Monday September 24: Five things the markets are talking about

Global equities are under pressure as China called off planned trade talks with US, potentially triggering an escalation in the tariff war between the world’s largest economies.

Note: US’ tariffs on +$200B in China goods took effect at midnight, while China’s counter tariffs on +$60B of US goods also came into effect this morning.

Presidents Trumps’ veiled threat to OPEC to increase global crude supply was met with a tepid response over the weekend. The Saudi oil minister said that the market was adequately supplied.

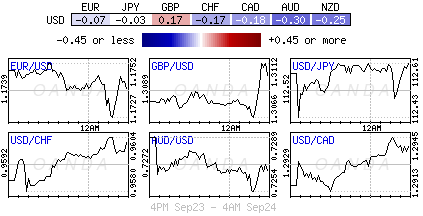

The ‘big’ dollar continues to find support on pullbacks, while Treasuries trade under pressure along with Euro sovereign bonds.

Topping investors’ agenda this week is the FOMC meeting along with the Fed’s updated forecasts and the chair’s quarterly press conference (Sep 25-26). The market is looking for a third +25 bps rate hike and is pricing in another one for December. Investors await Fed chair Powell’s views on trade and tariffs.

Elsewhere, the Reserve Bank of New Zealand (RBNZ) will also meet Wednesday (Sept 26) and no rate hike is expected. The UK posts its final estimate of Q2 GDP, while the Eurozone releases the September flash harmonized index of consumer prices (Sept 28). Also on Friday, Canada will release its monthly GDP data for July.

1. Stocks see red

Asian volumes were light and liquidity a concern as markets in China, Japan, South Korea and Taiwan were closed for holidays. Both Hong Kong and South Korea will be closed on Tuesday.

Note: Despite Japanese markets closed, Japans Economy Minister Motegi and USTR Lighthizer are expected to hold trade talks today in New York. Japan is said to considering a bilateral trade agreement with the US.

Down-under, Aussie stocks edged lower overnight, as lower commodities prices hit materials stocks while financials slipped on new revelations of wrongdoing in the sector revealed in a quasi-judicial inquiry. The S&P/ASX 200 index fell -0.1% at the close of trade. The benchmark rose +0.4% on Friday.

In Hong Kong, stocks plummeted after the US imposed fresh tariffs on an additional +$200B of Chinese imports and as Beijing cancelled planned talks between the two sides. The Hang Seng Index fell -1.62%.

In Europe, regional bourses opened in the ‘red’ and continue to trade lower. Market risk sentiment continues to be impacted over trade concerns as US tariffs came into effect at midnight and China cancels trade talks – consumer discretionary sector among worst performers.

US stocks are set to open in the ‘red’ (-0.2%).

Indices: STOXX 50 -0.3% at 3,419, FTSE 100 -0.1% at 7,480, DAX -0.3% at 12,389, CAC 40 -0.2% at 5,481, IBEX 35 -0.5% at 9,543, FTSE MIB -0.5% at 21,427, S&P 500 Futures -0.2%

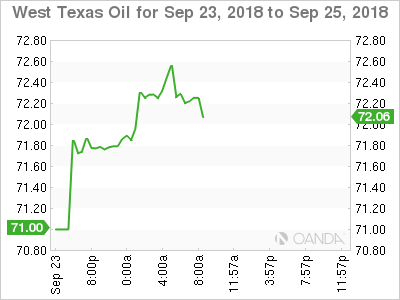

2. OPEC, Russia reject Trump’s call for immediate boost to oil output

Yesterday in Algiers, both OPEC and Russia ruled out any immediate, additional increase in crude output, effectively rejecting Trump’s calls for action to “cool” the market.

The recent price rally has mainly stemmed from a decline in oil exports from OPEC member Iran due to fresh US sanctions.

Also, according to OPEC’s projections, a strong rise in non-OPEC production could exceed global demand growth, which could eventually put pressure on prices.

Oil prices remain better bid this Monday morning as US. markets tighten ahead of Washington’s plan to impose new sanctions against Iran.

Brent crude futures are at +$79.74 per barrel, up by +94c, or +1.2%. US West Texas Intermediate (WTI) crude futures have rallied +74c, or +1.1%, to +$71.52 a barrel.

The market remains concerned about US inventory levels. US commercial crude oil inventories (EIA) are at their lowest level in three-years, and while output remains around the record of +11M bpd, recent subdued US drilling activity points towards a slowdown.

