Trend Model signal summary

Trend Model signal: Neutral

Trading model: Bearish

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. In essence, it seeks to answer the question, "Is the trend in the global economy expansion (bullish) or contraction (bearish)?"

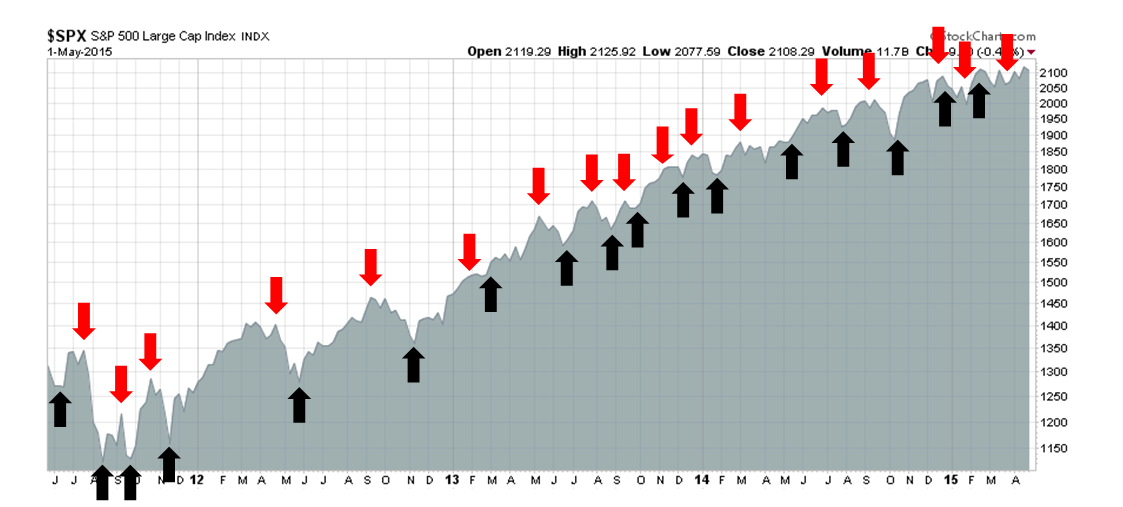

My inner trader uses the trading model component of the Trend Model seeks to answer the question, "Is the trend getting better (bullish) or worse (bearish)?" The history of actual (not backtested) signals of the trading model are shown by the arrows in the chart below. In addition, I have a trading account which uses the signals of the Trend Model. The last report card of that account can be found here.

Update schedule: I generally update Trend Model readings on weekends and tweet any changes during the week at @humblestudent.

The growth scare arrives

I have been forecasting an intermediate term top based on a growth scare catalyst in these pages in the past few weeks (see Growth scare = Tactical sell signal and New highs = A last hurrah?) and the growth scare seems to be arriving.

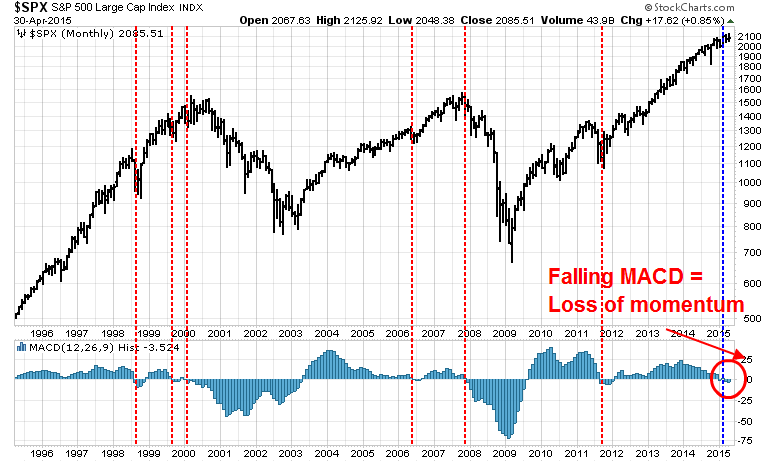

To recap, the technical picture had been deteriorating. While the long-term uptrend in stock prices has been intact, short-term trend, or momentum, had been choppy (see How to make your first loss your best loss). This analysis was based on work done by Wells Capital Management. Past episodes in the past 100 years of the combination of an extended uptrend and short-term momentum failure have resulted in stock market weakness. To illustrate my point in a different way, the 20 year monthly chart of the SPX below shows how MACD has weakened to a negative reading (bottom panel). Past instances of negative MACD (vertical lines) have marked market declines, either as a leading or coincidental indicator.

