Global Affairs

Asian equities advanced with US futures and government bonds, resuming yesterday’s US rally, after Fed Chair Janet Yellen tempered the Fed's tightening outlook. Naturally, the dollar weakened on a slower interest rate hike path. The greenback reached its last support before a 10-month low. The biggest beneficiary was the loonie after the BoC hiked interest rates for the first time in 7 years.

The Dow Jones Industrial Average opened on a 0.28 percent rising gap yesterday, registering a fresh all-time high at 21580.79, and beat its pre-Independence Day all-time-high by 18.04 points, or 0.08 percent. It also recorded a new record close of 21532.14, beating its earlier record, set on June 19, by 3.15 points, or 0.01 percent.

Asian markets followed the US lead. Sourth Korea’s KOSPI made an even more impressive record than the Dow’s. The index opened with a gap of 0.58 percent higher than yesterday’s close and 0.47 percent higher than yesterday’s high, extending its gains to a total of 1.07 percent. The Bank of Korea provided investors with three reasons for optimism: (1) as expected it kept its record-low 1.25% interest rate, but went further by saying that the BOK doesn’t have to respond to other central banks, thus delaying a hike (2) it raised its growth forecast to 2.8 percent and (3) the country's growth is likely to be higher after President Moon Jae-in’s $9.8 billion fiscal stimulus package, focused on job creation, is implemented. However the bill has made little progress in parliament.

Hong Kong’s Hang Seng opened with a second consecutive gap—after rising on mainland blue-chips—opening 1.25 percent and closing 0.85 percent above yesterday’s high. However, unlike the KOSPI, it hadn’t extended gains after the gap, but pared 0.2 percent of its rising divide. Still, the index reached its 2-year high since June 29, 2015, up 6.65 percent from its April 20, 2015 record close and 8.65 percent above its April 27, 2015 record high. Chinese exports beat forecasts, making the case for resilient global demand.

Yellen’s Congressional testimony provided equity traders with two gifts. First, a slower pace of rate increases allows for cheaper liquidity, which will continue propping up high valuations. Second, it kept focus away from the latest installment of the Trump-Russia saga, while inserting yet another nail into the coffin of Trump’s proposed tax reforms and spending.

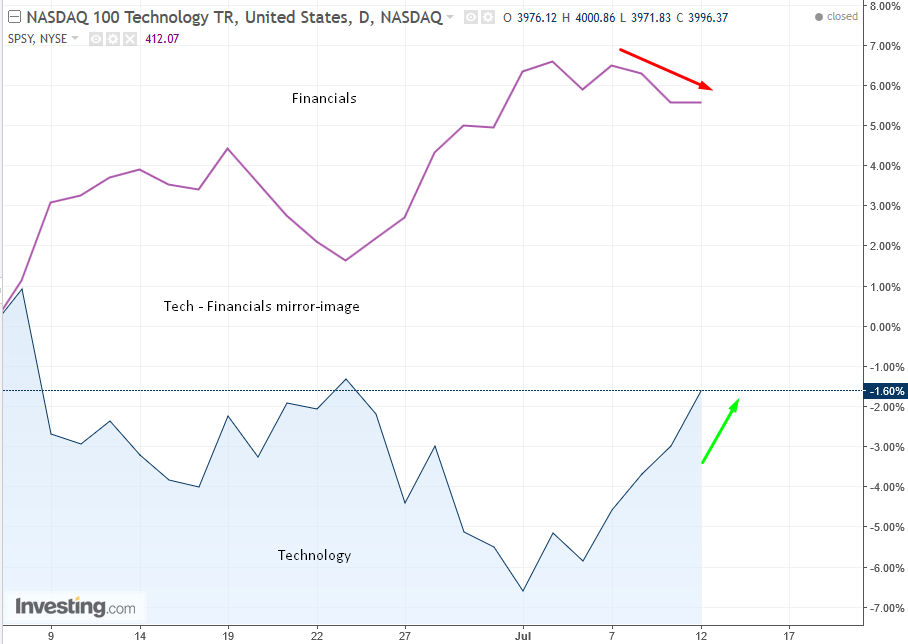

The biggest question on investors’ minds should be: how would slower tightening affect the leadership rotation out of tech and into financials? This switch was apt to occur before any economic kickstart could take place. Indeed, on June 9 Goldman Sachs warned that big tech stocks were overvalued, spurring a 2.43 percent selloff, with an intraday low of 3.85 percent in the sector.

