- Global stocks extend Friday’s US rally

- China stocks jump on rare official market call re:buying opportunity

- Dollar weakness boosts emerging market equities and commodities

- Pound falls after UK Brexit ministers resign over “soft” Brexit

- De-weaponized yuan seen to ease trade tensions

- European Central Bank President Mario Draghi addresses the European Parliament on Monday and may shed light on the timing of a rate increase next year.

- Chinese trade data due at the end of the week will probably show slightly slower export growth after early indicators pointed to softer overseas demand and weaker export orders, Bloomberg Economics said. China releases June PPI and CPI on Tuesday, both of which should show a pickup.

- The most noteworthy US data is Thursday's June inflation report; consensus expects it will show both headline and core price growth accelerating.

- Earnings season gets going with JPMorgan (NYSE:JPM) and Citigroup (NYSE:C) reporting Friday.

- The Stoxx Europe 600 increased 0.4 percent, hitting the highest in more than two weeks for a fifth consecutive advance.

- Futures on the S&P 500 Index advanced 0.3 percent to the highest in three weeks.

- The MSCI All-Country World Equity Index climbed 0.4 percent to the highest in almost three weeks.

- The MSCI Emerging Markets Index advanced 1.4 percent to the highest in more than two weeks, its most significant gain in more than a week.

- The MSCI Asia Pacific Index climbed 1.2 percent to the highest in more than a week.

- The Dollar Index pared an almost 0.2 percent decline to 0.13 percent, after reaching the lowest in three-and-half weeks on its fourth straight decline.

- The euro climbed 0.2 percent to $1.1764, the strongest in almost four weeks.

- The British pound gained 0.2 percent to $1.3312, the strongest in almost four weeks.

- The Japanese yen fell less than 0.05 percent to 110.50 per dollar.

- The yield on 10-year Treasuries advanced two basis points to 2.84 percent, the highest in a week on the largest gain in more than a week.

- Germany’s 10-year yield increased one basis point to 0.30 percent, the biggest climb in almost two weeks.

- Britain’s 10-year yield climbed two basis points to 1.267 percent, the highest in almost two weeks.

- The Bloomberg Commodity Index advanced 0.1 percent to the highest in more than a week.

- West Texas Intermediate crude climbed 0.2 percent to $73.95 a barrel.

- LME copper jumped 2.1 percent to $6,411.00 per metric ton, the first advance in more than a week and the most substantial surge in almost 12 weeks.

- Gold increased 0.4 percent to $1,260.60 an ounce, the highest in two weeks.

Key Events

Equities in Europe as well as US futures—including for the S&P 500, Dow and NASDAQ 100—are currently all tracking this morning's global open, following Asian markets higher. Traders appear to be shaking off any potential fallout from trade tariffs in anticipation of the upcoming earnings season, after data on Friday supported continued economic growth. Barring any surprises, we’re betting ongoing strong data and market technicals will be spurring investors to drive equities to new highs in the coming weeks.

The STOXX 600 gained, with miners and energy companies outperforming. The pan-European index headed higher for a fifth straight day, its longest rally since March.

Earlier today, stocks rose across Asia as all major regional benchmarks rallied. Even in Tokyo—where investors continue to asses the impact of local flooding and landslides in Japan, which killed at least 90 people, knocking out electricity and forcing many companies, including Amazon (NASDAQ:AMZN), Mazda (T:7261) and Panasonic (T:6752), to halt some operations—the TOPIX and Nikkei were buoyant. So far, no selloffs have been seen for either the yen or for Japanese benchmarks though Mazda pared gains and Panasonic retreated.

Hong Kong's Hang Seng was up as well, boosted 1.3% after enduring a week of losses. Today's much anticipated IPO of smartphone maker Xiaomi (HK:1810) was of additional interest, though shares fell during the stock's first day of trade.

