by Pinchas Cohen

The Big News

- Yen advances to monthly high

- Aussie erases losses as their equities fall

- Dollar reaches 8-month low as gold, bonds gain, while oil fluctuates downward

World Events

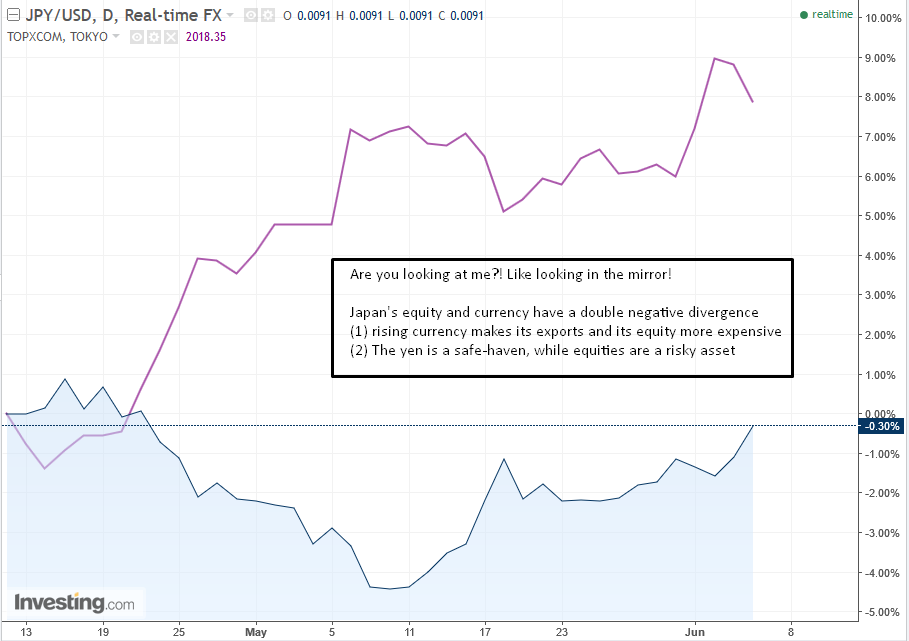

Two hours after Asian markets opened, stocks fell as the yen shot up 0.65% to 1.0973, reaching its highest level in a month. The "other" safe haven asset, gold, climbed 0.34% to an even $1,287, while 10-year Australian and Japanese yields reversed daily gains, falling 1.13% and 14% respectively.

While investors initially drove up the price of oil on concerns that the Gulf diplomatic crisis would interrupt supply, oil still closed yesterday near Friday’s 3-week intraday low. The commodity is poised for its sixth daily consecutive decline, its longest losing streak since March.

