Australia’s second quarter inflation report was due earlier this morning and was slightly below median forecast. Headline CPI grew 0.7%q/q while market participants were looking for 0.8%. Annually, inflation rose 1.5%y/y in Q2 versus 1.7% consensus. On the other hand, however, the trimmed mean measure surprised to the upside with a reading of 2.2%y/y versus 2.1% median estimate. Quarterly, core CPI was in line with market expectations and climbed 0.6%q/q in the second quarter while previous quarter’s figure was revised higher to 0.7%q/q from 0.6%. RBA’s Stevens also gave a speech in Sydney last night. He reiterated that further monetary policy easing moves remain on the table. He added, however, that the depreciation of the currency is having an expansionary effect on the economy. All in all, Stevens didn’t add clarity and the market is still wondering when and if the central bank will cut interest rate further.

In New Zealand, the market and we expect the RBNZ to cut its cash rate by another 25bps at its July meeting. We believe the rate cut is already fully priced in, however we don’t not rule out further Kiwi depreciation as Governor Wheeler never misses an opportunity to emphasize that further significant downward adjustment of the exchange rate is more than justified. NZD/USD is moving sideways above $0.66 ahead of tonight’s decision.

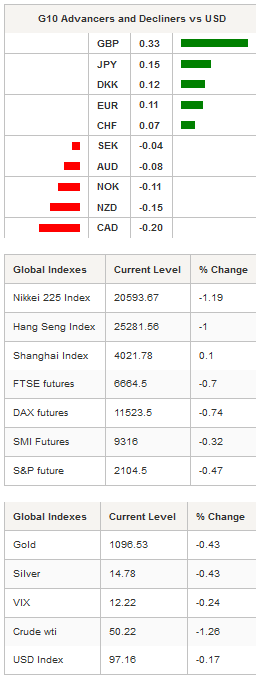

On the equity front, Asian regional markets are broadly lower this morning with Japan’s Nikkei 225 down 1.19% while the broader TOPIX index lost 1.11% despite Japan’s all industry index for May printed slightly above market expectations at -0.5% versus -0.6% consensus. In Australia, the S&P/ASX 200 is down 1.61% while New Zealand’s shares gained 0.87%. In China, mainland shares manage to stay in positive territory with the Shanghai Composite up 0.10%, the SZSE Composite adds 0.57% while Hong Kong’s Hang Seng pairs losses and retreats 1% to 25,281. Elsewhere, Thailand’s MSCI Thailand index lost 0.14%, South Korea’s KOSPI is down -0.91% while India’s BSE Sensex 30 gained 0.71%. In the FX market, USD/JPY dropped as much as 0.70% from yesterday’s 1-month high and is currently trading slightly below the 123.78 (Fib 61.8% on May-July debasement) support level.

In Europe, equity futures are trading in negative territory, following Asia’s negative performances. In Germany, Xetra DAX futures retreat 0.71%, the CAC 40 -0.53%, Euro Stoxx 50 -0.58% while in Switzerland, the SMI (CS:SMI) is down -0.32%. In UK, the FTSE 100 falls -0.70% while GBP/USD jumps above 1.56 as BoE’s Mills said that he sees inflation close to target towards the end of the year. He added that “the process of raising interest rates will likely come into sharper relief around the turn of this year”. On the downside, the cable will find support at 1.5550 (Fib 50% on June rally) and will find resistance slightly higher, around 1.5640/50 (previous highs).

Today traders will be watching CPI report from South Africa; the release of the MPC minutes in UK; mortgage applications, FHFA house price index and existing home sales from the US; RBNZ rate decision; IBGE mid-month inflation report, current account balance and foreign direct investment from Brazil.

Currency Tech

EUR/USD

R 2: 1.1436

R 1: 1.1278

CURRENT: 1.0935

S 1: 1.0819

S 2: 1.0660

GBP/USD

R 2: 1.5930

R 1: 1.5803

CURRENT: 1.5602

S 1: 1.5330

S 2: 1.5171

USD/JPY

R 2: 135.15

R 1: 125.86

CURRENT: 123.71

S 1: 120.41

S 2: 118.89

USD/CHF

R 2: 1.0129

R 1: 0.9719

CURRENT: 0.9587

S 1: 0.9151

S 2: 0.9072