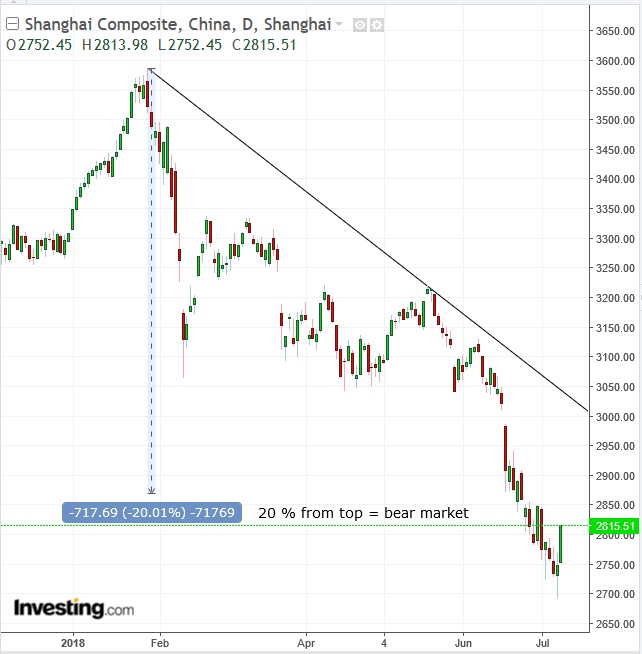

The clear leader this morning was, however, China’s Shanghai Composite which jumped +2.4 percent, despite Friday’s trade war escalation. Since the start of 2018 shares on the index have tumbled about 17 percent, though Chinese policymakers have tried to soothe investors with reassurances of solid fundamentals.

Additionally, in what may be considered an unprecedented signal, in its blog, officials of The Shanghai Stock Exchange indicated that beaten-down stocks are a buying opportunity after the index entered a bear market. Truth be told, it wasn't just propaganda—continuing corporate growth and record share buyback values actually support this bullish assessment. From a technical perspectiv, however, this ris is considered a correction within a downtrend.

Another boost to Chinese equities, ironically, may have come from a 0.3 percent decline in the Chinese yuan. Under normal economic conditions, a stronger currency weighs on a country's exports, causing headwind for equities.

However, just a week after China promised the US that it would not manipulate its currency in order to use it as a weapon in the US-China trade war, the rising renminbi is easing the trade dispute. And China officials are seen to be keeping their word.

However, like the Shanghai Composite, the yuan is in a downtrend, in which upticks are considered merely corrections. On the other hand, the currency has been supported by demand, as it reached its lowest levels since the USDCNY September peak, 'protected' by the 100 WMA (blue), after the 50 WMA (green) crossed below the 200 WMA (red), completing a Death Cross. The pair's momentum has reached its most oversold condition since January 2017, when US President Donald Trump said "the strong dollar is killing us."

The only Asian benchmark in an uptrend is Australia’s S&P/ASX 200, which on Friday completed a bullish pennant pattern.

Global Financial Affairs

The dollar fell to the lowest in more than three weeks, completing a small double top from June 14 through July 6, proceeding to cross below an uptrend line since May 14. The weakening dollar reduced pressure on commodities and emerging markets, which have been suffering from capital outflows to dollar-denominated assets.

However, the weakening dollar doesn't seem to be helping WTI crude which fell below $74. In the longer term, though, a tightening market should provide a tailwind to the commodity. Technical analysis supports this as price is forming a bullish, falling flag, which completes with an upside breakout.

Sterling trimmed gains after Brexit Secretary David Davis and Brexit Minister Steve Baker both resigned within 48 hours, over their opposition to UK Prime Minister Theresa May’s “soft Brexit strategy." The departures are a significant setback for May, who believed her ministers backed the compromise.

If that weren't enough for the beleaguered Prime Minister, Trump has been threatening to quit NATO unless Britain increases defense spending by 50%.

The euro is struggling to extend Friday’s advance, which was spurred by German industrial production recovering faster than expected, beating all estimates for May. The global economic outlook was additionally boosted on Friday after the release of June's US jobs report which showed another month of gains, indicating more Americans are re-entering the workforce.

Should corporate results resume their growth trend, they would provide a third support for the outlook of economic expansion, joining macro economics and equities in giving investors the fresh wind to their backs with which to drive stock prices to new records, even though the ever-expanding trade war saga continues to simmer in the background.

Up Ahead

Market Moves

Stocks

Currencies

Bonds

Commodities