by Eli Wright

The Fed was more hawkish yesterday than many expected. Though markets were generally in agreement that a hike would finally occur, consensus going into the meeting was that guidance could be vague as the Fed waited for more details of Trump’s fiscal agenda before spelling out their rate hike intentions for 2017. Instead, FOMC members unanimously voted for a 0.25 basis point hike, while the majority agreed on potentially three more quarter-point increases in 2017. As a result, the US dollar soared though equity markets ended the day mostly lower.

In Asia overnight, markets were mixed. The Shanghai Composite fell 0.75% to 3,117.05 as the Fed decision prompted investors to take their money out of the market. The decision also made future borrowing costs for Chinese companies more expensive. The close was a fresh one-month low for the Shanghai. Also worth noting is that after the Fed's rate hike last year the Shanghai benchmark index lost approximately 25% of its value in the six weeks following the Fed announcement. The descent was so hard and so fast that at one point the China Securities Regulatory Commission halted trading on the exchange.

Other Asian markets were more sanguine: the Hang Seng also fell, down 1.90%, to 22,040. In Japan, the value of the yen plummeted, making the country’s exports more attractive to buyers. The Nikkei rose 0.10%, to 19,273.79.

In Europe this morning, markets opened mixed: the FTSE is down 0.1%, at 6,941.90; the DAX is up 0.62% at 11,315.00, and the Stoxx 50 is 0.67% higher, at 3,239.50. There's a slew of economic data coming in from Europe today including Eurozone CPI readings which could impact US markets later in the day.

On Wall Street, the Dow touched an intraday record of 19,966.43, but ended by finishing 0.6% lower, at 19,792.53. The S&P 500 closed down 0.81%, at 2,253.28, and the NASDAQ fell 0.5%, to 5,436.67. The Russell 2000 lost 1.18%, falling to 1,358.35.

It's possible traders were simply caught off guard by the Fed's surprisingly hawkish tone. In pre-market trading, things are looking up once again. The Dow is up 0.11% and the S&P is up 0.03%. Only the NASDAQ remains depressed, down a tad at 0.04%.

Across the board, US bond yields rose sharply as investors dumped government bonds in response to the interest rate hike: the 2-year Treasury yield, the most sensitive to Fed moves, rose to 1.288%, the highest since 2009. The 10-year yield advanced to 2.608%, while the 30-year yield rose to 3.193%.

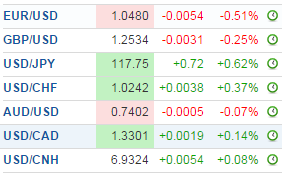

Forex

Wall Street may have already priced in the Fed’s interest rate hike, and yesterday's profit taking could simply be normal consolidation, but the currency markets moved sharply. The Dollar Index hit 102.48, the highest level in 14 years.

The Chinese yuan fell to an eight-year low, the Japanese yen dropped to 117, while the euro fell below $1.05.

The cable is down as well, but stronger than expected UK retail sales figures and the BoE meeting minutes providing in-depth insight into the UK economy could move the pound higher even in the face of strong dollar headwinds.

Commodities

Oil and precious metals, all priced in dollars, fell heavily yesterday as the greenback pushed higher.

Oil fell approximately 4-percent. Crude is now trading at $51.20, while Brent is at $54.30. Renewed concerns of an oil glut were also a major driver of the declines. The IEA said that November output actually increased, and even the Saudi Energy Minister expressed doubts as to how long it would take for OPEC and non-OPEC cuts—if adhered to—to affect prices. “We expect the impact...in terms of fundamentals to take several months to be reflected on the market,” he told reporters.

Gold is down approximately 2-percent since yesterday, slipping more than $25 to $1,138.5 and one has to wonder if $1,100 is now in sight. Whether that benchmark is reached, it's clear that the gold bear market hasn't yet ended.

Platinum has fallen 1.75%, down to $924.55 and silver has declined nearly four percent, to $16.61.

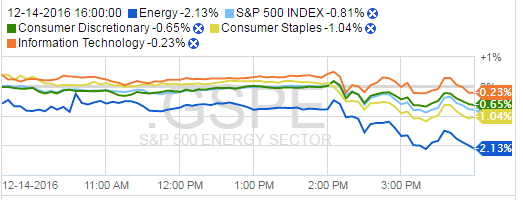

Stocks

In equity markets yesterday, Wall Street was down, but nothing fell further than Energy, which dropped 2%, compared to the 0.81% dip for the S&P overall, a result of lower oil prices and the rising dollar.

Exxon Mobil (NYSE:XOM), a big gainer on Tuesday, lost more than 2-percent yesterday, as did ConocoPhillips (NYSE:COP), Baker Hughes (NYSE:BHI), Apache (NYSE:APA), Devon Energy (NYSE:DVN), Kinder Morgan (NYSE:KMI), Halliburton (NYSE:HAL), and Anadarko (NYSE:APC). Hess (NYSE:HES), Marathon (NYSE:MRO), and Southwestern Energy (NYSE:SWN) each fell more than 3-percent, while Chesapeake (NYSE:CHK) and Murphy Oil (NYSE:MUR) both lost approximately 4%.

Yesterday's US retail sales release for November was lower than expected. Sales in November lagged ahead of the election, even though they picked up at the start of the holiday shopping season at the end of the month. The Consumer Discretionary Index lost 0.65% as a result, led by the General Motors' (NYSE:GM) 3.77% decline. The Consumer Staples Index was hit even harder, falling 1.04%, led by the Walgreen's (NASDAQ:WBA) fall of 2.27%.

Yesterday's best-performing sector was tech; the Information Technology Index lost just 0.23%. This might have had something to do with Trump’s meeting last night with tech titans, which by all accounts ended on an upbeat, optimistic note.

“We want you to keep going with the incredible innovation. There’s nobody like you in the world,” Trump told meeting attendees. “Anything we can do to help this go along, we’re going to be there for you.”

After the meeting Amazon (NASDAQ:AMZN) CEO Jeff Bezos said:

“I shared the view that the administration should make innovation one of its key pillars, which would create a huge number of jobs across the whole country, in all sectors, not just tech.”

Trump even added Elon Musk, Tesla's (NASDAQ:TSLA) founder to his advisory committee on business and economic policy.

NVIDIA (NASDAQ:NVDA) was the biggest gainer in the sector yesterday, up 5.79%; Alphabet (NASDAQ:GOOGL) moved higher by 0.31%; PayPal (NASDAQ:PYPL) (founded by Trump advisor Peter Thiel, who attended the meeting) rose 0.3%. IBM (NYSE:IBM) was up 0.13%.

Two tech giants report earnings today:

Oracle (NYSE:ORCL) is up 0.29% ahead of its Q2 2017 earnings report later today after the market close. The company is expected to report EPS of $0.60 on $9.06 billion in revenue.

Adobe (NASDAQ:ADBE) will also report earnings today after the close. It's expected to report Q4 2016 EPS of $0.86 on 1.57B in revenue.