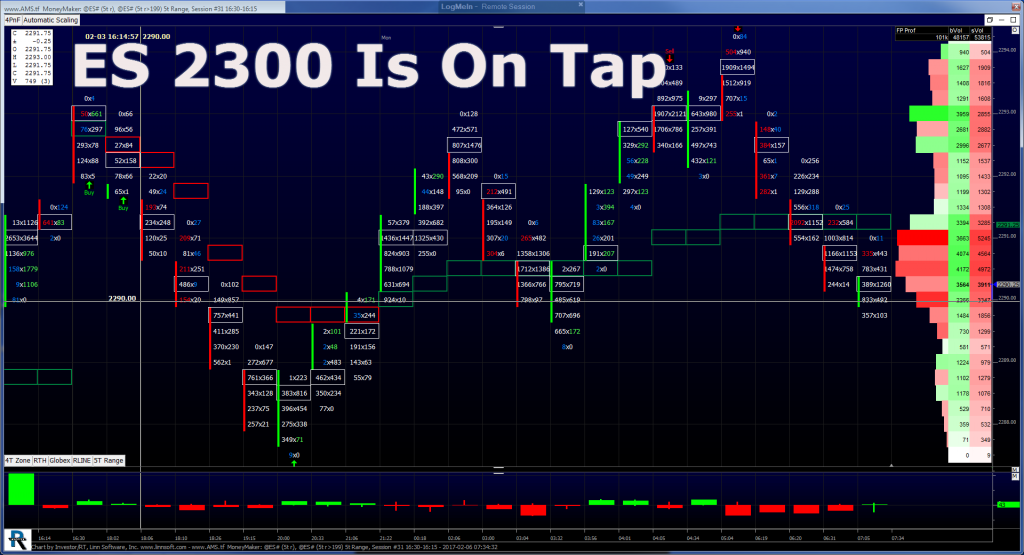

While the warnings about a jump in volatility and a big sell off for stocks continue to pile up, so do the gains in the S&P 500 futures. Fridays jump in the non-farm payroll number, and a higher jobs rate, seems to indicate that the stock market may have more room to the upside. The (ESH17:CME) exploded higher, having its best day since Nov. 14, and leaving the futures just 8.25 handles away from ES 2300.00. As we pointed out early last week, despite the weakness, the S&P did exactly what the overall ‘back and fill’ price has been doing for the last several years; sell off, trade sideways, and then rip higher. While I see the ES going higher, I am sticking to my guns that there will be some significant sell offs in 2017, but that doesnt looking like it’s in the cards right now.

Last Sunday night the S&P’s gapped lower by about 10 handles, then traded lower in the first two days of the week, but by midweek it looked like sellers were running out of steam. The PitBull has said that bull markets are weak early in the week and then rally late in the week, and that was exactly the case last week. When the S&P’s were down 25 handles early last week, traders started again calling for a market top, and once it was obvious that selling was dried up, the rush back up to the highs began.

We often repeat at MrTopStep that it takes days, and even weeks, to push the S&P’s lower, and just one day to bring it back up, and what we are seeing in this low volume, thin-to-win type environment is just that. In the short term, a 20 handle retracement gets very exciting, but in the long term it is just more water in the bathtub that will eventually splash higher.

Last week marked the end of January and the beginning of February, along with one of the most sizeable calendars that we have seen in awhile. This week’s calendar gets much quieter, with no strong headline risk. We saw small money pull out of equities going into the end of month, but then on the first of February, even larger money came pouring back into stocks. While I have said that there will be some noticeable downs this year, until bears can turn the personality of this market, it appears that for now the S&P’s are targeting 2300, and perhaps higher.

While You Were Sleeping

Overnight, equity markets in Asia bounced higher, meanwhile, Europe opened with a more mixed tone. The S&P 500 futures opened the globex session at 2293.00 and pushed to a session low early, trading down to 2287.50 on the Tokyo open, before rallying up to 2294.25 early in the Euro session. At 6:28 am cst, the last print in the ESH is 2290.00, down 1.00 handle, on volume of 100k.

Barclays (LON:BARC) Weekly Calendar Preview

This week is relatively light in data, and Fed speakers are likely to garner market attention. On Tuesday, we look to Bullard’s remark for any hint on the evolution of the FOMC’s thinking on near-term trade and fiscal policy from the administration, while we will be attentive to any shift in Evans’s views on near-term administration policies. Finally, Vice Chairman Fischer will speak in Warwick University on Saturday, February 11. In terms of data, we expect the trade deficit (Tuesday) to have narrowed slightly, to $45.0bn in December from $45.2bn. We forecast import prices to have risen a modest 0.4% m/m and 3.4% y/y (Friday) and expect imported inflation to pick up pace as the drag from energy and commodity prices abates. Finally, we expect the initial February estimate of consumer sentiment to edge lower, to 97.5, softening somewhat from the recent highs.

In Asia, 9 out of 10 open markets closed higher (Shanghai +0.54%), and in Europe 6 out of 11 markets are trading lower this morning (DAX -0.39 %). This week’s calendar includes 20 economic reports, 4 Fed speakers and 11 U.S. Treasury events. Today’s economic calendar includes Gallup US Consumer Spending Measure, Labor Market Conditions Index, a 4-Week Bill Announcement, a 3-Month Bill Auction, a 6-Month Bill Auction, TD Ameritrade IMX, Treasury STRIPS, and Patrick T. Harker Speaks.

Our View

The ES retested the 2294 level on Globex earlier this morning and started to come back down a bit. I am sticking to my guns that the markets are going to correct / sell off in the first quarter, and the end of February is my marker. Will it happen? I can’t say for sure, but the more President Trump presses, the more likely things will unravel. My gut tells me the ES is going to do some back and fill this week and take out the ‘big figure’ at 2300 then test the 2310 level. Our view is to sell the early rallies and buy weakness, or just go with the trend and buy weakness. There are a lot of buy stops building up above 2298.00 that initially run to 2306.

As always, please use protective buy and sell stops when trading futures and options.