What appears ominous about the current experience is that it appears most similar to the 1999/2000 top, where MACD had gone negative in late 1999, rose and declined again in early 2000 as a precursor to the 2000 market top. Fast forward to today: MACD went negative in January 2015, rose in February and went negative again in March. However, I am comforted by the fact that this model is better at forecasting direction than magnitude. Given the lack of catalyst for a major bear market, my best guess is that any weakness will be more comparable to the market experience in 2010 or 2011 - a minor hiccup.

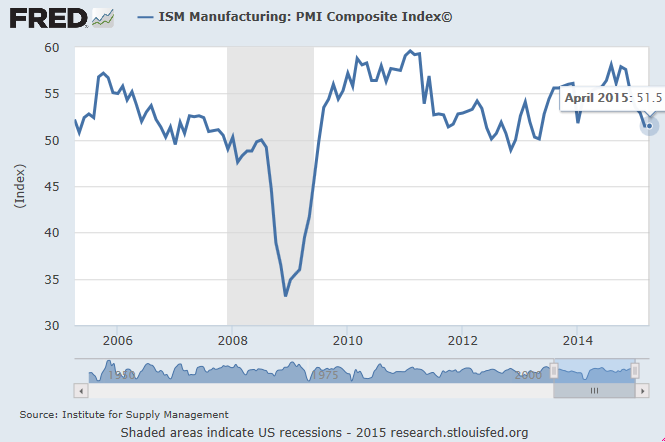

The apparent catalyst for a bearish impulse in stocks appears to be a growth scare. The horrendous miss of 1Q GDP growth of 0.2% (vs. an expected 1.0%) proved to be the first part of a double whammy for stock prices. These readings are consistent with New Deal democrat's characterization of the US economy as being in a shallow industrial recession, but with a resilient consumer economy. The latest ISM Manufacturing reading of 51.5 also tells the story of a slowing economy, but above 50 indicating expansion.

Despite the slowing growth evidenced by the 1Q GDP and decelerating ISM, subsequent reports showed that the growth in the Employment Cost Index remained robust, which meant that the Fed remained on course to raise rates some time this year. The market now has the worst of both worlds to contend with, slowing growth and the prospect rising interest rates. Indeed, the latest Fedspeak from Mester of the Cleveland Fed and Williams of the San Francisco Fed is, "All meetings are on the table."

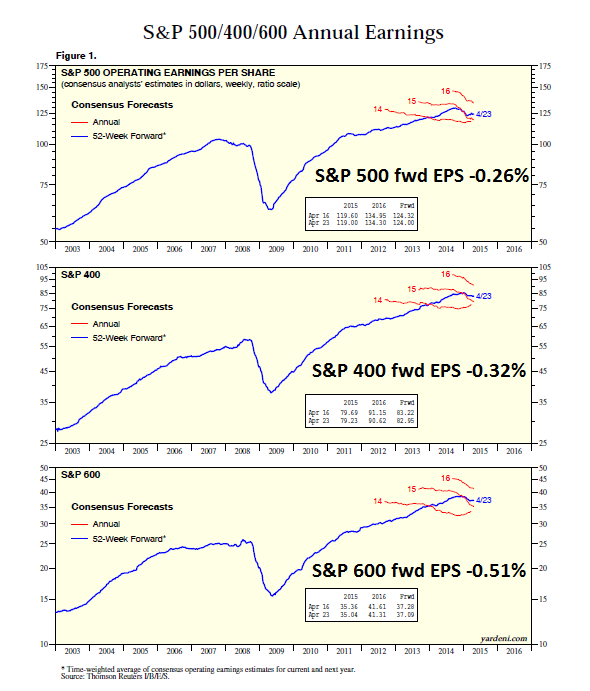

Indeed, Ed Yardeni recently confirmed market expectations of slowing growth when he showed in his analysis that forward 12 month EPS estimates were falling across all market cap bands (annotation of forward EPS change are mine).

