Trend Model signal summary

Trend Model signal: Risk-off

Trading model: Bearish

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. In essence, it seeks to answer the question, "Is the trend in the global economy expansion (bullish) or contraction (bearish)?"

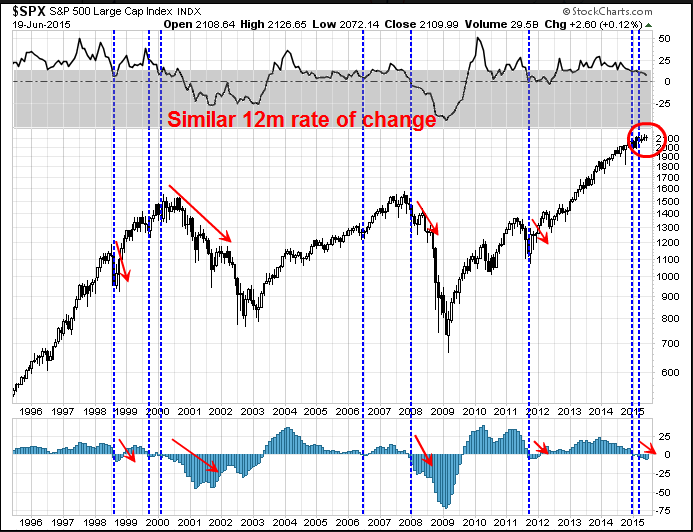

My inner trader uses the trading model component of the Trend Model seeks to answer the question, "Is the trend getting better (bullish) or worse (bearish)?" The history of actual out-of-sample (not backtested) signals of the trading model are shown by the arrows in the chart below. In addition, I have a trading account which uses the signals of the Trend Model. The last report card of that account can be found here.

Update schedule: I generally update Trend Model readings on weekends and tweet any changes during the week at @humblestudent.

Hegelian Dialectic: Bull and bear debate

Regular readers know that I have been cautious on the US equity market for several months. Instead of re-hashing the same points over and over again, I thought that I would try something different this week. I will re-examine the bull and bear case for stocks in the framework of the Hegelian Dialectic of "thesis, antithesis and synthesis", otherwise known as "thinking outside the box".

Thesis: The bull case for stocks

New information has come to light recently that bolsters the bull case for equities:

- Improving fundamentals

- Sentiment readings are becoming bearish, which is contrarian bullish

- Price strength in selected sectors, such as the all-time high achieved by the NASDAQ and Russell 2000, as an indicating of better price momentum

- The high likelihood of a relief rally from a resolution of the Greek crisis (see Two ways to play Greece)

Let's go through each of those points, one at a time.

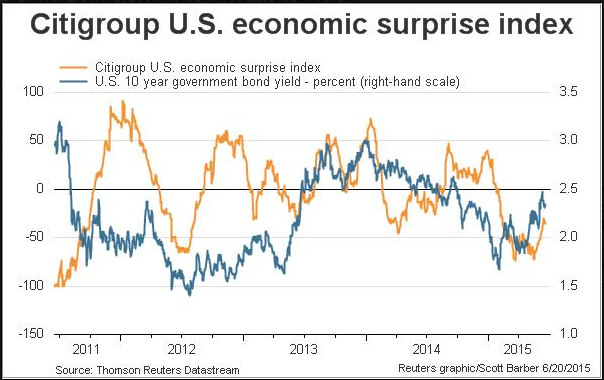

Better fundamentals

In the last few weeks, high frequency economic data has had a tendency to beat expectations, rather than disappoint as they've done for much of 2015. The Citigroup) Economic Surprise Index, shown below, is turning up, indicating an improving economic outlook. The Atlanta Fed GDPNow estimate of 2Q GDP growth has surged to 2.0% from a low of 0.7% in mid-May.

