Despite disappointing markets at their previous meeting, the Bank of England (BOE) managed to over deliver on market expectations last night, not only cutting interest rates by 25 basis points, but also introducing a range of new measures including quantitative easing, corporate bond purchases and a new Term Funding Scheme (TFS). While the markets were fully priced for a rate cut, the additional measures saw the pound dive 1.7%.

BOE governor Mark Carney’s assessment of the post-Brexit UK economy was very negative, predicting the unemployment rate will rise from 4.9% to 5.5% over the next two years despite the new stimulus. This makes it very likely that further cuts to the policy rate and expansions of the BOE’s other easing measures will be forthcoming over the coming months, providing further downside risks to the pound provided US economic activity does not begin to steadily weaken.

The main focus for the UK is what sort of fiscal stimulus package new Chancellor Phillip Hammond announces at his “Autumn Statement”. It’s safe to say former Chancellor George Osborne’s many years of austerity policies are set to be dramatically reversed.

This provided a big fillup to European markets overnight as the FTSE 100 gained 1.6%, and the DAX and the CAC both gained 0.6%. But the most reassuring development overnight was the strong performance by European banks, as Carney disavowed negative rates and implemented the TFS to try to help bank net interest margins. US equities were more muted, as uncertainty over this evening’s major nonfarm payrolls release kept most investors on the sidelines. But given the ebullience seen in European equities, barring a major miss in the NFP US equities are likely to be keen to play catch up in today’s session once that event risk is out of the way.

Oil-market concerns also continued to dissipate, as US$39-$40 seemed to be a key level for a lot of short positions to close out and the buying associated with the short covering helped the WTI oil price rise another 2.3% overnight. Although the energy sector in the S&P 500 declined -0.2%, showing that there still isn’t much conviction for prices to start moving dramatically higher from these levels, but the decline does look to be over for now, which is likely to be a positive for equities in the short term.

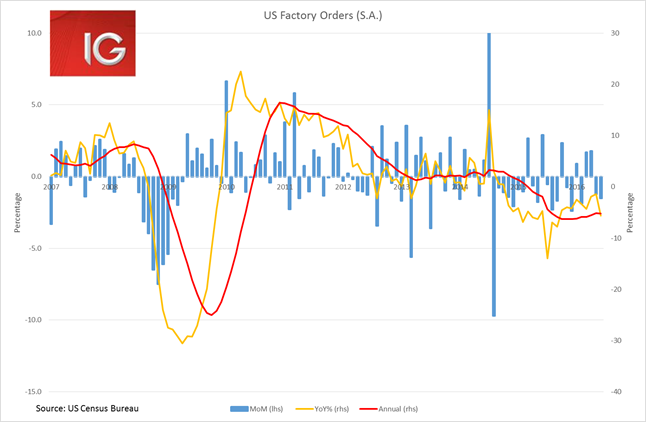

There were also some pretty woeful capital spending numbers out of the US overnight as durable goods, capital goods and factory orders all managed to disappoint. Although FX flows related to the BOE’s unexpectedly aggressive easing provided support to the US dollar, and the DXY dollar index climbed 0.2%.

The most important development overnight is the high expectations for global monetary and fiscal easing are steadily being met. Japan has announced both fiscal and monetary easing, the UK has announced monetary easing and Chancellor Phillip Hammond has indicated that fiscal easing is likely to be announced in his “Autumn Statement”. With China likely to keep the fiscal taps operating at high levels throughout 2H as well, and the possibility of fiscal spending in the EU to buttress some of the Brexit fallout, the bounce we have seen in commodities does make more sense. The Bloomberg Commodity was up 0.4%, and the Aussie dollar and Kiwi dollar were up 0.5% and 0.3%, respectively.

I feel this is a key development many of the bearish forecasts on the Aussie dollar are overlooking. Even though the RBA is likely to steadily cut interest rates to a terminal level of 1%, the global return to fiscal stimulus will continue to support the nascent revival in industrial commodities. There is a decent chance the AUD retests US$0.78 in 3Q, the likelihood of which would be considerably supported by the moderating trend we are seeing in US data of late. Although we will see the RBA’s Statement of Monetary Policy released today, which is likely to provide some downside risk to the Aussie’s overnight gains.

Asian markets are all set to open higher. The ASX looks set to regain the 5500 level with support coming from the commodities space and financials. The strengthening of the yen overnight looks like it may weigh on the Nikkei at the open, but it could be set to move into positive territory throughout the day if other markets in the region start feeling the BOE QE momentum.