Thursday February 9: Five things the markets are talking about

With currency manipulation trending strongly on Trump’s twitter rants, tomorrow’s high profile Abe-Trump summit will be closely scrutinized.

Japanese Prime Minister Abe has signaled he is prepared to discuss the currency issues at G20 and will try and convince POTUS to do the same and not just on a piecemeal one-on-one basis. Expect the PM to argue that Japan’s monetary policy is aimed at battling deflation and not at weakening the yen.

The BoJ’s deputy governor Nakaso also noted that while the central bank is prepared to consider raising long-term rates target in the future, momentum behind inflation does not yet justify the shift.

Yesterday, the UK’s PM Theresa May successfully passed her first hurdle and officially began divorce proceedings. As widely expected, the UK’s lower House of Parliament passed the bill to trigger Article 50, effectively starting Brexit negotiations with the E.U.

The vote was 494 in favor to 122 against; the bill now goes to the House of Lords, which is also expected to pass the bill (will be debated in the upper chamber later this month). The PM also promised that Parliament would get a vote on any Brexit deal before it is presented to the E.U.

1. Equities providing mixed results

Despite mixed results, the bulk of Asian shares climbed overnight, as investors grow somewhat more confident about China.

In Japan, the Nikkei share average fell -0.5% due to pressure from a stronger yen (¥112.28) ahead tomorrow’s U.S/Japan summit.

In Hong Kong, shares hit a four-month high with mainland companies outperforming, as expectations of further yuan depreciation continues to nudge Chinese investors into the city’s stocks. The Hang Seng index closed up +0.2%.

In Europe, shares are posting modest gains at the open, led by oil and mining companies, as investors seek fresh trading cues. The FTSE 100 was recently up +0.1%, while the Eurostoxx 600 index rose +0.4%.

U.S equities are set to open ‘flat.’

Indices: Stoxx50 +0.3% at 3,247, FTSE flat at 7,188, DAX +0.2% at 11,561, CAC 40 +0.3% at 4,781, IBEX 35 +0.1% at 9,336, FTSE MIB -0.4% at 18,696, SMI +0.4% at 8,414, S&P 500 Futures flat

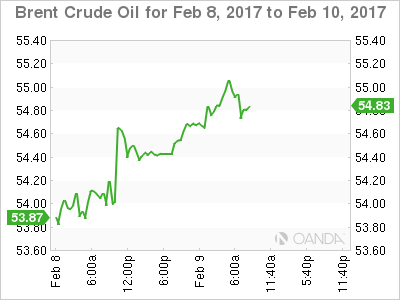

2. Oil higher on gas inventories, but bloated

Oil prices are being supported by an unexpected draw in U.S. gasoline inventories. However, bloated crude supplies should be capable of capping medium term prices.

Brent crude futures are trading up +50c at +$55.62 per barrel, U.S. light crude (WTI) is also up +50c at +$52.84 a barrel.

Yesterday’s U.S. Energy Information Administration (EIA) reported a drawdown on weekly gasoline inventories – fell by -869k barrels last week to +256.2m vs. expectations for a +1.1m barrel gain. The report also showed that U.S. commercial crude inventories rose by +13.8m barrels to +508.6m.

Note: High oil inventories continue to undermine efforts by the OPEC and other producers including Russia to tighten the market by cutting production.

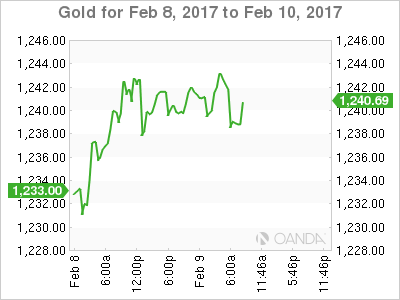

Gold continues to hold firm near its three-month highs hit yesterday (+$1,244.78) on dollar strength amid political and economic uncertainty on both sides of the Atlantic – U.S. and Europe.

Note: Investors are concerned about the strong showing in the French presidential race of far-right candidate Marine Le Pen, who has promised to take France out of the euro zone and to hold a referendum on EU membership.