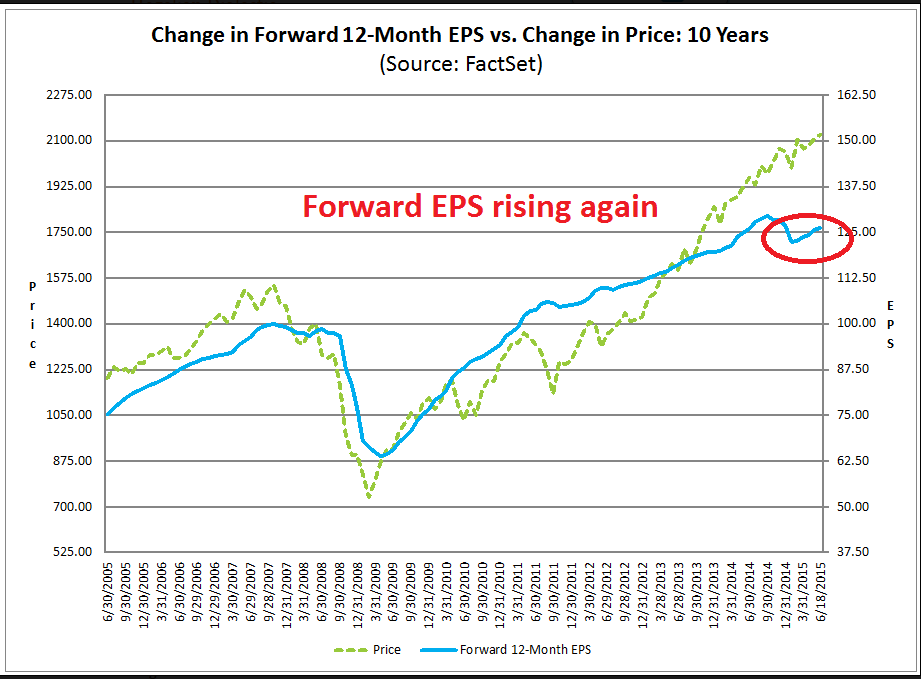

John Butters of Factset reported that consensus forward EPS estimates is growing in line with the better economic outlook. As the chart below shows, the change in forward EPS has been highly correlated with the direction of stock prices.

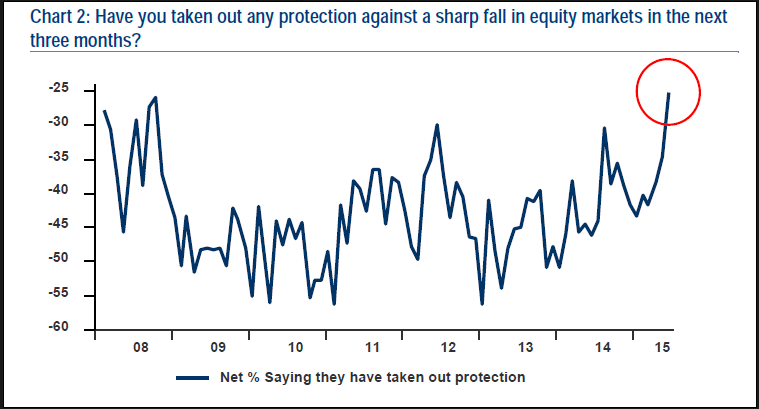

Sentiment getting too bearish?

In addition, sentiment models are getting more bearish. There was a lot of buzz generated early last week when the BoAML Fund Manager Survey (FMS) revealed that institutional managers had taken out a lot of tail-risk insurance, probably because of fears relating to Greek tail-risk (more on that below).

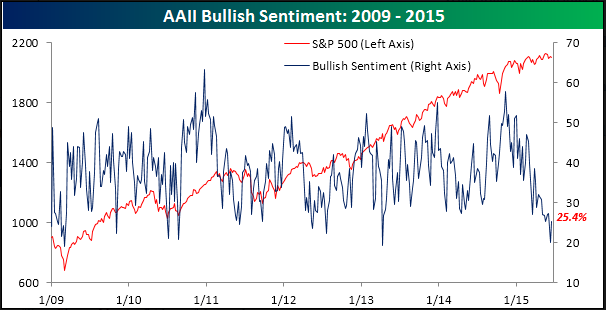

The latest AAII survey also showed bullish sentiment to be very low on a historical basis, though Bespoke did point out that bearish sentiment also ticked up during the week as neutral sentiment retreated.

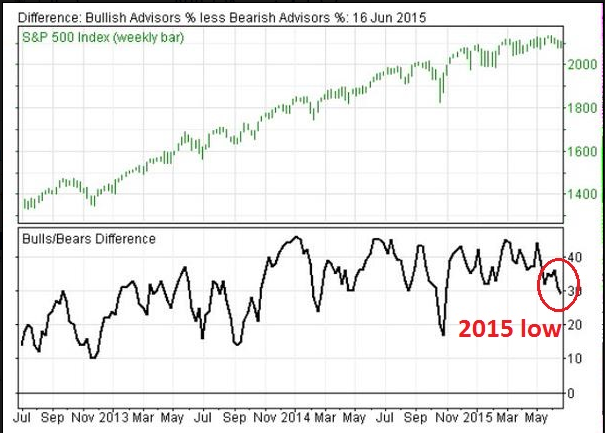

The latest II survey data also showed the bull-bear spread to have fallen to a new low for 2015:

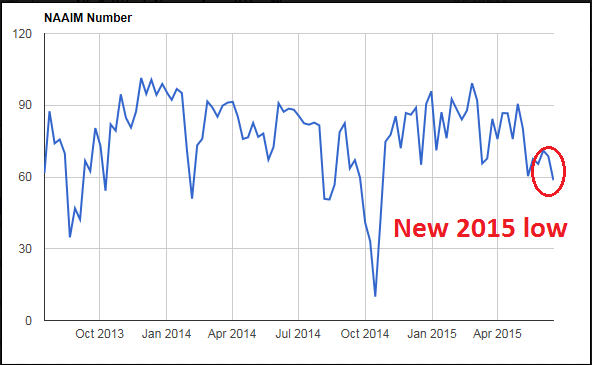

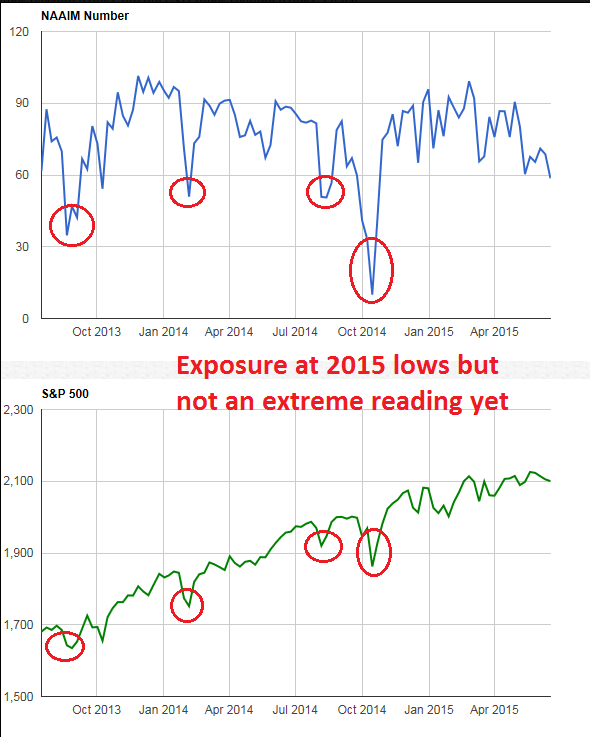

NAAIM exposure has fallen to a 2015 low, which is also contrarian bullish.

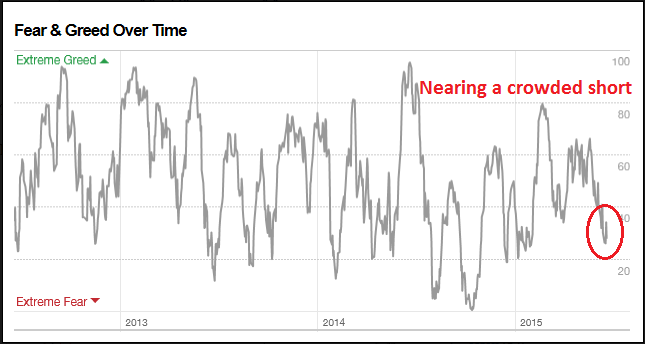

The CNN Money Fear and Greed Index is also at depressed levels indicating rising bearishness.

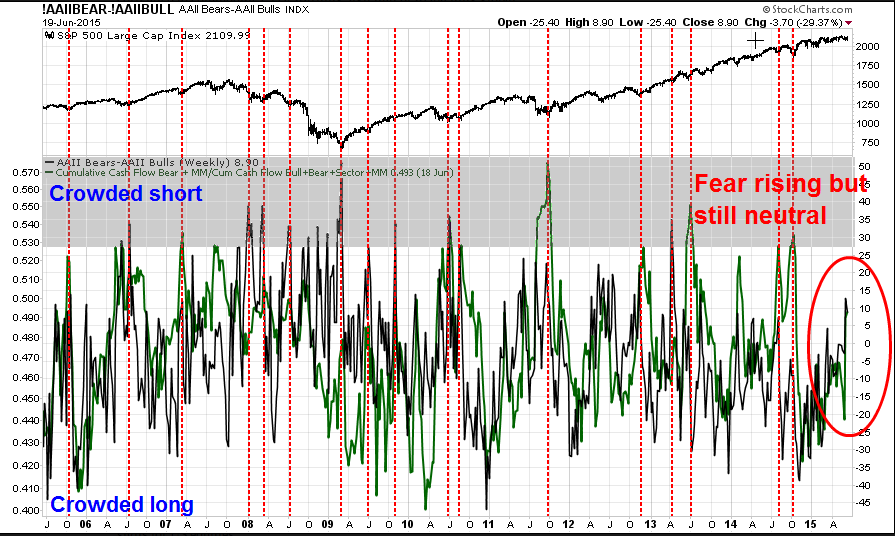

Overall, these sentiment readings are suggestive of a crowded short and the formation of the proverbial wall of worry.

Technical strength + impending rally = ?

All these readings would be understandable if stock prices had taken a tumble, but that's hardly the case. The SPX fell about 3% on an intraday peak to trough basis but recovered late last week. In addition, several leading indices, such as the NASDAQ Composite and the Russell 2000, made all-time-highs.

