Here’s the reality of investing outside the United States:

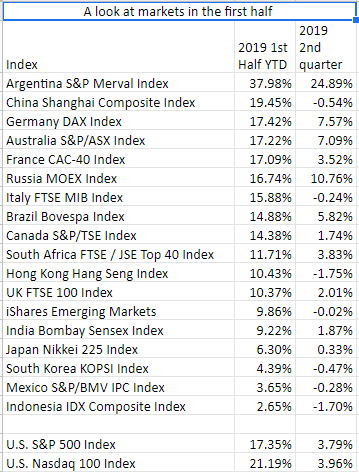

If you invested in stocks and markets of the most developed nations in the first half of 2019, you did fine, mirroring gains in U.S. markets. The S&P 500 rose 17.4% in the first half of the year. Germany's DAX gained 17.42%, and Australia's S&P/ASX 200 added 17.2%. Toronto's S&P/TSX Composite Index wasn't quite the performer, but it was up 14.4%.

There is, however, a downside to that near correlation—when one market goes south, especially the U.S. market, they all do.

The S&P 500 fell 14% in the fourth quarter of 2018. The NASDAQ 100 slumped 17%. The DAX dropped 14%. France's CAC 40 Index slid nearly 14%.

Likewise, markets had strong first quarters, followed by weak second quarters, a function of the uncertainty generated by the U.S. trade war. A big reason for the near correlation is that markets in developed economies are now so interconnected. And computerized trading allows simultaneous and instantaneous buying and selling across borders. So if big investors are making bets on, say, semiconductors, passive index funds must follow.

If there's been a disconnect between one country's markets with the overall picture this year and in years past, it's for discrete reasons. The United Kingdom's FTSE 100 rose 10.3% in the first half of 2019, but just 2% in the second quarter. Its comparatively weak showing, versus German, French and Italian markets, reflects the ever-growing uncertainty over what will happen in Britain if the country leaves the European Union with no transition plan.

The biggest discrete factor in markets this year has been the U.S. trade war with China. Both countries' markets suffered from the tariff threats and counter threats. And the effects spread broadly. Gains in the Japanese and South Korean markets were limited because so many of their technology companies have extensive interests in China.

Of course, the S&P's H1 gain was achieved mostly during the first quarter. Its second-quarter gain of 3.79% included a 6.6% loss in May. Likewise, China's Shanghai Composite Index, up 19.5% in the first half, nonetheless fell 0.5% in the second quarter, thanks to a 6.8% decline in May.

Can one get great returns in outlier countries? Maybe. But only if you buy carefully and are rigorous in your selling discipline. (In other words, if you hit your price, sell.)

Consider Argentina. Its S&P Merval Index jumped 37% in the first half of the year, 24% in the second quarter alone. It was easily one of the best market performances globally.

Argentina is blessed with natural resources and a vibrant agricultural sector. Yet, its economy has struggled against a strong U.S. dollar, which has boosted import costs and reduced the value of its exports. Its political system has been wracked with corruption and institutional turmoil.

A 37% return in the second half of the year is possible for Argentinean markets. But a prudent investor will wonder whether it's worth risking profits already in place, given the Argentine market's stormy history. In 2018, it fell 28% between January and August. Then, it rallied 37% over the next month and fell 20% in the subsequent three weeks.

Strong U.S. Economy, But Markets Looking Overbought

The rest of 2019 appears to be setting up fairly well for non-U.S. markets. The U.S. economy is strong, despite signs of softness in manufacturing and housing. That means U.S. demand for imports (including oil) should be solid

Most important, the United States and China have called a truce in their trade war, to the relief of everyone.

Interest rates are low; the 10-year U.S. Treasury yield is off nearly 25% this year. Rates are likely to stay low. The Federal Reserve, the European Central Bank (ECB) and others are worried about that softness spreading.

If there is a risk, it's that a few markets are starting to show signs of being overbought. U.S. markets hit new highs on Wednesday, ahead of the July 4th holiday. But technical measures suggested the Dow and S&P were crossing into overbought territory. France's CAC 40 hit a new intraday day on Wednesday.

Crossing above key technical levels is no guarantee a pullback is imminent, but the odds increase the longer prices remain elevated.