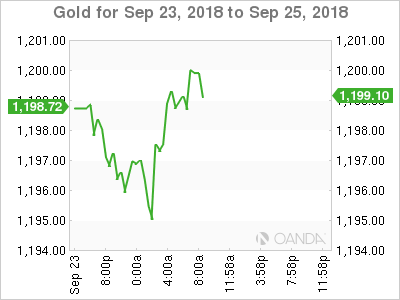

Gold prices have edged a tad lower this morning as the US dollar holds firm on news that China has cancelled trade talks with the US, while the market waits for this week’s FOMC meeting for guidance on future rate hikes. Spot gold is down -0.1% at +$1,198.36, after declining as much as -1.3% on Friday. US gold futures are little changed at +$1,201.60 an ounce.

3. HK interbank rates jump to 10-year highs after HKD surge

Some of the short-term rates banks in Hong Kong charge each other leapt to their highest levels in roughly a decade, in the first trading session after a sudden surge in the tightly controlled HKD.

Note: Speculators have been covering some significant ‘short’ HKD positions and the lack of liquidity has not helped the move.

The overnight HK interbank offered rate jumped +2% to +3.85%, it’s highest since 2007. One-month Hibor rose less sharply, but still reached nearly +2.17%. On Friday, HKD unexpectedly surged +0.42%, its biggest gain since 2003.

Note: The currency, which is pegged in a range of $7.75 to $7.85 to the US. dollar, was little changed at $7.8113.

Elsewhere, Italian government bond yields are backing up again this morning, again reflecting some unease among investors given this week’s deadline for the government to present its budget targets.

Note: ECB’s Mario Draghi speaks at the European Parliament later today, while on Wednesday; the Fed is expected to raise interest rates again.

Two-year Italian bond yields are up +4.5 bps on the day at +0.81%, while the ten-year yields are +3.5 bps higher at +2.87%. The gap over benchmark German Bunds yields have widened from Friday’s close at around +241 bps.

The yield on US 10-Year Treasuries has increased +1 bps to +3.07%. In Germany, the 10-Year Bund yield has rallied less than +1 bps to +0.47%, while in the UK, the 10-Year Gilt yield has climbed +1 bps to +1.563%.

4. Dollar hold firms, but G7 does find some support

GBP/USD (£1.3123) remains handcuffed to Brexit rhetoric and PM May woes. Sterling has begun Monday’s session on the front foot, reclaiming the psychological £1.31 handle after comments from U.K Brexit Minister Raab indicated that he is confident he will make progress on Brexit. There are also whispers that PM May has started contingency planning for possible snap election in November – however, Raab reiterated that “no election is planned.”

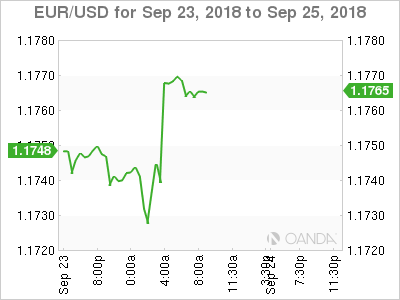

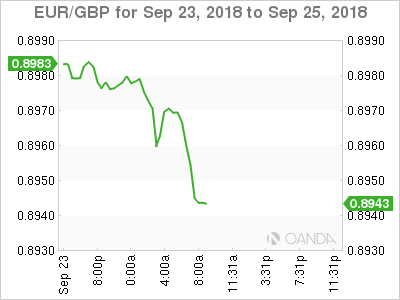

The EUR (€1.1770) is again wading towards the key €1.18 handle. Consensus does not expect this week’s data or monetary policy decisions to mount a serious challenge to the ‘single unit’s recent rally. The FOMC meeting is due on Wednesday, but a +25 bps increase to +2.25% is already priced into EUR/USD. The government in Italy is expected to roll out new fiscal projections, but the 2019 budget deficit will probably be set at close to +2% of GDP, which is similar to where the deficit stands now. While eurozone inflation data later this week should provide the euro with “minor support.”

The INR continues to weaken; with the USD/INR rallying to an intraday high of $72.73. There have been rumours that Reserve Bank of India (RBI) has intervened to cap dollar gains. Trade concerns continue to weigh as China cancels trade talks with the US.

5. German business sentiment slipped in September

Ifo data this morning showed that German business sentiment slipped this month following a sharp rise in August, as companies slightly lowered their business outlooks.

The Ifo business climate index decreased to 103.7 from an upwardly revised 103.9 in August, but still beat forecasts. The street had been looking for a decline to 103.2.

“Despite growing uncertainty, the German economy remains robust,” said Ifo president Clemens Fuest.

In manufacturing, managers were less content with the current situation in September compared with the month before. Business expectations, however, hit their highest level since February.

“Manufacturers plan to ramp up production in the months ahead,” according to the Ifo Institute.