Monday April 16: Five things the markets are talking about

Dealers and investors seem comfortable to start this week in a risk-taking mood as short-term geopolitical uncertainties continue to scale back for the time being.

Note: Missile strikes late Friday (April 13) by joint coalition forces – US, UK and France – on Syria, have not lead to a major escalation.

Overnight, global sovereign bonds prices have declined, equities are steady and oil is a tad weaker on anticipation that the fallout in Syria will be limited.

The market is now refocusing its effort on a number of economic data and corporate earnings coming out this week.

Today in the US, investors will be looking at the latest retail sales data (08:30 am EDT), which is an important gauge of the health of the domestic economy.

On Tuesday, US housing starts and building permits (08:30 am EDT) are also expected to be upbeat, while industrial production (09:15 am EDT) is expected to be soft.

On Wednesday, general inflation signals will be a focus of the Fed’s Beige Book (02:00 pm EDT).

On Thursday (08:30 am EDT), weekly jobless claims will be the focus – is the demand in the US labor market easing?

Also on tap this week are more earnings out of the US and speeches by Federal Reserve officials.

Elsewhere, in Canada, the Bank of Canada (BoC) is expected to leave overnight rates unchanged (+1.25%) on Wednesday (April 18) due to a combination of soft economic data and NAFTA uncertainties. The BoC will also publish its quarterly Monetary Policy Report (MPC).

On Friday (April 20), Canada will release consumer prices for March.

Later today, China will release Q1 GDP data along with March industrial output and retail sales (10:00 pm EDT).

On Tuesday, the UK releases its important labor market report for March along with consumer and producer prices (April 18) and retail sales (April 19).

1. Stocks mixed after Syria air strikes

In Asian overnight, stocks early gains were eroded, led by declines in Hong Kong and China over worries about the HKD.

In Japan, equities rallied modestly on relief that a US led missile strike on Syria appeared to be a one-off event. Nevertheless, ongoing concerns about a trade war had investors seeking defensive shares. The Nikkei rose +0.26%, while the broader TOPIX gained +0.40%.

Down-under, Aussie shares pared earlier gains to finish higher overnight, with strength in commodities countered by a fall in financials. The S&P/ASX 200 index rose +0.2%. In Korea, the KOSPI closed +0.1% higher.

In Hong Kong, shares dropped amid worries that slowing credit growth and tightening regulatory requirements in China will hurt economic growth. The Hang Seng index fell -1.6%, while the China Enterprises Index lost -2.1%.

In China, indexes fell and posted their worst day in three-weeks, on slowing credit growth. The blue-chip CSI300 index ended down -1.6%, while the Shanghai Composite Index slid -1.5%.

Note: The People’s Bank of China (PBoC) raised the Open Market Operation (OMO) interest rate on the 14-day reverse repo by +5bps to +2.70%.

In Europe, regional indices trade little changed in a lackluster session ahead of corporate earnings.

US stocks are set to open in the black (+0.4%).

Indices: STOXX 600 -0.1% at 378.7, FTSE -0.3% at 7244, DAX +0.1% at 12449, CAC 40 +0.1% at 5311, IBEX 35 +0.1% at 9775, FTSE MIB +0.1% at 23358, SMI -0.2% at 8757, S&P 500 Futures +0.4%

2. Oil prices drop as fears about Syria strikes fallout wane, gold lower

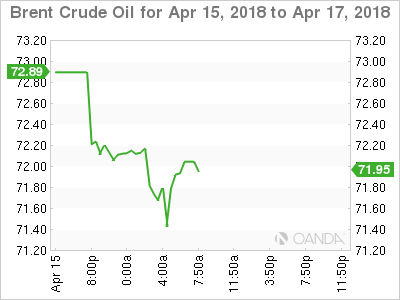

Oil prices are under pressure ahead of the US open after data showed that US drilling activity rose and fears waned about escalating tensions in the Middle East.

Brent crude oil futures have slipped -$1.34 to +$71.24 a barrel, while US crude futures are down -$1.16 at +$66.23 a barrel.

