Here are the latest developments in global markets:

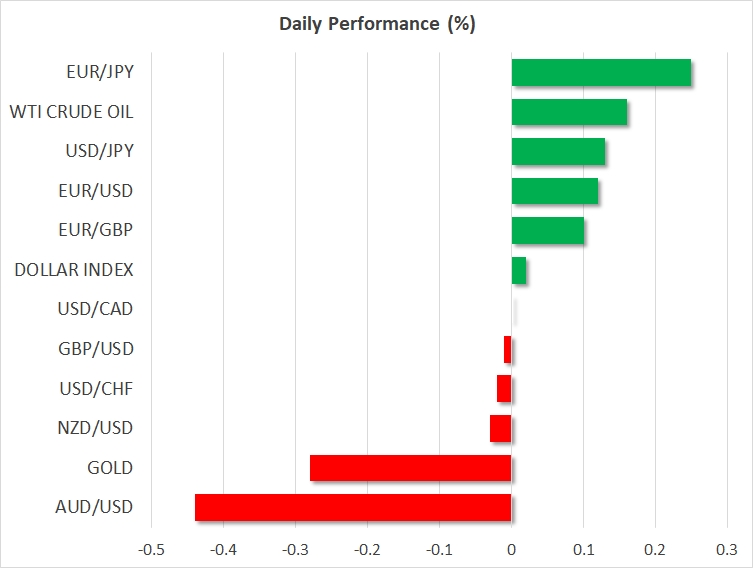

· FOREX: The dollar recorded a six-week high versus a basket of currencies ahead of Fed chief Jerome Powell’s hearing before the Senate Banking Committee and key data out of the US. The aforementioned high came mostly on the back of gains from previous days though, as the dollar index was little changed on the day.

· STOCKS: US markets closed lower once again yesterday, ending February on an uncertain note. The Dow Jones led the way lower, tumbling by 1.5%, while the S&P 500 fell 1.1%. The NASDAQ Composite declined by 0.8%. Futures tracking the Dow, S&P and NASDAQ 100 are all currently in positive territory, but only marginally so. Overall, the wild price swings in these indices have continued in recent days, which indicates that stock investors remain quite cautious still. Japanese indices took their cue from their American counterparts and tumbled as well, with the Nikkei 225 and TOPIX indices both falling by 1.6%. In Hong Kong, the Hang Seng was up by 0.3%. In Europe, futures tracking all the major indices were flashing red, signaling that these benchmarks may open lower today.

·COMMODITIES: In energy markets, oil prices rose marginally today, recovering some of the notable losses they posted yesterday following the weekly EIA inventory data. Crude stockpiles rose by more than anticipated, enhancing concerns that the rapid rise in US production may be finally showing up. Besides inventories,oil prices were probably also pressured by the rebound in the US dollar yesterday, as well as the broader decline in equity markets, which usually weighs on risk-sensitive commodities like oil. In precious metals, gold was 0.3% lower today, with the latest pullback likely being owed to the recovery in the greenback.

Major movers: Dollar at multi-week high ahead of Powell hearing and busy data day; euro and sterling consolidate losses; aussie at 2-month low

The dollar index touched 90.74 earlier on Thursday, this being its highest since January 19. The “milestone” though was for the most part attributed to advancing from previous sessions, with the index little changed on the day.

Fed chief Powell’s optimism on the economy in his comments on Tuesday led market participants to revise their rate hike projections, now expecting a more “aggressive” Fed in terms of tightening policy. This in turn boosted the greenback.

Rising expectations for a higher interest rate environment though are weighing on stocks, with major Wall Street indices recording notable declines for the second straight day on Wednesday. Powell’s hearing before the Senate Banking Committee later on Thursday might give him the opportunity to clarify certain of the comments made a couple of days ago, and in a way “endorse” or not the market’s interpretation of his remarks. It remains to be seen whether more equity blood is on the horizon.