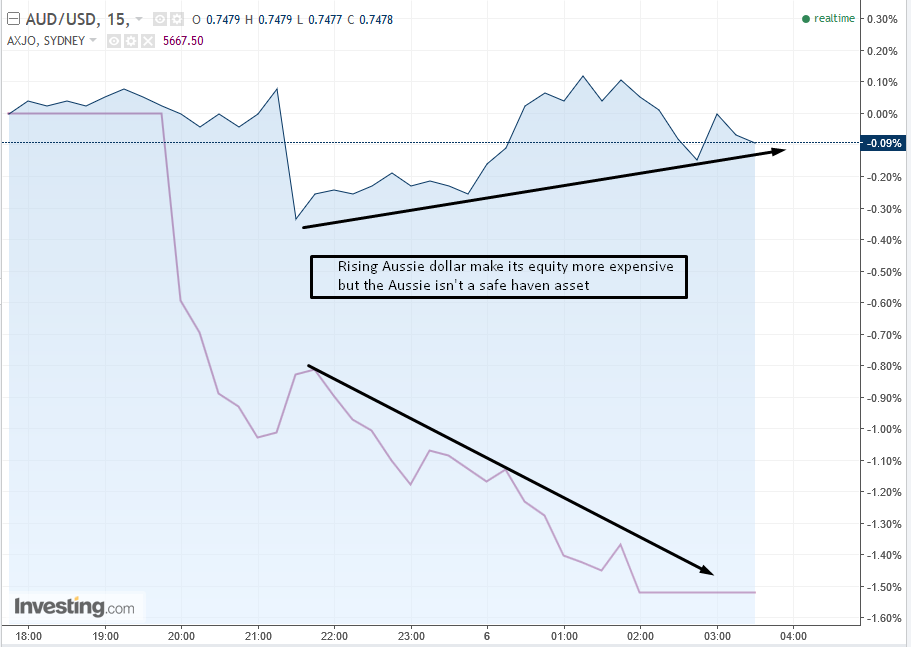

The pattern of equities losing value in favor of local currencies also occurred in the Australian market, where stocks maintained losses while the Aussie rose, even after an initial loss following the RBA's announcement to keep interest rates on hold at 1.5 percent for a tenth consecutive month, due to “sub-par growth.”

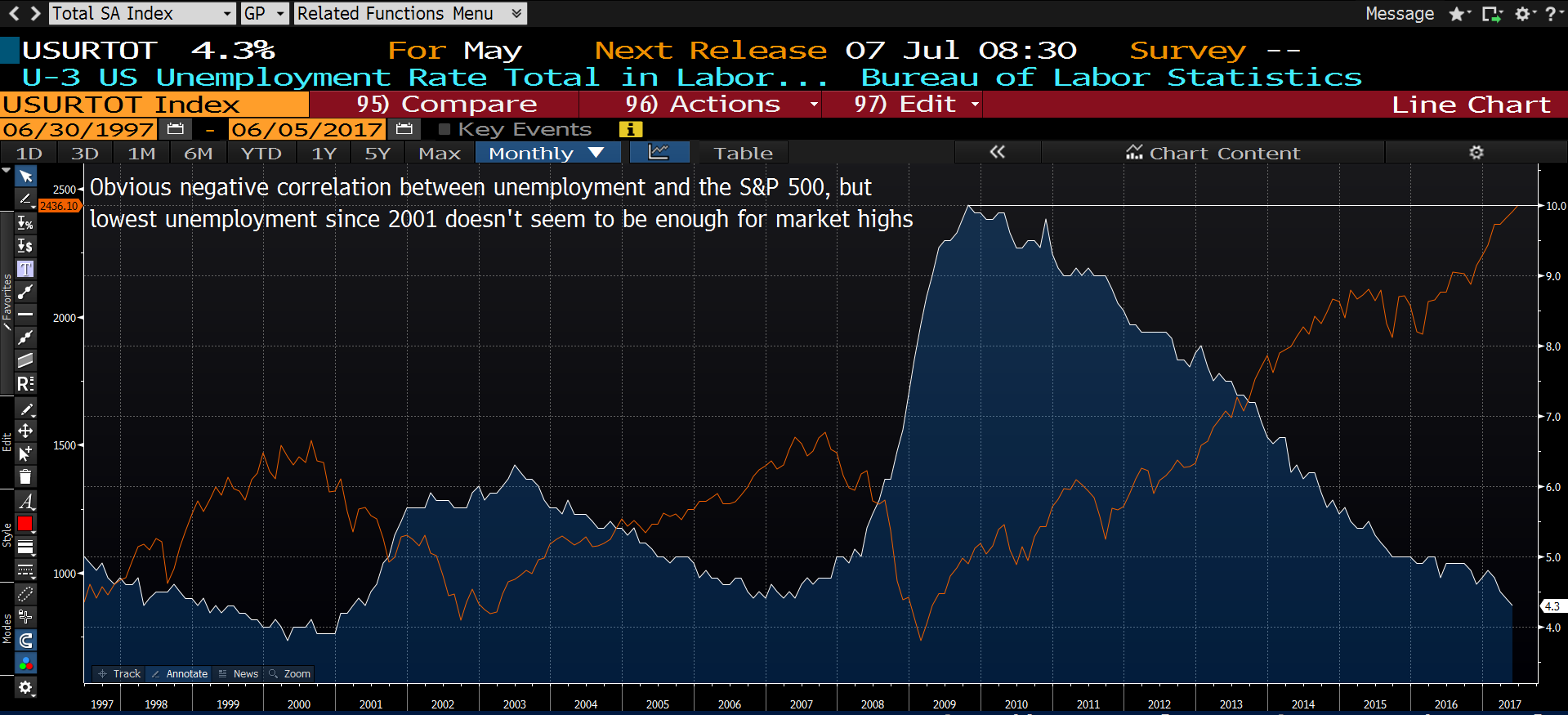

The S&P 500 closed lower on Monday, after recent US economic data indicated steady growth. That could be viewed as a sign that investors remain hopeful even as economic analysts cite the recent string of disappointing data as a reason to be bearish about US economic growth. Economists characterize the current situation as the slowest expansion in three years, pointing to recent GDP numbers and the disheartening US employment report as proof.

