Investing.com’s stocks of the week

by Eli Wright

The FOMC opens their two-day meeting this morning, ahead of tomorrow’s interest rate decision and the expected rate increase. It’s difficult to predict what markets will do in the run-up to the Fed announcement, but two separate studies (described in detail below) could provide some guidance. Spoiler alert: one of the studies shows how Twitter-based trades ahead of Fed decisions could actually help your portfolio.

As of now, markets are mixed ahead of the Fed decision, with a tug-of-war occurring between bulls and cautious profit-takers. Each group is waiting for Fed guidance regarding interest rate plans for 2017.

In Asia overnight, the Nikkei closed half-a-percent higher, at 19,250.52 and the Shanghai Composite crept up 0.04%, to 3,154.20. The Hang Seng fell 0.14%, to 22,402.

In Europe markets are trading higher: the FTSE is up 0.18% to 6,902.30, the DAX is up 0.78% to 11,276.50; the Euro Stoxx 50 is up 0.95% to 3,228.50.

On Wall Street, the Dow climbed an additional 40 points, rising 0.2% to 19,796.43 as the 'will-it-hit-20,000-in-2016' watch continues. The S&P 500 however, fell 0.11% to 2,256.96; the NASDAQ declined 0.59% to 5,412.54; and the Russell 2000 lost nearly 1%, falling to 1,375.20.

In pre-market trading the Dow is up 0.33%, the S&P is up 0.26% and the NASDAQ is up 0.31%.

Yields on the US 10- and 30-year Treasury notes have declined slightly, to 2.464 and 3.145 respectively. The 2-year yield has edged up to 1.145.

Forex

The Fed begins its meeting today, ahead of tomorrow’s heavily watched interest rate decision, where a 25 bp hike is widely expected. The continued strength of the dollar could depend on the FOMC’s forward-looking guidance. If Janet Yellen’s comments hedge by refering to data dependency as potential benchmarks for future decisions thus delaying the time-frame for additional rate increases further into 2017, it could have a negative impact on the greenback.

As of this writing, the dollar is slightly higher against a basket of currencies, including the euro, cable, loonie, Japanese yen, Swiss franc, and Chinese yuan.

Annual British CPI figures will be released later this afternoon, which could influence the pound. And in Japan, important readings from the manufacturing and service industries come out this evening.

Commodities

Apparently, the highs reached by oil following this weekend's OPEC/non-OPEC agreement to curb output by 2% have subsided. Crude and Brent are both slightly lower on the day, as traders now worry about deal compliance. Indeed, according to Goldman Sachs:

“...in 17 production cuts since 1982, OPEC members have reduced output by an average of just 60% of their commitments.”

BMI Research added:

"We note that the higher the barrel price, the greater the temptation to break allocated quotas.”

Despite the tick down, oil remains on an uptrend; yesterday, energy company shares benefitted: Chevron (NYSE:CVX) was up 1.16%, Exxon (NYSE:XOM) rose 2.22%, and W&T Offshore (NYSE:WTI) gained a whopping 13.2%.

The expected announcement of Exxon Mobil Chief Executive Rex Tillerson as Donald Trump’s Secretary of State is likely another reason for the boost in the company’s stock price.

Gold is currently hovering near historic consolidation points which often come right before larger price moves (chart below). Round numbers are often of psychological importance, and with the gold price having plowed through $1,200 in its post-election plunge, it's possible that if the yellow metal can't hold support at the $1,150-$1,140 level there may not be much stopping it from heading toward $1,100 and possibly even $1,000.

From a fundamental perspective as well, with a stronger dollar and plenty of perceived risk-on sentiment in the markets, investors simply don't appear to be incentivized to look at gold as an attractive asset just yet.

Silver, aside from being a poor man’s safe haven, is also a major component for manufacturing, used in a variety of industries, including automotive, medical, and solar panels. Demand from these sectors is expected to increase slightly over the next two years, which could drive the price up to $18-$19.

Looking at the technicals, silver has been clobbered in the second half of this year. Like gold, it is currently trading close to sizeable zones of consolidation/inflection points. However, unlike gold, it actually appears to be struggling to regain its balance. The charts also demonstrate that a move to $18-$19 is entirely possible; however, that should be weighed against the steep almost six-year downtrend (inset below) for the white metal.

Stocks

With the Fed's final meeting in 2016 about to begin, there's some interesting research worth considering if you plan to buy or trade stocks during the next 24-48 hours:

- A MIT abstract released earlier this year analyzed tweets sent out before and after FOMC meetings, between 2007-2015, and actually found that a “tweet-based asset-allocation strategy outperforms several benchmarks.” If that’s the case, now is a good time to start tracking Fed-related conversations on Twitter.

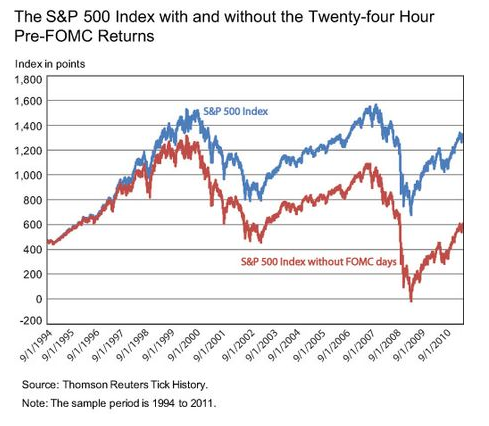

- A separate study, posted on Liberty Street Economics' blog showed that unrelated to actual Fed actions, between 1994-2011, more than 80-percent of the equity premium on U.S. stocks was earned in the 24 hours preceding FOMC announcements.

Source: WSJ

Interestingly, the study also found that international indices, including the FTSE, DAX, France's CAC 40, Spain's IBEX, and Canada's TSX, don’t have similar drifts related to their country’s monetary policy announcements – but just like US stocks, they too, react to Fed announcements.

Returning to a point about social media for a moment, Twitter may be a powerful tool with a direct cause/effect relationship to financial markets. And tweets from influential people wield yet more power. Last week, when Trump tweeted about Boeing's (NYSE:BA) outsized $4B price tag for a new Air Force One, the stock fell 1% in the immediate aftermath. (In fresh Boeing news, the company sealed a $17 billion deal with Iran, an agreement which could fall under intense political scrutiny.)

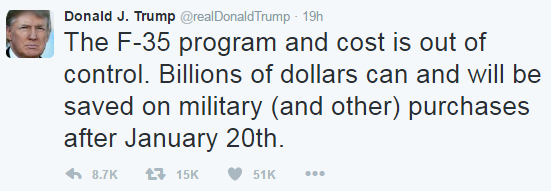

Yesterday, the Tweeter-in-Chief was back at it. This time, Lockheed Martin (NYSE:LMT) was the target: “The F-35 program and cost is out of control. Billions of dollars can and will be saved on military (and other) purchases after January 20th,” the President-elect tweeted.

As a result, $3.5 billion was wiped from Lockheed Martin's valuation, as shares fell 2.47% in the tweet’s aftermath.

Other defense stocks were also hit hard: Heico Corp (NYSE:HEIa) and Northrop Grumman (NYSE:NOC) each lost approximately 2.66%; Huntington Ingalls (NYSE:HII) dropped 1.82%; Raytheon (NYSE:RTN) fell 1.7%; General Dynamics (NYSE:GD) and the Curtiss-Wright Corporation (NYSE:CW) each declined close to 1%.