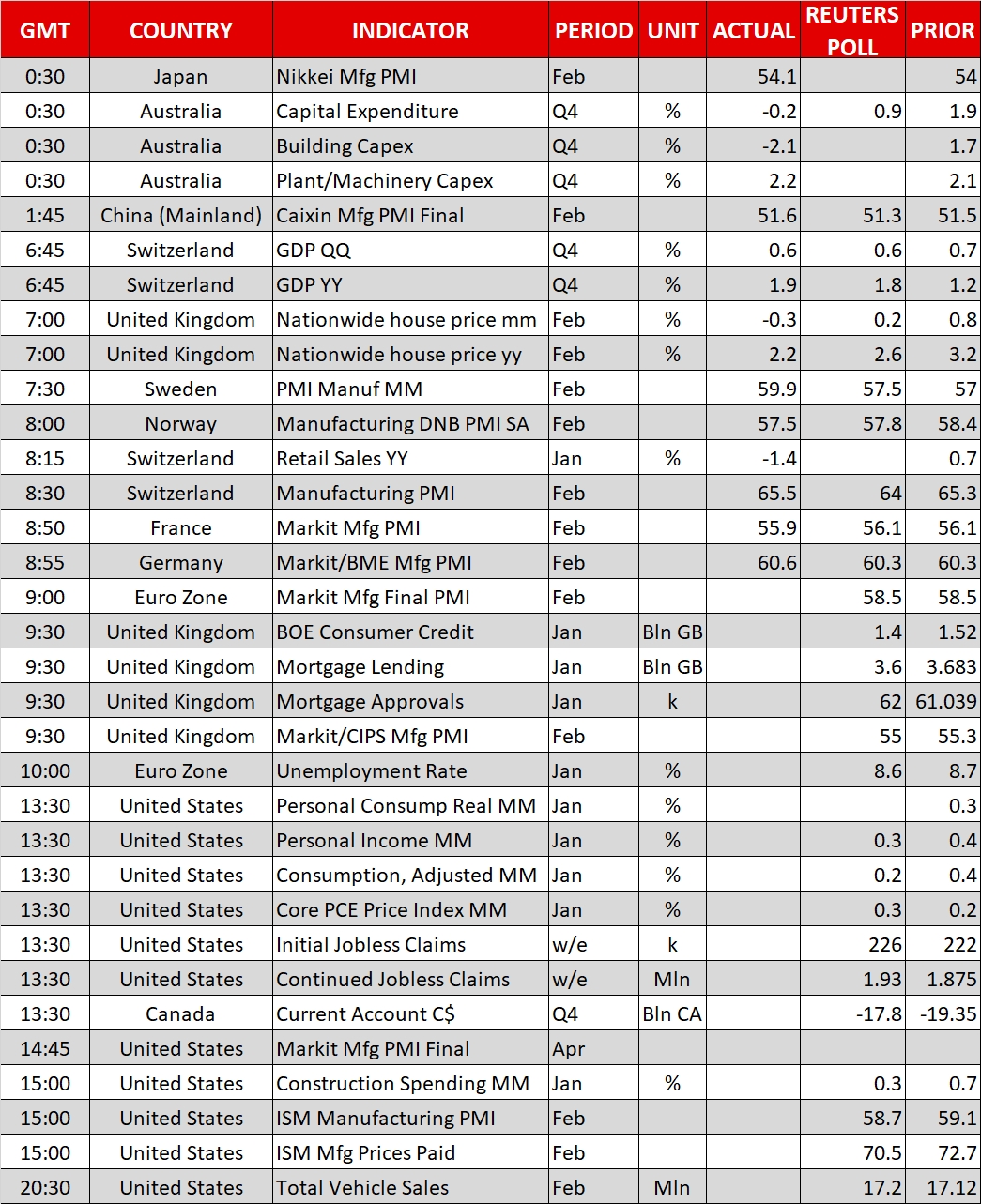

Besides Powell’s hearing, other key data are on the agenda during Thursday’s trading, including figures on consumption and the core PCE price index, the Federal Reserve’s preferred inflation measure.

