Are you getting tired of the Greek news? I know I am. The market seems to be tired of Greece too.

This is a chart of the Global X FTSE Greece 20 (NYSE:GREK), the Greek ETF. Despite all of the dire news that's been coming in in the past few weeks, GREK hadn't fallen very much and has failed to make new lows. This kind of price action suggests that most of the bad news is already in the market.

Here is a chart of the Euro Stoxx 50, which peaked in April and has been in a downtrend since May. The index is now just above a support zone that could serve as a near-term floor. Does this mean that most of the Greek bad news is already priced into the market?

An examination of the market internals of other major European averages on IndexIndicators suggests that eurozone stock markets are also washed out. This chart of the average 14-day RSI of DAX stocks is nearing oversold levels, where it has staged decent rallies in the past.

Here is the same chart for the CAC 40. The conclusion is the same.

These readings are highly suggestive of a "sell the rumor, buy the news" strategy, where Mr. Market has already capitulated and fear is rampant.

Conflicting messages

How can we square these technical conditions with the Bloomberg report that Street strategists haven't capitulated and they remain bullish on eurozone equities (emphasis added)?

Greece isn’t budging, and neither are Europe’s stock strategists.

Clashes between officials in the Mediterranean nation and its creditors are wreaking havoc on markets, yet none of the 15 forecasters tracked by Bloomberg lowered their year-end estimate for European indexes. All of them see gains. UBS Group AG even raised its projection this month, citing better-than-expected earnings growth and a turn in the economy.

With analysts projecting three straight years of earnings growth surpassing 10 percent and European Central Bank stimulus in force, equity forecasters view Greece jitters as temporary. A Bank of America Corp). survey showed the region is still favored among stock investors. Citigroup Inc., the most bullish firm, sees the Europe STOXX 600 Index jumping 17 percent through the end of the year.

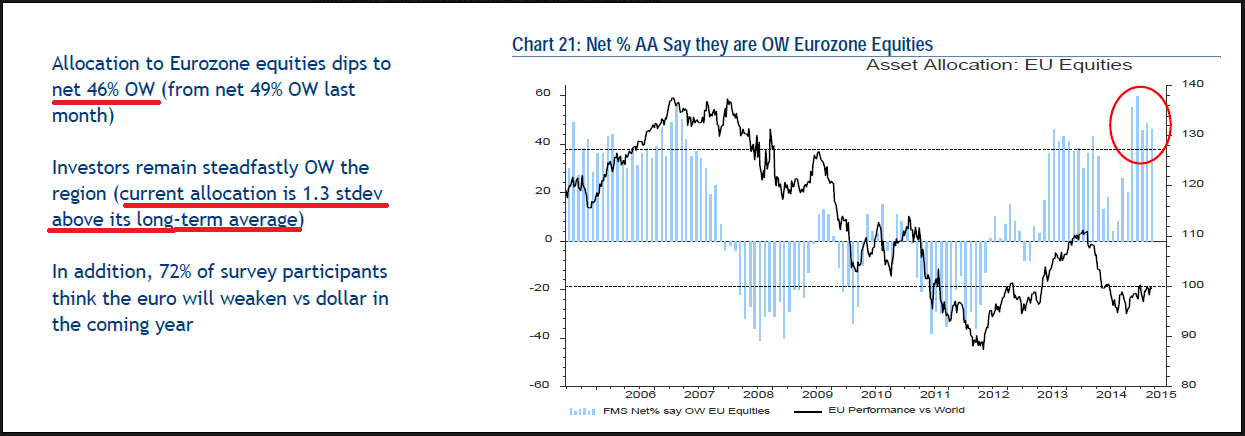

The latest BoAML Fund Manager Survey indicates that institutional fund managers remain heavily overweight eurozone equities, with a net 46% of managers overweight the region to a 1.3 standard deviation level above their historical average exposure.