On June 14, the Fed raised rates, a move whose biggest beneficiary were financials. On June 26 the second tech selloff started, which advanced after all the big banks passed the Fed stress test with flying colors—the first time all were declared healthy since the Great Recession—helping secure Fed approvals for generous buybacks.

Yesterday’s hike path slowdown may have turned the wheel back on the leadership rotation. The NASDAQ 100 Technology Index gapped up 0.89 percent and kept going up to a total gain of 1.41 percent—crossing above the downtrend line from the June 29 and June 26 selloffs, opening the door to an upward reversal. The S&P 500 Financials Index on the other hand, declined 0.66 percent, raising the possibility of a double-top reversal.

It turns out that, as things stand, bond traders were right to doubt Fedflation all along.

Australian sovereign debt followed gains in Treasuries on Yellen’s more tepid tightening outlook, making current yields proportionately more attractive.

The dollar weakened on the slower rise of the interest rates outlook, today reaching 5 pips above its June 30 low, the last support before the USD's lowest point since September 30 2016.

The biggest winner was the loonie, extending yesterday’s 1.27 percent gain to 1.43 percent today. The surge occurred after the Bank of Canada raised the interest rate for the first time in 7 years to 0.75 percent, and suggested it will begin shrinking its balance sheet, saying Canada no longer need strong stimulus.

The last Canadian rate change was down to 0.5 percent, to support the country's economy after the collapse of oil prices. Therefore, this rate hike is a clear signal that its economy has recovered. On Monday, we forecast the likely loonie correction downward will be followed by a rally. Even after the rate hike, there is still a long opportunity for trading strategies.

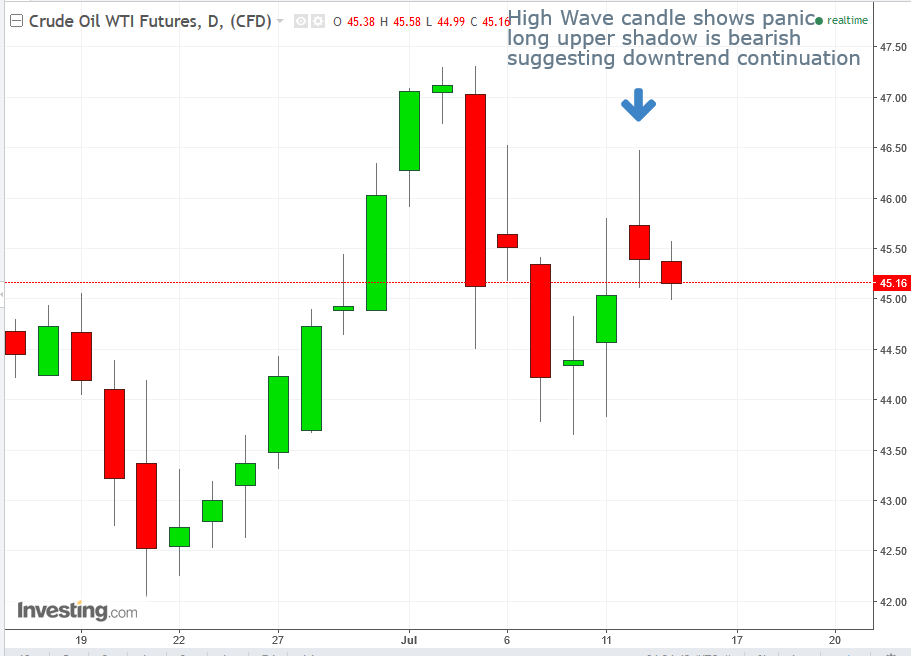

Oil jumped yesterday to a high of $46.68, after a bigger-than-expected drop in US crude stockpiles, falling 7.6 million barrels in the last week, more than double the 2.9-million-barrel estimate. However, oil couldn’t hold on to those gains and settled near its low of the day at $45.40, but still above the $45 key level.