Bulls losing control of the tape

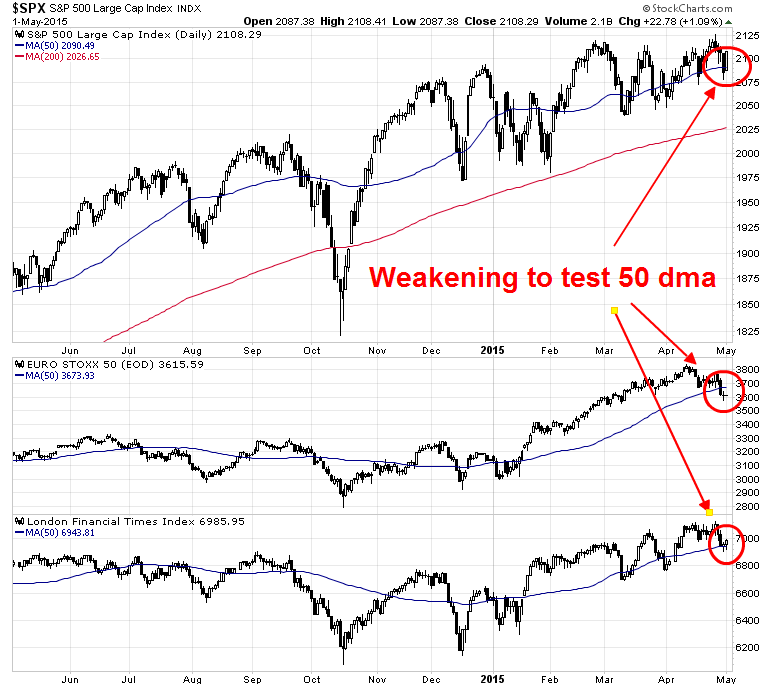

From a technical perspective, risk appetite is starting to wane and the bulls are starting to lose control of the tape. Both the American and European markets (via Euro Stoxx 50 and London Financial Times Index) are starting to look a little wobbly as the major indices have weakened to test their 50 day moving averages. Such behavior is an indication of the loss of price momentum.