Dollar/yen was up by 0.1% at 106.82. It is interesting that the US currency has posted notable gains relative to majors recently with the exception of the yen. Uncertainty over equity markets in conjunction with the Japanese currency’s perceived safe-haven status is one of the factors contributing to this.

The euro was up 0.1% versus the dollar at 1.2208, after touching 1.2182 earlier in the day, its lowest since January 18. It is noteworthy that euro/yen touched a six-month low of 129.84, though the pair was 0.25% up at 130.39 at 0732 GMT. February’s flash inflation figures undershooting the ECB’s target by a large margin are weighing on expectations for further policy tightening by the central bank, while risk events including Sunday’s Italian elections are looming.

Pound/dollar was little changed at 1.3757, falling as low as 1.3740, a level last experienced on January 16. The pair declined significantly yesterday, as Brexit uncertainty is acting as a drag on sterling. UK PM Theresa May said on Wednesday that the EU’s draft legal text would undermine Britain and threaten its constitutional integrity. This development further complicates discussions. Euro/pound was 0.1% up, recording a two-week high of 0.8876.

The aussie was 0.45% down versus its US counterpart at 0.7726. At its lowest it touched 0.7714, a level last seen around two-months ago. Disappointing data on Australian business investment contributed to weakness in the currency. Kiwi/dollar was not much changed at 0.7207.

Day ahead: Powell testifies again; Trump set to introduce new tariffs; raft of key US data on the agenda

The economic calendar is packed with key releases today, most notably out of the US. Also attracting interest in the US will be a testimony by Fed Chair Jerome Powell, this time before the Senate, as well as a potential announcement by the White House regarding new tariffs on steel imports.

In the UK, the manufacturing PMI for February is due out at 0930 GMT. The index is anticipated to slip to 55.0 from 55.3 previously, signaling that the sector may have lost some momentum lately. Another potential market mover for the British pound may be any Brexit updates, in light of the notable developments yesterday and ahead of UK PM Theresa May’s keynote Brexit speech tomorrow. It is not uncommon for such major speeches to be leaked to the media ahead of time, perhaps as early as today.

In the eurozone, the unemployment rate for January (1000 GMT) is anticipated to tick down to 8.6%, from 8.7% prior.

Turning to the US, Powell's introductory remarks will be identical to Tuesday’s, but markets will still pay close attention to the Q&A session, in case he touches on something new. Considering how optimistic he was perceived as being on Tuesday, the risks surrounding the dollar from his remarks today may be asymmetrical. More hawkish comments would be no surprise to anyone, and are thus unlikely to push the greenback meaningfully higher. The surprise would be if he changes tune and appears more cautious, which could lead to a notable tumble in the greenback.

In terms of trade, media reports suggest that the White House is set to announce steep tariffs on Steel and Aluminum imports today. If these reports are accurate, this would mark yet another step towards an escalation in global trade tensions. In terms of market action, such tariffs could prove harmful for the currencies of nations that export steel and aluminum to the US, such as China, Canada and Mexico. The Australian dollar may be also negatively impacted, considering the currency’s sensitivity to changes in risk sentiment and developments in China.

Turning to US data, the core PCE price index for January will probably attract the most attention (1330 GMT), as it is the Fed’s preferred inflation measure. The yearly rate is projected to hold steady at 1.5%, but considering the upside surprise in the core CPI rate for the same month, investors may be looking for a similar reaction in this indicator as well. At the same time as the core PCE print, the US will also release its personal income and spending data for January, both of which are anticipated to slow on a monthly basis. Later (1500 GMT), the ISM manufacturing PMI for February is due out and expectations are for the index to decline somewhat, but to still remain at an elevated level, consistent with robust expansion in the sector.

In Canada, current account data for the final quarter of 2017 are due out at 1330 GMT, while the manufacturing PMI for February will be released at 1430 GMT.

As for the speakers, besides Fed Chair Jerome Powell, New York Fed President William Dudley (voter) will also step up to the rostrum, at 1600 GMT. He is considered one of the most influential Fed officials and thus investors will look for any signals as to whether he would entertain the prospect of four rate hikes this year.