Today crude is flat, but still above the key $45.20 level.

Goldman Sachs' head of commodities research, Jeff Currie, said yesterday on CNBC the problem isn’t too much oil but too much money. After the 2014 crash, US producers learned to be more efficient and cost effective. On top of that, Wall Street financiers helped them become even more capable, enabling them to be profitable at ever lower prices. It seems to us that Currie’s statement is saying that there is an excess of oil because too much money is invested and focused on keeping production high.

Up Ahead

- US PPI for the month of June, released at 8:30 EDT, is expected to decline from 2.4% to 1.9% YoY and from 0.0% to a negative 0.1% MoM.

- Yellen’s second-day Congressional testimony at 10:00 EDT. What more can she say? The Q&A session may give dollar bulls something to chew on.

- Core US CPI for the month of June, released at 8:30 EDT, is expected to remain steady at 1.7% YoY and rise from 0.1% to 0.2% MoM. Compare this to China, whose CPI was unable to follow its PPI, which may have helped a selloff in Chinese equities on Monday. Here was our report.

- Brainard’s speech will follow Yellen’s testimony at 10:00. Brainard stated on Tuesday she was wary of hiking rates, ahead of Yellen’s testimony yesterday.

- JPMorgan Chase (NYSE:JPM)., Citigroup (NYSE:C) and Wells Fargo (NYSE:WFC) are all scheduled to release earnings on Friday. Yesterday we discussed trading strategies for Citigroup.

- The UK publishes its Brexit repeal bill, which Labor threatens to block.

Market Moves

Stocks

- The Dow Jones Industrial Average rose 123 points to a record 21,532.

-

- The FTSE 100 was down 0.1 percent after rising 1.2 percent the previous day, its most since April 24.

- S&P 500 futures were up 0.2. The underlying index advanced Wednesday to just 0.4 percent shy of its closing record.

- The MSCI ACWI Index, which includes emerging and developed world markets, rose 0.2 percent to a record high.

- Hong Kong’s Hang Seng climbed 1.1 percent, its highest since July 2015. A gauge of Chinese companies listed in Hong Kong jumped 1.5 percent, while China's Shanghai Composite gained 0.6 percent.

- Japan’s TOPIX was steady after fluctuating.

- Australia’s S&P/ASX 200 Index strengthened 1.1 percent.

- The KOSPI in Seoul rose 0.7 percent. South Korea’s central bank held its benchmark rate, as expected.

Currencies

- The Canadian dollar rose 0.1 percent after jumping 1.3 percent Wednesday.

-

- The South Korean won rose 0.8 percent, its most since May 25, to 1,136.35 per dollar.

- The US dollar was down against all G-10 peers.

- The Dollar Spot Index is flat at 95.75. It fell 0.30 percent to its June 30 low of 95.47, and the last support before its lowest since September 2016.

- The pound and euro both climbed 0.4 percent.

- The Brazilian real jumped 1.4 percent Wednesday after former President Luiz Inacio Lula da Silva was convicted of graft and money-laundering.

Commodities

- Wheat for September on the Chicago Board of Trade dropped 1.5 percent to $5.29 a bushel, down a second day. The U.S. Department of Agriculture said domestic production will be greater than analysts expected.

- West Texas Intermediate crude was down 0.5 percent at $45.29 a barrel. It climbed 1 percent the previous session after data showed crude inventories fell 7.56 million barrels last week.

- Gold added 0.2 percent to $1,222.99 an ounce, a fourth day of gains.

Rates

- The 10-year U.S. Treasury yield was down less than one basis point at 2.32 percent.

- The yield on Australian government notes with a similar maturity dropped three basis points to 2.69 percent.

Related Articles

Economic resilience has held up, but emerging signs of weakness suggest investors should stay vigilant. Market volatility is creeping higher, hinting at a potential shift from...

Last week, we discussed that continued bullish exuberance and high levels of complacency can quickly turn into volatility. Over the previous week, the market fell sharply...

This week we got the second look at Q4 GDP, which showed the economy grew at a 2.3% annualized pace. Which was the same as the 1st estimate, but below the historical average of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.