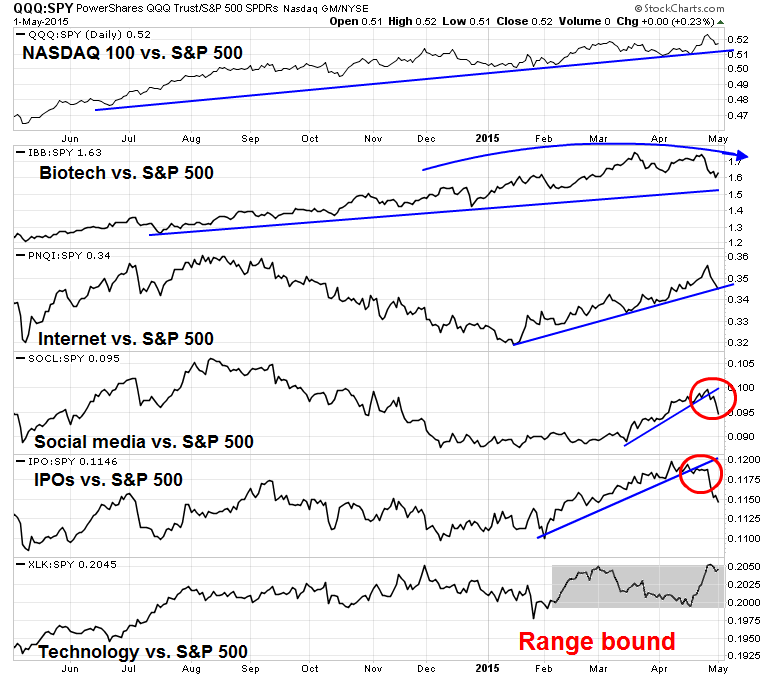

In the US, high-beta groups are are losing relative strength. The chart below shows the relative performance of various glamour and high-beta sectors and industries (via SPDR S&P 500 ETF (ARCA:SPY), PowerShares QQQ Trust Series 1 (NASDAQ:QQQ), iShares NASDAQ Biotechnology ETF (NASDAQ:IBB),PowerShares NASDAQ Internet ETF (NASDAQ:PNQI), Global X Social Media ETF (NASDAQ:SOCL), Renaissance IPO ETF (ARCA:IPO) and Technology Select Sector SPDR (NYSE:XLK) . All are in various stages of losing momentum. Faltering leadership by these stocks is often a precursor to further market weakness.

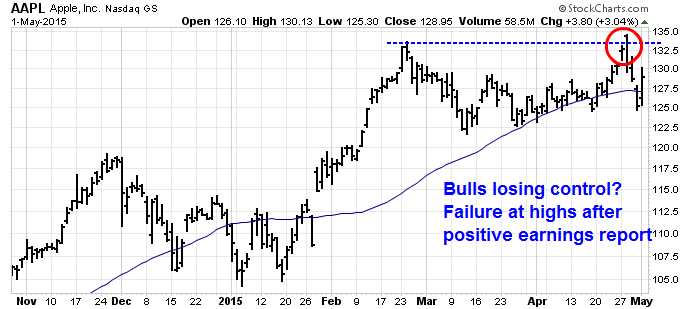

I was also disturbed by the price action of Apple (NASDAQ:AAPL) after its earnings report beat expectations both on the top and bottom line. The tone of Street analyst reactions was positive after the report, but the price reaction was not. The failure of heavyweight market leaders like AAPL to rally in the face of good news is another sign that the bulls are losing control of the tape.

Trade Followers, which monitors stock trader sentiment on Twitter, also noted a loss of momentum and flashed this warning (emphasis added):

At the close yesterday (4/30/15) a consolidation warning was issued from 7 day momentum calculated from the Twitter (NYSE:TWTR) stream for the SP 500 Index (SPX). The warning comes from a negative divergence that lasted more than three weeks which was followed by a break of the confirming uptrend line that began in January. This suggests that sentiment on the Twitter stream is falling and likely turning from bullish to bearish.

As a reminder, a consolidation warning doesn’t mean the market is making a long term top. It merely means bulls are stepping aside and the bears are asserting themselves. When this occurs the market struggles to move higher and often dips more than 5%. Long story short, the odds favor lower prices in the short term.