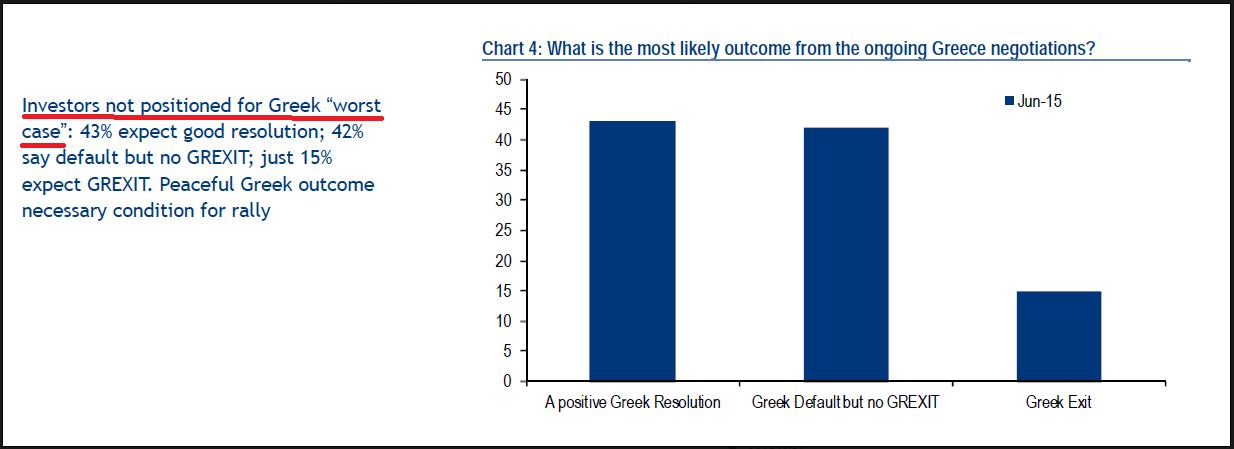

The FMS also shows that institutional managers are not positioned for the worst case scenario, with 43% expecting a last-minute deal and 42% expecting a Greek default:

The technical conditions and the survey data are highly contradictory and make no sense. Is the Street bullish or bearish on Europe?

All this has happened in the face of yesterday`s Bank of Greece dire warning of floods, plagues and locusts should Greece fail to reach an agreement (emphasis added):

Failure to reach an agreement would, on the contrary, mark the beginning of a painful course that would lead initially to a Greek default and ultimately to the country's exit from the euro area and – most likely – from the European Union. A manageable debt crisis, as the one that we are currently addressing with the help of our partners, would snowball into an uncontrollable crisis, with great risks for the banking system and financial stability. An exit from the euro would only compound the already adverse environment, as the ensuing acute exchange rate crisis would send inflation soaring.

All this would imply deep recession, a dramatic decline in income levels, an exponential rise in unemployment and a collapse of all that the Greek economy has achieved over the years of its EU, and especially its euro area, membership. From its position as a core member of Europe, Greece would see itself relegated to the rank of a poor country in the European South.

After tabling that report, the governor of the Bank of Greece Yannis Stournaras was attacked by the House Speaker for "uninhibited intervention". In the meantime, anti-austerity Syriza forces had begun a demonstration to show that even if the Tsipras-led government were to compromise and there was a deal, they would have to bring out the tanks to enforce its terms.

This picture is worth a thousand words:

Traders vs. investors

Here is my interpretation. Traders and investors should behave differently in the current circumstances.

For traders: The fast money crowd has been selling Greece (and eurozone stocks) in anticipation of a negative resolution to the negotiations. Judging from the technical condition of the markets, they are nearing a crowded short condition and a significant relief rally is likely when any resolution of the issues, whether positive or negative, hits the tape. The most likely negative trigger would be the ECB either refusing to support the Greek banking system any further through ELA, or requiring higher haircuts on Greek paper pledged as ELA collateral.

For investors: The ultimate measure of the value of stock prices is earnings and the discount rate to those earnings. Investors therefore have to make a decision on the likely effects any Greek resolution will have on those factors. A deal, even if it's a temporary solution, will obviously be bullish for European equities.

On the other hand, suppose that Greece were to default, but uncertainty remains as to whether it would stay in the euro. I have highlighted in the past that a Greek default would hit the budgets of other eurozone governments badly, with Italy being the most exposed (see Bears wake up, but they're not out of the woods). Under those circumstances, the contagion effects would be very real as peripheral yield spreads would likely widen and risk premiums rise, which negatively affects the discount rate on earnings. As well, the viability of Greece in the eurozone and within the EU itself would also shake the very foundation of the European Union.

One of the benefits of the introduction of the euro was a greater economy of scale. Not only did the euro simplify the cost of doing business in the eurozone, which raised the earnings growth rate, it created an economy of scale in the corporate bond market. A Dutch company could finance a cross-border acquisition of an Italian company—or vice versa—more cheaply because of the better depth of the euro-denominated corporate bond market, compared to a single currency one like the Dutch guilder. Much of those benefits could come into question.

Institutions have large equity holdings with positions that they can only trade in and out of in months, not days and minutes like fast-money traders. The BoAML FMS indicates that they are overweight the eurozone and they will likely be re-evaluating their eurozone equity exposure if Greece were to go over a cliff. In the case of a relief rally in the face of a Greek default or Grexit, investors should take the opportunity of any relief rally to lighten their positions.

Bottom line: Traders should buy the news of any resolution, investors should wait for the news and then decide on what to do next.

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.