Thursday January 5: Five things the markets are talking about

Fed minutes released yesterday revealed that apart from a unanimous agreement to raise interest rates for the first time in a decade last month, the committee expressed concerns as to the results of future Trump policies, with a view to maintain a “wait-and-see approach.”

Almost all Fed members agreed that the U.S. economy ‘could’ grow faster if policies are implemented correctly. The Fed also raised its concerns for a rise in inflation under any Trump fiscal boost, with many considering a faster pace for interest rate increases through 2017, while other not.

Net result, U.S short-term rates have come in on perception the latest Fed minutes were somewhat less “hawkish” then anticipated. This has caused the dollar to fall by the most in two-months overnight, the Chinese yuan to surge (aided by speculative buying) to its biggest two-day rally in six-years outright and gold to extend its gains, while equities show mixed results.

1. Stocks take a breather

Global equities are showing some mixed results overnight as investors digest the latest minutes from last months FOMC meeting.

In Asia, the Hang Seng Index was the standout performer, notching a gain of +1.4% after positive business surveys out of China and Hong Kong. The Singapore’s Straits Times Index climbed +1.2%, the most since Nov. 10.

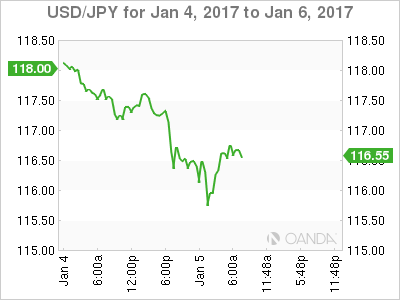

Elsewhere in the region, Japan’s Nikkei Stock Average fell -0.4% after closing up +2.5% in the previous session, as the yen gathered momentum against the dollar (¥116.52).

In Europe, indices are trading mixed. Financial are leading the gains on the Eurostoxx, which is on track for its second consecutive day of losses after entering a bull market territory on Tuesday, while homebuilder stocks are trading notably higher once again in the FTSE 100.

U.S futures are set to open flat.

Indices: Stoxx50 +0.3% at 3,322, FTSE +0.1% at 7,193, DAX +0.1% at 11,596, CAC 40 +0.1% at 4,901, IBEX 35 +0.4% at 9,497, FTSE MIB +0.4% at 19,703, SMI +0.2% at 8,371, S&P 500 Futures flat

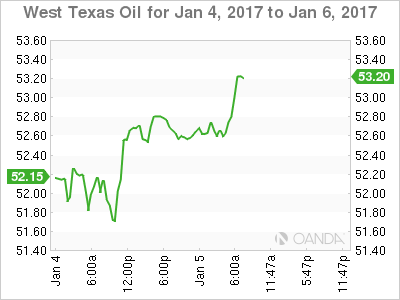

2. Oil steady on U.S. data, doubts over output cuts

Oil prices have steadied overnight as a fall in U.S. crude inventories yesterday seems to be balancing investor doubts that OPEC would cut output as promised to reduce global oversupply.

Note: On Nov 30th OPEC Ministers confirmed cutting output to +32.5M bpd, a six-month agreement that started on Jan 1.

Brent crude futures are down -15c a barrel at +$56.31, while U.S. light crude oil (WTI) is down -10c a barrel at +$53.16 ahead of the U.S. open. Both contracts rose +2% yesterday after weekly API Oil Inventories recorded a drawdown of -7.4M vs. +4.2M prior – largest draw since Oct 4th.

Crude prices may be capped to its recent range, as there remains a question mark over whether OPEC, with a long history of non-compliance, would actually follow through with the production cuts.

Dealers will look to today’s weekly EIA report (11:00 am EST) for directional clues.

Gold continues to find support as investors pare back their expectations of a more aggressive Fed rate rising cycle. Ahead of the U.S. open, prices are up +1.1% at +$1,178 an ounce and are on course for their highest close since late November.

3. Treasury yields fall on “uncertain” Trump Yields

Investors betting the Fed would raise interest rates at a faster clip than previously expected had helped push the dollar index to a 14-year high this week and send U.S. treasury yields sharply higher over the past two-months.

However, a less than anticipated “hawkish” Fed has some dealers willing to take recent bookable profit off the table.

The yield on the U.S. 10-Year Treasury note is currently trading down -4bps at +2.414% ahead of the U.S open.

Elsewhere, the 10-year German bund inflation-related woes should subside after yesterday’s release of the provisional Eurozone inflation number for December. Higher-than-expected German inflation prints have reversed a large part of their end-2016 rally. The bund bid yield now stands at +0.25%.

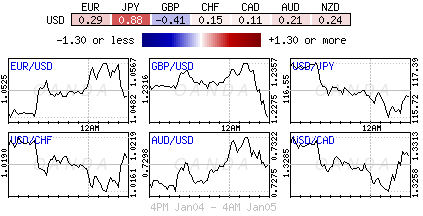

4. Forex sees seesaw action

With mixed views on whether the Fed was less “hawkish” or not has led to some volatile dollar moves in the overnight session.

There seemed to be a consensus that since the “big” dollars pace of gains have started to slow, it must be followed by a quick and sizable correction.

In Asia, USD/JPY fell to test below ¥115.60, the EUR above €1.0550 and sterling north of £1.2350. Nevertheless, the USD has since regained some of its composure during the E.U session and made back a good portion of its earlier losses (€1.0489, ¥116.67 and £1.2310).

Note: GBP/USD rebounded after its Dec PMI Services registered its fifth month of expansion and highest level in 17-months.

China was in the spotlight again Thursday as the Chinese yuan rose sharply outright. Chinese yuan was up over +1% in offshore market overnight after press reports that authorities plan to order State-owned-Enterprises SOE’s to sell USD. Today’s “official” yuan fix by the PBoC was a new three-week high (¥6.9307).

Note: The ‘offshore’ yuan-borrowing costs have surged amid rumblings about China cracking down on capital outflows.

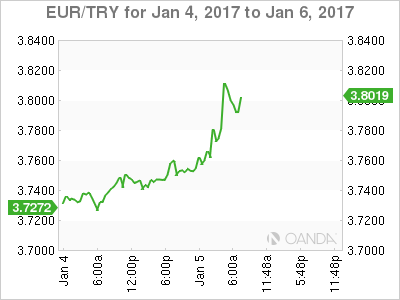

Some of the emerging market currencies did not participant in the USD selloff. Both TRY and MXN hit fresh record lows against the greenback (TRY3.6218 and MXN21.53).

5. U.K. Service Sector PMI grows at the fastest pace in 18-months

U.K data this morning showed that the British services sector grew last month at the fastest pace in 18-months, supported by healthy domestic demand and a boost to exports from a weak pound (£1.2300).

The PMI index for the services sector rose to 56.2 from 55.2 in November.

The headline print would suggest that the U.K. economy ended 2016 on a strong footing, further defying expectations of a post-Brexit slowdown.

Yet, future growth is expected to ease this year as accelerating inflation squeezes consumers’ wallets and uncertainty over the U.K.’s future ties to the E.U should impede future business investment.