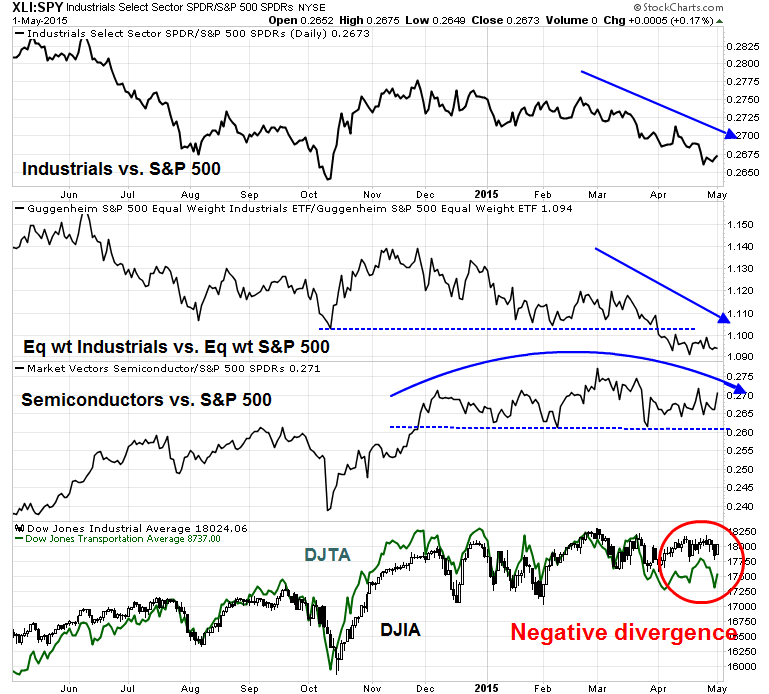

Cyclical stocks are not showing leadership, either in the form of industrial or semiconductor stocks (via Industrial Select Sector SPDR (ARCA:XLI), Guggenheim Invest S&P 500 Equal Weight Industrials (NYSE:RGI), Guggenheim Invest S&P 500 Equal Weight (NYSE:RSP), Market Vectors Semiconductor (NYSE:SMH). More disturbing is the negative divergence between the Dow Jones Industrials and Dow Jones Transportation, which may be flashing a Dow Theory sell signal.

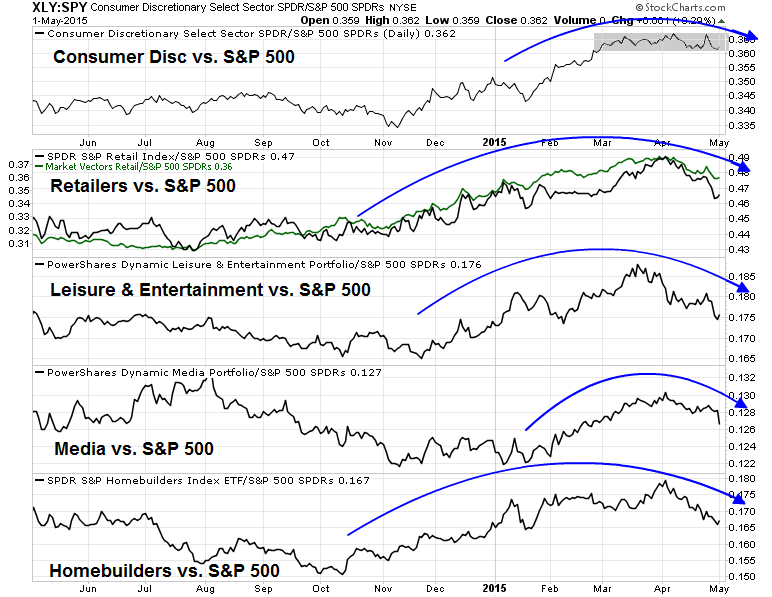

What about the Almighty American consumer? Mr. Market doesn`t think much of her as Consumer Discretionary stocks have been losing momentum and they are now rolling over on a relative basis. This negative pattern can be seen at the sector level and across different consumer spending sensitive industries (via Consumer Discretionary Select Sector SPDR (ARCA:XLY), SPDR S&P Retail (NYSE:XRT), Market Vectors Retail (NYSE:RTH), PowerShares Dynamic Leisure & Entertainment (NYSE:PEJ), PowerShares Dynamic Media (NYSE:PBS)and SPDR S&P Homebuilders (NYSE:XHB)) .

When I put it all together, the combination of declining relative strength among the glamour stocks and the failure of economically sensitive groups like cyclical and consumer discretionary stocks to take the mantle of market leadership add up to one thing. Risk appetite is waning as the market prepares for an economic slowdown.

The week ahead: Time to fade strength

With so many negatives for US stocks, does that mean that investors should rush and push the "sell" button on Monday morning?

