Tuesday, January 29, 2019- S&P 500 Future: -2 points

- The U.S. 10-Year Yields: -0.004 to 2.74%

- U.S. dollar index: -0.06 to 95.68

- Oil: +$0.46 to $52.47

- VIX: +0.14 to 18.99

International Markets

- Nikkei +0.08% to 20,664.64

- Hong Kong Hang Seng -0.16% to 27,531.68

- Shanghai Composite -0.10% to 2,594.25

- U.K. FTSE 100 +1.44% to 6847.13

- German DAX +0.09% to 11,219.95

Key Events:

- Global markets continue to look healthy, and that continues to be a positive sign for U.S. equity prices. UK equities are rising ahead of another Brexit vote.

- The FOMC meeting starts today, and it is widely expected for the Fed not to raise rates. But more important will be the commentary that comes from the meeting. Additionally, the press conference tomorrow will likely show many important points surrounding future rate hikes and the balance sheet run-off. I will update with more details on of what to precisely listen for tomorrow morning.

- Earnings will also continue to be in focus:

These companies will likely help to either propel markets higher in the days to come, or help to sink them.

The stock market is pointing to a flat opening based on the S&P 500 as earnings continue to pour in. The pace of earnings is about to pick up meaningfully this afternoon. There is a very big gap in the S&P 500 which needs to be filled up to around 2,660. It would suggest to me there is a very good chance the S&P 500 rises today to that 2,660 level.

Is the semiconductor outlook improving?

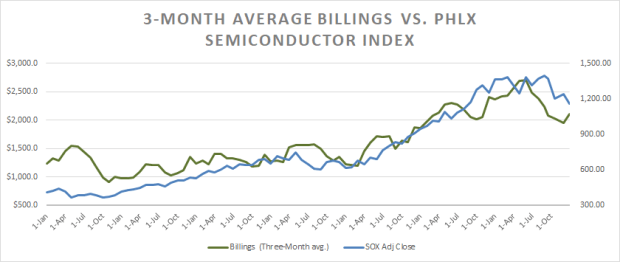

According to Semi.org, North American Semiconductor Billing Spending increased by almost eight percent in December versus November, the first increase in seven months. Whether it is the start of a new trend higher or just a pause in a steeper decline is the big question. But when we combine this with the Lam Research (NASDAQ:LRCX) results, we can see a glimmer of hope for the semis and global economic pick-up. Chips are used in nearly every aspect of our lives today, so if chips are doing better then it is likely to be a positive sign the economy is doing better.

There is a robust correlation historically with billings and the PHLX semiconductor index over the years. So let’s hope that the billings data suggests that the chip sector is due for a turn higher.

Lam (LRCX)

Lam is trading higher this morning after RBC upgraded the stock to outperform from sector perform, and raised its price target to $190 from $160.

$169.60 is a level of technical resistance for the stock and should it rise above that level it could go on to increase to around $183.

Pfizer (PFE)

Pfizer (NYSE:PFE) is falling today after it guided it fiscal 2019 earnings to $2.87 at the mid-point versus estimates of $3.04. Meanwhile, the company sees revenue at $53 billion at the mid-point versus estimates of $54.3 billion.

The stock has fallen sharply over the past few months after reaching a multi-year high in November. The stock is trading near a significant level of support around $38, a drop below $38 sends the stock lower towards $37.

3M (MMM)

3M (NYSE:MMM) is rising this morning after it guided its 2019 EPS to $10.45 to $10.90 versus consensus of $10.70. At the mid-point guidance is a touch below consensus.

The shares have struggled at resistance at $194, but this morning it is rising above that level; it is likely to continue to be a battleground zone for the stock.

Verizon (VZ)

Verizon is falling after it reported earnings that beat estimates by $0.03 per share but missed on revenue at $34.28 billion below consensus of $34.45 billion.

The stock is trading within a key level of support around $54.50. A drop below that region could send the stock lower back towards $52.

Square (SQ)

Square (NYSE:SQ) is falling this morning after Raymond James cut the stock to underperform from market perform. The stock is trading below support at $74.80, but the trend is still higher at the moment.

Nvidia (NVDA)

NVIDIA (NASDAQ:NVDA) was downgraded by Morgan Stanley (NYSE:MS) to equal-weight from outperform; it was also lowered by Needham to underperform from buy but was upgraded at UBS to buy from neutral. Expect more upgrades/downgrade and price target changes in the days to follow after the disastrous quarter.

Resistance for the stock remains around $139, but downside risk continues to be around $121.

Disclaimer: Michael Kramer and the clients of Mott Capital own Apple (NASDAQ:AAPL), Verizon (NYSE:VZ), Microsoft (NASDAQ:MSFT), Tesla (NASDAQ:TSLA)