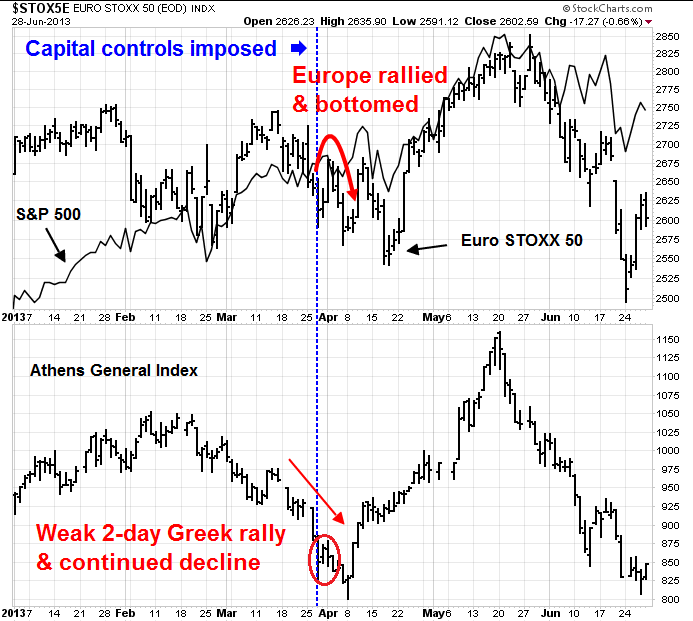

In addition, I wrote last week that eurozone stocks and, in particular, Greek equities were no longer responsive to bad news from the Greek crisis, which indicated that they were poised for a relief rally. As the chart below of the Euro STOXX 50 indicates, eurozone stocks had been falling since April, but their uptrend from last September remains intact.

The combination of the technical condition and skeptical psychology of the market leads me to believe that European stocks are likely to stage a significant relief rally once the Greek crisis is resolved - and it appears that a final resolution is highly likely this coming week. Given the high degree of correlation between US and European markets, a Greek inspired relief rally is likely to push US stocks higher as well.

Antithesis: The bear case

I have been writing about the bear case for so many weeks I am starting to sound like a broken record. The best summary can be found at my previous post Why I am bearish (and what would change my mind).

To make a long story short, the intermediate term bear case rests on a series of technical conditions that amount to more or less the same thing. Call it what you want, excessive complacency, deteriorating price momentum, uptrend violations - they all amount to the same thing. The monthly chart below illustrates my point (note that this is a monthly price chart and therefore daily squiggles don't matter very much).

A 100% accuracy model in calling bear phases

The chart above has a 100% accuracy in calling bear phases in the last 20 years (N=5). Further analysis based on DJIA data going back to 1900 also came to the same conclusion. Whenever the MACD histogram (bottom panel) turns negative, the market is either in a bear phase (shown by the 12m rate of change in the top panel), or is about to enter into a bear phase. We saw MACD turn briefly negative in January 2015, tick back to positive in February, followed by relapse into negative and deteriorating MACD readings in starting in March 2015.

The intermediate term bearish argument is also supported by deteriorating breadth and other internals. This chart from IndexIndicators showed the % of SPX stocks above their 50 dma have been steadily declining. On Thursday, when the SPX rallied about its 50 day moving average on Thursday, the percentage of stocks in the SPX above its 50 dma was barely above 50% at a 53.8% reading. Taken together, that`s not a picture of strong breadth.

At the end of the week, most of the technical conditions that prevailed for much of 2015 were unchanged. The market remains in a tight trading range, with the RSI(14) indicator (second panel) staying highly range-bound, having refused to get either overbought or oversold all year. The shorter term RSI(5) indicator (top panel) reversed off an overbought reading on Friday, however, which is bearish on a 2-3 day time frame basis.

Intermediate term technical conditions continued to deteriorate. The equal to float weighted SPX ratio (green line, third panel) has been falling, indicating a negative breadth divergence. In addition, the relative price performance of HY bonds to equivalent duration Treasuries (bottom panel via iShares iBoxx $ High Yield Corporate Bond (ARCA:HYG) and iShares 3-7 Year Treasury Bond (ARCA:IEI)) has been rolling over and creates concerns about the quality of global risk appetite.

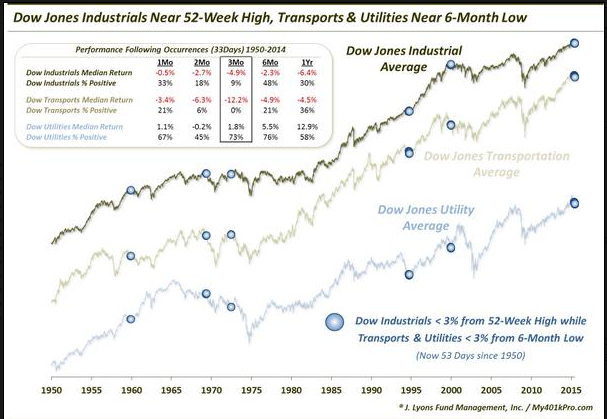

There has also been a lot of recent discussion about weakness in the DJ Transports as a non-confirmation of the new highs in the DJ Industrials, which is a Dow Theory concern. Dana Lyons showed that not only are the Transports weak, the DJ Utilities are weak. Such conditions have tended to resolve themselves bearishly in the past.