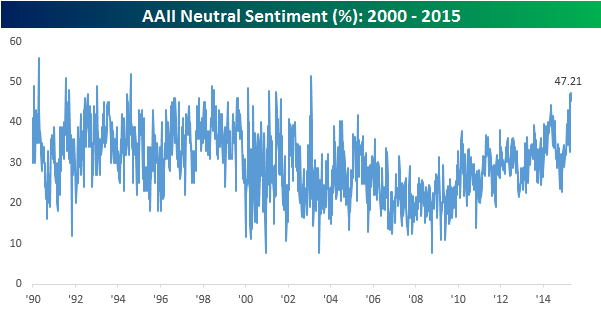

While some caution is warranted, no one should panic. Despite the fact that the bulls may be losing control of the tape, there is no evidence that the bears have taken the decisive upper hand either. Recent bull and bear moves have been marked by a lack of conviction. Bespoke highlighted this chart of AAII neutral sentiment, which is highly elevated relative to its own history. That tells me that market psychology remains indecisive and we may continue to chop around for a few more weeks.

This chart from IndexIndicators.com tells a story of patience. It shows the aggregate 14-day RSI for the SPX. While the pattern of lower highs is highly suggestive of a loss of momentum, readings are at levels where the market has staged rallies in the past. This suggests that bears should wait for strength to either short or sell into the rally.

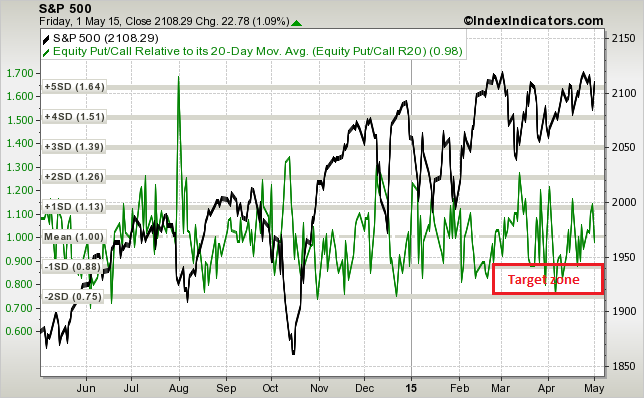

For another perspective, this chart depicts the equity-only put/call ratio relative to its own 20-day moving average. Readings are neutral and I would therefore be inclined to wait until the ratio descended into the target zone levels before selling or initiating short positions.

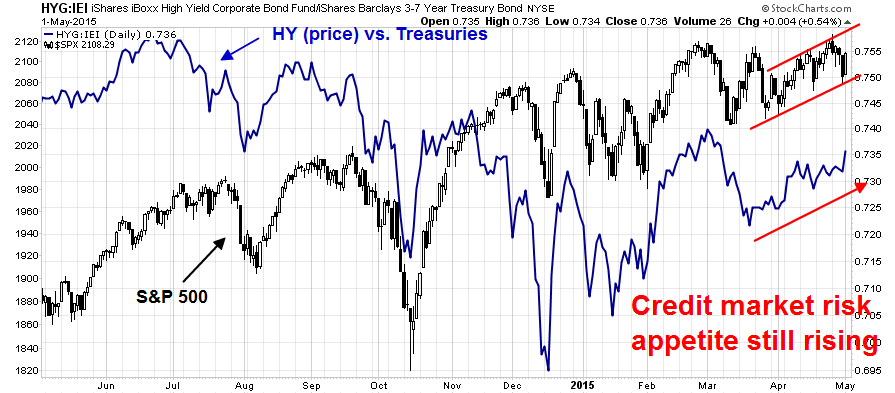

In addition, while sector and industry level relative returns show that risk appetite is diminishing, the message from the credit market is that risk appetite remains healthy. The bears cannot be said to be taking authoritative control of the tape until the credit markets start to get spooked. I will be watching this chart (iShares iBoxx $ High Yield Corporate Bond (ARCA:HYG) vs iShares 3-7 Year Treasury Bond (ARCA:IEI)) very carefully in the days and weeks to come as for a decisive signal that a stock market correction has begun.

As well, there may be a couple of bullish catalysts that could spark a rally in the near future. First of all, China is highly resilient despite all the negative news about its slowing economy. On the weekend, Barron's featured an article with a very bullish tilt on China:

Now here’s the scariest part: Economists and strategists suggest that this bull market has just begun, as China begins to open its stock markets to global investors. At 4442, the Shanghai Composite Index still is 27% below its 2007 peak of 6092. This means long-term investors with horizons of more than three years may need to hold their noses and look to pullbacks to build their Chinese portfolios.