All this just after the Fed voiced its most hawkish position on growth—and a related rate hike—since the Great Recession. Even the silver lining, the unemployment rate falling a tenth of a percent to 4.3%, a 16-year low, shouldn’t be celebrated. A deeper look reveals that this was due to people giving up on their “unemployed” status, skewing the numbers behind the headline statistics.

If the employment rate is likely as low as it's probably going to go, why are there growing signs of equity investors losing heart? Perhaps investors are realizing that Trump’s 3% growth target is not going to happen; perhaps they believe that the markets' overvalued prices are becoming less and less justified; or perhaps confusion is ramping, right before markets come tumbling down?

Still, analysts are betting that there is a 90% chance of a June rate hike, saying the Fed has a macro view, which has been repeated multiple times by Fed regional presidents over the past weeks.

When it comes to equities however, investors will probably await the outcome of former FBI director James Comey’s testimony and the UK elections.

Upcoming Events

- While the ECB keeping its monetary policy fully intact is a forgone conclusion after Draghi spelled out his conviction that an “extraordinary amount of monetary support is still necessary…” to European lawmakers in his May 29 speech, investors are waiting to hear whether market guidance has shifted. This is particularly salient since Europe is increasingly being viewed as taking the lead in the global economic recovery, the first time since the Great Recession.

- After taking a gamble in order to increase her majority in parliament by calling a snap election, UK PM Theresa May bolstered her approval ratings, and buoyed sterling. Recently however, polls and analysis have shown that her numbers, in tandem with the pound's value, have steadily declined. The general election takes place this coming Thursday, June 8.

- Comey’s testimony is the next dramatic event in the investigation into US President Donald Trump's campaign and its supposed collusion with Russia, the outcome of which will be the biggest hurdle to Trump’s administration.

Market Moves

- The Dollar Index fell 0.2% to 96.6, its lowest point since the greenback's intraday plunge on November 9th, a result of the surprising news that Trump won the election.

- The yen rose 0.7 percent to 109.69 per dollar as of 3:31 p.m. in Tokyo, reaching its highest level since April 25.

- The Australian dollar was little changed at 74.86 U.S. cents, erasing a decline of 0.4 percent. The Reserve Bank of Australia kept its benchmark interest rate unchanged amid a mixed picture of weaker growth signals, a stronger job market and slowing house prices.

- The New Zealand dollar rose 0.4 percent.

- The Mexican peso retreated 0.3 percent after jumping 1.8 percent on Monday. President Enrique Pena Nieto’s party won the election for governor of Mexico’s largest state.

Stocks

- Japan’s TOPIX fell 0.8 percent for the biggest decline since May 18.

- Australia’s S&P/ASX 200 Index tumbled 1.5 percent, the most in over two months, reaching its lowest level since February 9.

- South Korea was closed for a holiday.

- Hong Kong’s Hang Seng Index rose 0.3 percent.

- China's Shanghai Composite slipped 0.1 percent.

- S&P 500 Futures dropped 0.2 percent after the underlying gauge slid 0.1 percent Monday.

- Contracts on the Euro Stoxx 50 slid 0.3 percent.

- Qatari stocks have plunged the most since 2009 on Monday after four U.S. Arab allies isolated Qatar over its ties to Iran.

Commodities

- Gold climbed 0.7 percent to $1,289.19 an ounce, advancing for a third day to the highest since April 19.

- WTI crude rose 0.3 percent to $47.52 a barrel, after dropping as much as 1 percent earlier. Oil fell 0.6 percent in the previous session as investors shrugged off the political clash in the Gulf. Saudi Arabia and three other Arab countries have severed diplomatic and economic ties to Qatar as punishment for its links with Iran and Islamist groups.

Bonds

- The yield on 10-year Treasuries declined two basis points to 2.16 percent, after climbing two basis points in the previous session.

- Australian benchmark yields dropped two basis points to 2.37 percent.