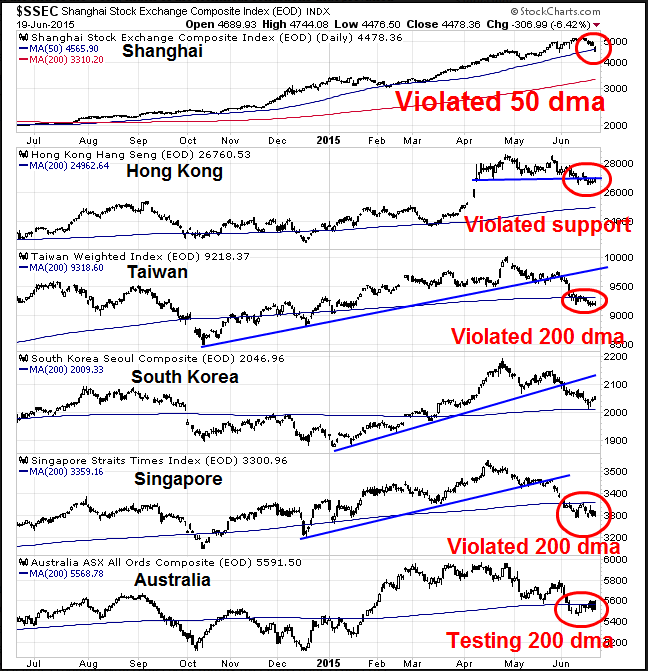

Global risk appetite, which is what the Trend Model is measuring, is also a concern for stock prices. The UK FTSE 100 (not shown) is now under both its 50 and 200 dma. In addition, the Shanghai Composite has now fallen over 10% on a peak-to-trough basis and under its 50 dma, which puts it into correction territory. The chart below shows not only the Shanghai Composite, but the indices of Greater China, or China's major trading partners (except for Japan, which has its own issues). All of the regional bourses—the Hong Kong, Taiwan, South Korea, Singapore and Australia—are struggling technically and several (Taiwan and Singapore) have violated their 200 dma, which is used to delineate bull and bear markets.

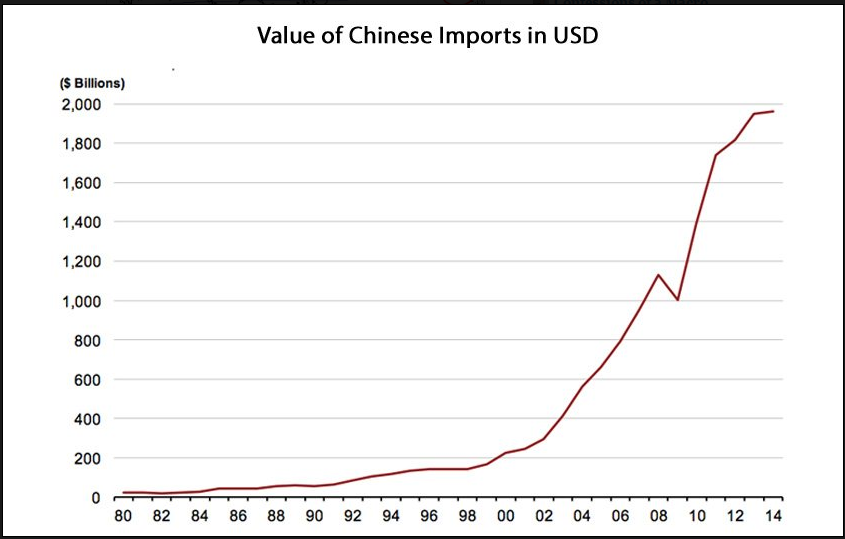

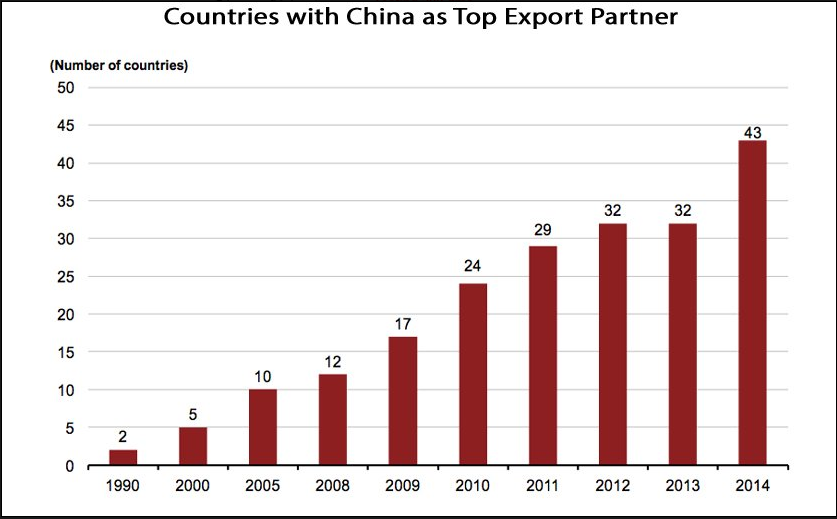

The technical difficulty of the stock markets of China's major trading partners illustrate the point that China has become an increasingly important part of the global economy. A report from Business Insider shows how Chinese imports have exploded over the last few years.

The number of countries that count China as its top trading partner has been steadily rising and now number 43. A Chinese slowdown would therefore have a much greater impact on the global economy than at the time of the Lehman Crisis in 2008, when the count was only 12.

