The storm clouds are lifting in Europe. The FTSE 100 in the UK has rallied to an all-time high. Greek tail-risk is receding, but the drama doesn't seem to be over yet (though the Greek market seems to be washed out, see last week's post that was written before news of the deal, Is it time to buy Greece?). Moreover, we are seeing more and more articles like 7 charts that will make you feel more optimistic about Europe, which are:

- Emerging Europe PMIs swinging up

- Growth in the eurozone is good for the globe

- Surprise! Europe is beating expectations (at a macro indicator level)

- GDP growing

- No lack of confidence in consumption

- Russia, the not so bad news bear

- Low valuations, high dividend yields

Is this the time to be jumping into European equities?

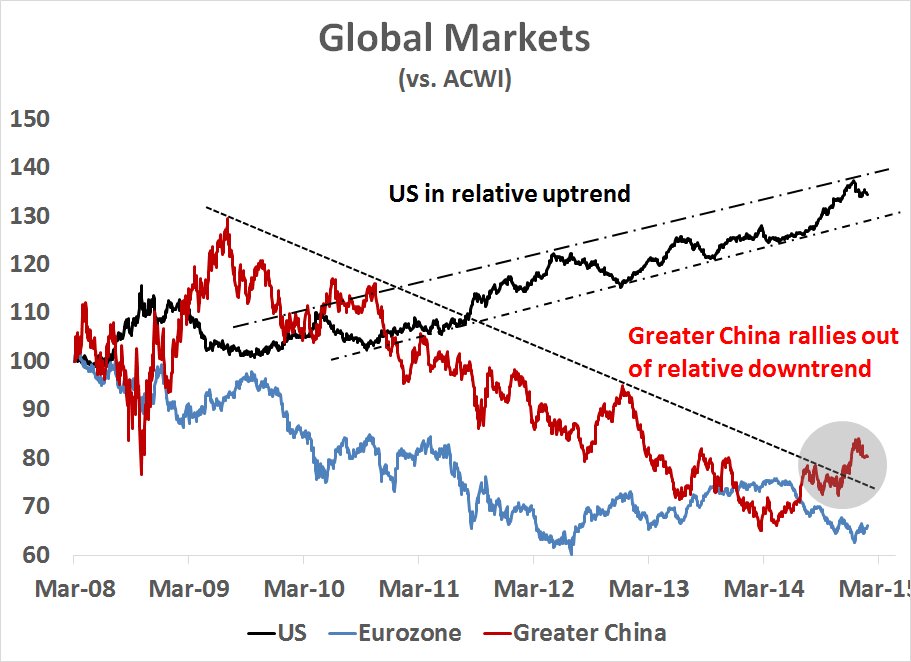

Not so fast! After giving the matter some thought, I came to a contrary conclusion of targeting the bulk of an investor`s equity exposure to the US and Asia X-Japan. Here is a chart of the relative returns of the US (via the SPDR S&P 500 ETF (ARCA:SPY)), Europe (via the SPDR DJ Euro STOXX 50 ETF (NYSE:FEZ)) and Greater China (equal weighted iShares FTSE/Xinhua China 25 Index (ARCA:FXI), iShares MSCI Hong Kong (ARCA:EWH), iShares Taiwan Index (ARCA:EWT), iShares South Korea Index (ARCA:EWY)) relative to the MSCI All-Country World Index (ACWI). These relative returns are useful in that they all use ETFs trading in USD so there are no currency effects.

Stay long the US

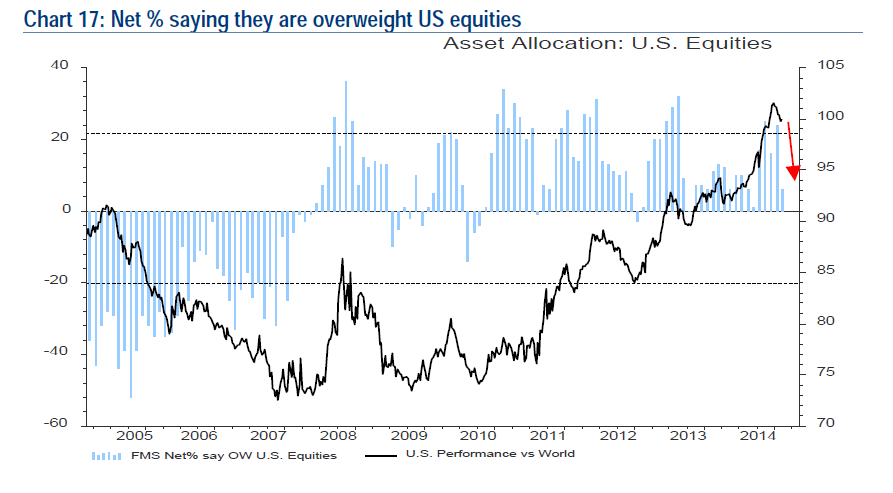

As the chart shows, the US market has been in a steady relative uptrend against global stocks since 2010 and there is no technical sign that relative uptrend is likely to be broken. Further, the latest BoAML shows that institutional managers have pulled back from their US weights and they are roughly neutrally weighted in US stocks, which can give them more room to run.