“Despite the run-up in equity markets, this is just the beginning,” says Helen Zhu, BlackRock’s head of China equities. “Structural-reform progress, rather than cyclicality in economic growth, has played a large part in driving the strong returns, and by reducing the tail risks that have been associated with China.” Chuck Clough, CEO of Clough Capital Partners in Boston, which manages several funds including one focused on China, agrees. He thinks the Chinese are just starting to buy stocks again for the first time in recent years. “China is at the beginning of a big movement from savings toward stock investing,” he says.

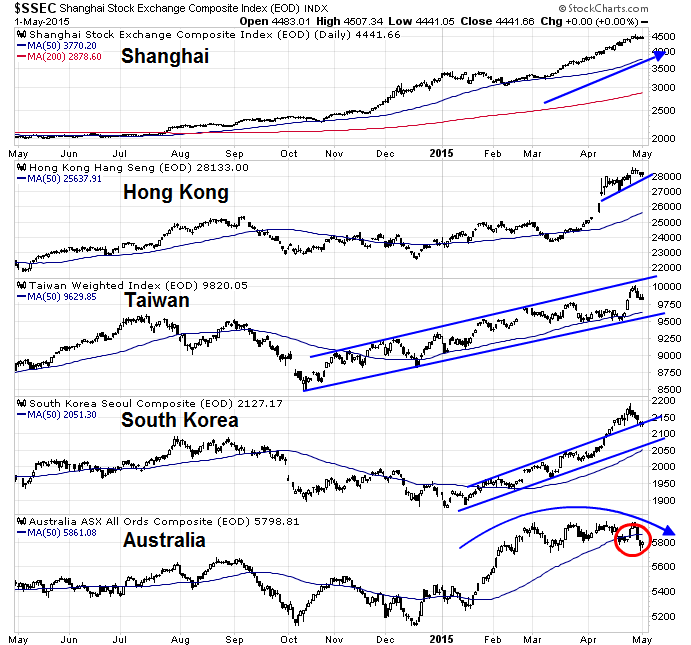

I hesitate to gauge the Chinese economy based on its stock market, because their equity market is regarded as a casino. However, the charts of its neighboring Asian trading partners (the Shanghai Composite, Hang Seng, Taiwan Weighted Index, KOSPI, and the ASX All Ordinaries) appear to be very healthy, with the exception of Australia. Mr. Market is therefore telling me that Greater China is alive and kicking and Asian bullish forces could serve to temper the decelerating US growth outlook and put a floor on US stock prices.

In addition, we could see a (temporary) resolution of the Greece-eurozone impasse next week. Athens is due to make two payments to the IMF in May, €200 million on May 6 and €750 million on May 12. While the Syriza government struggles with the May 6 payment, it is the May 12 payment that may push Athens into default. Their backs are to the wall, but Tsipras is signaling possible concessions. The Telegraph recently speculated that the Greeks will have to blink:

This Emergency Liquidity Assistance (ELA), which has hit €77bn since February, has been described the "Sword of Damocles" hanging over the country.

With negotiations showing little discernible progress, the ECB has touted plans to put a firm ceiling on ELA, as well as forcing banks to take a bigger haircut on the collateral they need to access the funds.

It is a stance that is beginning to scarily resemble the threats which resulted in Ireland eventually bowing to eurozone bail-out terms in 2010.

The most immediate effect of a settlement with Greece would reduce tail-risk and raise risk appetite. If a last minute deal does get struck, which is highly likely, I will be watching the market reaction to see how it reacts to the good news.

I have been getting nervous about the technical and macro conditions underpinning the stock market for several weeks. My inner investor has already de-risked and moved his asset allocation to a neutral policy weight.

My inner trader covered his short position and went to cash last week. He is waiting for the market bounce to opportunistically re-enter his shorts at higher levels. Depending on how things develop, it would not be a total surprise for the market to rally to test the old highs or even make marginal new highs. While the medium term trend is likely to be down, the short-term trend remains "data dependent".

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.