Baker Hughes data on Friday showed that US drilling companies added seven rigs in the week to April 13, bringing the total to 815, the highest in three years.

Note: Despite this, Brent is still up more than +16% since February’s 2018 low.

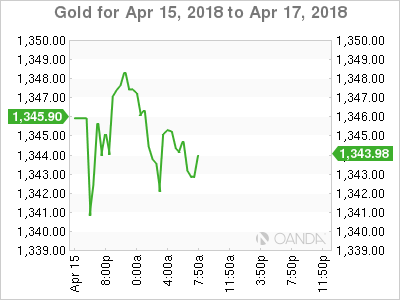

Ahead of the US open, gold prices are little changed as overnight markets assess the possible consequences of a US.-led missile strike against Syria over the weekend. Spot gold is down -0.1% at +$1,344.03 an ounce.

3. Yields back up

Sovereign bond prices have edge lower, lifting yields overnight, as the market shrugs off coordinated missile attacks in Syria.

Also supporting higher US yields is the FOMC minutes last week showing officials leaning towards a slightly faster pace of tightening at their March meeting as their growth outlook and confidence in hitting inflation targets strengthened.

Yields on both German and US 10-year government bonds are both at their highest level in four-weeks.

The yield on US 10’s has climbed +3 bps to +2.85%. In Germany, the 10-year Bund yield has advanced +3 bps to +0.55%, while in the UK the 10-year Gilt yield has advanced +2 bps to +1.455%.

4. Dollar downside risks remain

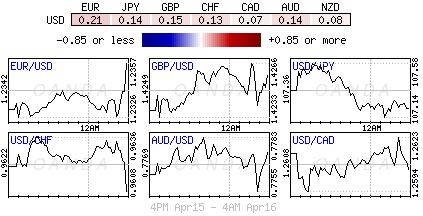

Despite geopolitical and Middle East risks the FX market remains somewhat subdued overnight.

Nevertheless, with the US pushing its twin deficits up while also increasing interest rates, dollar bears continue to look for selling opportunities.

The US Treasury’s bi-annual report on FX policies of G20 trading partners delivered a relatively “measured” tone and did not name any country as a currency manipulator. Even the weekend military strikes on Syria saw limited price action.

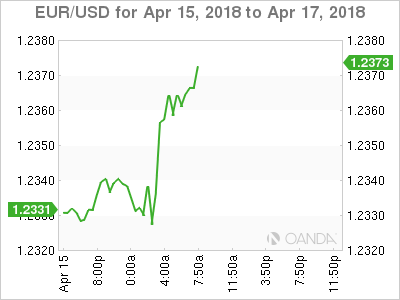

EUR/USD (€1.2364) remains contained within recent ranges ahead of the US open.

GBP/USD (1.4303) trades atop of the euro session high and has penetrated the strong psychological resistance level of £1.4300. Expect investors to focus on the EU/UK meeting to discuss post-Brexit trading relationship during the week.

USD/JPY (¥107.08) is holding above the key ¥107 level. Techies are looking for the yen to remain susceptible to further weakness ahead of next week’s BoJ meeting and PM Shinzo Abe’s falling approval numbers.

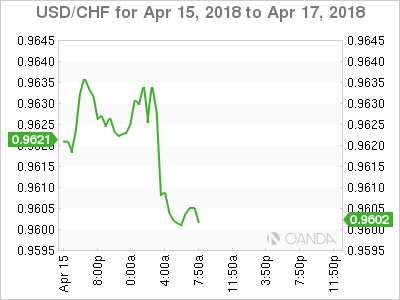

5. Swiss inflationary pressures under control

Data this morning show that inflationary pressures remain well contained in Switzerland.

The combined producer and import price index fell -0.2% in March versus February. On an annual basis, the index was up +2%.

Digging deeper, annual consumer price inflation (CPI) is running at +0.8%, which would suggest that the Swiss National Bank (SNB) should be in any hurry to tighten interest rates in the coming months.