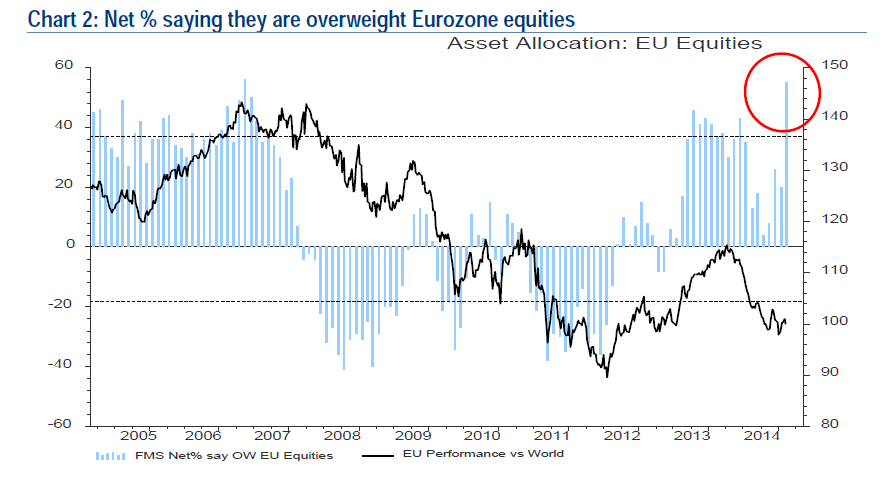

Eurozone crowded long

By contrast, institutions are highly overweight eurozone equities, which makes the contrarian more cautious about this region. Expectations are running high for the eurozone.

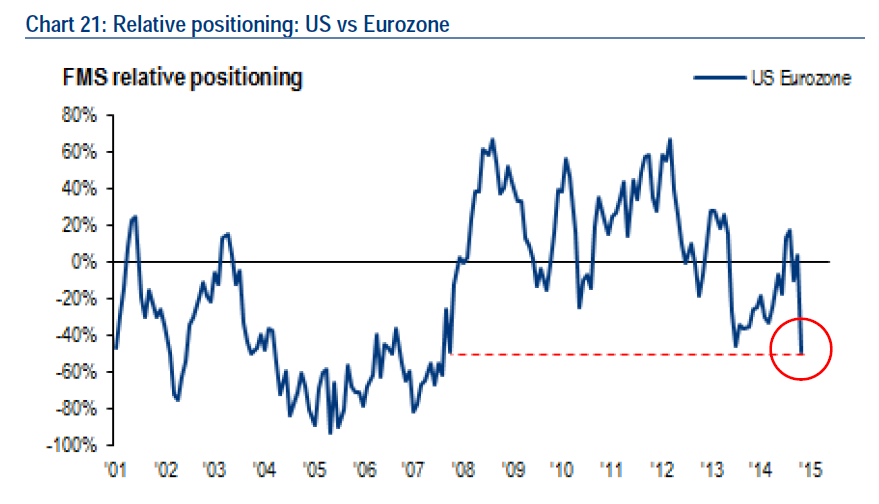

On a relative basis, the last time the eurozone-US relative weight spread was at this level was November 2007:

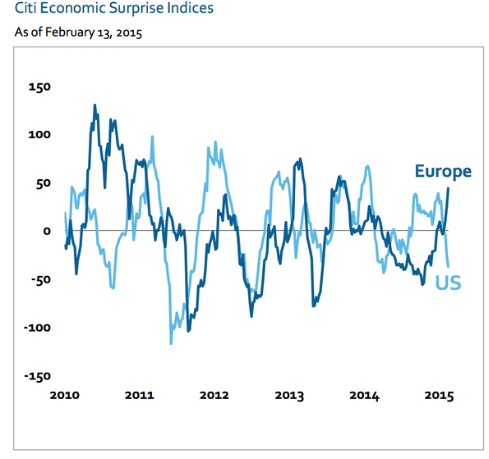

The greater propensity of fund managers to overweight the eurozone compared to the US can be explained by the expectations of better than expected growth in the eurozone compared to the US:

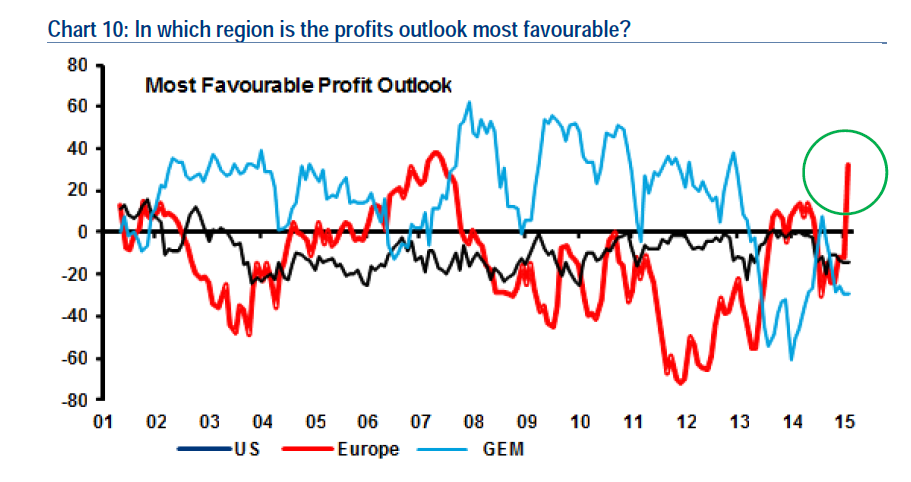

This discrepancy has led to a spike in earnings growth expectations for European equities.

Wow, talk about heightened expectations for Europe! One wrong step and managers could all rush for the exit.

Greater China turns up

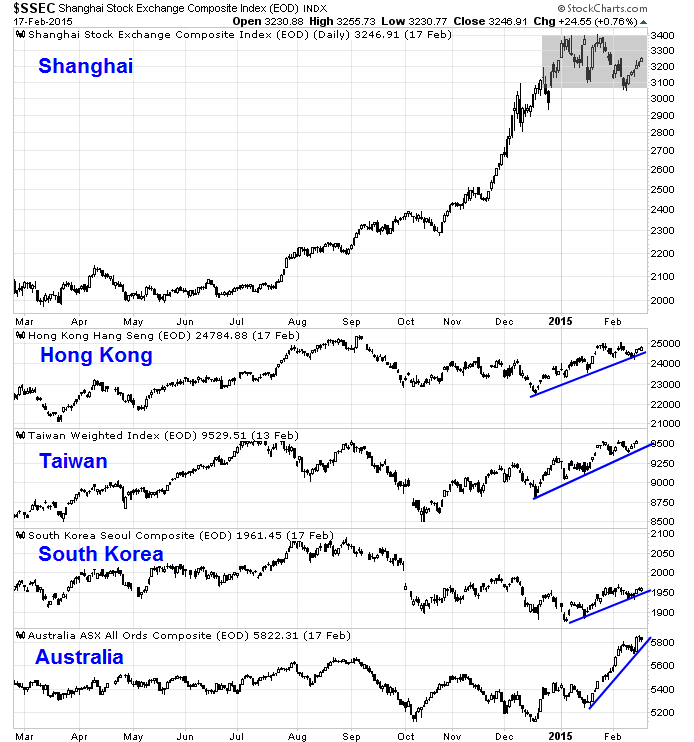

By contrast, Greater China (China, Hong Kong, South Korea, Taiwan) is starting to show a turnaround in relative performance. By way of explanation, I constructed the Greater China ETF basket as a useful way of getting exposure to China and its major Asian trading partners.This basket rallied through a multi-year relative downtrend and seems to be on its way to better relative returns. I had also highlighted the constructive chart patterns of the stock markets of China's Asian trading partners in my recent post (The 2011 pattern continues).

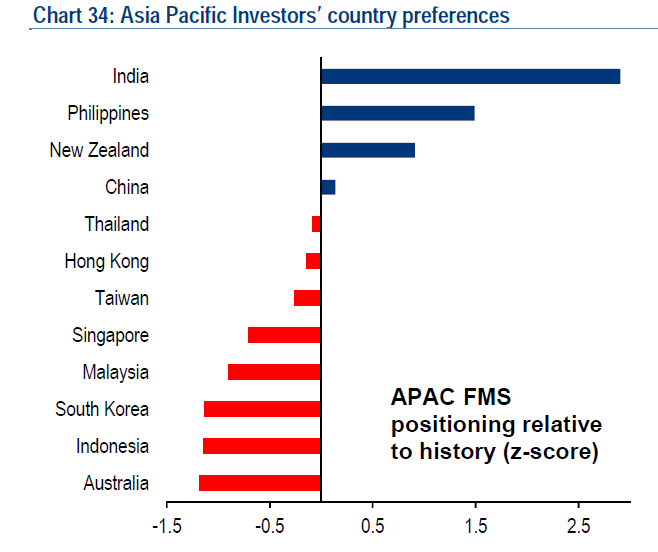

If we were to just focus in on Asia x-Japan equity allocations as reported by the BoAML Fund Manager Survey, the greatest overweights are India, the Philippines and New Zealand, which indicates a possible contrarian long position in the Greater China theme.

When I first focused on the question of regional equity allocation, my first instinct was to think about the eurozone. Upon further study, the excessive optimism about the eurozone was a surprise to me. My conclusion is to tilt the weight of the equity portion of a portfolio towards the US and Asia x-Japan.

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.