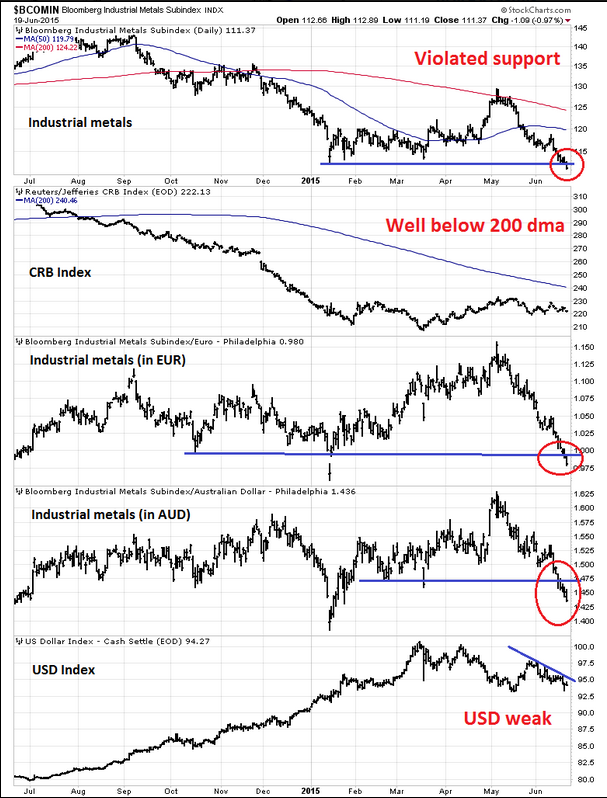

China is the biggest marginal consumer of many commodities and the global growth signals from commodity prices is disappointing. The chart below shows the price of industrial metals (top panel) and the CRB Index (second panel) and the US Dollar Index (bottom panel). I have also shown the cyclically sensitive industrial metals in euros and Australian dollars. The key takeaway here is commodity prices are weak, regardless of currency. In particular, the recent decline in commodities in the face of a falling USD, which tends to be inversely correlated to commodities, is a warning sign that of weakening global demand, especially from China.

In conclusion, the combination of weak price momentum, deteriorating breadth and poor global risk appetite are all intermediate term bearish signs for US equities.

Rising earnings? Not so fast!

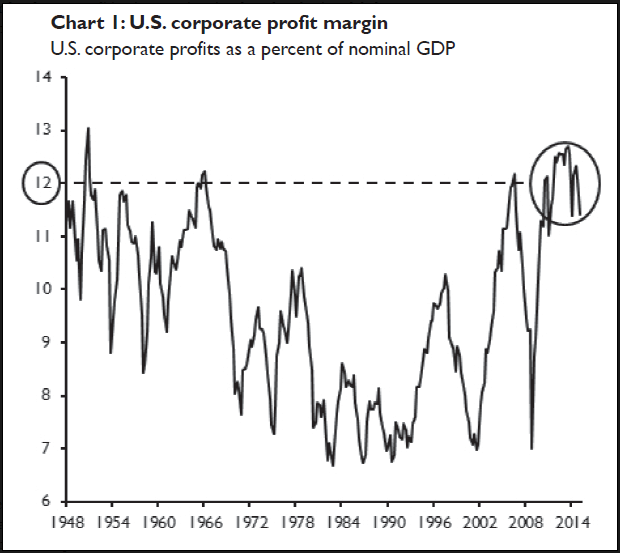

I recognize that the improving economy and rising EPS estimates are likely to provide a tailwind for equity bulls. However, Jim Paulsen at Wells Capital Management has a dissenting viewpoint. Paulsen wrote in his June letter that he was worried about margin pressures cutting into earnings growth. He observed that US corporate margins appeared to have reached a plateau:

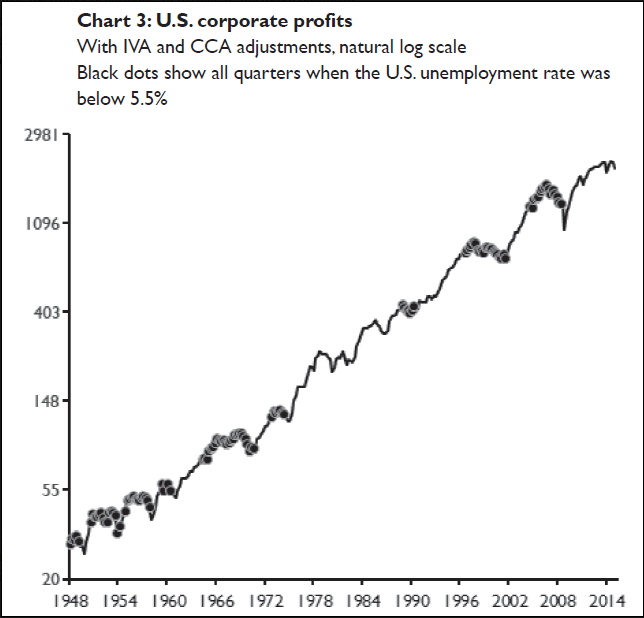

...and unemployment is falling, which creates wage pressure and therefore squeezed margins. Historically, corporate profits have struggled once the unemployment rate reached the current level of 5.5%.