The precious metal has gained nearly +5% over the last month, and nearly +7% since the year began.

3. G7 Sovereign yields remain under pressure

The U.S. bond market rally continues to question the confidence of three FOMC rate hikes this year. With the market continuing to look for guidance, Fed Chair Yellen’s Congressional testimony next week may be a key determinant of near term policy bias.

Yesterday’s U.S. 10-year Treasury note auction drew an average yield of +2.333% compared to last month’s +2.342%. The bid-to-cover was 2.29 vs. 2.22 – the average over past four-auctions is 2.52.

In Europe, yields on 10-year debt in Italy and Spain yields have dropped -3bps, while those in France were little changed.

Down-under, Aussie 10-year bonds have rallied for a fourth consecutive day, driving yields down -5bps to +2.64%, the lowest in three-months, while kiwi bonds fell -10bps to +3.16% after the Reserve Bank of New Zealand (RBNZ) kept policy steady (as expected), and noted that policy to continue to be accommodative, but noted that global uncertainties remain.

Note: Its interest rate projections for 2017 and 2018 were “less hawkish” than market expectations.

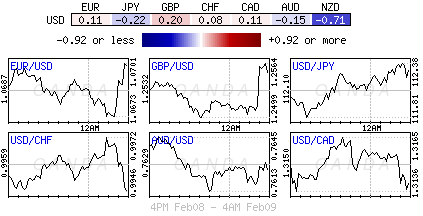

4. FX wary of verbal intervention

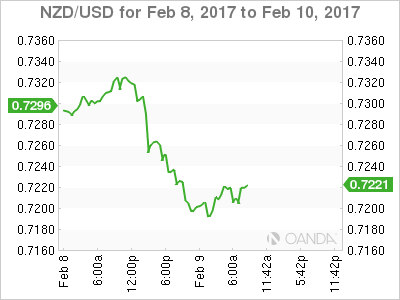

With most of the major pairs trading in their ‘contained’ ranges on global political concerns for now, periphery G20 currencies have seen some volatile intraday swings. The NZD (N$0.7213) was one of the highlights in the overnight session.

With the market preparing for a rate liftoff from the RBNZ, the communiqué of economic projections, and subsequent commentary delivered a squarely “neutral” assessment, pushed the kiwi down -100pts to trade atop of NZ$0.7200.

The EUR is holding just below the psychological €1.0700 level, with markets getting worried about peripheral spread widening even further on political concerns. The key support at the €1.06 level remains intact for the time being.

USD/JPY is holding above its two-month low print this week (¥111.59). Dealers are seeking guidance from tomorrows US/Japan summit. GBP is up +0.35% at £1.2567.

In China, the PBoC has skipped its reverse repo operations, calling liquidity conditions ample. USD/CNY closed at ¥6.8672.

5. Norway’s Economic Recovery picks up, Bank of Mexico to hike

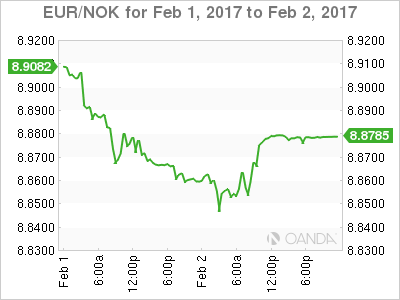

Data this morning shows that Norway’s economic recovery picked up in Q4. GDP rose +0.3% on the quarter from a downwardly revised uptick of +0.1% in Q3.

Analysts note that GDP growth looks set to pick up further with the Government planning a fiscal stimulus worth +0.4% of GDP this year – this should favour the NOK in the medium term. EUR/NOK is trading down -0.15% at €8.8807.

Later this afternoon (02:00pm EST) the Bank of Mexico is expected to raise interest rates by +50 bps to +6.25% in order to stem inflation. The MXN, which has recovered ground in recent weeks and is now trading at levels not seen since mid-December, is down -0.15% at $20.5072.