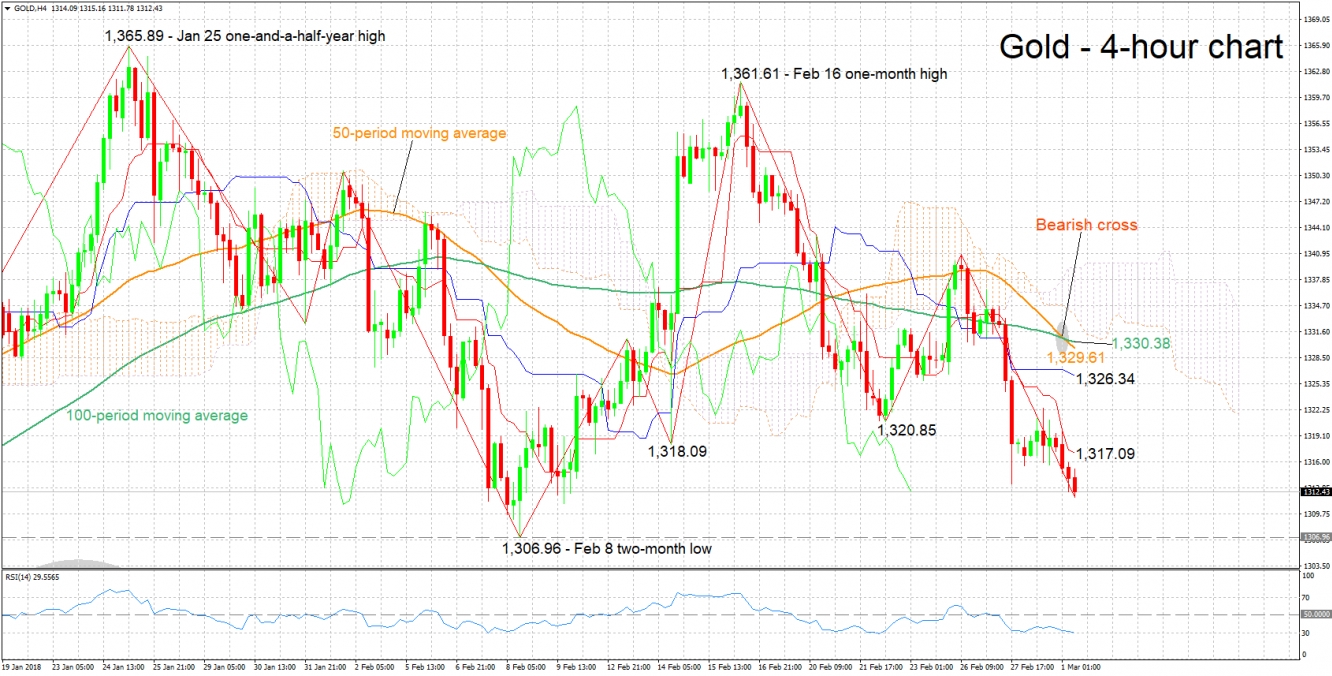

Technical Analysis: Gold posts three-week low; RSI oversold

Gold has notably declined, hitting a three-week low of 1,311.78 earlier on Thursday. The Tenkan- and Kjun-sen lines are negatively aligned, projecting a bearish picture in the short-term. The RSI which is falling adds to the view for negative momentum. Notice though that the indicator has marginally moved below the 30 oversold level; a rebound in the short-term is not to be ruled out.

A stronger US currency – for example on the back of hawkish comments J. Powell or strong US data later today – is expected to lead to additional weakness in the dollar-denominated precious metal, with the area around the two-month low of 1,306.96 from February 8 coming into view as potential support.

A weaker dollar on the other hand, could lend support to gold. In this case, resistance might come around current level of the Tenkan-sen at 1,317.09. Notice that the range around this level also encapsulates a couple of bottoms from the recent past, perhaps increasing its significance.