Paulsen also raised concerns about the effects of Fed tightening on the profit cycle. In the past, stock prices have continued to rise when the Fed started tightening "because the profit cycle is usually still in the early stages of recovering from the previous recession", but not this time [emphasis added]:

Of the many unique aspects characterizing contemporary monetary policy, one which may prove very important for the stock market is “how long” the Fed has waited to begin the tightening process. Our concern is not that by waiting so long, the Fed is behind the curve (although that also is possible). Rather, by waiting too long to start the process, the Fed has allowed its traditional exit ramp (i.e., raising interest rates against strong gains in corporate profits) to expire. Consequently, the Fed is now about to begin the process of raising interest rates without its traditional buffer of recovering profitability.

Jim Paulsen is no permabear and his views add a fresh perspective on the macro outlook for equities. He has been increasingly cautious on the stock market and his views should be given due consideration.

Sentiment: What fear really looks like

I also want to address the issues raised by apparent bearish sentiment readings. The US equity market has not seen a 10% correction since 2011, so many investors and traders may not really remember what real fear looks like. So if we were to accept the premise that the stock market appears to be vulnerable intermediate term, a wimpy 3% pullback is unlikely to create the kinds of sentiment backdrop for a durable bottom.

Let's take a look at what real fear has looked like in the past. Here is a 10-year chart of the AAII Bear to Bull ratio (in black) and the Rydex bear fund+money market to bull fund cash flow ratio (in green). True, bearish sentiment readings have spiked, but they are only slightly in the bearish side of neutral and nowhere near the extreme bearish readings seen at past market bottoms (marked by vertical lines). The same comment could be made about the AAII data.

Here is a chart of the VIX-VXV ratio, which measures the term structure of the VIX Index. When the ratio is above 1, it indicates backwardation in the term structure and a high level of fear in the market. Current readings can only be characterized as neutral and nowhere near the extreme fear readings seen at past market bottoms.

The NAAIM exposure readings appear ominous, but in reality they can only be characterized as neutral and not at a bearish extreme. I have indicated with circles what real fear has looked like in the past.

One last thing, if everyone is so bearish on stocks, why did Lipper report that investors pulled $5.2b out of taxable bond funds and pour $6.9b into equity funds, with a $4.5b lion's share going into US equities?

Greece: Faites vox jeux

The key to the bull-bear debate in the short-term rests with Greece and how that crisis gets resolved. After many, many so-called "deadlines", it is finally crunch time for Greece and the crisis will likely get resolved this coming week, one way or the other. An emergency summit has been called for Monday in which Athens will undoubtedly be given a take-it-or-leave-it ultimatum. There are three scenarios to consider:

- Someone blinks and there is a deal. Even if it's an incomplete kick-the-can-down-the-road solution, we can pretty much expect that the markets will stage a relief rally.

- Greece defaults but stays in the euro. We can look at the Cypriot episode as a template of what might happen next. When the Cypriot banking system unexpectedly melted down, the authorities were able to contain the damage to the eurozone financial system and equity market downside was limited. Stocks rallied soon afterwards.

- Greece defaults and leaves the euro. This is highly unlikely. The Europeans don't want to kick Greece out and the Syriza controlled Greek government does not appear to be operationally prepared to leave the euro (see this discussion about what's involved at Naked Capitalism). It took years of preparation to transition from national currencies to the euro and such a change can't be done overnight without causing total chaos. I don't find Grexit to be a credible threat for the immediate future.

As an aside, I have written before that the problems that Greece faces are intractable and the solutions advocated by each side only addresses part of the problem (see What would happen after a "Speech of Hope"?). I am not here to make moral judgments, but to ascertain what the likely trajectory of the European markets will be next week. Consider the alternatives. Option 1 is obvious, the markets rally. Option 3 is unlikely for the reasons I outlined, so let's explore what happens with the discussions leading up to option 2.

Yves Smith at Naked Capitalism provided a useful synopsis of how such a scenario might play out. It has been said that the euro was a flawed monetary union from the beginning and the strains might even lead to war. Indeed, we are seeing a form of war as the Europeans have very effectively weaponized the financial system. Smith highlighted analysis from David Zervos of Jeffries of how it might all play out over the next few days [emphasis and comments added]:

1. Greece misses its IMF payment on the 30th of June. This could be a trigger but it may not be. The IMF has 30 days to call Greece in arrears so technically Greek government guaranteed collateral, and hence the Greek banks, are still solvent after the 30th. However on the 20th of July the Greeks will surely default to the ECB without a deal. This is the official d day.

2. Upon default, the collateral at Greek banks cannot be posted any longer to the Euro system. The Greek banks then become insolvent and the ECB, through the newly created Single Resolution Mechanism (SRM), is obligated to resolve the Greek banks. [Cam: Klaus Regling of the European Stability Mechanism has stated that their loans are linked to the IMF and a default to the IMF is a default to ESM.]

3. So the ECB goes to Tsipras and tells him – we are immediately instituting capital controls [Cam: Actually the decision to impose capital controls is up to the member state and not the ECB, but that's only a minor detail] and we will begin resolution of your banks unless u sign the agreement and re-enter a program. Without a bailout program in place the Greek government, and banking system, are both insolvent. So Tsipras says – what do you mean resolve my banking system? And then Mario explains as follows. First we wipe out all equity and bond holders. And then, as in Cyprus, we bail in depositors. There are 130b in Greek deposits against 90b in ELA. And while those deposits are technically insured up to 100,000 euro, there is no pan European bank insurance yet in place. That only comes in 2016. Right now Greek deposits are only insured with a Greek deposit insurance fund that has about 3b in it. This Is hardly enough for the 130b in deposits. So we take the 130b against the 90b in ela. Any remaining deposits go to fund a bad bank that begins resolving all the NPLs. The good loans of course will go into a good bank which will be funded with German capital and most likely will have a German name. Of course depositors will get 2 to 3 euro cents on the dollar for their existing balances from the 3bio in the insurance fund. So you have that going for you!

4. Tsipras hyperventilates and quickly reaches for a bottle of ouzo.

5. Then it’s basically time for the gallows. He either signs a document cutting pensions, raising VAT and violating all his red lines. Or he takes the Greek people into bankruptcy and out of the euro. Either way he is a dead man. His own party destroys him if he does the former [Cam: and his wife leaves him]. And the 70 percent of Greek who want to stay in the euro destroy him if he does the latter. Of course there is one other choice for Tsipras. He could just resign and call for new elections. In that case maybe the banks stay closed and the ECB does not start the resolution process until the Greek people decide what they want. But in any event, it’s over for Tsipras in that case as well.

The German fiscal disciplinarians have won the battle. Tsipras dies under that bridge. The end!

A weaponized financial system indeed! These kinds of bare knuckled negotiating tactics are likely to push Tsipras into blinking, signing a deal and falling on his political sword. As the time of this writing, Bloomberg has reported that Tsipras has presented Merkel, Hollande and Juncker a last-minute proposal that crosses his own red lines on pension reform. We'll have to see how much ground Greece has given and if the provisions are satisfactory for the Eurogroup.

Supposing that Tsipras doesn't sign the deal and decides to default, we can consider the Cypriot experience of what might happen next. The chart below shows the price action of the Euro STOXX 50, the SPX (top panels) and the Athens General Index (bottom panel) during the Cypriot bail-in. The Greek banking system was highly exposed to Cyprus so it had a higher Cypriot beta, while US stocks were the least exposed so they barely reacted at all. European stocks were somewhere in between. Stock prices fell on the day that capital controls were announced (remember that it was surprise). They staged a two-day rally (weak for Greece, stronger for Europe), declined for a week afterwards to a bottom and then rose afterwards. The lack of reaction from the SPX was likely indicative of how far removed the Cypriot situation was from the US economy and financial system.

The bottom line: Expect a short-term rally, followed by a possible decline into an ultimate bottom. In any case, the downside is limited.

Synthesis: Long Europe, short US

Based on this analysis, I continue to believe that the intermediate term direction for US stock prices is down. US equities moved into a mild overbought condition on Thursday and, if recent history of the narrowly range-bound market were to repeat itself, we are likely to see further declines early in the week. On the other hand, a bearish beta exposes a simple short position to the risk of a Greek driven rally. Quantitative models suggests that the beta of the SPX to Greek news is relatively low. This chart of the relative performance of Greek stocks compared to eurozone stocks (via the Global X FTSE Greece 20 ETF (NYSE:GREK) and the SPDR Euro Stoxx 50 ETF (NYSE:FEZ)) indicate that the rolling 20-day correlation of Greek relative performance to the SPX is only 0.30.

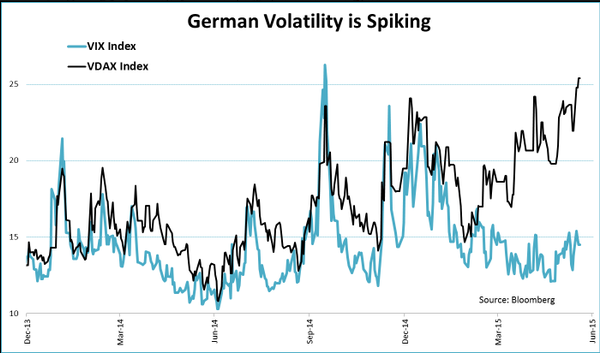

This chart shows that DAX volatility has spiked while VIX has remained flat (via Jeroen Blokland), which is another disconnect.

However, these results appear highly counter-intuitive. Even with the best quantitative tools, I cannot predict how the US markets are likely to react to a Greek rally.

As a solution, my inner trader has decided to do something completely different. He has entered into a pair trade, where he is long eurozone and short US stocks (via FEZ and the SPDR S&P 500 ETF (ARCA:SPY)) to express his convictions and control risk (see my tweet last Friday). The chart below shows the long FEZ-short SPY pair. European stocks in USD have been in a trading range against US stocks for most of 2015 and the pair is now at the bottom of the range. The RSI(5) indicator (top panel) shows that it has flashed a buy signal by bouncing off an oversold condition.

Should this pair move back to the top of the range, the upside potential would be about 4.5%. If the Greek market beta of SPX is lower than eurozone stocks, which is a reasonable assumption, the upside potential could be a lot higher.

On the other hand, my inner investor remains cautious as he stays focused on the intermediate term downside risks in US equities.

Disclosure: Long SPXU, EURL

Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.